-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Finding the Balance – Assessing Weight Changes in Underwriting

Publication

How Is AI Being Used to Enhance Traditional Life Underwriting? Business School

Business School

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review

Publication

Fasting – A Tradition Across Civilizations Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Finding a Way Forward for Disability Income Insurance in Australia - Embarking on a Sustainability Journey [Part 1 of series]

November 18, 2020

Viviane Murphy

Region: Australia

English

Australia’s Individual Disability Income Insurance (IDII) market is facing challenges that must be addressed without delay. The Australian Prudential Regulation Authority has mandated that Life companies must urgently improve the performance and sustainability of IDII.

IDII is a core product for the Life sector. Insurers in Australia earned $2.8 billion in premium from IDII products in the 12 months to March 2019, representing almost 30% of total risk business sold to retail consumers. In fact, Australia has one of the highest penetration rates for the product in the world.1

IDII needs to go back to its intended purpose - to cover the replacement of lost income in part and instil a path for recovery. Replacement ratio is a significant issue and the product intent is not to cover replacement of all income. The insurance offering and contract should be balanced and fair to all parties (including the insurer) with an abundance of clarity on what is and is not covered.

IDII exists to adequately replace income when it is needed most - at times of significant injury/illness causing an inability to work for a duration expected for that individual. Customers should know exactly what they are buying and how it is structured.

Assessing the relative price of a product compared to previous products can be difficult, because each new product launch creates a different product with different pricing. In addition, poor claims experience, over-insurance, ancillary benefits and sales target strategies are all known root problems. [See our whitepaper Time For Action: Radical Steps Are Needed to Fix Individual Disability Income Insurance in Australia].

It is clear to us at Gen Re that whilst government and regulators can help reform the market, product manufacturers themselves need to lead the change as part of a company top down-led strategy. That’s why we are proposing a new product framework for IDII that involves the participation of every part of the value chain in the building of a new product.

It’s been a long and explorative journey, but now we feel ready to share our product design for an economically sustainable IDII product proposition. To explain how we got here, we decided to chart the framework’s development in a short blog series.

Embarking on an IDII Sustainability Journey

We realised early on that to future proof IDII we had to stand in our clients’ shoes and then build a product from scratch. So, in 2019 Gen Re set out to establish a dedicated focus and company strategy and embarked on our Individual Disability Income Insurance (IDII) Taskforce Sustainable Journey.

First, we developed a key framework paper that called out critical success factors for each task force team. We wanted to deliver a base product framework that made changes to encompass regulatory requirements and would be within our risk management framework and underpinned by pricing support. Our second option considered a more ideal product structure, augmented by a green-field option where we could capture ideas of what could be possible.

The IDII Taskforce squads also examined the principles of insurability, ensuring that the product framework would be anchored with a consistent direction leading to the IDII sustainable product structure and design.

Insurance is at its core, with the emphasis on indemnifying a quantifiable loss. For customers, the product attempts to make sure they are not worse off financially, whilst disabled. Additional features should be at the customer’s choice, selected and priced for. The insurance cover meets a specific need and an intended purpose: the product intent is to provide the customer with some financial protection and relief at claim time to achieve a restorative pathway to recover from his or her sickness or injury. An effective tapered replacement ratio lends to achieving this intent and cannot exceed the financial position before the sickness or injury.

It was also important to ensure balanced risk mitigation of loss and obligation for both parties, with clearly defined occupation and duties, adherence and commitment to recovery/well-being, effective compliance with treatment, and to instil incentive to go back to work. The insurer is in turn required to assess, service, support and compensate customers within the policy framework in a timely manner and in the spirit of good faith.

Squad goals and plotting the route

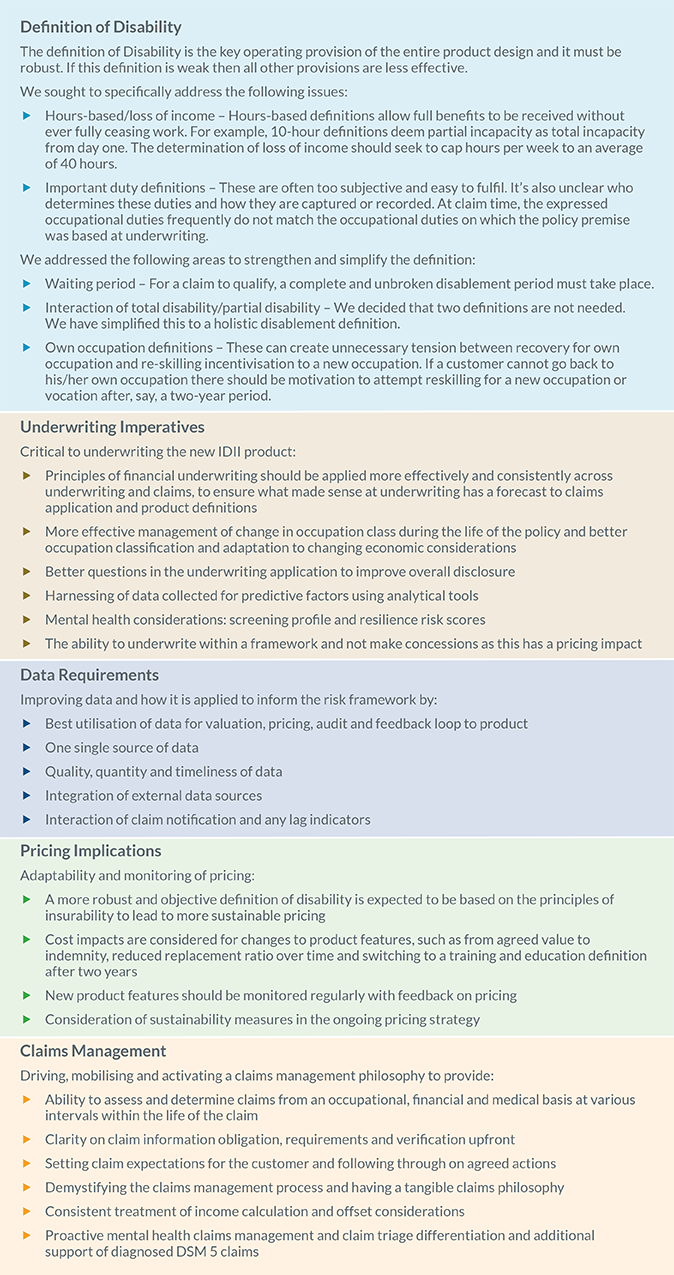

Each of the IDII squads (as illustrated below) was made up of multi-disciplinary teams to avoid any silo effect and maximise cross-pollination of expertise.

They each had to consider four aspects:

- Customers, distribution channel and marketing proposition

- Regulatory aspects expressed in APRA’s expectations letters in May and December 2019 (and more recently the letter of September 2020)

- Inter-dependencies between IDII squads and what considerations other groups need to look out for

- Resourcing

In building the product framework, we identified several important structural considerations:

- Replacement Ratios that taper down over time in order to create an incentive to return to work. The reduction is in line with sustained affordability and stable pricing

- Offsets that are all encompassing, clearly defined, with the ability to be applied consistently in the post-disablement income definition

- Clearly defined income pre- and post-disablement (this includes defining the interaction of passive income), and a clear definition of what is insurable income

- Benefits paid to the insured should be taxable and deducted. If that is difficult to achieve in the first instance, then benefits should be supported in an annual benefit statement that can be submitted for taxation purposes

- Ancillary benefits should not form part of the base offering, but rather be add-ons, packaged for additional flexibility and choice. (Anything related to return-to-work or rehabilitation recovery should be included in the base product or as a service offering.)

The key priority for the IDII squads was to fully explore the operation and effect of the current challenges in the product design and to pivot to the future product offering.

Transparency, motivation and recovery

IDII (or Income Protection) is a key insurance product for consumers that offers essential financial protection to people when income falls away due to sickness or injury.

Creating transparency - with robust and clear definitions and with the product intent understood by all stakeholders - is of paramount importance. The determination and fair application of return-to-work capacity within the parameters of product design is key to a balanced outcome at claim time.

Working promotes health. Motivating recovery and the ability to return to work are the responsibility of all parties and custodians of IDII. A stronger focus on capability is required and we should incentivise rehabilitation, re-skilling or re-training in a meaningful and impactful way.

Essentially, the health benefits of good work should be part of the claims philosophy, encouraging language, desire and interactions to incentivise and activate life and health goals from the outset.

Part 2 of this blog series will further explore our thought processes on the future IDII product offering - and provide a sneak preview sample of what to expect.

Endnote

- Time For Action: Radical Steps Are Needed to Fix Individual Disability Income Insurance in Australia