-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

What Are We to Make of Cannabis Use in The Insured Population? Business School

Business School

Publication

Knife or Needle: Will the New Weight Loss Medication Replace Bariatric Surgery?

Publication

Weight Loss Medication of the Future – Will We Soon Live in a Society Without Obesity? Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Why ESG Spells Big Changes Ahead For Insurers

June 17, 2021

Alexander Eistert

Region: Europe

English

Deutsch

The year 2020 was the warmest in Europe since weather recordkeeping began in the mid‑19th century. Extreme weather events are also on the rise, causing a multitude of severe natural disasters.

It is hardly surprising that concern over climate change is growing, and more companies now realise that they can no longer ignore or underestimate the risks it poses to their business. In the Allianz Risk Barometer 2021, “climate change” is ranked 9th worldwide and has climbed into the top 10 here in Germany.1

Supported by high-profile initiatives such as the Fridays for Future movement and questions over the use of resources as well as fair working conditions, companies are being forced to look at how they can meet emerging sustainability criteria.

The acronym ESG commonly summarizes criteria in the area of sustainability. While ESG is not limited to climate change, it is still the most observed criterion at present.

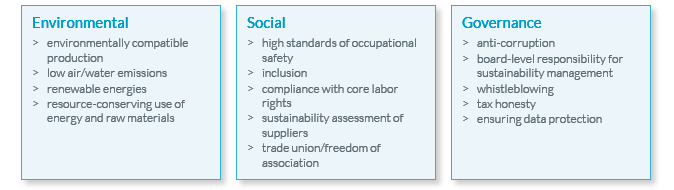

Put simply, ESG is generally understood to represent a standard of sustainable investments in the areas of environment, social and governance. The table below provides examples:

The term ESG originally arose as an investment concept and concerned issues relevant to the capital markets, especially in relation to a company’s investment strategy. In the recent past, for example, some financial services companies, including insurers, have stopped investing in industries with poor environmental performance.

While it undoubtedly has a role to play, such decisions are not solely a result of public pressure. In fact, large companies in the EU are now required to report on their approaches to social and environmental challenges (Non‑Financial Reporting Directive 2014/95/EU).

As a result of further EU measures focusing on ESG, private companies and investors (and thus the insurance industry) will be subject to additional reporting and regulatory requirements.

The EU Taxonomy Regulation (EU 2020/852) adopted last year explicitly defines reinsurance and primary insurance as economic activities that can contribute to climate change mitigation.

The Taxonomy Regulation provides criteria for determining whether an economic activity qualifies as environmentally sustainable, thereby enabling the environmental sustainability of an investment to be assessed and prevent “greenwashing”. It is aimed at EU member states, financial market participants offering financial products, and companies that are required to publish a non-financial statement.2

The European supervisory authority EIOPA and the German financial regulator BaFin are also currently drafting similar requirements. BaFin has already published an initial orientation guide for companies in the form of a fact sheet on dealing with sustainability risks.3

As a result of these proposed regulations, (re)insurance companies may have to pay even more attention to the asset classes they invest in. The GDV (Germany’s insurance association) recently announced that the insurance industry would fully invest capital assets of EUR 1,700 billion in a climate-friendly manner by 2050.4

Beyond green investment

ESG and sustainability issues for (re)insurers are also gaining momentum outside of investment strategy. Articles on ESG appear daily in the insurance press, and statements on this complex of topics are now a regular feature of (re)insurance company annual reports. It seems likely that ESG will influence both underwriting and product development.

In underwriting, the analysis of a risk could now expand from classic aspects, e.g., types of operation or geographical characteristics (e.g., U.S. exposure), to qualitative analyses in relation to ESG criteria.

In most cases, insurers’ risk appetite is already limited with regard to a wide range of industries that have ethically questionable business models. However, even for less controversial industries, ESG‑compliant underwriting will take into account parameters that, to a large extent, are not currently considered.

Such parameters could include, among other things, the granting of employee rights but also possible audits of supplier companies (as already outlined in the proposed Supply Chain Acts in Germany and the EU).5 Some insurers are already actively moving away from underwriting risks that deal with fossil fuels.

Risks that actively address sustainability issues could also benefit from this change in the underwriting process. For example, opportunities could arise in pricing, and new leeway could also be created in terms of program structuring, including lower deductibles, more flexible terms, and the like.

Companies could thus be given incentives to change their processes and also contribute to compliance with wider sustainability and climate targets.

Recalibrated risk appetite

For insurers to implement the ESG concept effectively into the underwriting cycle, they first need to think about recalibrating their risk appetite. What risks are they prepared to underwrite, and what consequences must be factored in if there are disclosure requirements as to the proportion of premium drawn from risks that are not ESG‑compliant?

Growth targets may also have to be adjusted to account for sustainability initiatives.

In a further step, the underwriting process itself must then be adapted to the ESG concept. In this respect, it is important that the revised process does not complicate or slow down underwriting.

Scoring systems or analysis tools must be integrated into the underwriting process in a streamlined manner, and the risk dialog with the policyholder should play an important role upfront. It will be absolutely elementary to understand and evaluate the processes across the company, even beyond classic underwriting topics.

ESG criteria are also important in product development. The first sustainable insurance products, especially in the area of private insurance, are already being marketed. For example, in a sustainable household insurance policy, policyholders can expect compensation for additional costs if appliances need to be replaced with new ones that meet the highest energy efficiency class.

In the automotive sector, better differentiation can be achieved through the use of telematics, or discounts could be considered for the purchase of an electric car.

ESG concepts can also be transferred to industrial insurance, and it will be exciting to see what sustainable product features and innovations the insurance industry comes up with in the future.

Conclusion

ESG is an area of growing focus in the EU. Even if this is currently still strongly focused on the area of investments, an expansion of activity to other corporate areas, as outlined here, can now be seen.

While it is still too early to foresee precisely how ESG factors will be implemented in insurance underwriting or product development, insurers should maintain an awareness of growing developments in the area of ESG, which are sure to impact the insurance industry for years to come.

Endnotes

- https://www.agcs.allianz.com/news-and-insights/news/allianz-risk-barometer-2021.html.

- A first delegated act on sustainable activities for climate change adaptation and mitigation objectives was published on 21 April 2021, https://ec.europa.eu/info/publications/210421-sustainable-finance-communication_en#taxonomy.

- https://www.bafin.de/SharedDocs/Downloads/DE/Merkblatt/dl_mb_Nachhaltigkeitsrisiken.html.

- https://www.gdv.de/de/themen/news/die-nachhaltigkeitspositionierung-der-deutschen-versicherer-im-wortlaut-65404.

- In an early consultation on March 3, 2021, the German cabinet approved the draft law on the Supply Chain Act, the so-called Due Diligence Act. According to the plans of the German government, large companies will be obliged to ensure compliance with human rights along the entire supply chain from 2023. On March 10, 2021, the European Parliament passed a legislative proposal for a European supply chain law. In parallel, the EU Commission is also pushing ahead with its own plans for a supply chain law at European level. https://www.europarl.europa.eu/news/en/press-room/20210304IPR99216/meps-companies-must-no-longer-cause-harm-to-people-and-planet-with-impunity.