-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Risk Management Review 2025 -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Underwriting the Dead? How Smartphones Will Change Outcomes After Sudden Cardiac Arrest

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows Business School

Business School -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

A Cancer Is a Cancer Is an Indolent Lesion of Low Malignant Potential?

Clinical Diagnosis as a Basis for Critical Illness Definitions

Critical Illness (CI) insurance is an important living benefit in many countries – providing financial support and some peace of mind in the event of developing a serious medical condition. This article discusses the broad spectrum of possibilities in product design from offering a solution for the customer’s peace of mind in a very comprehensive way on the one hand and products that protect them in very critical situations in their lives at more easily affordable premiums on the other hand.

In order to meet customer expectations and continue to offer a sustainable product, it is essential for insurers to describe, to the customer, in a clear, unambiguous and transparent way the link between the critical illness and the benefit pay-out.

While the name of the product – be it critical illness, dread disease, trauma or similar – already indicates a certain severity, customers are likely to expect that the benefit will be paid as soon as their doctor makes a diagnosis from the list of covered diseases.

The idea of pay-out upon diagnosis certainly is appealing to customers, yet it comes with some drawbacks, both from a medical and an insurance perspective. In the medical field a diagnosis is not necessarily clear-cut. The understanding of diseases is progressing rapidly and advances in treatment often attenuate and limit the impact of potentially serious conditions. From the insurance side, pricing actuaries and claims managers may be concerned that changing evidence to confirm a diagnosis and new techniques leading to earlier diagnosis, typically go along with a higher prevalence of cases with no, or less severe, health impacts.

Recently, some insurers have changed definitions to be more generous – by paying upon diagnosis, requesting little to no evidence and no longer excluding milder forms of a disease. While customers might welcome this move, the overall affordability of the products and possibly the financial stability of an insurer may be affected.

We will look at examples of the most important diseases covered in CI policies, review where simplifications are justifiable, and what the risks are when omitting crucial features in the definitions.

Cancer

Let us assume the benefit trigger for cancer relies solely upon the definite diagnosis by an oncologist.

Before looking at exclusions, we compare this approach to what is typically used:

Usually the definition states cancer characteristics such as “malignant“, “uncontrolled growth“ and “invasion of tissue“. These are in line with the medical understanding of cancer and are positive to include. However, one could argue that these terms don’t add much because they are part of malignancy by definition. Requiring histological confirmation, which is not mentioned above but typically included is highly recommended because it protects against potential future diagnostic methods such as liquid biopsy. Although currently in experimental status for diagnosis, one could imagine cases with a positive liquid biopsy result, but no tumour identified or confirmed by other means.1

Within the context of CI, we usually find several exclusions in cancer definitions, and – understandably – customers might wonder why their coverage does not protect them in the case of some specific cancers.

In response to this, it is important to note that cancer is not one uniform disease but comprises various types, occurring in different sites, and ranging from highly lethal to an innocuous incidental finding.

Cancers that may not develop clinical symptoms in the lifetime of a patient may be discovered incidentally, through screening programs or at autopsy. This unknown number of unreported cases increases the uncertainty in terms of future claims payments for the insurer. Sensitive and wide-spread screening may detect cancer that does not require treatment or have an adverse health impact. Without any financial loss or impact on the insured’s well being, there is no insurable interest that justifies pay-out of the benefit. At the same time, highly prevalent, innocuous findings have the potential to dramatically increase the insurance cost for all.

Prominent examples of common exclusions from CI coverage in respect of cancer are low stages of prostate and thyroid cancer as well as non-melanoma skin cancers.

Let’s take a look at each of them:

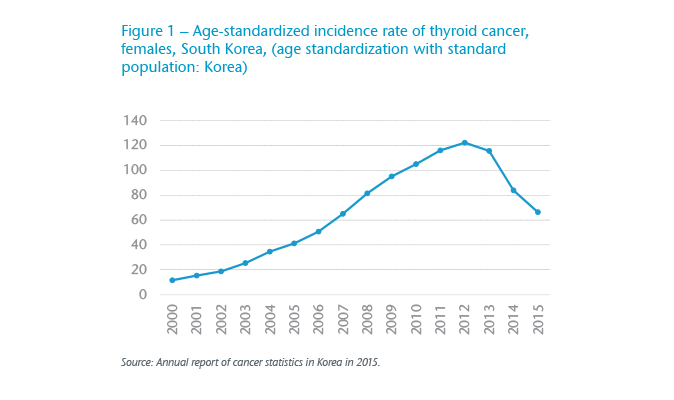

- Thyroid cancer – For thyroid cancer we observe a very strong correlation between screening practices and detection rates of asymptomatic neoplasms in the thyroid gland, which are in the vast majority of low severity. This has led to a large increase in thyroid cancer incidence rates for example in South Korea from 2000 to 2013 (Figure 1). After observing alarming numbers of surgeries to remove the thyroid gland, in March 2014 a coalition of eight physicians in South Korea published an open letter that discouraged thyroid screening with ultrasound.2 Subsequently, the US Preventive Services Task Force concluded, “Screening that results in the identification of indolent thyroid cancers, and treatment of these overdiagnosed cancers, may increase the risk of patient harms.”3

- Prostate cancer – Similarly, the US Preventive Services Task Force states, “Many men with prostate cancer never experience symptoms and, without screening, would never know they have the disease.”4 When diagnosed, active surveillance is a common treatment option, which poses a particular challenge for specifying the benefit trigger in products with multiple pay-out for cancer, as the tumour is not removed.

- Non-melanoma skin cancer (NMSC) – 99% of non-melanoma skin cancers (NMSC) are Basal Cell Carcinomas (BCC) or Squamous Cell Carcinomas (SCC). Studies estimate that the incidence of NMSC is 18-20 times higher than that of melanoma,5 the latter typically being covered in CI policies if in moderate to high stages. Cancer registries around the world usually do not collect full data on NMCS or even exclude them, probably for practical reasons in ascertaining the large number of cases or because of the low mortality rate.6 The very low malignant potential of BCC or SCC, together with the high level of uncertainty around their high prevalence are a strong argument against covering NMSC – even for partial payments.

Potential overdiagnosis, overtreatment, no or very low impact on mortality, and unknown prevalence due to asymptomatic behaviour is common to these three cancer types, which is why they are not suitable as triggers for substantial benefit pay-outs. These are not the only examples of reasonable cancer exclusions – which unfortunately make definitions lengthier and more difficult to understand for laymen but are necessary for a robust product design.

Heart Attack

The second most common cause for payment of CI benefits is heart attack. A short and simple definition could just require a definite diagnosis of myocardial infarction by a cardiologist.

Such a definition leaves out the usual requirements for evidence, such as signs and symptoms indicative of a heart attack, new changes in an electrocardiography (ECG), and the elevation of cardiac biomarkers.

In order to assess the necessity of requiring evidence explicitly, we need to look at another important requirement of the heart attack definition in the insurance context, the death of heart muscle due to inadequate blood supply. This needs to be mentioned as it links the definite diagnosis to evidence for death of heart muscle.

With heart attack being an acute event for which the time lag between onset of symptoms and treatment is of utmost importance, treatment guidelines are continuously being refined in order to quickly confirm the diagnosis of heart attack and act upon it accordingly.

For the insurer, this means that a definite diagnosis in nearly every case goes along with collection of evidence – at least in most markets, where we find standardised treatment guidelines for heart attacks. There needs to be evidence for the death of heart muscle which forms the basis of a cardiologist’s assessment, together with thresholds and criteria in line with the medical definition and treatment guidelines. In cases of dispute such evidence could be requested and used to decide about a definite diagnosis being fulfilled.

It also needs to be stipulated that the heart attack is an acute or new event – which is essential and cannot be omitted, because otherwise claims could be made based on incidental findings of past events.

Similar to many common definitions, this approach also covers all severity levels of heart attacks. There is no exclusion of mild heart attacks. Using reduced vs. normal left ventricular function in order to measure impairment subsequent to a heart attack is an option. At the same time, this distinction results in declining a high portion of heart attack claims: patients of a Swedish study show normal function of the left ventricular after a heart attack in more than 60% of the patients.7 Managing customers’ expectations is as equally important for insurers as having clarity about which heart attacks are covered both for the pricing and the claims management functions.

Stroke

Stroke is also among the leading causes for CI claims. One could think of just using the definite diagnosis by a neurologist as benefit trigger.

In this case a typical basic requirement like “death of brain tissue” is not mentioned, nor is evidence, e.g., in form of imaging technique, required.

Another important aspect of the definition is the requirement of clinical symptoms. Requiring that symptoms last at least 24 hours is in line with the (outdated) understanding of a transient neurological event. The insurer needs to address the question of whether all strokes – even those without any lasting impact on the life or well-being of the customer – should be covered or whether an insurable interest is only present for strokes of a minimum severity, i.e., requiring persisting symptoms which show some permanent and irreversible neurological dysfunction.

While for stroke – similar to heart attack – the lag between onset of symptoms and treatment is of utmost importance, the collection of evidence might be handled completely different.

What insurers are concerned about is the potential situation where a person has a transient neurological event, such as a Transient Ischaemic Attack (TIA) which is a standard exclusion for insurance stoke definitions. Without MRI follow-up, it is possible that a neurologist may say to a patient that they likely had a small stroke. When this is labelled as a definite diagnosis in the context of a claim – how should it be addressed at claim stage? In many markets, it is difficult to challenge claims on more technical grounds and practices. Also, access to investigations do vary.

Interestingly enough, in order to rule out TIA, imaging is required and shouldn’t have any evidence of infarction. The time for which symptoms lasted should only be of secondary consideration.

Incidental findings and other conditions

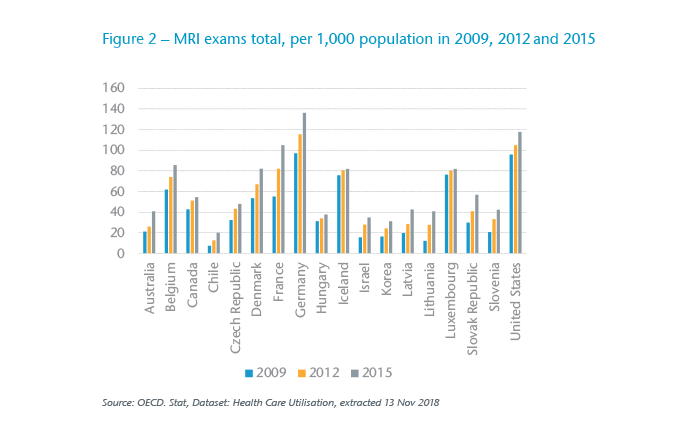

With an overall increased use of imaging techniques, as for example, the increasing number of MRI scans per 1,000 population for selected OECD countries shows (Figure 2), we can expect more abnormal findings, which are not associated with symptoms and do not require treatment. Especially for asymptomatic conditions, the prevalence will be determined by the penetration of screening and the sensitivity of diagnostic methods (e.g., resolution of MRI devices).

Brain cysts are one example of a common incidental finding which are often asymptomatic. During the underwriting process they do not attract a loading or an exclusion clause. Consequently, they should not be used as a benefit trigger for pay-out of the covered amount.

The prevalence of such anomalies is often unknown, which can lead to massive underpricing in the insurance context - particularly in the future as the sensitivity of screening technology improves and utilisation generally increases.

The broader picture

For all diseases, one can argue that the mere diagnosis itself is enough shock and anxiety for the insured and should justify the pay-out of the benefit amount to avoid another negative surprise. Creating more anxiety by determining that the event – despite being perceived as serious – was not actually covered, and denying the payment is not what insurers want.

From the customers’ perspective, it might also be true that the experience leads to a change in lifestyle. The pay-out of a financial benefit might come into good use and help them find a healthy direction in life again.

Also, the typical customer is not an expert in medical terminology, will often not understand the differentiation of severity levels, and likely didn’t study these policy details during the application stage.

So, the insurance company needs to be as transparent as possible about what is covered and what is not. It may still not be possible to avoid all disappointments due to decline of claims. At the same time, it is tempting to just switch to the layman’s understanding of a disease or diagnosis rather than follow the moving target of a medical definition for a condition with ever-changing diagnostic criteria.

As we have seen in the examples above, certain requirements for exclusions, evidence, and severity levels are not only required for sustainable management of the insurance risk but also make good sense for the customer base as they help to provide affordable insurance cover.

The challenge for insurers is particularly high when whole of life or long duration insurance products with guaranteed premium rates are concerned. Who can predict what cancer diagnosis will look like in 2075, how prevalent it will be or what the consequences might be?

Although rare, we have seen insurance terms and conditions allow for medical progress and the potential change in implications for customers along these lines:

“… if in the process of medical science development, new illnesses are included in the list of critical illness or health condition diagnosis and/or efficient treatment methods within the policy validity period are introduced, the Insurer shall have the right to exclude certain illnesses from the list of critical illnesses covered or make supplements to it, make corrections to the definitions of the critical illnesses and/or diagnostic criteria …”

While this certainly has some merit, following such a flexible approach could appear questionable to customers and regulators.

Still, the underlying concept that due to advances in medical science, what constitutes as a critical illness is subject to change and would justify adjusting the benefit triggers in order to maintain the same level of “criticality” is intriguing. In summary, this approach takes the idea of following the spirit of the definitions rather than the letter of the definitions, to the next level.

Another option found in many markets to help with customers’ expectations, is to pay partial benefits for conditions of milder severity. Clearly, this takes away the disappointments of claims being declined. However, for some highly prevalent conditions there still can be substantial financial implications for the insurers. One can also anticipate that the maximum amounts for partial payments may increase over time as they become subject to competitive pressure.

Covering more generous definitions or definitions more prone to increases in claims due to more opaque wordings poses an additional risk for the insurer. In the absence of adjustable definitions or premiums, it therefore requires some additional margin commensurate with such additional uncertainty – making the product more expensive than an alternative whose definitions leave less room for interpretation at the crucial points.

Critical illness insurance can range from an inexpensive protection for every customer against life’s extreme scenarios to a comprehensive peace-of-mind solution for the affluent – all parties do need clarity about the level and purpose of the respective cover. For products with long-term guarantees some minor conditions need to be excluded to ensure that the spurious generosity for some is not to the detriment of the whole insured portfolio.