-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Business Interruption Exposure – An Underwriter’s Guide to Getting It Right

October 16, 2019

Leo Ronken

English

Deutsch

The significance of business interruption insurance is growing in our modern, globalised world with its increasingly intricate division of labour. Many experts now regard business interruption insurance as being at least as important to companies as property insurance.

According to a claims study,1 the cost of business interruption claims is often significantly higher than the cost of property damage: The average property business interruption loss is now in the region of more than EUR 3.1 million, i.e. more than a third higher than the average property loss (EUR 2.2 million). Business interruption losses increase more rapidly than property losses and are significantly more volatile. For example, when a business interruption event occurs, customers search for alternative delivery options and often do not return to the original supplier even after business has been restored.

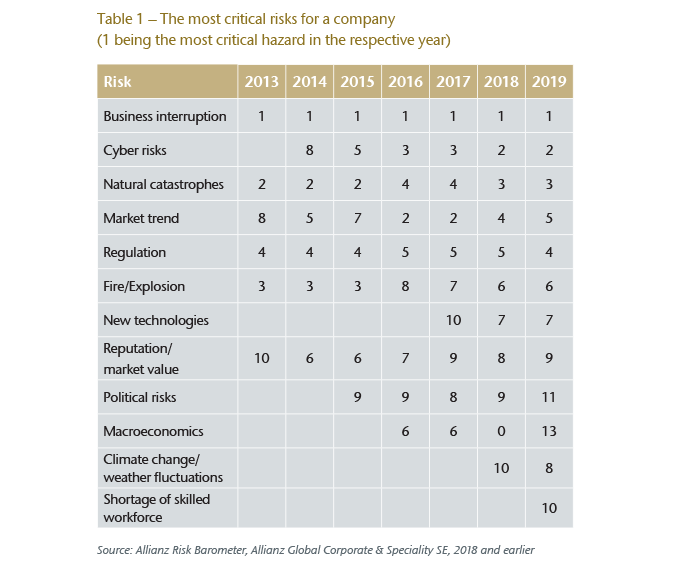

Another study from the same insurer reveals that business interruption has been regarded by the companies surveyed as the most problematic risk for many years (see Table 1).

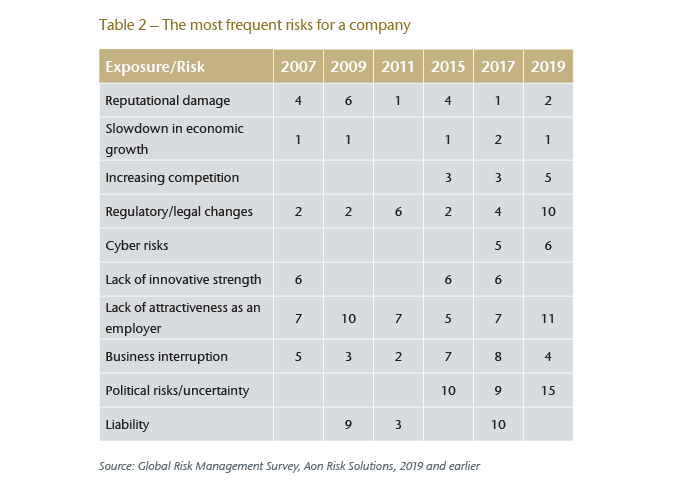

The Global Risk Management Survey carried out every two years by Aon, in which corporate managers worldwide are asked about the current risk situation, also paints a similar picture (see Table 2).2 Since 2007, business interruption has consistently been recorded as one of the top 10 risks. 2019 figures show an increase in these losses compared with 2017.

As a result of production trade flow, supply chain globalisation and both macro- and socio-economic trends, the implications of business interruption losses are increasingly far-reaching. The reduction of redundancies and the lack of alternatives in the event of a loss due to the increasing specialisation of companies have contributed greatly, not only to the loss amounts observed, but also to an increase in causes. These range from traditional risks such as fire, machine breakdown, natural hazards, or supply chain interruptions, to new triggers caused by ongoing digitalisation. The latter don’t typically cause material damage but can result in substantial financial losses.

New economic and business trends are also impacting exposure, e.g. customer behaviour, changes to business models, centralisation, outsourcing, patenting, specialisation, production processes, infrastructure in “industrial parks”, transport routes, exchange rate fluctuations, and insolvencies of companies in the supply chain.

Overall, it can be said that business interruption insurance for commercial and industrial businesses has evolved from being a cover that used to be neglected to a standard cover that is indispensable. It's therefore vital for an insurer to consider and assess the business interruption exposure separately from the property loss risk – business interruption carries significantly more weight in underwriting decisions than in the past.

In a previous article I shared my thoughts on possible future developments in business interruption insurance.3 The focus of this current article is rather on its components (e.g. concerning capacity, premium and reinsurance placement) which in our opinion are significant for underwriting decisions.

Necessary information

Often during site inspections, the risk of business interruption is only casually considered in comparison to the risk of property damage. Questions about business interruption are kept general and do not help form a detailed assessment of its possible consequences after an insured property loss.

To make an appropriate underwriting decision that also considers the relevance of business interruption insurance, careful assessment of the facts recorded during an inspection is required. Other items to consider include the underlying insurance contract, the specific situation of the company to be insured, how its production is organised, and its financial situation.

The following list contains possible criteria to allow a risk assessment for business interruption insurance to be conducted. Despite its considerable size, it’s not an exhaustive list as, depending on the situation, different aspects come into play.

General information

For a general assessment, there are three areas that should be examined:

- Scope of business interruption insurance cover

- Possible interdependency losses

- Possible contingency losses

In order to conduct a proper assessment, it is advisable to consider the following:

- Ownership (e.g. of land, buildings, equipment, and inventories)

- The policyholder’s business areas (e.g. trading, production, provision of services, and possible dependencies between these business areas)

- Gross profit per business segment

- Financial situation of the policyholder (e.g. equity/debt ratio, liquidity, necessary costs for repayment, and interest)

- The market position, presence and development prospects of the company to be insured (past, present, and future in terms of turnover, profit, market)

- Necessary certifications, licenses, approvals, etc.

- Organisational structure of the company, including decision-making, production, and sales structures, interdependencies of these departments and their significance to operating performance (interactions between enterprises/areas of the company)

- Buyer/client structure of the company, including the proportion of the most important buyers/clients as well as alternatives (to assess potential additional damages)

- Supplier structure of the insured company, including information on the proportion of most important suppliers and possible alternatives (to assess potential contingency losses)

- The company’s dependency on the import/export of goods/services and the extent to which seasonal dependencies may exist

- Frequency of internal audits and controlling mechanisms for checking, controlling, and evaluating the (most important) suppliers and buyers

- Willingness of the policyholder to assess risks and implement risk management procedures

- Existing fire protection plan as well as further preventive and protective measures against the risks insured in the insurance contract

- Loss history

Information on the underlying insurance contract

- Basis of the current business interruption insurance contract (e.g. standard policy of the insurer or broker form)

- Type of policy (e.g. named risks, all risks policy)

- Covered risks

- Agreed exclusions

- Business interruption compensation based on gross earnings, gross profits, gross revenue, rent insurance, and increased cost of working insurance

- Agreed business interruption insurance sum (Is the reported/agreed insurance sum plausible and realistic?)

- Development of the sum insured in recent years

- Agreed indemnity period (Is the reported insured sum equal to the indemnity period? Is the agreed period of liability sufficient or too short?)

- Agreed extended liability period

- Type and amount of agreed deductibles

- Agreed maximum compensation or limitation of liability

- Underinsurance agreement

- Agreed first risk positions (e.g. additional costs, access restrictions, official reconstruction restrictions, fines/penalties, expert costs, etc.)

- Trade sanctions and other exclusions/inclusions under the insurance contract (e.g. war, terrorism, etc.)

- Inclusion of interdependency losses

- Inclusion of contingency losses (named, unnamed)

- Type and extent of the coverage limit (e.g. layering, specification of the layer limits)

Information on the business to be insured

- Address and location information of the business to be insured (e.g. companies in the neighborhood with a possibly higher risk potential, earthquake and flood area, mining area, traffic infrastructure, etc.)

- Business areas, operations and facilities on the premises (main, ancillary, auxiliary), and their respective interdependencies

- Organisation of operations (e.g. operational, structural, administrative, IT, and sales)

- Number of permanent employees vs. percentage of employees with contracts for work and services

- Gross profit of the insured per business segment (e.g. trading, production, services) or business interruption insurance sums (necessary indication of the key date of their calculation and expected development within the limits of the insured liability period)

- General description of potential consequential business interruption losses after a possible insured property loss (e.g. related to production facilities and areas, logistics, IT, infrastructure as well as the expected financial effects on sales/profit and market share of the business, etc.)

- Number of operating shifts in the course of a year

- Degree of utilization of the plant in the course of a year

- Seasonal fluctuations in the individual product and business segments

- Substitution possibilities for the individual product/business areas as a result of a business interruption (e.g. alternative production, relocation to other plants, contract manufacturing, existing stocks)

- Existing bottleneck areas, machines, plants including commercial and technical IT, energy and telecommunication facilities/supply as well as backup possibilities/emergency plans, etc.

- Indication of the terms for delivery/replacement and installation times required for important machines and plants (series machines vs. custom-made vs. self-built)

- Required reconstruction times for destroyed/damaged buildings including the procurement of the necessary permits as well as any expected reconstruction restrictions due to official requirements

- Time required to regain important operating licences and licences to resume production for operations that require permission from authorities, (e.g. in Germany operations subject to the Federal Imission Control Act (BImSchG), biotechnology operations, pharmaceutical operations)

- Susceptibility of the production plant (e.g. just-time-delivery, automated production) as well as the goods produced/stored (e.g. to fire, heat, smoke, humidity).

- Storage and duplication of important business documents and data (including IT data) and their protected outsourcing. Details of type and frequency of backup and storage locations (in the company, outside, protected, etc.)

- Stockpiling of important spare parts and reserve systems

- Business Continuity Management (BCM), Risk Management measures (regularly updated and tested)

- Estimated time needed for “technical recovery” and full “commercial recovery” of operations

Supplementary information for companies with multiple locations

- Addresses of the individual insured companies as well as the respective countries (including geocodes, if applicable)

- Natural hazard exposure of the individual locations/countries (e.g. earthquake, storm, flood)

- Business interruption sum per insured location, alternatively indication of the individual business segments in the respective locations with details of the products manufactured (e.g. number of units, tonnage, metres) or percentage of total sales, consolidated sales analysis, etc.

- Indication and description of existing interdependencies between the various sites

- Indication and description of potential backup possibilities including location (internal or external alternatives) and realistic assessment of alternative capacities specifying the percentage of the turnover

Once this information has been collected, it's possible to make an assessment of the current risk situation with regard to the possible extent and complexity of property damage, its potential consequences, the expected loss of earnings, possible additional costs, and the quality of existing protective measures. This also includes the description and calculation of the business interruption Maximum Foreseeable Loss (MFL).

This loss is independent of the material loss and its complex analysis, i.e. the largest material loss does not necessarily cause the largest business interruption loss. To this extent, it is essential to determine the combined property and business interruption MFL from the established property and business interruption maximum loss considerations, including the first risk positions agreed in the insurance contract. This also includes any other existing insurance contracts that may accumulate in the event of a claim.

Furthermore, to determine the classic fire MFL, the corresponding maximum loss considerations must also be made with regard to other insured risks in the insurance contract. For example, the combined property/business interruption fire MFL may be lower than the possible maximum loss from a natural hazard if several of the policyholder’s businesses are affected by the same loss event at the same time.

Conclusion

The business interruption exposure of companies has changed significantly in recent decades. In addition to property insurance, business interruption insurance is now a necessary basic cover, because business interruption can threaten the existence of a company. An insurer must take these changes into account when underwriting a proposed risk. Business interruption risk must no longer be seen as simply being an appendage to property insurance, but as an independent type of risk that can cause considerable losses for both the policyholder and the insurer.

In the future, we believe it will be necessary to consider and assess the business interruption scenario independently of the property loss risk. As a result, the topic of business interruption will become significantly more important in underwriting decisions, e.g. concerning capacity, premium, and reinsurance placement.

The task of underwriting business interruption risks is complex. We would be happy to explore this topic with you and discuss your individual needs regarding raising awareness with your underwriters and sales staff.