-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Key Takeaways From Our U.S. Claims Fraud Survey

September 11, 2024

Jason Weesner

Region: North America

English

Insurance fraud is a global threat for all lines of business, with significant financial repercussions. In the U.S. alone, insurance fraud is estimated to cost the industry approximately $308.6 billion per year. This blog provides a snapshot of key findings found from Gen Re’s 2024 U.S. Insurance Claims Fraud Survey. Our survey obtained data from 40 companies that offer a variety of Life, Health, and Disability products.

Results show companies are leveraging many of the industry-recognized best practices that are known to effectively mitigate risk. However, based on our key findings, there is work yet to be done.

Personnel

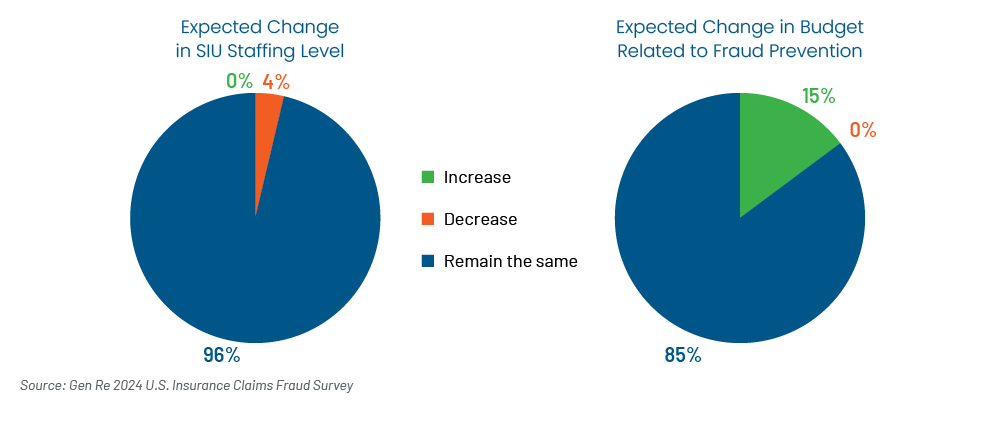

While 30% of participating companies in our survey do not have an in‑house SIU, and 4% expect a decrease in SIU staffing, it was encouraging to see that all respondents expect their fraud prevention budget to remain the same or increase within the next year.

Companies may view financial losses that stem from fraud as “a cost of doing business” but there are several implications with this approach. Susceptibility to fraud schemes not only affects the bottom line, but also brings reputational risk, the threat of consumer harm, and raises the potential for civil litigation. Therefore, organizations should adequately budget for counter-fraud efforts. It is also important to consider that dedicating personnel to a Special Investigative Unit (SIU) role may help ensure regulatory compliance in certain markets.

Identification

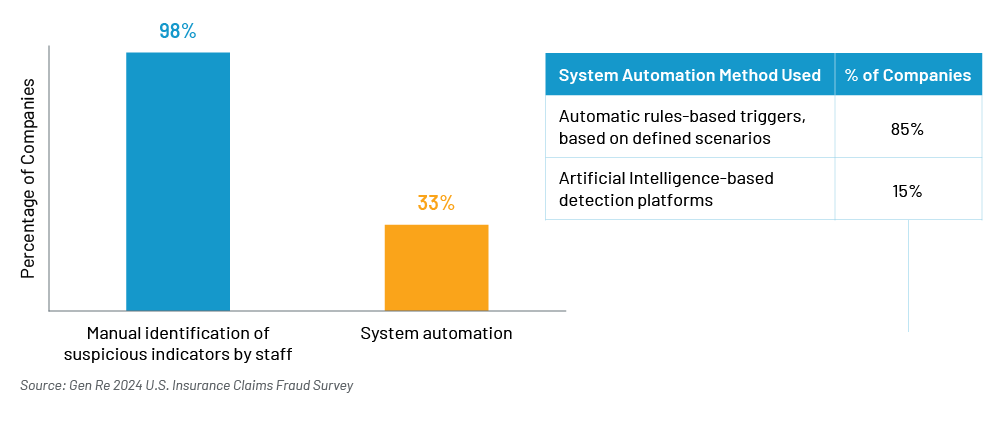

Nearly all respondents said they rely on staff to manually identify suspicious indicators, yet only 33% use system automation of any sort. This is remarkable, considering that respondents cite a lack of automated resources as the top factor increasing their exposure to questionable claims.

Being able to effectively identify suspicious indicators is key to any claims and underwriting risk management program. Anecdotally, there is broad consensus that manual and systematic processes do complement one another.

Companies should therefore consider effective systematic options that suit their data environment and needs. Whether a simple rules-based platform or AI‑analytics, these solutions can provide an added layer of defense and address blind spots.

How SIU Referrals Are Identified for Further Review

When asked to name the most common type of fraud they see, companies reported several specific fraud schemes. More than half mentioned material misrepresentation on the application as the top concern.

The Most Common Types of Fraud Reported in Ranked Order

|

1. Material misrepresentation on applications |

|

2. Durable medical equipment / Provider fraud related to DME |

|

3. Unreported income and/or employment |

|

4. Account takeovers |

Respondents are keenly aware of threats posed by identity theft, account takeovers, and fabricated (synthetic) identities, with 74% having a system or process in place to address these concerns.

However, there is still work to be done to mitigate this rapidly evolving risk. A multilayered “Know Your Customer” program is essential in today’s environment and will help protect organizations and their customers from harm.

Respondents reported that increased digital interactions with customers is a top driver of fraud exposures. The survey shows that slightly more than half now use accelerated underwriting and automated claim processes.

Of those, the vast majority have adopted controls to identify questionable claims or underwriting issues – this is critical, since fraudsters will continually test automated processes, and will exploit any loopholes for monetary gain. As more companies begin to adopt these automated/accelerated workflows, consideration should be lent to implementing controls such as post-issue audits, random holdouts, or other screening measures not already in place.

Training

The keystone of any organization’s counter-fraud effort is fraud awareness, and training is vital. In this category, 95% reported that their assessors are trained to identify suspicious indicators.

Much of the training occurs during onboarding, or in the form of “on-the-job” training. The data, however, shows that formal training opportunities for tenured employees is not as prevalent.

Statutory and regulatory requirements outline guidelines for industry compliance. For example, some states require no less than two hours of continuing education training be provided to non‑SIU personnel each year to emphasize the responsibility of identifying and reporting internal and external fraud to the proper authorities.

As such, Gen Re encourages companies to provide formal fraud awareness training to all employees on a routine basis. This keeps the front-line apprised of the latest trends and schemes and helps to ensure compliance with anti-fraud training requirements mandated by many states.

Claims Investigation

Most companies (85%) have specific procedures in place that guide staff on how to investigate suspicious claims and bring them to resolution – this is a common best practice. However, to conduct proper verifications, access to quality information is vital.

Nearly all respondents (97%) reported they take steps to verify deaths on all Life Insurance claims. However, 17% do not have a special process in place for deaths that occur abroad. Foreign death claims are widely considered to be higher risk; therefore, this may point to an opportunity for some to examine their processes.

The survey findings show that 38% do not utilize third-party information platforms to assist with their verifications. This highlights an opportunity for some to explore the various information resources potentially at their disposal. The ability to leverage reliable information platforms may support staff’s ability to perform routine due diligence background checks on insureds/claimants, noting that only 41% currently do so.

When it comes to investigation activities, most respondents (65%) outsource to third-party providers. While outsourcing can be an effective force-multiplier and investigative tool, vendor utilization also brings risks (e.g., customer service lapses, QA concerns, data/privacy breaches, etc.). Instituting and maintaining robust vendor management vetting and monitoring processes help to ensure third-party providers adhere to service level agreements, quality, and compliance standards.

Policy Language

An insurer’s ability to investigate and the ultimate outcome often hinges on the policy language. The vast majority of respondents utilize policy language that allows for the voiding of the policy or declining of the claim when material misrepresentations and/or concealments are identified.

Additionally, 85% also utilize language that requires the customer/insured to cooperate and provide information relevant to the claim. Lastly, nearly 80% of respondents have policies that contain an exception to the incontestability provision when the policy is procured by fraud. An opportunity may lie in the fact that only 23% of respondents use policies that afford the right to an Examination Under Oath (EUO). The EUO has proven to be an effective investigative tool and is a common contractual element in some areas (for example, an insurer’s right to an EUO is commonly defined in most P&C policy contracts).

Administration

Because fraud risk exposures are constantly evolving, it is important for organizations to take stock of their internal processes and perform fraud risk assessments on a routine basis.

Although two-thirds of respondents already do so, more organizations would benefit from these risk assessments as a way of proactively identifying potential vulnerabilities before becoming a victim.

Tracking and reporting are essential elements of any counter-fraud effort. While over 60% of respondents report their fraud statistics to various regulatory agencies, it is notable that nearly 40% do not report suspected cases of fraud to the authorities. Anti-fraud statutes in most states require insurers to file reports with appropriate agencies when they have a reasonable belief that a fraud may have occurred. To ensure compliance, organizations should maintain familiarity with the reporting standards for their respective jurisdictions and adhere to same.

A prominent area of opportunity relates to information sharing as only 49% of respondents reported having a process in place that allows for information sharing with other insurers on matters related to questionable claims. This stands in stark contrast to what we see in Property & Casualty insurance, as most insurers have developed compliant information sharing processes that better enable them to assess matters of concern (e.g., double-dipping, application misrepresentations / non-disclosures, ID theft, etc.).

Gen Re is here to support our clients’ organization’s fraud risk management efforts and is available to provide consultation services. Although this blog summarizes the key takeaways from our survey, we remind all claims professionals that claim decisions should each be made on their own unique set of circumstances.

To learn more about any topics discussed in our report, or if you would like to discuss potential solutions, please contact me.

Participating companies can access a more comprehensive report by emailing the U.S. Research Center for more information.