-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

What is Claims Digitization and Why Do We Care?

April 25, 2024

Patricia Bailer

English

Digitization is the crucial first step in the digital transformation process. The majority of firms have a digitization strategy or plan to incorporate it into their business operations because it is cost-efficient and future-proof. The claims discipline within an organization is a great place to employ such innovation.

When one thinks of claims management, it makes sense to implement automated systems and digitize transactional claims processes so carriers and reinsurers can reduce manual errors, streamline workflows, and accelerate the claims journey. A vital success factor to the effort is engaging experienced claims professionals at the onset of the initiative.

From Analog to Bytes – Historical Milestones

What exactly is digitization? It refers to the conversion of analog data (such as printed text, photographs, or analog audio) into a digital format that can be processed or stored by computers. This process involves breaking down the analog signal into a series of discrete values, which are then represented using binary code (i.e., the digits 0 and 1). Analog-to-digital converters, scanners, and other hardware facilitate this conversion, allowing data to be changed, stored, and shared electronically.

When personal computers and the World Wide Web emerged in the end of the 20th century, digitization started gaining popularity.

Key Milestones of Digitization

Decoding The Digital – Terms And Definitions

Digitization, digitalization, and digital transformation are related terms. They are often used interchangeably as their boundaries can blur. But generally, they are three distinct technology concepts with different implications for business.

- Digitization is the process of converting information from a physical, analog format into a digital format.

- Digitalization refers to using digital technology to automate tasks, optimize processes and improve efficiency.

- Digital transformation is an integration of digital technology into all areas of business.

While digitization is the first step of converting analog to digital, digitalization uses digitized data to optimize processes, and digital transformation encompasses a broader shift in organizational processes, culture, and customer experiences. It involves leveraging technology to create new business models and enhance value delivery.

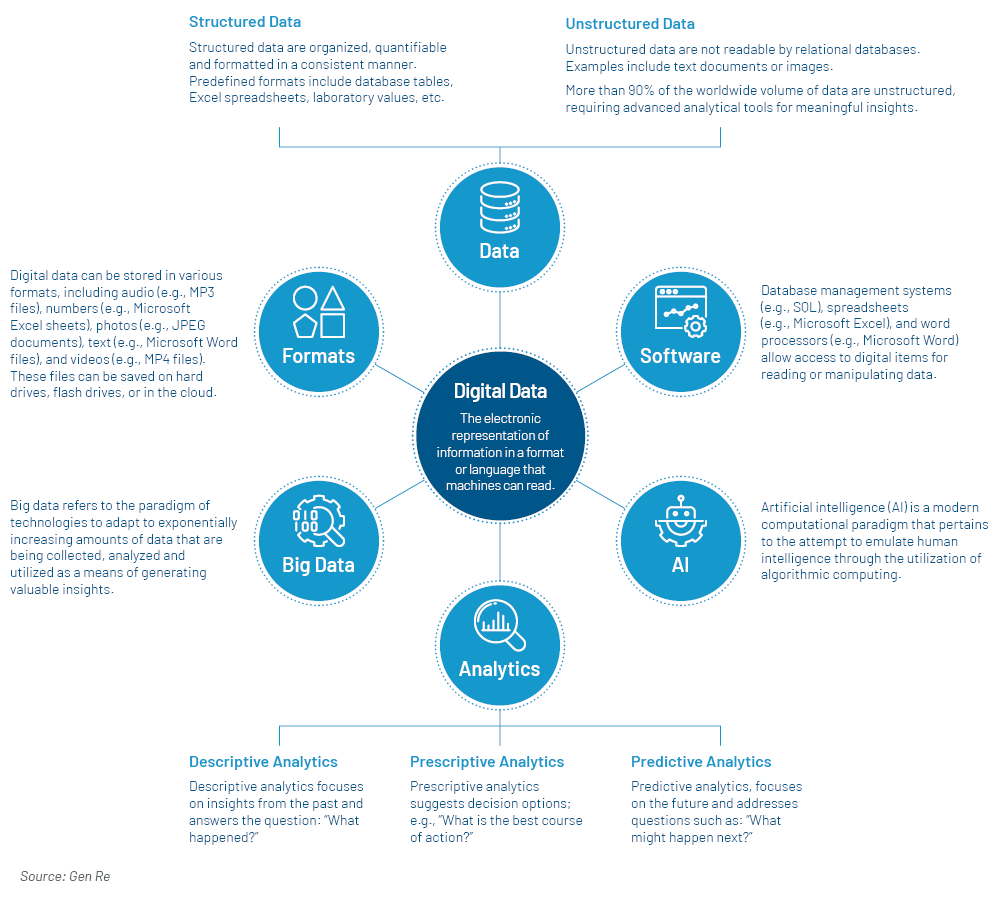

Key Terms of Digital Data

Driving Innovation – Importance of a Digital Strategy

In today’s rapidly evolving business world, it is crucial to have a powerful digital strategy as companies with a robust digital action plan may gain a competitive edge. They can adapt swiftly to market changes and technological advancements as well as tailor their products, personalize marketing, and improve customer engagement.

Interactive websites and apps continue to facilitate the contact between clients and insurance companies: for example, during the conclusion of contracts or in case of a claim leading to increased customer satisfaction by fast processing. Since data are the core of Life insurers, innovative technologies and high computing capacity are needed to process them.

Aligning a company’s digital strategy with individual departments is crucial for a successful digital transformation. It ensures that everyone is moving in the same direction, working toward common goals, and leveraging technology effectively. On the other hand, misalignment might result in poor company performance and a decline in employee satisfaction, as well as inefficient resource location and increased costs.

The art of digital claims assessment

To illustrate the value of digitization in the claims discipline, consider the many ways this can be incorporated:

- Automated data ingestion

- Triage capabilities allowing claim assignment based on claim complexity, assessor skill level, client relationships, etc.

- Summarization tools

- Risk rules

- Fraud detection, prevention, and mitigation

A customer-centric claims approach is essential in the digital age. Insurers should consider prioritizing seamless interactions and quick resolutions for policyholders. Digital claims processes enable faster communication, automated updates, and self-service options, leading to improved customer satisfaction.

Automated claims workflows may reduce manual effort and lead to a faster claims processing, translating to cost savings and operational efficiency. Also, insights from data analytics enhance accuracy, speed, and overall effectiveness as well as help identify suspicious patterns and spot potentially fraudulent claims.

How insurtechs can support

We’ve all seen or heard from insurtechs offering digital self-service tools, mobile claims reporting and chatbots to assist customers throughout the claims process. The new world of digitization introduces generative artificial intelligence (GenAI). GenAI can create new and realistic content such as text, images, audio, video, and 3D models, based on existing data.

GenAI offers opportunities for personalization: it enables businesses to create tailored content for their clients and allows individualized interactions. Modern insurance platforms have emerged to deliver the flexibility, agility and scalability insurers and reinsurers need to adapt to rapidly evolving market needs.

A slew of escalating global risks challenge the insurance and reinsurance industry’s capacity and readiness to react. A growing number of insurtechs address some of the most pressing challenges on the risk mitigation and claims fraud prevention front as well as the various regulatory environments and currencies of global companies.

Unlocking Potential – Job Enrichment by Digitization

Digitization transforms claims assessment by improving efficiency, enhancing the customer experience, preventing fraud, and fostering transparency. Insurers should consider embracing this shift to stay competitive in the evolving digital landscape.

Digitization may lay the foundation for improved performance and increased satisfaction on many fronts, but the knowledge and experience of claims professionals in this work is invaluable, necessary and should not be overlooked. If integrating digital technologies in the claims process is based on a strong claims expertise, digitization results in operational efficiency and cost reductions.

Removing the transactional nature of claims processing from the claim assessor’s work allows them more focused time for complex matters, such as the advancement of assessor’s skills. This includes:

- Forward thinking

- Ideas about the future of work

- Disruptive technologies: do they change habits and skillsets or the lives of those who can’t/won’t adapt?

Digitization enables claims professionals to establish critical and strategic thinking more consistently, to demonstrate experience with complexities of claims and to apply thought leadership and share best practice/learning. Time efficiency will lead to improved communication and increased transparency and information exchange, plus claims assessors will have the chance to develop and further enhance skills that won’t be automated.

The human aspect will always be vital in claims assessment as it allows for empathetic understanding of each individual’s unique circumstances and for evaluation of the social and emotional support needed.

Consequences of digitization of which we should be aware:

- Fraudsters may exploit digital vulnerabilities, necessitating robust security measures.

- The risk of attackers with pure-play digital business models increases.

- Unauthorized access or data breaches may lead to legal consequences.

My claims colleagues around the world dedicate this year’s Claims Focus periodical to innovation in the claims space. Our series highlights many of the above aspects. I’m very excited about the upcoming articles. Please reach out to your Gen Re claims professionals throughout the world to learn more, and make sure to get in touch if you wish to regularly receive Claims Focus.