-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Industry 4.0 – Implications for the Insurance Industry

August 01, 2018

Leo Ronken

English

Deutsch

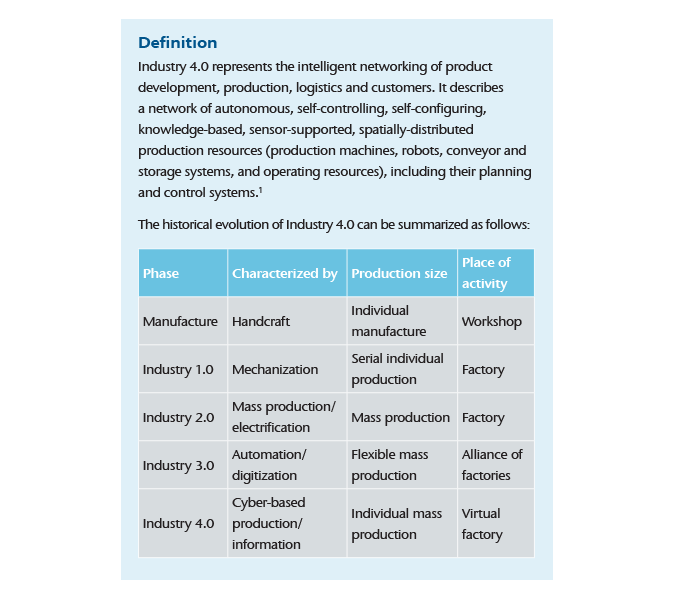

The topic of Industry 4.0 has been discussed at many conferences in recent times. When you talk to participants and colleagues, you quickly realize that everyone associates this buzzword with something different. To make matters worse, the term is now used in almost every industry as a synonym for the digitized, automated and interconnected world, also known as the “smart factory”.

This article discusses the term Industry 4.0 and examines its impact on Property insurance.

Industry 4.0 is a new level of organization and control over the entire value chain of a product – from idea and design, to flexible production of customized products and delivery to the customer. Customers and business partners are directly involved in the processes.

The term Industry 4.0 is synonymous with a range of available automation, data exchange and manufacturing technologies to increase production flexibility and efficiency/profitability and to advance the value chain conceptually in industrial production and manufacturing. The basic principle is the intelligent networking of machines, workpieces and systems as well as all other business processes along the entire value chain, in which everything is regulated and controlled independently.

The ultimate vision of Industry 4.0 is to create an intelligent factory in which all production and business units, machines and devices communicate with each other – as much as possible without human intervention, but involving both employees and external suppliers.

It should not be forgotten that the term Industry 4.0 is used synonymously for digitized production with the ultimate goal of increasing production at significantly lower costs.

Design principles

The design principles of Industry 4.0 can be summarized as follows:

- Networking/interaction

Machines, devices, sensors and people can network with each other and communicate via the Internet of Things, or the Internet of People. - Information transparency

Sensor data extend information systems of digital factory models to create a virtual image of the real world. - Decentralization

Cyber-physical systems are able to make independent decisions. - Real-time decisions

Cyber-physical systems are able to collect and evaluate information and translate it directly into decisions. - Service orientation

Products and services (of cyber-physical systems, people or smart factories) are offered via the Internet. - Modularity

Smart factories adapt flexibly to changing requirements by exchanging or extending individual modules.

Challenges for Industry 4.0

Although the goals of Industry 4.0 sound promising, a number of challenges remain to be resolved, including:

- Availability of relevant information in real time through connectivity of all entities involved in the value chain

- Reliability and stability for critical machine-to-machine (M2M) communication, including very short and stable latency (real time)

- Progress in network technology towards real-time actions

- Need to maintain the integrity of production processes

- Increased vulnerability of the supply chain

- IT security problems

- Data, network, cyber and device security, etc.

- Need to avoid unexpected IT errors that can lead to production downtime

- Protection of industrial know-how

- Lack of adequate skills to drive the Industry 4.0 revolution

- Threat of redundancy problems in the IT department

- Ethical and social impact on society – what would be the impact if a machine were to override the human decision

Challenges for the insurance industry

The insurance industry will continue its interest in collecting data and information for underwriting, and preparing and evaluating it by linking new algorithms and artificial intelligence principles. For example, information collected at the operating and machine level could help to identify certain patterns and predict when maintenance work or servicing is required or when a machine is nearing the end of its life. This allows a more detailed assessment of the actual exposure, which in turn can have an impact on all business areas of the insurance industry – so that the insurance principles might have to be redefined accordingly.

In the future, a claim will affect several lines of business simultaneously, which will often make it difficult to identify a person liable for a loss and to assign the loss to a line of business; this in turn will ultimately complicate claims settlements. The probability of business interruption losses – caused by fire or natural catastrophe, for example – will increase due to the virtualized value chain that is the result of the optimization of systems and their dependency on the environment or on suppliers, customers, energy supply, etc. Ultimately, this could lead to a significant extension of the recovery period following a loss event, which will, in particular, be a consequence of the search for causes, the substitution of destroyed machines, plants, networks and communication channels.

As a further consequence, the complexity of the linked systems and technologies will also result in exposures not yet known, with serious but also unexpected outcomes. For example, a cyber attack or security failure could lead to an interruption of production/supply, whereby cascade effects can ultimately even lead to a complete collapse of the entire value chain. For the insurance industry, the outcome of such an event could be comparable to current losses from natural catastrophes or a pandemic event.

The problem is that industry and insurers generally have little, if any, experience with the real, but intangible and difficult to quantify risks arising from the networking and automation of business processes.

Options for insurers

The economy is doing everything it can to make Industry 4.0 a reality as quickly as possible. One example is the Mindsphere initiative launched by Siemens, a cloud-based open IoT operating system that can already be used today by the companies involved. It was developed for three purposes:2

- To simulate plant and machine behavior before conversion and modernization

- To monitor machines set up at customers’ businesses

- To compare production, quality and maintenance data with other machines, and thus increase efficiency and the ability to identify problems – for example imminent defects – so that repairs can be carried out early and a prolonged production downtime can be prevented

“The change in our current industrial production to Industry 4.0-based production will probably also have lasting effects on the insurance industry, not just on the insurance products offered but also on underwriting and the corresponding administrative processes.”

Currently under discussion is the extent to which the insurance products available today in the Property and Liability lines of business offer sufficient cover for this concept. As Industry 4.0 is controlled via networks and data streams, protection against cyber attacks will certainly be taken increasingly into account in the current coverage concepts.

In addition, however, new risks will arise with integrative and automated production, and new insurance solutions will have to be developed to cover these risks. The use of the new technologies will result in new and different liability scenarios for all market participants. One of the difficulties will be to determine, for example, what caused the damage and who could be held liable. In other words, is there insurance cover for a specific loss and, if so, under which insurance policy?

In this respect, it is necessary for the insurance and reinsurance industries to address the topic of Industry 4.0 at an early stage and to support policyholders in the implementation of their Industry 4.0 concepts – in order to recognize the associated changes in risks and their implications for the Liability and Property insurance cover. In order to establish the insurance industry as an important know-how carrier and partner for the respective policyholder, a discussion with policyholders must be conducted as a matter of urgency regarding potential risk scenarios and possible protective measures.

Furthermore, insurers should proactively support the industry from the outset in the development of necessary protection and prevention measures – such as predictive maintenance, defence against cyber attacks, drawing up business continuity plans, measures against the failure of critical infrastructures – in order to identify and avert potential risks before their manifestation so that a possible loss can be avoided (i.e., preventive risk management).

In addition, the insurance industry should promote the development of its own concepts for the analysis and assessment of new risks, including:

- Turning away from burning cost towards risk models

- Developing new loss prevention measures

- Developing artificial intelligence

- Introducing more extensive data analyses and forecast models in order to mitigate losses before they occur

The use of Big Data/IoT technologies can, for example, help insurers identify new risks and, if necessary, develop appropriate insurance solutions. This will include the development of new insurance products that meet both the challenges and exposures as well as the loss prevention and mitigation measures of policyholders, e.g. model terms and conditions for an Industry 4.0 all risks policy. Ultimately, the decisive element will be development of new ways to cope with accumulation scenarios by Industry 4.0 loss events with the focus on major losses.

In addition, the internal and external business processes of insurance companies (keyword: digitization) will be affected, for instance, in the areas of communication, transparency, claims handling, preparation of proposals, etc.

Conclusion

If Industry 4.0 is implemented as planned, it will lead to a revolution in existing business processes that will also affect the insurance industry, which will need to adapt both its processes and current insurance products.

In accordance with the promoted goals, Industry 4.0 can create an enormous added value, especially for industrial companies and not least for our global economy and society. It will be accompanied by the generation of enormous data streams that can be evaluated and used for resource-efficient and high-quality production. Ultimately, it will affect our well-known world of manufacturing and selling products and finally our whole lives.

However, this concept will also entail new risks, such as cyber, data protection, failure of critical infrastructure and uncorrelated effects.

Industry 4.0 will change the insurance industry as a whole and our currently well-known and widely-used strategies for defining risks, insurance, underwriting exposures and insurance products. This means that the Industry 4.0 concept will also be a revolution for the insurance sector.

This requires those in the insurance industry to follow developments and inherent changes in the industry as closely as possible and to adapt current insurance products to the new realities. In this respect, one can ultimately speak of today’s insurance industry as moving towards an Insurance Industry 4.0.

Endnotes