-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

The Gen Re Dread Disease Survey – Key Takeaways for Mainland China Market [Infographic]

July 22, 2024

Samuel Lim

Region: Asia

English

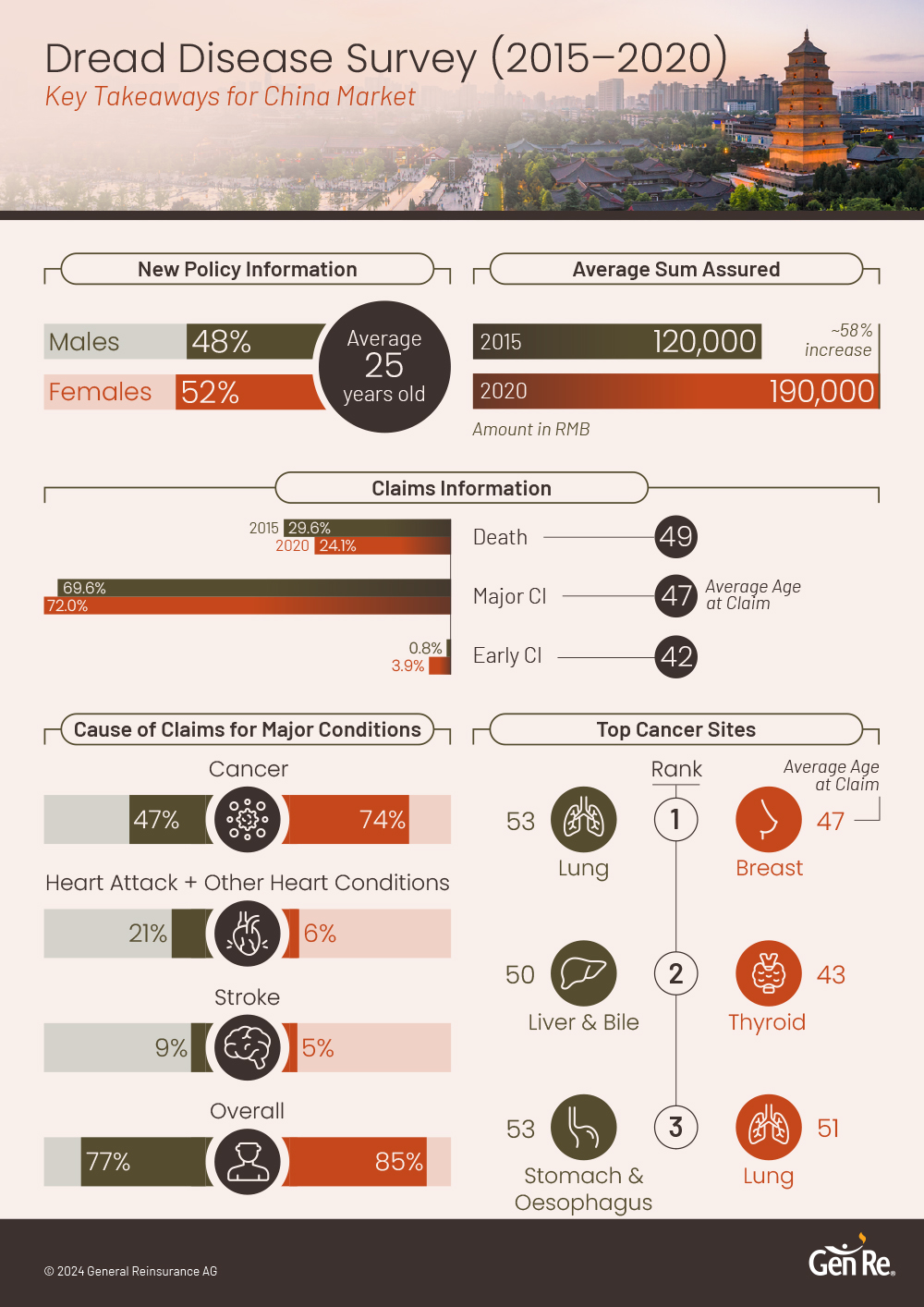

Earlier this year, Gen Re successfully completed the 8th Edition of the Dread Disease Survey for the Mainland China market. The study examines the period from 1 January 2015 to 31 December 2020. We extend our gratitude to the participating companies for their continued support and resilience as we embarked on this endeavour, especially given the challenges posed by COVID‑19. Thank you once again for your invaluable contribution to this study.

In this blog post, we’ll explore the high-level findings from our study, using the infographics provided above to highlight key trends and their implications for Critical Illness (CI) insurance business.

New Business Demographics

The new business for Critical Illness (CI) insurance in Mainland China observed an average entry age of 25, notably younger than in more established markets such as Hong Kong and Singapore, where the average age is 28.

Across Mainland China, the average age at issuance in Tier 1 cities (23 years old) is younger compared to that in new Tier 1 (25 years old), Tier 2 (25 years old), and Tier 3 cities (26 years old). This variation highlights that the target demographic for CI insurance differs significantly across city tiers, underscoring the need for a diverse range of CI products tailored to meet the distinct needs of different client segments.

Protection Gap

The CI business saw significant growth from 2015 to 2020. According to our study, the average sum assured in this sector increased from approximately RMB 120,000 to RMB 190,000, showing the most substantial growth among the four key markets surveyed by Gen Re.

Despite this rapid growth, the protection gap for CI has likely not narrowed significantly since 2015. One way to gauge this gap is by comparing it to wage growth. According to the National Bureau of Statistics of China1, the average wage has grown by 57% during this period, with the average sum assured maintaining pace with wage increases.

Therefore, it remains crucial for insurers to continually innovate in the CI sector and raise awareness about the CI protection gap. These efforts are essential to prevent the gap from widening, ensuring that coverage keeps pace with economic changes and healthcare needs.

Distribution of Claims

In this round of study, the proportion of death claims can be seen to be reduced by around 5%. Such observation raises the importance of CI insurance to the people. As mentioned by Dr. Marius Barnard the founder of CI insurance:

“You need critical illness insurance not because you will die, but because you will survive!”2

Therefore, with the shift in the distribution of claims, the significance of critical illness (CI) products and ongoing innovation will become increasingly important.

Major Critical Illness Condition

In the CI insurance sector, major claims predominantly arise from three conditions: cancer, heart attacks (along with other heart-related conditions), and stroke. In the Mainland China market, these conditions account for a significant portion of major CI claims – 77% for males and 85% for females. These proportions are higher than those in Malaysia but remain lower than the corresponding figures in both the Hong Kong and the Singapore markets.

Cancer Sites

Cancer remains the predominant contributor to claims for CI products. In our recent study, the top three cancer sites for males were identified as lung, liver & bile, and stomach & oesophagus, with the average age of diagnosis in the 50s. Notably, the ranking of cancer sites have changed since the previous survey, with lung cancer moving from the second to the first position.

For females, the most common cancer sites in the current survey are breast, thyroid, and lung. A major change from the previous survey is the increase in ranking of lung cancer from fourth to third place. Incidentally, the worsening of lung cancer incidence rates coincides with an increase in usage of low-dose computed tomography (LDCT) scans.

If you have any questions about the research or would like to find out more about how to participate in the future, please don’t hesitate to reach out to our CI analytics team.

Endnotes

- https://data.stats.gov.cn/english/easyquery.htm?cn=C01.

- International Actuarial Association Health Section (IAAHS) 2007 Colloquium, Dr. Marius Barnard, “Critical Illness Insurance – The Good, the Bad and the Future” – slide 25: https://www.actuaries.org/IAAHS/Colloquia/Cape_Town/Barnard.pdf

Endnotes last accessed on 16 July 2024.