-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

March 10, 2025

Timothy Fletcher

Region: North America

English

We’re starting to see them in our neighborhoods and on freeways – white SUVs and minivans with cylindrical devices on top. The vehicles seamlessly merge in and out of traffic, signaling turns and making stops well within safe driving standards. Passengers enter and exit without incident. All appears normal, except for one glaring omission:

No one is behind the wheel.

Robotaxis, otherwise known as autonomous vehicles (AVs), are being deployed on a growing number of city streets and highways, in the process logging millions of incident-free development miles while taking greater numbers of us along for the ride. When we last looked at the state of AV development in 2022, the road ahead appeared murky; While slow and steady progress was being made, numerous technological hurdles needed to be overcome before AVs could become mainstream. However, recent advances have accelerated AV development, with significant potential ramifications for society and the insurance industry.

How did we get to this point and what does it mean for insurers? Let’s take a look.

Robotaxi Development in the Fast Lane

Leading the robotaxi charge in the U.S. has been Waymo, begun in 2009 as part of Google and since spun off as part of its parent company Alphabet.1 It currently operates services in Phoenix, Los Angeles and San Francisco.2 Notably, San Francisco has served as a development hotbed, with Waymo and GM subsidiary Cruise traversing city streets in great numbers. The increased presence of these driverless vehicles has not been without controversy, with a few notorious incidents, such as the October 2023 accident in which a hit-and-run driver struck a pedestrian and threw her into the path of a driverless Cruise car, which then pinned the woman underneath and dragged her 20 feet at slow speed.3

Subsequently, after determining that Cruise officials misrepresented the accident details, California regulators deemed the cars unsafe. This resulted in Cruise largely suspending operations.4 In February GM announced that it would integrate Cruise-developed technology into its current “Super Cruise” system and halt funding of the robotaxi business, bringing to an end an investment of $10 billion.5

Even such tragic events haven’t materially stalled robotaxi deployment. In November 2024, Waymo opened its Los Angeles service to all riders, covering roughly 80 square miles and utilizing 100 vehicles.6 That same month, Amazon subsidiary Zoox began operations in San Francisco, expanding beyond its Foster City, California pilot that began in February 2023.7 Zoox, in existence for a decade, employs a novel design approach; Unlike its competitors that convert existing electric vehicles (EVs) into robotaxis, it instead created an entirely new, purpose-built EV without pedals or a steering wheel.8

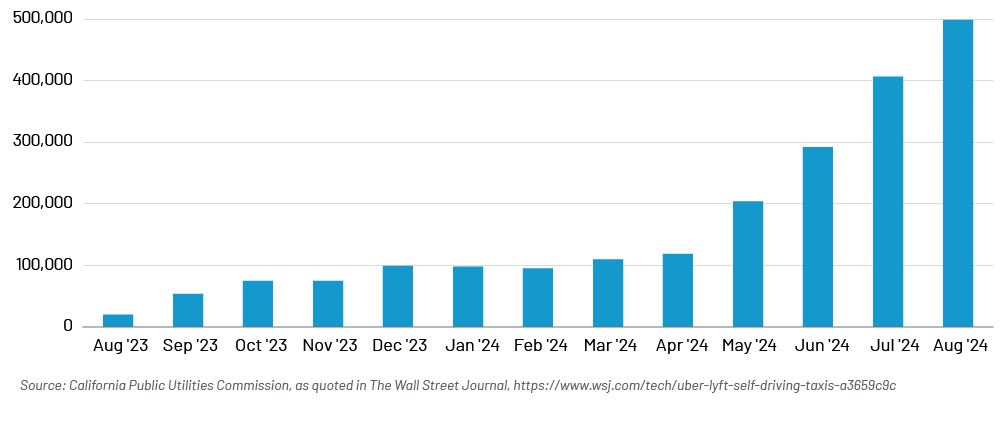

Robotaxis have proven to be popular. In the summer of 2023, Waymo reported having 10,000 paid rides per week; by May 2024, the number of paid rides had increased to 50,000.9 In August 2024, Waymo vehicles picked up nearly 500,000 passengers, a significant increase over the 20,000 passengers it reported a year earlier.10

Passengers in Waymo Vehicles (California) – August 2023‑2024

Fueled by this success, later in 2025 Waymo will launch robotaxi operations in Atlanta and Austin, partnering with Uber for fleet servicing and vehicle depots and with Waymo for remote/roadside assistance and most customer support.11 Joining Waymo in Atlanta will be May Mobility, which in partnership with Lyft will deploy a fleet of driverless Toyota minivans (but with safety drivers on board, at least initially).12

Further expansion is on the horizon, with Waymo launching its robotaxis this year in Miami13 in partnership with Nigerian mobility enabler Moove, and beginning manually-driven testing in Las Vegas, San Diego and New Orleans14 similar in scope to winter-related work it began last year near Lake Tahoe, upstate New York, and Michigan. May Mobility also launched a driverless testing operation in November 2024 in Ann Arbor, MI and anticipates increasing its active deployments to 13 by the end of 2025.15

A Potential $5 Trillion Market and MAAS

Analysts project that the AV market could be huge, possibly as much as $5 trillion, despite not currently being profitable.16 There are a number of markets in which AVs could thrive, most notably New York and Chicago, where concentrated demand for ridership and airport access could mimic Waymo’s San Francisco rollout and what is currently being done in Phoenix (where Waymo vehicles ferry passengers to and from Sky Harbor International Airport).17

Ambitious robotaxi expansion is predicated on becoming more than another Uber or Lyft; rather, it’s based on being able to convince households to give up car ownership (possibly that second or third car) and replace it with robotaxi-enhanced transit, taxi, and other modes.18 Called Mobility as a Service (Maas), users would use smart devices to combine transport modes – public transport, shared cars, and bicycles – to reach their destinations.19 Such a program might include a flat monthly robotaxi fee competitive with the total cost of car ownership, factoring lease payments, maintenance costs, insurance, and the like.20 Convenience would add to the appeal, such as no longer needing to figure out parking when travelling to downtown areas.21

Technological Advancements and Moving Beyond the Sun Belt

While robotaxis are thriving in the Sun Belt (the southern and southwestern states) and on the West Coast, the snow and ice of the Northern United States pose longstanding challenges: There, vehicles struggle with the longer time needed by automated braking systems to stop on snowy and icy roads.22 Solving that problem entails developing technology that uses information such as tire make and type, along with weather information taken from vehicle cameras to predict braking under certain conditions. One such prototype was unveiled last month by Goodyear and Dutch research organization TNO.23

Other advancements may further speed implementation and adoption. Crowdsourced maps, created by using data from cars equipped with sensors and cameras, could serve to speed up and/or enhance the mapping critical to robotaxi operation.24 Additional developments may make maps unnecessary, as shown by UK‑based developer Wayve, which uses “end to end” AI to conduct unsupervised learning from vast quantities of unlabeled real-life or simulated driving videos, potentially providing greater ability to cope with the rare and unpredictable scenarios that might cause a crash.25 More immediately, Large Language Model (LLM) planners are showing heightened ability to replicate and understand driving situations, both key to accident prediction and planning.26

Impressive Safety Results – So Far

AV developers have long touted the safety advantages of these vehicles over human-driven ones, arguing that eliminating human error and behavior while driving will save lives and minimize carnage.

Preliminary statistics would seem to bear that out. In December Waymo released a study in which it claimed that through the course of 25 million autonomous miles, its vehicles “had 88% fewer property damage claims and 92% fewer injury claims than average human drivers” – and 86% and 90% respectively when compared with those human drivers having advanced safety features such as adaptive cruise control, anti-lock brakes, and lane departure warning.27

Some experts contend that the data is insufficient and that the vehicles need to be driven much farther – perhaps as much as a few billion miles – before meaningful conclusions can be drawn.28 As developers incorporate more freeways into robotaxi routes – viewed as a critical step in scaling operations – risks will increase.29

Impact on the Insurance Industry

With all indications pointing to an increasing robotaxi presence on America’s roads, one can’t help but wonder about impacts on the insurance industry. We know that predictions often go awry, as did one projection that automated driving would firmly take hold in 2017,30 but insurers need to be prepared for increased growth in the AV sector.

The passage of time and technological advances continue to shape the industry. Forecasts are now being made as to when and under what circumstances personal auto insurance begins to become passé.

In September 2024, financial advisor Morningstar shared the following key takeaways in a report on the state of the AV industry and its impact on the insurance industry:31

- Rapid technological advancements in computer vision, artificial intelligence, machine learning, sensors, and enhanced processing power have dramatically improved autonomous driving capabilities.

- As long as there is material driver involvement, Personal Auto insurance will remain necessary and the regulatory environment surrounding Auto insurance will lag technological changes.

- Because a human driver is not in control, it’s hard to see how an owner of a driverless car could be found legally liable for damage; consequently, car insurance will most likely morph over time into a product liability product borne by the manufacturers.

- Highly autonomous – and affordable – vehicles will need to be available on a wide scale before drivers will not be required to maintain some level of insurance.

When these variables will come into play remains an open question. As the Morningstar study stated, under a scenario that assumes rapid technological advancements and aggressive public AV adoption, Personal Auto insurance could become unnecessary within 20 years, with a more moderate scenario extending that timeframe to 2060.32

Conclusion

Much of modern life seems filled with rapid change, unexpected hurdles, and unforeseen twists. Such is the case with AVs – fast-moving developments punctuated by technological speed bumps and a cloudy road ahead. But just as those rosy projections of 10 years ago that AVs would be integral to our lives by 2017 proved woefully off target, so too may be those that state AVs are at best decades away from widespread usage.

Reality likely rests somewhere in between, with future AV developments worthy of our scrutiny by virtue of the dramatic change they promise to bring to human mobility.

- “Map Shows Where Robotaxis Are Approved,” Newsweek, June 7, 2024, https://www.newsweek.com/map-robotaxis-approved-robot-vehicles-cruise-waymo-zoox-1909285

- Ibid.

- Otts, Nakrosis, “General Motors Scraps Cruise Robotaxi Program,” The Wall Street Journal, Dec. 10, 2024, https://www.wsj.com/business/autos/general-motors-scraps-cruise-robotaxi-program-ea3298a8.

- Ibid.

- “GM Takes Full Control of Cruise in Autonomous Personal Vehicle Shift,” U.S. News & World Report, Feb. 4, 2025, https://money.usnews.com/investing/news/articles/2025-02-04/general-motors-acquires-full-ownership-of-cruise-autonomous-business.

- Templeton, “Waymo Robotaxi Now Open to All in Los Angeles,” Forbes, Nov. 12, 2024, https://www.forbes.com/sites/bradtempleton/2024/11/12/waymo-robotaxi-now-open-to-all-in-los-angeles.

- Doll, “Zoox begins testing its unique robotaxis in San Francisco,” Electrek, Nov. 11, 2024, https://electrek.co/2024/11/11/zoox-begins-testing-its-unique-robotaxis-in-san-francisco.

- Ibid.

- Bobrowsky, Kruppa, “How San Francisco Learned to Love Self-Driving Cars,” The Wall Street Journal, Oct. 18, 2024, https://www.wsj.com/tech/waymo-san-francisco-self-driving-robotaxis-uber-244feecf.

- Rana, “How Uber and Lyft Are Gearing Up for the Robotaxi Revolution,” The Wall Street Journal, Jan. 6, 2025, https://www.wsj.com/tech/uber-lyft-self-driving-taxis-a3659c9c.

- Templeton, “Waymo to Launch in Atlanta and Austin With Uber for Hails and Depots,” Forbes, Sept. 20, 2024, https://www.forbes.com/sites/bradtempleton/2024/09/20/waymo-to-launch-in-atlanta-and-austin-with-uber-for-hails-and-depots.

- Turnbull, “Gridlock Guy: May Mobility’s driverless vans are coming to Atlanta’s streets,” The Atlanta Journal-Constitution, Dec. 1, 2024, https://www.ajc.com/news/atlanta-news/gridlock-guy-may-mobilitys-driverless-vans-are-coming-to-atlantas-streets/M7W4W7ISHZHKDGK34W4QKZHVS4.

- Templeton, “Waymo to Launch Robotaxi in Miami in 2026 With Logistics Partner Moove,” Forbes, Dec. 5, 2024, https://www.forbes.com/sites/bradtempleton/2024/12/05/waymo-to-launch-robotaxi-in-miami-in-2026-with-logistics-partner-moove.

- Brasted, “Scoop: Waymo to send self-driving cars to New Orleans,” Axios New Orleans, Feb. 6, 2025, https://www.axios.com/local/new-orleans/2025/02/06/waymo-driverless-cars-new-orleans.

- “May Mobility expands autonomous driver-out vehicle operations to second U.S. city,” Mass Transit, Nov. 21, 2024, https://www.masstransitmag.com/alt-mobility/autonomous-vehicles/press-release/55245027/may-mobility-may-mobility-expands-autonomous-driver-out-vehicle-operations-to-second-us-city.

- Tan, “Waymo’s Robot Taxis Are Almost Mainstream. Can They Now Turn a Profit?” The New York Times, Sept. 4, 2024, https://www.nytimes.com/2024/09/04/technology/waymo-expansion-alphabet.html.

- Ibid.

- Templeton, “Waymo Plans Massive Robotaxi Service Area But Not Massive Enough,” Forbes, Jan. 22, 2024, https://www.forbes.com/sites/bradtempleton/2024/01/22/waymo-plans-massive-robotaxi-service-area-but-not-massive-enough.

- “Smarter Travel with Mobility as a Service,” TNO, https://www.tno.nl/en/digital/liveable-cities-regions/smarter-travel-mobility-as-service.

- Id. at note 18.

- Ibid.

- Bousquette, “Self-Driving Cars Don’t Do Snow. Goodyear Says the Solution is Smarter Tires,” The Wall Street Journal, Jan. 9, 2025, https://www.wsj.com/articles/self-driving-cars-dont-do-snow-goodyear-says-the-solution-is-smarter-tires-6ccf0e85.

- Ibid.

- Templeton, “Dashcams and Smart Cars Solve the Self-Driving Mapping Problem,” Forbes, Jan. 2, 2025, https://www.forbes.com/sites/bradtempleton/2025/01/02/dashcams-and-smart-cars-solve-the-self-driving-mapping-problem.

- Oliver, “Wayve’s AI Self-Driving System is Here to Drive Like a Human and Take On Waymo and Tesla,” Wired, Dec. 13, 2024, https://www.wired.com/story/wayves-ai-self-driving-system-is-here-to-drive-like-a-human-and-take-on-waymo-and-tesla.

- Templeton, “Robocars 2024 in Review – Top Ten Stories and More,” Forbes, Dec. 20, 2024, https://www.forbes.com/sites/bradtempleton/2024/12/20/robocars-2024-in-review-top-ten-stories-and-more.

- Templeton, “Waymo and Swiss Re Show Impressive New Safety Data,” Forbes, Dec. 19, 2024, https://www.forbes.com/sites/bradtempleton/2024/12/19/waymo--swissre-show-impressive-new-safety-data.

- Viglucci, “Waymo says it’s brining its fully driverless robotaxis to Miami. But are they safe?,” Miami Herald, Dec. 16, 2024, https://www.miamiherald.com/news/local/community/miami-dade/article297065439.html.

- Bobrowsky, Kruppa, “Self-Driving Cars Enter the Next Frontier: Freeways,” The Wall Street Journal, March 15, 2024, https://www.wsj.com/tech/waymo-self-driving-cars-freeway-phoenix-241266e1

- Fowler, Stern, “Tech That Will Change Your Life in 2017,” The Wall Street Journal, Dec. 28, 2016, https://www.wsj.com/articles/tech-that-will-change-your-life-in-2017-1482937534?mod=article_inline

- Horn, Sharma, “Analyzing the Implications of Self-Driving Cars for the Auto Insurance Industry,” Morningstar, Sept. 23, 2024, https://www.morningstar.com/company-reports/1244185-analyzing-the-implications-of-self-driving-cars-for-the-auto-insurance-industry.

- Ibid.