-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review

Income Protections insurance (IP), also referred to as Disability Income insurance (DI) is a unique product for everyone in the insurance cycle – not least claims managers and actuaries (like me). It is not only one of the most important biometric products in many European or Anglo-Saxon markets, but also somewhat more complex in certain respects than other products. In Germany, for example, IP accounts for around two thirds of the protection business in the Life insurance market. The 3D tool which I’ll present in this article has been designed for the German market, but also other markets have shown interest in implementation.

Why pay extra attention to Income Protection insurance?

An actuarial challenge in IP is that it is not enough to only consider the probability of the insured event occurring (incidence rates); the duration of the annuity payment must also be calculated. This depends on the termination rates, i.e., the recovery rates and mortality rates of the disabled lives. From a claims management perspective, this means that not only the initial assessment plays a role, regular follow‑up assessments (reviews) to ensure that the beneficiary remains entitled to benefits are also important. Each claim is evaluated on its own unique set of circumstance in line with policy terms and conditions and the regulatory environment one operates within. This includes reassessing ongoing liability.

For long-term Disability products, both claims managers and actuaries focus on the initial claim assessment or incidence rates. This is for a good reason as the incidence rates have the biggest impact on the premium: 50% higher incidence rates result in roughly 50% higher premiums. And mistakes made during the initial assessment of an IP claim can rarely be corrected later.

A win-win for the insured and the insurer: Recovery!

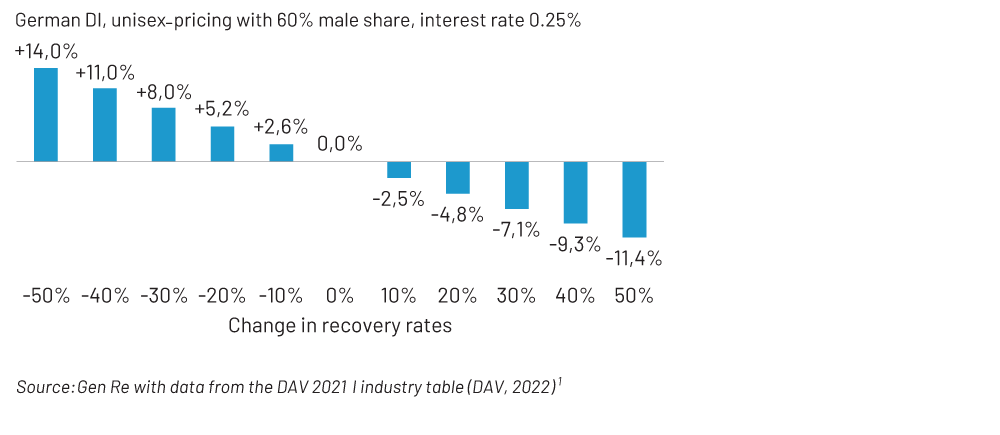

Understanding one’s motivation is key to ensuring proper return to work strategies are developed. Of course, for the insured, the goal should always be to return to work. And what has been said above on incidence rates and first assessment of a claim does not mean that recovery should be neglected. On the contrary, their impact on the premium for an IP policy is significant, as shown in Figure 1.

Figure 1 – Impact of change in recovery rates on premiums

A permanent 30% increase in recovery, for example, could reduce premiums by 7% – this is significant, especially in times of shrinking margins. In terms of claims reserves, for those disabled at age 40 the claims reserve would be 9% lower.

Typical for an actuary, I have already bothered you with some figures on the subject. As a claims manager, you may be wondering: is there also concrete added value for your work, i.e., claims reviews, that actuaries can offer? I dare say the answer is ‘yes’; at least if we actuaries are ready to better understand some of the challenges of IP claims-handling.

For actuaries, this means that we have to communicate with non-actuaries – at first, it may sound like an effort, but it’s worth it! At Gen Re, claims managers and actuaries have teamed up to tackle the issue of claims reviews for German DI. Before we take a closer look at what came out of this, let me briefly outline what the typical German DI product looks like.

Long-term IP without deferred period

The German IP product (Berufsunfähigkeitsversicherung) has no deferred period, i.e., policyholders receive financial support from the first day of disability. But there is one crucial condition: medical evidence about the disability must be given, and it needs to be certified by a doctor and confirmed by the claims manager, that the disability is expected to last for at least six months. Hence, despite the absence of a deferred period, this is still a long-term Disability product. Most policies are sold in the individual business and usually cover the insured’s own occupation, i.e. provide financial protection if an individual can no longer perform the occupational duties they have been trained for.

Traditionally, four occupational classes for IP policies were distinguished: from class A (very low risks) for e.g. office work with no exposure to hazards to class D (high risks) for e.g. heavy manual work. It has been shown that claims experience depends very much on the profession, making a more detailed differentiation appropriate. Today, insurers offer 12 occupational classes or even more.

Claims-handling for this product involves examining medical facts and considering the profession that the person held in healthy days. Against the backdrop of growing IP portfolios (which is positive in itself), the need for qualified claims managers is increasing. Finding a delicate balance between initial claims assessment and ongoing claims management is a challenge in many organisations.

How can actuaries support claims?

Trying to fully automate the claims management of complex insurance products does not sound like a good idea. It would probably cause more new problems than it would solve old ones. However, our actuarial data can help with prioritisation in the review process.

What do I mean by that? IP claims portfolios may comprise thousands of active Disability claims. To support claims departments in allocating their capacities, it would be great to assign some measure to active claims, indicating their suitability for review. The goal is to identify those cases with:

(a) A high probability of recovery

(b) A high (remaining) present value of benefits

Part (a) suggests that we should concentrate our efforts on cases with a good chance of success – in other words: not spend too much time on the claims that have a low probability of return to work. At the same time, cases should be economically significant. Suspending payments for individuals with minimal sums insured releases very few reserves. This is addressed by part (b).

Experienced claims managers have a strong gut feeling for which claims (a) and (b) are high or low. On the other hand, they rarely have a comprehensive overview of the entire claims portfolio which would be essential for a systematic review process. This is where actuaries come into play. In collaboration with claims managers, we have designed the 3D Tool, the three Ds standing for “Data-Driven Disability” claims management.

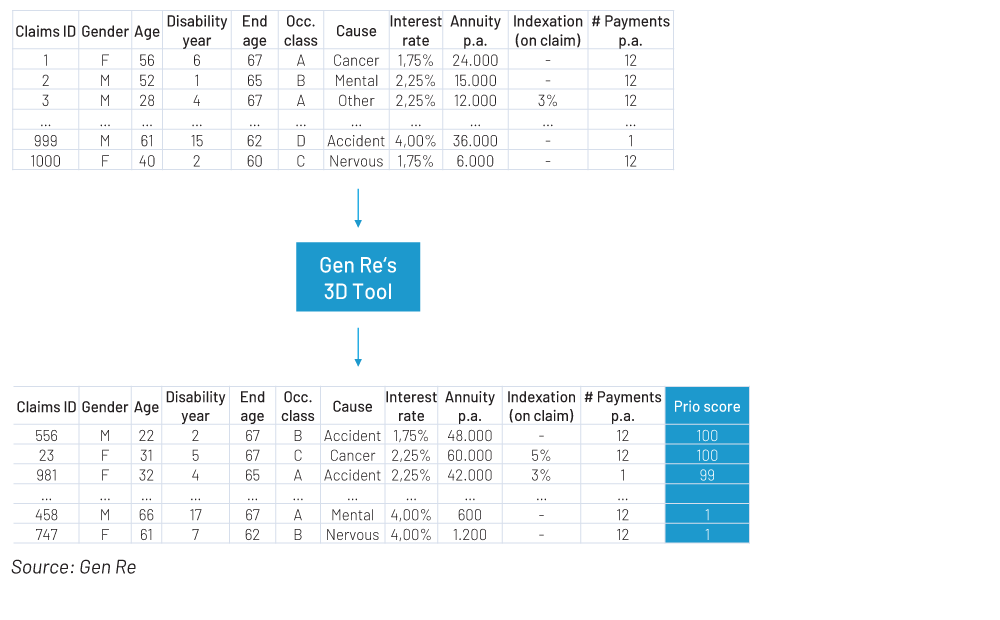

Using statistical analyses, the 3D Tool determines on a best estimate basis (a) the probability of recovery within one year, and (b) the remaining present value of benefits, i.e., the expected total amount yet to be paid out. Both criteria – recovery chances and present value of benefits – are combined into a “prio score” ranging from 1 to 100. The higher the prio score, the more suitable an IP claim is for being reviewed: 1 indicates very low present value and (statistically) low chances of recovery; 100 indicates high present value and high chances of recovery.

The tool helps the claims department to allocate resources. If a claims department has the capacity to review, say, 30% of active cases, they could concentrate on the 30% with the highest prio score – and not assign resources on cases with a particularly low score. The actual reassessment of the claim, however, must still be carried out by the claims managers themselves.

The data behind the 3D Tool

As we aim for the most objective, systematised evaluation of a claims portfolio we need reliable statistics on a solid data basis. We use two sources for this: the new industry DI table (DAV 2021 I)2 and Gen Re analyses from our biometric data pools.

The new industry table for DI came into force in 2022, replacing the old DI table from 1997. The German Actuarial Association (DAV) is responsible for the derivation of this new table. It is based on the three big biometric data pools in Germany, run by Munich Re, Swiss Re, and Gen Re, which together cover 85% of the DI market – a splendid data basis!

Besides incidence rates, which measure the probability of becoming disabled, termination rates are included – separately as recovery rates and mortality rates of the disabled. We need both: recovery rates go into our prio score directly and via the remaining present value of benefits; mortality rates of the disabled affect only the present value.

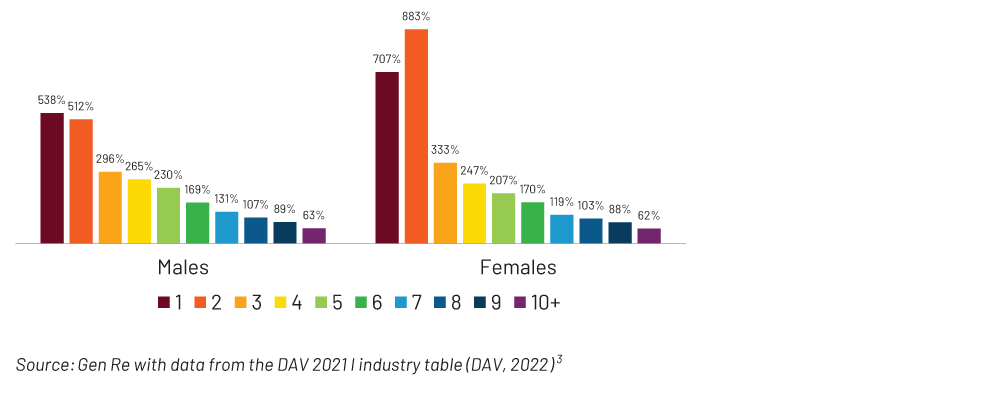

This gives us a good estimate of how the chances of recovery are influenced by three factors: age, gender, and years of disability. As shown in Figure 2, the probability of recovery for men in the first year of disability is 5.4 times as high as in disability years 6+; for women it is 7.1 times as high.

Figure 2 – Recovery by disability year in % of disability years 6+

Experienced claims managers would certainly agree that the impact of the disability year is huge, and that the chances for recovery are significantly higher in the first year, compared to six years after the onset of the claim. The advantage, however, is that we can now quantify this on a reliable statistical basis.

The same is true for the influence of the claimant’s age, as illustrated in Figure 3. It is no surprise that the probability of recovering from disability, which can be as high as 150 per mille (or 15 %) at young ages, falls sharply with increasing age.

Figure 3 – Recovery in ‰ by age and gender for the first disability year

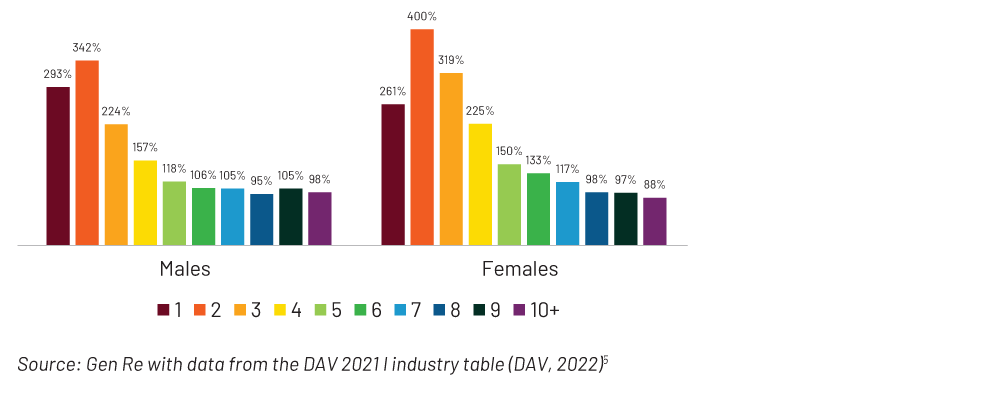

The higher the mortality rate among the disabled, the lower is the present value. It is therefore important to understand how mortality depends on parameters such as age, gender, and year of disability. As an example, the influence of the year of disability (at the same age of the person) is shown in Figure 4. In the second year of disability, mortality is still 3.4 or 4 times as high as in disability years 6+, depending on gender.

Figure 4 – Mortality by disability year in % of disability years 6+

The impact of occupation class and cause of disability

Mortality risk does not depend only on biometric parameters such as age and gender. For example, cancer patients have a significantly higher risk of dying than others. Claims managers also often note that it is particularly challenging to reintegrate individuals with mental illnesses into the workforce. Can we take this into account, i.e., quantify it?

Unfortunately, the data for the new DAV table do not include information on causes of disability – not even occupation classes, which should also have an influence. However, analyses from the Gen Re biometric data pool, to which more than 20 German companies contribute, can provide insights here. On an annual basis, we analyse their IP portfolio data with respect to claims experience (incidence, recovery, mortality), new business structure, and lapse rates.

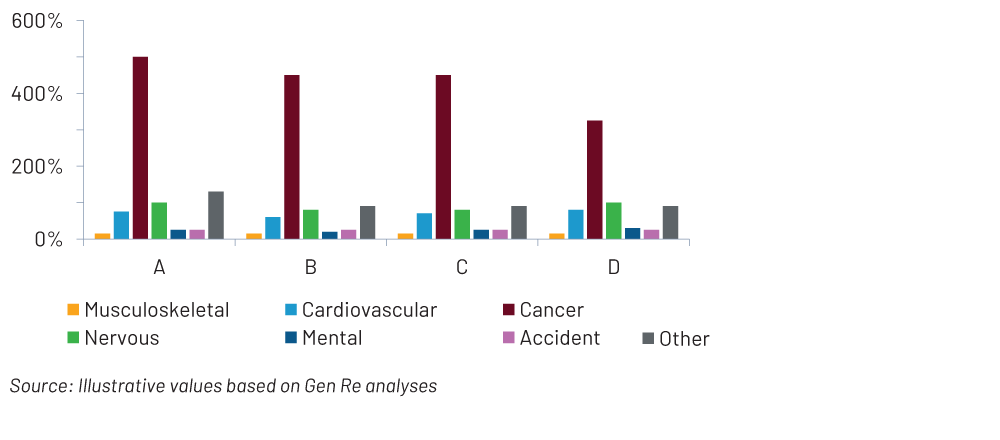

In particular, we know how terminations vary depending on the cause of disability and occupation class. This is shown for recovery in Figure 5 (illustrative values). For occupations, we use a rough categorisation into classes A (particularly low-risk occupations, such as pharmacists) to D (particularly high-risk occupations, such as roofers). Values above 100%, which can be observed for accidents in all four occupational classes, indicate an above-average likelihood of recovery. For neurological diseases (most frequently in this group is multiple sclerosis), the prospects are well below average – as might be expected, since these are often progressive diseases.

The impression that individuals with mental ill-health have lower chances of recovery is also confirmed. In terms of mortality among disabled people, the high values for cancer are striking (see Figure 6) while for disabilities due to musculoskeletal conditions, the mortality risk is well below the average.

Figure 5 – Relative recovery by cause and occupation class

Figure 6 – Relative mortality of disabled by cause and occupation class

What does the 3D Tool do in practice?

We now have good statistics describing the impact of several parameters on recovery and mortality of disabled individuals, and these are implemented in our 3D Tool. All we need as input for the tool is a current list of the complete IP claims portfolio including specifications of the following attributes:

- Claims ID (only as identifier)

- Gender

- Age

- Disability year (how many years on claim)

- End age (at what age do payments stop in accordance with the policy)

- Occupation class (one out of A, B, C, or D)

- Cause of disability (one out of cardiovascular disease, cancer, mental disorder, musculoskeletal disorder, neurological disease, accidents, other)

- Interest rate (for the present value)

- Annuity per annum (the sum of benefit payments per year)

- Indexation while on claim

- Number of payments per annum (e.g., 12 for monthly payments, four for quarterly payments)

All these attributes should be readily available in the databases of the claims departments allowing the list to be created with minimal effort. Personal data such as name, address and date of birth are not included, which makes sense in terms of data privacy and protection.

This specification list is sent as input to the 3D Tool, which calculates the prio score for each dataset and returns the list as prio score sorted output – with cases particularly suitable for a review at the top (see Figure 7). The lower the suggested priority, the further down a claim is placed. Depending on how much capacity is available for review, claims departments could, for example, initially concentrate on the top 30% segment of the list.

Figure 7 – Example of use of Gen Re’s 3D Tool

Where exactly is AI involved?

The tool works completely without artificial intelligence (AI). Large language models, which perform impressive tasks for chatbots such as ChatGPT, are of no help for this particular purpose. The 3D Tool is not a black box; every single step can be explained using analyses that were carried out on the basis of portfolios of insured individuals. The tool requires no AI‑related documentation.

One advantage of a data-driven approach to prioritising reviews, in addition to automating the process, is objectivity: the prio score is calculated based on large statistics. However, this does not guarantee that all claims with a prio score above 90 can be successfully reactivated. In individual cases, a claims manager may know that a claim involves a particularly mild cancer, for example, so that the recovery prospects may be better than predicted by the 3D Tool. The tool is helpful in prioritising the – often large – claims portfolios, but the review work remains the responsibility of the claims managers.

However, let’s look at criteria additional to the biometric parameters described above that claims managers’ experience tells them can have a positive or negative impact on a successful return to work strategy. An important example for a non-promising recovery effort is when the person on claim also receives benefits from other resources (e.g. workers’ compensation, social security disability annuity). We do not want to ignore these factors, so the 3D Tool offers the option to include such soft criteria.

Based on expert assessments by the Gen Re claims department for the German market, we have identified 10 criteria (with more in progress) and evaluated and quantified their impact on the prio score:

- Full and unlimited IP annuity from social security (negative impact)

- Stay in psychiatric hospitals (negative impact)

- Insolvency (negative impact)

- Severity/chronicity of the disease (negative impact)

- Substance dependence (negative impact)

- Unemployment (negative impact)

- No hospitalisation (positive impact)

- Retraining successfully completed (positive impact)

This means that if desired, and the corresponding information on the criteria is available in the databases of the IP claims portfolios, a second, adjusted prio score based on hard and soft criteria can be determined in addition to the prio score based only on the hard criteria.

First experiences and outlook

The 3D Tool has been designed for the German market, where we have already employed its use with several IP insurers over the span of one year; other insurers – in Germany as well as in other markets – have already expressed interest. This is more than we expected and highlights the importance of claims review in IP. When we thoroughly analyse claims portfolios, we occasionally identify cases that have reached end age and should no longer receive benefits – it’s beneficial to uncover these cases as well!

Another, probably even more important, side effect is that right from the start, the tool was planned and implemented as a joint project between claims managers and actuaries. When we present our 3D Tool to insurers, we make sure that representatives from both disciplines are involved. For me as an actuary this close collaboration has been helpful to better understand IP claims management, and I am convinced that the reverse is also true.

In other large IP markets, the initial situation is not fundamentally different: while IP is one of the most important and expensive biometric products, claims departments suffer from high workload and often lack sufficient capacity for claims reviews. With good data on key aspects (which should of course be market- and product-specific), a prioritising tool can provide real added value.

Focusing on cases with a high prio score leads to more return to work successes and recoveries overall, more claims reserve release and increased cost efficiency. From the client’s point of view, it also makes sense to orient the claims managers to approach those individuals who have a good chance of returning to work rather than those who are likely to be too ill to ever work again.

Let me close with the kind feedback from our pilot partner: “The results of the 3D Tool are absolutely convincing and can be put to practical use quickly.” Please get in touch if you are interested in more details about the 3D tool.

Endnotes

- Deutsche Aktuarvereinigung e. V. – DAV (26.1.2022). DAV 2021 I: Biometrische Rechnungsgrundlagen für Berufsunfähigkeitsversicherungen.

- Ibid at Note 1.

- Ibid at Note 1.

- Ibid at Note 1.

- Ibid at Note 1.