-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Insurance Fraud – Definition, Motives and Suspicious Loss Indicators

November 14, 2023

Jason Weesner

English

To discuss insurance fraud, let’s first understand what it is, and why we need to be concerned. As commonly defined: “Insurance fraud occurs when an insurance company, agent, adjuster, or consumer commits a deliberate deception in order to obtain an illegitimate gain. It can occur during the process of buying, using, selling, or underwriting insurance.”1 In order to prove that a fraud occurred, the following elements typically need to be met:

- A false representation of material fact

- Made intentionally and knowingly

- With intent to mislead

- Reliance by the party misled and

- Resulting damages to the party misled

It’s important to remember that insurance fraud comes in many forms and can be committed at any stage of the insurance value chain, by any party involved along the way.

Why should we care? Fraud statistics

The true scope of insurance fraud is unknown since many incidents go undetected. Quantification can be difficult as accurate fraud statistics in certain parts of the world are hard to come by. However, we can infer the global scale of insurance fraud by looking at data from individual markets. For example:

U.S.

- Insurance fraud costs the U.S. USD 308.6 billion annually (EUR 294 billion).2

EU & UK

- France’s ALFA reports EUR 360 million of P&C fraud in 2020.3

- In the UK, insurers uncovered 89,000 fraudulent claims worth almost GBP 1.1 billion (EUR 1,27 billion) in 2021.4

- Approximately EUR 13 billion of fraudulent claims were registered in Europe in 2017.5

South Africa

- South African Life insurers detected 4,287 fraudulent and dishonest claims in 2021, worth ZAR 787.6 million (EUR 40 million).6

India

- 78,000 insurance frauds were identified in 2021–2022, worth INR 42,766 crore (EUR 4.86 billion),7 with insurers losing 10% of overall premium collection to frauds.8

Australia

- Australian insurers detected AUD 280 million (EUR 168 million) in fraudulent claims in 2017.9

Although insurance fraud is often thought of as a “victimless crime”, some fraudsters are known to finance other criminal activities with the fraud proceeds. For example, the money obtained through an insurance fraud scheme may be repurposed for offences such as drug or human trafficking, terrorism, etc. In fact, insurance fraud has enormous ramifications globally.

Who are the players? Actors and their motives

In order to identify insurance fraud, it’s important to understand the actors and their motives. Fraudsters are not confined to a particular demographic, nor a particular geographic region. Perpetrators may be organized crime groups or international syndicates, or simply “the person next door” – no matter their social background. Their motives can vary widely, with some cases being clearly premeditated and others merely taking advantage of a situation (e.g., padding/i.e., exaggerating the seriousness of an event).

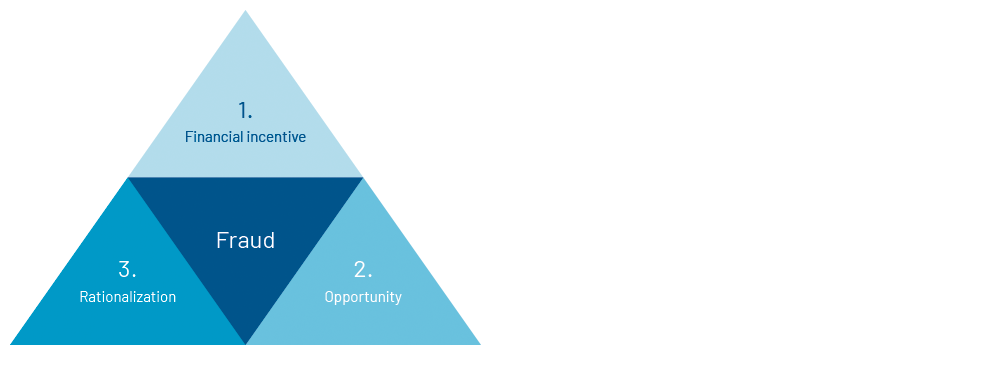

Although the individual motives and schemes may differ, most frauds contain the common elements of what is known as “The Fraud Triangle”.

The Fraud Triangle

Financial incentive

Regardless of the perpetrator, the primary driver of insurance fraud is financial gain. Organized groups target insurers as part of their criminal enterprises as a means to make money and/or to fund other illicit activities. On an individual level, the financial drivers vary, but economic woes are a factor when considering motive. The cost-of-living crisis in various countries has been well publicized, and is linked to increased fraud rates in some areas. One UK insurer attributes a 31% jump in fraudulent property claims and a 7% rise in fake casualty claims in 2022 to cost of living challenges.10

Occasionally, people are lured into schemes with promises of quick, no‑strings financial rewards. A prominent anti-fraud agency in France, ALFA, recently reported on the proliferation of such cases being carried out via social media channels.11

The UK Insurance Fraud Bureau (IFB) published a study in 2022 that illustrates how economics and attitudes towards fraud intersect. Their data show that one in 10 people would consider insurance fraud if struggling financially. In the 18 to 24‑year-old age group, that number rises to one in five.12

Opportunity

If an individual with financial motive perceives an opportunity to achieve financial gain, they may decide to take advantage of an insurer’s processes and procedures. For example, they could choose to pad their claim, submit a false document, or provide other false information in order to profit. These opportunities may arise via streamlined underwriting or claims processes, or perhaps because the insurer lacks adequate due-diligence measures that serve as a control.

Organized groups will continually test insurers’ processes, looking for vulnerabilities that will allow them to exploit the enormous money-making opportunities associated with successful insurance scams.

Rationalization

Potential fraudsters will rationalize their choices by telling themselves that it’s not really stealing, and no‑one is getting hurt (i.e., it’s a victimless crime), or that the insurance company owes them a little extra in light of all the premiums they’ve paid over the years. Hypothetically, a desperate fraudster may need to pay their mortgage bill this month and falsifying an insurance claim is the only way they can keep their home.

Or perhaps an applicant realizes that they’d never be able to afford the premium for a much-needed Life policy if they admitted to prior nicotine use or past illnesses, so they conceal material information at the time of application.

What can we do about this? Limit vulnerabilities

The impact of fraud goes way beyond a simple “cost of doing business” and requires us to take steps to mitigate the impact. It’s everyone’s responsibility to be aware and take action so that we have multiple lines of defence in place.

Maintaining awareness, implementing controls, validating information, and stress-testing new processes will help limit our vulnerabilities. It’s also important that we know our customer. Ultimately, knowing the facts and knowing our customers helps us make better decisions.

Gen Re Germany’s Claims Visiting Service (CVS) is a great example of how we can achieve these goals. CVS is unique in that it provides us with an opportunity to meet with a claimant face to face in order to gather relevant information about that person’s situation. Through this program, our team can have direct conversations with claimants to better understand the circumstances surrounding complex matters.

Gathering information related to the “Who, What, Where, When, Why and How” improves our ability to objectively evaluate the merits of the claim. These detailed conversations also allow us to determine whether any discrepancies or suspicious loss indicators exist.

What to look out for? Suspicious loss indicators

Whether we’re meeting claimants face to face (as with CVS) or whether we’re reviewing file materials remotely, it’s important that we’re able to identify the common industry-recognized suspicious loss indicators.

|

Industry-regognized suspicious loss indicators |

|

|---|---|

|

|

Proper identification and documentation of these indicators helps form the reasonable basis for us to take further action (e.g., request additional proofs, conduct a surveillance, interview witnesses, etc.). Documentation helps us explain to anyone (the claimant, their attorney, a regulator, etc.) why we are pursuing certain courses of action and helps mitigate our exposure to complaints or allegations of bad faith claim handling.

It is important to remember that the mere presence of a suspicious indicator should not be considered proof of fraud. The presence of suspicious indicators should prompt further inquiry as part of our fact-finding process. Concerns can be often resolved by asking the right questions.

Conclusion

The insurance industry faces enormous challenges when it comes to combating insurance fraud. Furthermore, data privacy and regulatory restrictions that impede information-sharing is a significant barrier to fraud mitigation efforts.13

A fundamental best practice for all insurance professionals is to maintain awareness of the trends, schemes, and suspicious indicators. The ability to identify suspicious indicators serves as a key control and is a vital first line of defence.

Insurance professionals should become familiar with, and utilize, the tools and information resources that are available to them in their market. The CVS Program is an example of an excellent resource (specific to the German market) that helps Gen Re with our Claims Risk Management processes – ensuring we pay what we owe.

- National Association of Insurance Commissioners; Center for Insurance Policy and Research (2023). Insurance fraud. https://content.naic.org/cipr-topics/insurance-fraud (accessed 13 October 2023)

- Coalition Against Insurance Fraud (2023). The impact of insurance fraud on the US economy, 2022. https://insurancefraud.org/fraud-stats (accessed 13 October 2023)

- ALFA (n.d.). Fraude a l’Assurance. https://www.alfa.asso.fr/fraude-a-lassurance/#chiffres-cles (accessed 13 October 2023)

- Association of British Insurers (n.d.) Fraud data. https://www.abi.org.uk/products-and-issues/topics-and-issues/fraud/fraud-data (accessed 13 October 2023).

- Insurance Europe (2019). Insurance fraud: not a victimless crime. https://insuranceeurope.eu/publications/703/insurance-fraud-not-a-victimless-crime (accessed 13 October 2023)

- ASISA (2022). Life insurers uncover record numbers of fraudulent and dishonest claims in 2021. https://www.asisa.org.za/media-releases/life-insurers-uncover-record-numbers-of-fraudulent-and-dishonest-claims-in-2021 (accessed 13 October 2023)

- IRDAI (2022). Annual report 2021‑2022. https://irdai.gov.in/annual-reports (accessed 13 October 2023)

- The Hindu Business Line (2021). False claim. Insurance frauds see an increase during pandemic, says survey. https://www.thehindubusinessline.com/money-and-banking/insurance-frauds-see-an-increase-during-pandemic-says-survey/article35482061.ece (accessed 13 October 2023)

- Insurance Council of Australia (n.d.). Insurance fraud. https://insurancecouncil.com.au/industry-members/report-fraud (accessed 13 October 2023)

- The Independent (2023). Cost of living challenge fuelling surge in bogus insurance claims. https://www.independent.co.uk/news/uk/zurich-aviva-households-british-city-of-london-b2311373.html (accessed 13 October 2023)

- Coalition Against Insurance Fraud (2023). FraudBlog: How fraudsters are using social networks to scam the French insurance industry. https://insurancefraud.org/publications/fraudblog-how-fraudsters-are-using-social-networks-to-scam-the-french-insurance-industry (accessed 13 October 2023)

- Insurance Fraud Bureau (n.d.) Don’t chance fraud. https://www.insurancefraudbureau.org/media/1403/dont-chance-fraud-campaign-infographic-insurance-fraud-bureau.pdf (accessed 13 October 2023)

- Coalition Against Insurance Fraud (2021). Globalization of insurance fraud study. https://insurancefraud.org/wp-content/uploads/Globalization-of-Insurance-Fraud-report-Final-2.pdf (accessed 13 October 2023)