-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Cat Bonds – A Threat to Traditional Reinsurance?

February 05, 2025

Dr. Jonas Kaiser

English

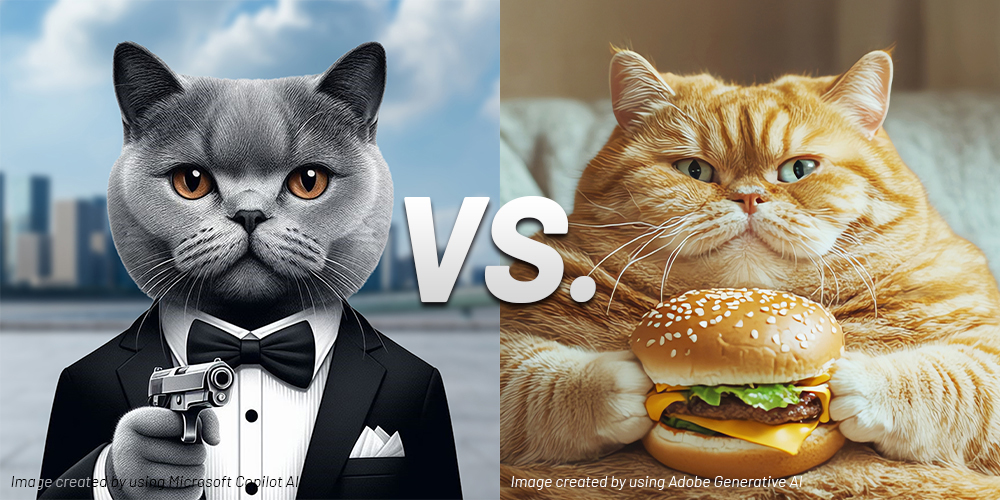

With its piercing brown eyes, tuxedo, and gun, this Cat Bond (image created by using Microsoft Copilot AI) certainly looks like someone who is not messing around. So – is the Cat reinsurance world shaken or just stirred?

Cat Bonds are not a new class of assets; they have been available for about 30 years. Recently, Cat Bonds (and insurance-linked securities in general) seem to have gained more traction and coverage, and these instruments have seen strong growth.1 This blog aims to provide some thoughts regarding similarities and differences between Cat Bonds and traditional Cat reinsurance.

Cat Bond Basics

A Cat Bond is not a complicated instrument. Since the technical details are well described elsewhere,2 in this article we only look at two parties of the Cat Bond transaction. The sponsor is the party (often, but not always, an insurance company) that seeks coverage for Cat risk.

The investors provide the capital from which eventual losses are to be paid. The invested capital is paid back to the investors after a pre-determined time span (three years being the standard) if no Cat event happens. In exchange for taking this risk, the investors earn a high interest rate.

Two crucial factors warrant further discussion:

- Trigger mechanism – This term refers to the circumstances under which the investment is lost.

- Pricing – How high should the interest rate be?

Cat Bond Triggers

Cat Bond has a gun, and the gun has a trigger: a mechanism describing which Cat events would lead to a partial or total loss of the invested capital. During the evaluation of a Cat Bond, there must be clarity as to what constitutes a Cat event. We will now have a closer look at two specific trigger types.

Parametric Trigger

This trigger type is defined by measurable criteria, e.g., maximum wind speed and/or core pressure at landfall for a cyclone or the magnitude of an earthquake.

A parametric trigger has obvious advantages: There should be no or little discussion in case of an event and, importantly, the money can be released quickly, which can mitigate the effect of the catastrophe by not having to wait for claims adjusters or even legal disputes.

However, a parametric trigger also has clear drawbacks. The “measured strength” of a Cat event does not always correlate with the damages it causes – and ultimately, the purpose of a Cat Bond is to replace losses. The Cat Bond could trigger even though losses are not very severe. Or, worse, the Cat Bond could not trigger although the occurred losses are devastating.

In cases of cyclones, the exact location of landfall, the tide at the time of landfall, and many other factors will contribute to the eventual loss burden. For earthquakes, the depth of the epicenter and local and regional building codes are among the important factors that contribute to the loss burden.

Indemnity Trigger

This type of trigger depends on the sponsor’s actual losses and thus clearly reflects the severity of the event. However, it will take some time until losses are known, and some cases might be disputable. With an indemnity trigger, the parties need clarity about what constitutes an event, how long losses can be aggregated, and what happens if multiple perils are involved, which is usually the case. These specifics are very closely related to those that would have to be clarified in a ”traditional” Cat reinsurance wording. The Cat Bond can complement the reinsurance program and replace some coverage. Frequently, it attaches above the reinsurance program and covers further losses after the exhaustion of the reinsurance program.

Other trigger types are industry loss or modelled loss triggers, but consideration of these is beyond the scope of this blog.

Pricing

Let us imagine an insurer seeking to buy EUR 150 million protection for Cat losses exceeding EUR 500 million. The classical solution would be buying a Cat Excess-of-loss (Cat XL) treaty. This treaty would have a price which is commonly expressed in rate-on-line (ROL) terms, meaning the relation of premium paid to coverage provided. Four percent ROL would mean that the total premium is 4% of EUR 150 million, or EUR 6 million. The ROL can be seen as an interest rate on the capital provided.

Alternatively, the insurer could issue a Cat Bond with an indemnity trigger with the same attachment point and limit. This is directly comparable to the Cat XL (we will outline the differences below), so the prices should also be comparable.

However, in practice the interest rate for a Cat Bond is usually much higher than the ROL of a comparable traditional reinsurance treaty, e.g., 6% interest rate (in addition to the risk-free investment yield).

Why is this the case – and is this justified? Despite a recent decline in 2024, Cat reinsurance prices are still perceived as rather high. It remains to be seen if (or to what extent) this is the classical cycle. After all, risks – and losses – have severely increased as well. Climate change is omnipresent and felt in our market. For example, we observe an increase in both frequency and severity of hail and flash flood events in Europe.

These factors also impact Cat Bond pricing, possibly with some delay due to the multi-annual nature and the update cycle of Cat vendor models.

Cat Bond vs. Cat XL: Head‑to‑Head

The Insurance Linked Securities (ILS) Market can undeniably provide practically unlimited capacity, albeit for “the right price”. With ongoing climate change, larger insured values and higher take‑up rates on insurance, Cat risks and losses worldwide will certainly increase. If traditional reinsurance is unwilling or unable to provide the much-needed additional capacity, the ILS market can do just that. Additionally, many reinsurers rely on retrocession; if this is scarce, these reinsurers can struggle to provide the required traditional capacity.

Cat Bonds are usually multi-year. The sponsor locks in the price and coverage for several years, with three years being the standard. Reinsurance treaties are commonly one year, although multi-year treaties are certainly possible. But reinsurers could hesitate to provide capacity for several years going forward. To account for the higher uncertainty, a multi-year catastrophe reinsurance treaty would usually be more expensive than a classical one-year treaty.

Perhaps the most obvious and undeniable advantage of Cat Bonds over traditional reinsurance is the non-existence of default risk. The money is completely collateralized. The natural counterargument would, however, be that top tier reinsurers have a practically non-existing default probability. Especially those with a very strong capital base such as …, well, I think you know.

Cat Bonds also open other channels and possibilities. They can reduce dependency on a single reinsurer – many insurers like to diversify their reinsurance capacity, which is certainly a valid point to consider.

And then there’s the simple economic argument: More available capital sources mean more capacity supply – and lower prices.

So, why do I think Cat Bonds are inferior to traditional reinsurance? Firstly, traditional reinsurance is simply much more flexible. It can generally better account for client needs, whereas Cat Bonds struggle with things that are considered standard in traditional insurance, such as reinstatements: If a large catastrophic event happens, a reinsurance treaty will usually cover additional events after the first one. This simply does not work for a Cat Bond: If the invested capital is gone, there is no capital available for future losses. This alone implies that Cat Bonds can fully replace so called “top layers” (covering remote risks, expected to happen with low frequency), but hardly so called “middle” or “working” layers where events are expected to happen with a higher frequency.

Furthermore, as their name implies, Cat Bonds can provide coverage for Cat events, but not all risk is Cat risk. The flexibility and ability to better meet client needs also applies to a much broader perspective, such as for long-tail business.

In addition to being the more flexible instrument, traditional reinsurance is also usually the less expensive solution. In addition to the high interest rates, sponsoring a Cat bond involves significant costs and workloads, such as providing the necessary data and documentation to investors.

In the traditional reinsurance market, there is always some degree of opportunism, as must be expected by rational parties reacting to supply and demand. However, decisions are usually not completely opportunistic, there is value in partnership and long-standing relationships. Client relationships are not given up lightly. Cat Bond investors, however, are completely opportunistic. What happens in the ILS market after one or many very large event(s) remains to be seen. If a Cat Bond is not seen as an attractive placement (e.g., after considerable losses in this market segment), it will not be placed – or the price will be much higher than initially anticipated.

Capital can quickly move elsewhere if opportunities arise. The reinsurers are here to stay; providing coverage is their business model.

Gen Re has the financial strength and the appetite to provide large Cat capacities. We believe that the traditional reinsurance market has significant advantages, and that classical reinsurance is overall simply the better – and generally less expensive – product. We are also happy to discuss tailor-made solutions to help your business.

Endnotes

- Steve Evans, “Record cat bond issuance of $17.7bn in 2024 takes outstanding market near $50bn: Report”, 2 Jan 2025, https://www.artemis.bm/news/record-cat-bond-issuance-of-17-7bn-in-2024-takes-outstanding-market-near-50bn-report/.

- Andy Polacek, “Catastrophe Bonds: A Primer and Retrospective”, Federal Reserve Bank of Chicago, Chicago Fed Letter, no. 405, 2018, https://www.chicagofed.org/publications/chicago-fed-letter/2018/405.

Last visited 20 January 2025.