-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

PFAS Regulation and Development at the European Level with Focus on Germany and France

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

Fasting – A Tradition Across Civilizations

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review Business School

Business School

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Property Business Interruption Insurance – a German Perspective: Quo vadis?

June 21, 2018

Leo Ronken

Region: Germany

English

Deutsch

Traditional insurance products are increasingly coming under pressure, not only from policyholders demanding more innovative and simpler coverages, but also from insurers who are looking for new ways to serve the insureds’ demand to cover new risks and to optimize their portfolios.

In the property insurance landscape in Germany, interest seems to be particularly focused on innovations in the business interruption area. On the one hand, as a result of legal, regulatory and societal requirements, policyholders are increasingly exposed to liability claims, which seriously affect the balance sheets and financial resources of policyholders’ companies. This pressure results in policyholders pushing for extensions of existing insurance that will enable them to cover financial losses. At the same time, insurers are striving to safeguard their own profitability and trying to grow their portfolios – while facing fierce competitive pressure due to declining demand and lower profit margins in traditional Property and business interruption insurance.

After a brief review of the traditional business interruption insurance, this article discusses the changes that are currently taking place and what can be expected in the future.

Property business interruption insurance today

Business interruption (BI) insurance is a type of insurance that provides cover for loss of revenue due to an interruption or impairment in the economic performance of the insured business.

In the event of a BI claim, the profit loss, as well as the unearned ongoing (fixed) costs during the so-called indemnity period of the insurance policy, are usually reimbursed. The indemnity period starts with the occurrence of a material damage (not the interruption of the insured’s operations), the consequences of which lead to a business interruption in the insured company. In general, a business interruption may impact more than one company’s business; it may affect a group of related companies that have losses because of their interdependency – e.g. branches of the same company.

The basic prerequisites for an insured BI loss include all of the following elements of property damage that occurs in the following situations:

- At the insured location specified in the insurance policy

- Through a peril named in the insurance policy

- At an insured interest serving the company

- During the policy period

- Not excluded according to the terms of the policy

In this context, a BI loss is defined as any impairment of a business unit that affects profit and costs.

Nowadays, different covers for BI losses are available, including:

- Gross Profit cover – All costs are covered until the commercial restoration of normal business operations to the level immediately prior to the damage, including the ongoing loss of turnover even after technical restoration, but at the latest until the expiry of the agreed liability period.

- Gross Earnings cover – Costs are covered only until the technical readiness for operation has been restored; there is no contractually agreed liability period.

- Increased Cost of Working insurance (ICOW) – All costs are covered that do not accrue in the normal operation of the insured entity, but have to be paid in the event of an insured loss, in order to avoid a business interruption or to reduce its consequences; for example, rental costs for new premises, contractual penalties for non-performance of a contract or wages for necessary overtime. These costs will be reimbursed to the extent that they are economically justified, even if they do not have a detrimental effect during or after the indemnity period.

- Loss of Rent insurance – A subform of Loss of Earnings insurance, this insurance replaces one special type of loss of earnings, namely, loss of rent.

- Public Utility insurance – Public Utility insurance covers damages caused by loss of utility services; e.g. electricity, water, natural gas, refrigeration, telecommunications, waste disposal.

- Interdependence insurance – This insurance covers losses caused by interactions (e.g. property damage at one facility causes a business interruption at another facility of the same insured).

- Contingent Business Interruption (CBI) – CBI covers losses due to a BI at a main supplier.

- Denial of Access – This is insurance against loss of earnings due to access obstructions/regulatory restrictions in the event that an insured risk in the neighborhood causes property damage.

Current threats for policyholders

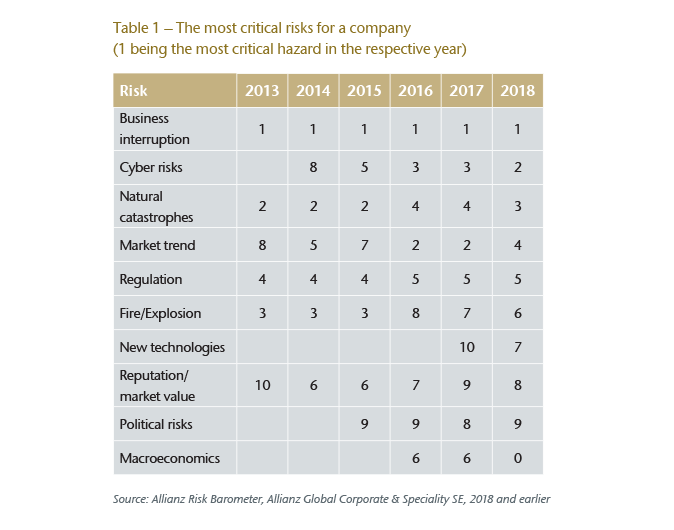

Every year, experts and companies worldwide are asked what risks they consider to be the most critical for their companies.1

Since 2013, business interruption has been cited as the most problematic risk, being assessed as even greater every year.

The number of causes for a BI loss is growing every year. They range from traditional risks such as fire, natural hazards or supply chain interruptions, to new triggers caused by ongoing digitisation. While the latter typically does not cause damage to property, it can lead to high financial losses.

These risks were listed as the main triggers for a BI (multiple answers were possible)

- Cyber

- Fire, explosion

- Natural disasters

- Supplier failure

- Machinery breakdown

According to a 2015 study, the costs of a BI loss are often significantly higher than those of property damage: The average BI loss was about USD 2.4 million, more than one-third higher than the average property damage (USD 1.75 million).2

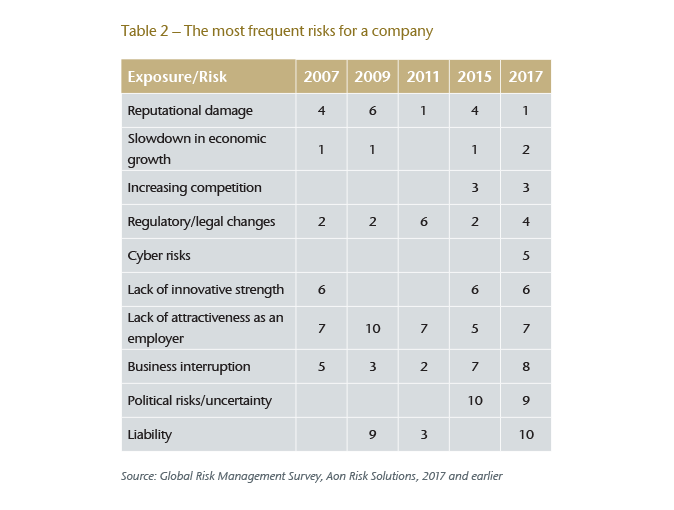

A similar risk survey carried out in 2017 paints a similar picture, with BI among the most frequently cited risks for a company.3

Overall, it can be said that BI insurance in commercial and industrial business has developed from a formerly rather neglected area of insurance to a necessary standard cover.

Statistical analyses of incurred losses show that the average BI loss is approximately 36% higher than the average property damage. One reason for higher average BI losses is that they increase faster than property damages. Another reason is that BI losses are considerably more volatile. For example, in the event of a business interruption, the customers of a company look for alternative supply options and oftentimes do not return to their former supplier after the restoration of the impaired business.4

In order to counter this potential threat, the industry is increasingly demanding cover for unusual risks in property BI insurance; for example, non-damage BI, which means compensation for a financial loss, even if the damage that caused the financial loss is not covered.

Problem areas in today’s BI insurance

BI insurance in its current form no longer seems to be able to keep up with the changes in exposure caused by new economic/risk management lessons – e.g. centralization, patenting, specialization, infrastructure in “industrial parks” – as new risk scenarios are constantly emerging.

A typical problem in today’s BI insurance arises with the determination of the necessary insurance sum and indemnity period. The calculation of the insured sum does not follow the existing business principles of income calculation (i.e. IFRS), but takes into account other criteria, such as definition of operating profit, which can often lead to confusing results in the calculation of the insured amount, the sum insured and the actual financial loss. In addition, a change in business models – such as outsourcing, globalization, new production methods, and more complex assessments of the resulting consequences – increases the risk of not taking significant loss potentials into account, so that the actual loss for policyholders and insurers is higher than expected. In addition, new types of risks arise as causes of damage; for example, interruption of operations due to disruption of transport routes, exchange rate fluctuations, insolvencies in the supply chain and failure of the infrastructure.

When analyzing losses, it becomes apparent that today’s BI claims are considerably more cost-intensive than they had been in the past.5 Examples of causes of losses due to globalization include:

- Increasingly complex supply chains

- Growing efficiency by reducing redundancies and enhancing specialization

- Success of IT and telecommunications

- Networking and coverage of additional revenue items of companies; e.g. derived from emissions trading6 or the Energy Saving Act7

But there are still players in the market who see BI insurance as an annex to property insurance (among other things, the property premium calculation triggers the BI premium, e.g. small business interruption insurance in conjunction with property insurance), so that there is no individual assessment of the BI risk.

In addition, other problem areas are emerging that call for changes in today’s approach to BI insurance:

- Different interpretation/understanding of clauses and components of cover by the contracting parties can happen, for example, if a combined heat and power plant serves several facilities in an industrial park.

- Due to the seasonal nature of a business, even small property damage can lead to enormous BI damage, e.g. textile manufacturers at the beginning of the season.

- Increasing complexity of the insured’s business relationships and obligations make it difficult to assess the actual BI loss in the event of a partial loss.

Considerations for today’s underwriting

Current BI insurance appears to no longer meet today’s requirements of a global and shared economy. In addition, risk assessment and underwriting, which are mainly driven by the property perspective, must be looked at even more closely.

It seems necessary to consider and assess the future BI scenario independent of property risk. As a result, business interruption will gain significantly more weight in underwriting decisions on capacity, premium and reinsurance placement. In particular, the following questions should be considered:

- What are the special BI risks in a company and what are their potential consequences/impacts?

- What preventive safety precautions did the insured take to hedge against the BI exposures (per BI analysis)?

- Is there an adequate correlation between current turnover and profit, the predicted future development of the company, the insured sum and the desired indemnity period?

- What is the relevance of the desired first risk positions with regard to the current loss exposure?

Looking forward

It is to be expected that – especially considering the changes in production and administrative processes and the associated specialisation (Industry 4.0) – the number of BI losses will continue to increase and dominate the total exposure of a risk. Expanding networks can lead to more incidents resulting in a greater accumulation loss for existing BI policies.

In this respect, BI insurance might continue to evolve from property damage cover to a model of compensation for the financial consequences of unexpected business interruptions. For example, the German industry and its stakeholders are already demanding cover for financial losses without a property damage having occurred (non-damage BI) in order to protect the balance sheet.8 These coverages are already being offered by some insurers, but – as far as we know – are only rarely requested.

In my opinion, this development will almost inevitably take place, as the insureds’ risk management nowadays is more and more geared towards safeguarding the financial situation of a company. This specifically includes the protection of the following:

- Assets

- Earnings/success of the company

- Cash flow

- Company growth

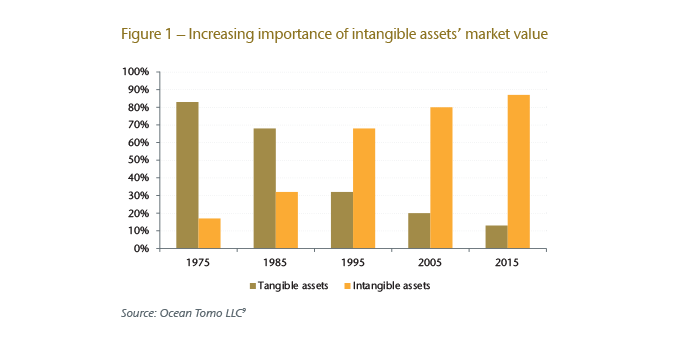

In addition to the traditional insurance of material assets (property line of business) and the claims of third parties (casualty line of business), the protection of intangible assets is becoming even more important, as can be seen in Figure 1.

In the past, the value of a company was mainly measured by the tangible/material assets (buildings, facilities and equipment, inventory). This has now shifted in favor of intangible assets – predominantly intellectual property, networks, platforms, data, customer relationship or the company’s reputation.

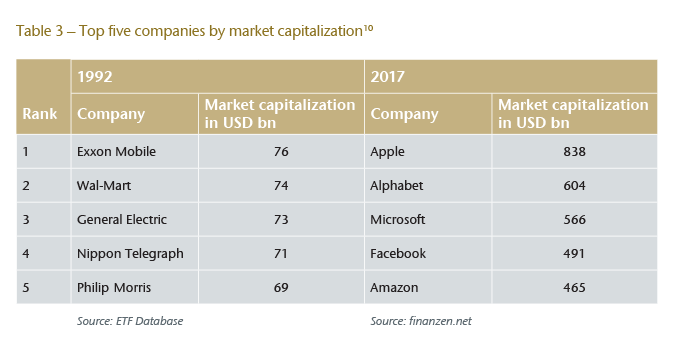

Changes in the five largest corporations in the world illustrate a shift from the largest manufacturing companies to technology and service companies, driven, in particular, by digital transformation:

For this reason, the comprehensive collection and analysis of data, and the interconnectedness of all parts of the company with the manufactured goods, are regarded as imperative for successful risk management. This allows detailed risk identification, risk assessment and more targeted information on risk protection. This enables insureds to make a more targeted decision as to which risks can be borne by themselves and which ones are to be transferred to third parties, i.e. insurers or the financial market.

More recent BI losses, which are increasingly being caused by non-traditional risk exposures – such as data theft or compromised technology services without property damage – confirm this development. The following will inevitably cause companies to look for new ways to hedge income and cash flows:

- Business interruptions due to non-physical damage

- Cyber risks

- Product recalls

- Damage to reputation/trademarks

- Risks associated with weather damage, utility prices, exchange rate fluctuations, volatility in raw material prices, agricultural products, interest rate changes, etc.

As a result, the demand for insurance products might change in the future, as the gap between economic and insured losses continues to widen. Currently, for example, in the case of natural catastrophes, at best 30% – 50% of losses are insured; in developing countries the percentage is significantly lower.11 Companies are increasingly looking for new forms of risk coverage, because the rapid and partly disruptive technological change caused, for example, by autonomous systems and artificial intelligence (AI), will lead to new legal, regulatory, social and ethic requirements, risks and liabilities for companies.

Motivation for the future purchase of insurance cover

A company’s main motivation in connection with risk mitigation and the transfer of financial risks has been and will continue to be:

- Avoidance of financial bottlenecks after a loss occurrence

- Stabilization of financial assets, such as cash flow, to protect production and investment plans or to recover compensation for potential contractual penalties for non-performance of contractual obligations

- Tax reasons

The focus will therefore be on safeguarding the financial stability of the company in the event of a loss by providing financial resources.12

In the future, insurance might serve as an economic alternative to risk financing in order to provide for sufficient liquidity or a capital increase, which can take the following various forms, depending on a company’s point of view:

- Classic insurance (fire/machinery insurance, BI insurance etc.)

- Integrated profit/capital protection insurance solutions; comprehensive insurance covering all areas (property/casualty, political risks, financial risks; e.g. single, dual trigger)

- Parametric insurance solutions such as ILS (Insurance Linked Securities) or Cat Bonds

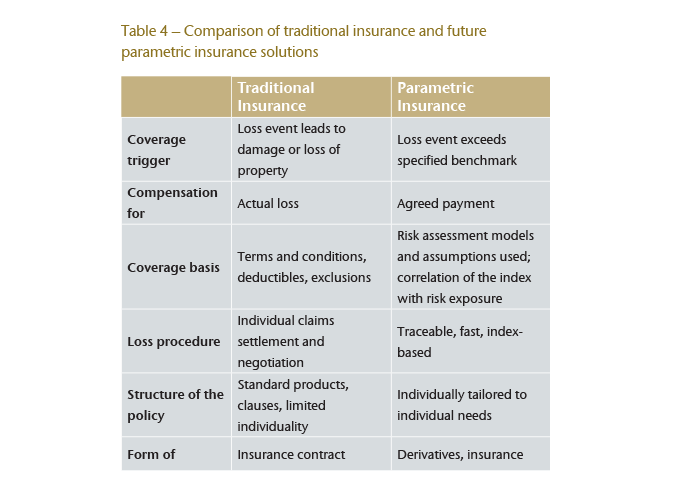

Parametric insurance, in particular, may serve to cover additional protection gaps. Insurance cover is triggered by facts. The sum insured is paid out as soon as the conditions/thresholds or measured values specified in the contract are exceeded, such as defined magnitude of an earthquake or a certain wind speed. The challenge for the parties will be to establish a link between the triggering measured value and the actual risk exposure. If this should work, further innovative insurance solutions will be developed to protect income and cash flow instead of assets and balance sheets. First signs can already be seen in new coverage concepts tested in the market; e.g. cyber-, non-damage BI and supply chain.

Parametric insurance solutions therefore can be the result of a consistent extension of insurance cover from pure property damage, complimented by cover for business interruption and retroactive claims, to income and cash flow losses.

The beginnings of this development can already be seen in non-damage BI and cyber insurance policies. For example, depending on the agreed insurance terms and conditions in a predefined loss scenario, the financial consequences for the company are covered, even without prior traditional property damage to the insured’s or third parties’ property. The compensation payment can be based on any of the following:

- The loss actually suffered, similar to the conventional BI insurance

- The amount of compensation agreed upon, triggered by exceedance of a previously defined measured value or other thresholds

- A staggered compensation, triggered by the sequence of two or more objective events and any predefined intensities

It is a problem that both types of cover are subject to considerable uncertainties with regard to frequency and severity of losses, and that it is difficult to establish a correlation between the risk exposure and the respective risk situation as a result of constant changes in the risk situation.

Both examples are associated with an enormous accumulation problem for insurers/reinsurers that is very difficult to quantify and to assess using today’s methods and models.

With the introduction of Artificial Intelligence (AI) and further automation – such as Industry 4.0 and Blockchain – this problem will exacerbate. These technologies might give rise to additional new, as yet unknown risks that will require more far-reaching solutions.

Challenges for the insurer

- Randomness: The time and place of the insured event must be unpredictable and the occurrence must be independent of the behavior of the insured entity.

- The frequency and severity of the insured events must be predictable and quantifiable with sufficient reliability.

- Economic viability: From the perspective of the insurance buyer, the premium must be affordable and sufficiently reduce the insured risk. For the insurer, the premium including the corresponding investment income must be at least sufficient to cover the expected claims and claims costs as well as its administrative and capital costs.

The new challenges are increasingly pushing the boundaries of insurability. New markets, new risks and innovative risk transfer solutions are constantly expanding and in some cases even exceeding the limits of insurability.

In order to maintain the criteria for insurability and provide a targeted and adequate capacity, it will probably become indispensable to do the following:

- Develop more detailed and complex risk models; for example, detailed analysis of known losses and improved evaluation/analysis of the data in order to determine the respective probabilities for a loss occurrence and its expected severity.

- Develop holistic analysis tools that identify, analyze and control potential accumulations, since some risks affect all areas of a company, such as cyber risks and non-damage risks.

- Continue to develop adequate pricing tools to be able to rate the new cover concepts in accordance with the exposure.

- Implement systematic risk management measures in all areas of the insured’s company, especially in order to be protected against infrastructure risks (e.g. loss of energy, climate change, geopolitical changes, etc.).

Conclusion

In my opinion, traditional non-life insurance solutions will change because the demand from insurance buyers will change substantially in the future.

The significance of current insurance products will decrease with the changing risk management approach of companies and their need to hedge identified risks, while new forms of cover will develop and be in demand.

The goal of the new forms of cover will be to – at least financially – offset the potential threat to earnings and cash flow, and to stabilize the company’s situation irrespective of the occurrence of a negative event. These new or expanded forms of risk transfer will require risk modelling and risk assumption on the basis of statistically relevant data sets. Existing loss scenario analysis models and methods will evolve, or new risk models will have to be developed if such risks are to be insurable.