-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

What Are We to Make of Cannabis Use in The Insured Population? Business School

Business School

Publication

Knife or Needle: Will the New Weight Loss Medication Replace Bariatric Surgery?

Publication

Weight Loss Medication of the Future – Will We Soon Live in a Society Without Obesity? Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Group Term Life - Results of 2017 U.S. Market Survey

June 03, 2018

Region: North America

English

Our annual survey covers the U.S. Group Term Life and AD&D industries, tracking sales and in-force results. In addition, lapse rate, renewal and employee-paid results are provided for companies that reported this information. Twenty-five carriers participated in the 2017 survey. Below is a summary of the survey results.

Download the PDF version for a list of participating companies.

Group Term Life and AD&D In-force Results

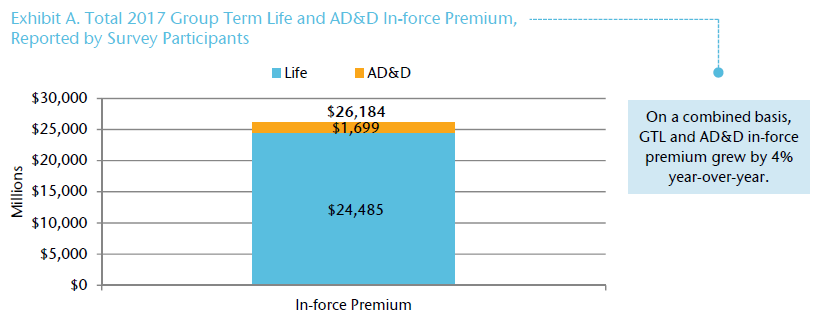

Twenty-five companies shared Group Term Life (GTL) results in 2017, with 23 also providing AD&D data. On a combined basis, total GTL and AD&D in-force premium reached just under $26.2 billion.

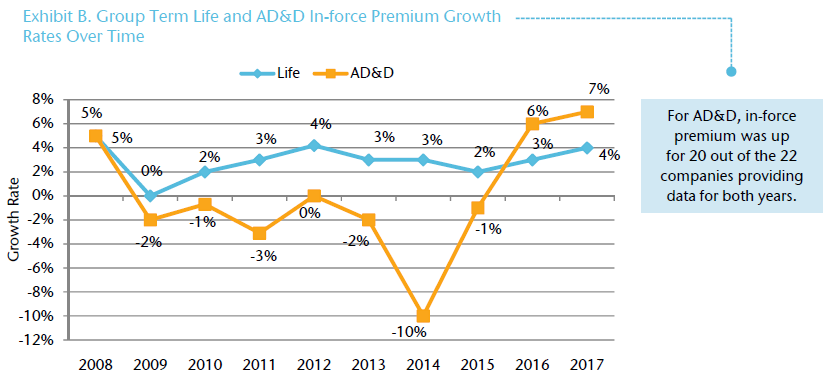

Group Term Life in-force premium rose by 4% in 2017. Over the past eight years, in-force premium growth has remained between 2% and 4%.

AD&D in-force premium increased by 7%, representing the second year in a row where AD&D in-force premium growth was positive.

Group Term Life and AD&D Sales Results

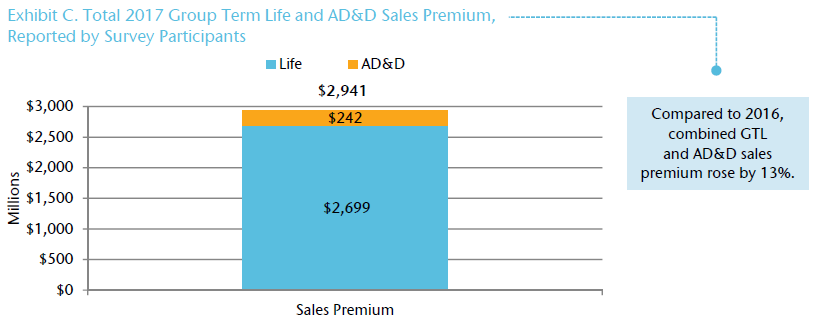

Participating companies reported just over $2.9 billion in combined total Group Term Life and AD&D sales premium in 2017.

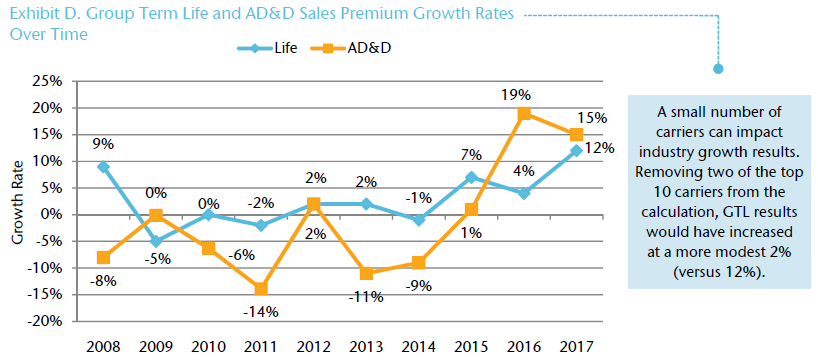

Breaking away from a long trend of single-digit growth, the industry posted a 12% increase in new GTL sales premium in 2017. Of the 13 companies reporting positive gains, seven reported increases of more than 20%.

For the second year in a row, AD&D sales premium was up significantly, increasing by 15% over 2016.

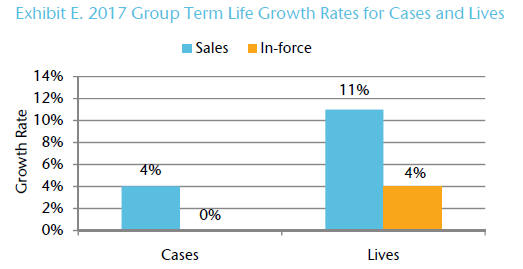

Group Term Life Growth – Cases and Lives

With an increase of 4% in 2017, reported new sales case counts for the industry were up for the third consecutive year. Thirteen out of 22 companies reported gains. Overall growth may have been impacted by an increase in smaller cases sold year over year. For companies providing results for both years, the number of sales cases in the 1–9 lives category rose by about 10%.

While the number of both new and in-force lives rose year-over-year, the double-digit increase in new sales lives is notable. Looking back as far as 2009, this is the highest increase we have reported on the survey. That being said, this result was influenced by a small number of carriers, and potentially some larger case activity.

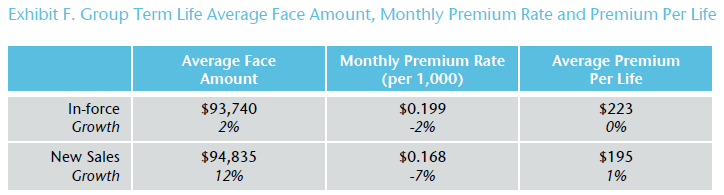

Group Term Life Pricing and Volume Levels

Average new sales face amounts grew by 12% in 2017. As in the past, a small number of companies strongly influenced this result, and some larger case sales may have also played a role.

Average sales premium per life was up by a slight 1% in 2017. For in-force, average premium per life was flat, while average in-force face amounts were up by 2%.

In Our View

Group Term Life in-force premium exhibited positive growth in 2017, with a steady yet modest upswing since 2015. The path for new sales premium, however, has been more volatile. Just a few years ago in 2014, the industry posted a slight decline in results. However, in 2017 the industry reported a 12% increase. As we’ve seen in the past, a small number of carriers can influence the industry result. While there is some evidence of larger case activity playing a role this year, sales results as a whole continue to be unpredictable.

For Group Term Life, new sales lives were also impacted with an 11% increase for the industry, after ranging between -2% and 4% from 2013 to 2016. New sales face amounts are also important to mention, wherein average new sales face amounts were up by 12% in 2017. At $94,835, the average new sales face amount was the highest seen in the survey in 10 years.

For AD&D, in-force premium was up by 7%, but a more compelling story for AD&D lies in the past two years of double-digit increases for new sales. More than half of the companies reported strong growth year over year.

Throughout 2017, news stories and industry blogs outlined significant changes impacting the insurance sector. InsurTech companies are already challenging deep-rooted business models and creating new partnerships. Market demographics are shifting, with the Pew Research Center announcing that millennials are on the cusp of becoming the largest living adult generation in the U.S. in 2019.1 And, for the Group Term Life marketplace, mergers, acquisitions, new entrants and product launches are contributing to a changing landscape.

According to our 2017 Market Pulse, an additional Market Survey segment covering distribution details, some companies are concerned with marketing opportunities, competitiveness of pricing and the level of distribution activity as we move forward in 2018.

In closing, while 2017 was a good year for the Group Term Life market, there are some headwinds facing the industry. As always, Gen Re will work with our clients, as well as the industry, to effectively and consistently monitor this business.