-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Workers’ Comp – “Connecting” to the Future

June 11, 2018

Bill Lentz

Region: North America

English

The Workers’ Compensation industry had another positive year in 2017 as solid financials and further underwriting gains continue to be achieved. This marks a seven-year trend of improving results. Indicators trending favorably include positive combined ratio development, an increase in pretax operating gains and a continued decline in both lost-time claim frequency and reserve deficiencies.

The National Council on Compensation Insurance (NCCI) recognized the industry’s accomplishments of the past year, while also providing historical data reflecting the cyclical nature of this business and the need for diligence.

The theme of this year’s Annual Issues Symposium (AIS) was “The Future@Work.” In sync with the theme was NCCI President and CEO Bill Donnell’s descriptive word: “Connecting.” With technology always advancing and causing a state of constant change, Mr. Donnell stressed the importance of staying connected with the changing landscape, as the Workers’ Comp industry strives to adapt to the worker and the workplace of the future in order to continue serving its needs.

NCCI CEO Overview

In light of the 30th anniversary of AIS, Mr. Donnell lauded the success of safety efforts, resulting in the reduction of fatalities – down 30% since the early 1990s. He also pointed out the contrast between the six-year stretch of WC pretax operating losses 1987–1992 and the most recent six years (2012–2017) of pretax operating gains the WC industry achieved, with the last five being well above the industry average. Citing the cyclical nature of the business, Mr. Donnell made his point that “The health of the Workers’ Compensation system is m uch stronger.” Most important, he stressed, is the industry’s continued commitment to serving the employers and workers of our nation.

Mr. Donnell discussed the importance of the Workers’ Compensation industry “connecting” to its future with regard to work and the impact of automation, the worker and the changing demographics, and the workplace with the increased leveraging of technology. As daunting as that may sound, he believes the insurance industry is well-equipped and conditioned to handle the changes that are ahead.

A study concerning the adoption of automation indicated that up to 60 million jobs in the U.S. will be significantly changed over the next 10 years. However, Mr. Donnell pointed out a few natural speed bumps in the adoption of automation in the following areas:

- Cost Benefit Analysis – Business owners will not invest in such technology unless there are significant benefits.

- Regulatory Issues – Significant regulatory complexities can tend to slow the process.

- Human Element – Natural resistance to change dominates, an example being the cashier job classification. Despite all of the self-checkout options that have been made available, the number of cashier jobs has not changed over the last ten years.

With regard to the future worker, Mr. Donnell advises that millennials are the most educated generation ever, the most diverse, and extremely savvy with technology. Not only will they be future employees but future business owners and employers as well. As such, he believes they will be the pioneers of the new technology-infused landscape and are equipped for it.

As to the future workplace, Mr. Donnell shared his beliefs as to what we may see:

- A Safer Work Environment – Technology will continue to improve safety (i.e., robotics, wearables, etc.).

- Virtual World – Businesses will make greater use of online conferencing, telemedicine and virtual reality. Studies find that telecommuting is up 100% over the past 10 years, and in the next several years more than 50% of workers may be working remotely in some way. More virtual companies will have no home office or shared work space.

- More Connected – Better monitoring of conditions, increased connection with workers, and more data gathered for analytics will lead to more tools to understand and mitigate risk.

While the Workers’ Compensation industry must continue to transform and adapt to stay relevant, Mr. Donnell stated that our success will also be “measured by how we embrace technology to deliver our services and positively impact workplace safety and return-to-work efforts.”

NCCI State of the Line

The State of the Line report was presented by Kathy Antonello, Chief Actuary for NCCI. This report provides a detailed review of trends and cost drivers in the Workers’ Compensation industry. The 2017 data is preliminary. The full report is available at NCCI.com; however, here are some selected highlights from Ms. Antonello’s presentation:

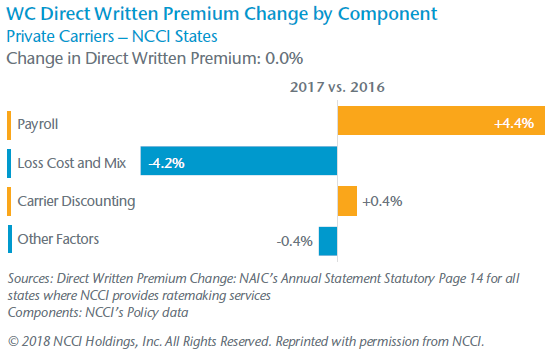

- WC Premium – Net written premium for private carriers decreased slightly to $39.8 billion – as compared to $40.1 billion in 2016. The total market net written premium volume also declined slightly to $45.0 billion. The rationale for this result is the continued growth of offshore cessions and little to no change in carrier pricing levels. The total net written premium for the P&C industry increased by 4.6%.

- WC Combined Ratio – The calendar-year combined ratio for private carriers further improved to 89% (a 5-point difference from 94% in 2016). The loss ratio component also improved to 49%. The accident-year combined ratio for private carriers increased by 4 points to 99%; however, NCCI expects accident year 2017 to develop favorably over time.

- Investment Results – WC investment gain on insurance transactions is 12% for 2017. This a slight increase over the revised gain of 10.8% for 2016. This result still remains below the longterm average of 13.2%.

- Pre-Tax Operating Gain – A pre-tax operating gain of 23% is largely due to the continued improvement in the loss ratios in recent years.

- Net Reserve Deficiencies – The estimated 2017 WC Loss and LAE reserve deficiency for private carriers is $1 billion, which is $4 billion less than year-end 2016. This amount represents 1% of calendar-year total reserves.

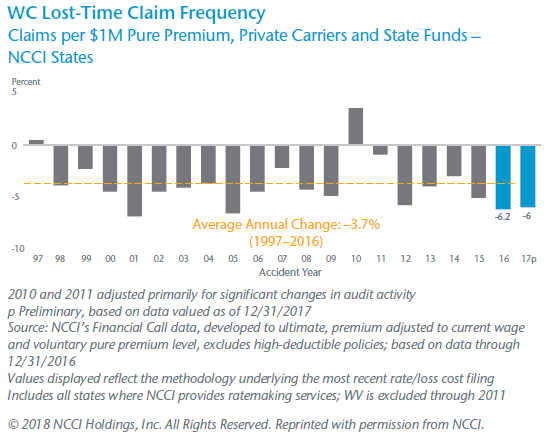

- Claim Frequency – WC lost-time claim frequency is estimated at a -6% change between 2016 and 2017. The longer term average annual change 1997–2016 is 3.7%.

- Indemnity Severity – The 2017 average indemnity cost per lost-time claim rose to $24,400, which is a 4% increase over 2016.

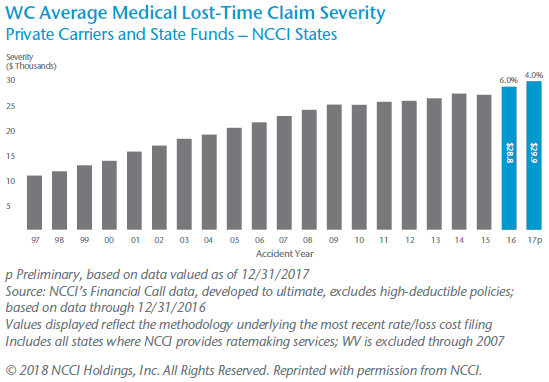

- Medical Severity – The average medical cost per lost-time claim increased by 4% to $29,900 in 2017. The Personal Health Care Chain-Weighted Price Index (PHC) rose 1.4% in 2017 as compared to 1.2% for 2016.

- WC Residual Market – The 2017 residual market pool premium of $1.0 billion has not seen significant change over the last four years. The preliminary combined ratio for the pool is 106% as compared to 98% for 2016. NCCI advises that this estimate is based on an incomplete year and will likely be revised.

- Utilization of Opioids – NCCI’s research has determined that in 2012, 55% of injured workers who were given a prescription were prescribed an opioid. That share decreased to 45% by 2016.

Summary of NCCI Observations

Positives- Combined ratio improved – Lowest level in over 50 years

- Decrease in opioid utilization

- Reserve position continues to strengthen

- Continued decline in claim frequency

- Improved investment results

- Embracing and keeping up with changing technology

- Evolving work, workforce & workplace

- Increasing medical severity

- Investment income, which remains below long-term average

Gen Re Note

Congratulations to NCCI’s AIS on its 30th anniversary! This symposium can always be counted on for excellent content and enjoyable networking opportunities, and is always looking towards the future in Workers’ Compensation.

We applaud the efforts made within our industry, as well as in many state legislatures, to address the opioid issue and are thrilled to see positive results in this area. It’s the responsibility of those of us working within the Workers’ Comp system to see that all treatment provided to injured workers is appropriate and in accordance with established medical guidelines – and to question and challenge instances in which they are not, for the benefit of the injured worker.

Many of us may have been somewhat surprised by the 89% combined ratio estimated for 2017. But this number, along with other favorable trends, points to a strong and healthy system. As noted by Mr. Donnell, we must adapt in order to ensure future success and continue to prove that the “Grand Bargain” is a great deal for all involved, especially for injured workers.

However, as we have also been reminded, this business is cyclical and any carrier playing in the Workers’ Comp arena must be committed and prepared for the long term. As claim duration can extend many years and with both indemnity and medical severity continuing to rise, it is important to take a longer, more measured view. How are you dealing with medical severity? Are long-term costs accounted for in your reserving process? Gen Re has always been in it for the long haul. Please feel free to reach out to discuss these issues.

We express our appreciation to NCCI for giving us permission to reproduce materials from its 2018 Annual Issues Symposium.

About NCCI

Founded in 1923, the mission of the National Council on Compensation Insurance (NCCI) is to foster a healthy workers compensation system. In support of this mission, NCCI gathers data, analyzes industry trends, and provides objective insurance rate and loss cost recommendations. These activities – combined with a comprehensive set of tools and services – make NCCI the source you trust for workers compensation information.