-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

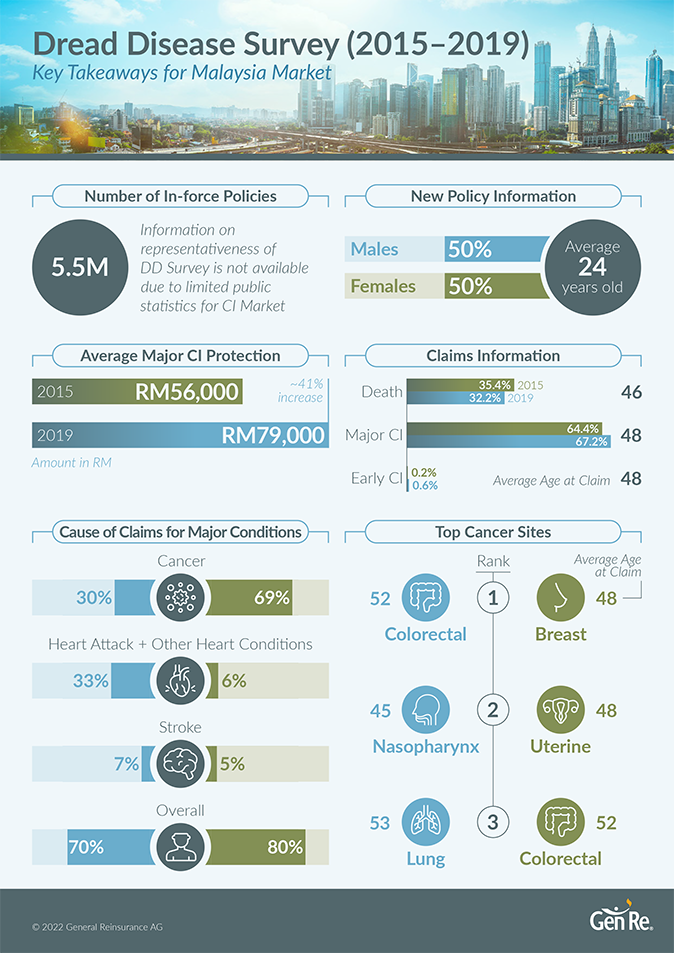

The Gen Re Dread Disease Survey – Key Takeaways for the Malaysia Market [Infographic]

November 30, 2022

Samuel Lim,

Benedict Tan,

Wendy Low

Region: Asia

English

As promised to many of our participants, we are pleased to finally share the infographic and some of the key highlights from Malaysia’s survey. To this end, I thank our participating companies once again for their continuing effort to support the study despite the challenges posed by the COVID-19 pandemic.

Growth in Critical Illness business

From the studies, the Critical Illness (CI) coverage for Malaysia has grown from 3 million in-force policies in 2015 to 5.5 million in-force policies at the end of 2019. This is a growth of around 80% from the last survey.

Reasons for such growth can be attributed to the growth of the CI market penetration in Malaysia as well as the increased coverage of the study from our participants. Clearly, from the growth seen between 2015 and 2019, coupled with the renewed importance of protection coverage brought about by the pandemic, we foresee that CI business in Malaysia will continue to grow.

Demographic split

In terms of demographics of CI policies issued over the study period, the overall gender split in Malaysia is equal at 50% for both genders, with a low average age of issuance at 24 years old.

When comparing numbers across the region in places such as Hong Kong and Singapore, this finding is not entirely surprising, as Malaysia has a relatively younger population. However, it does reinforce the importance of developing products that are appealing to young adults. Digital modes of distribution should be considered to further penetrate the CI market.

Protection gap

According to the Life Insurance Association of Malaysia’s (LIAM) “2012 Underinsurance Study”1, the insured population reported an average of RM 53,000 of CI protection per person in 2012. This estimation is in line with the results of Dread Disease Survey, which found that protection among the insured was at RM 56,000 in 2015. However, from 2015 to 2019 we observed a rapid growth of 8% per year, increasing the protection level to RM 79,000.

The LIAM study calculated that there remained a potential protection gap of RM 152 billion in 2012. We believe that the protection gap has widened alongside inflation, despite the growth in CI protection seen over the Dread Disease Study period. Hence, it would be important to revisit the level of CI protection for insureds periodically and to examine the adequacy of CI protection.

Distribution of claims

CI products have become increasingly comprehensive, covering more major and minor CI conditions. The result of such product changes can be seen with three times as many minor claims in this survey from the previous one. An increase of 3% in major CI claims was also observed. This increase in major and minor claims was offset by the decrease in death claims in this survey.

Heart disease remains the top cause for claims for men. Cancer remains the top cause of female CI claims. CI products are meant as a protection for those who survive a CI, and our result certainly shows that insureds are benefiting from the expansion of the scope of coverage.

Major Critical Illness conditions

Moving on to claim causes for major CI conditions, it can be observed that bulk of claims still come from the “Big 3” conditions: cancer, heart disease, and stroke. These contributed to 70% and 80% of the claims for men and women, respectively.

That said, when comparing Malaysia’s results to those of Hong Kong and Singapore, the proportion of claims from the Big 3 conditions is still relatively low. In more mature markets such as Hong Kong and Singapore, the tendency for claims to arise from the Big 3 conditions increases.

The reasons for such a different proportion in claims are multifaceted. One of the factors for the lower proportion for Malaysia could be due to lower screening rate and more accidental deaths. In the case of Malaysia, this is clearly what has been observed, with accidental death making up 7% of the claims for men and 2% of the claims for women.

Top cancer sites

Cancer being the largest proportion of claims has always been an area of focus. In this edition of the Dread Disease Survey, the top 3 cancer sites for men are colorectal, nasopharynx, and lung cancer. For women, the top 3 cancer sites are breast, uterine, and colorectal cancer. There were no surprises in that regard as the top 3 cancer sites are in line with the previous study.

Across the Hong Kong, Malaysia, and Singapore markets, it can be observed that the top 3 claims for men are similar – except for Singapore. Singapore experiences a higher incidence of prostate cancer that can be attributed to a relatively older portfolio than the other markets.

As for female cancer sites, all three markets showed a similar composition – other than Hong Kong. Hong Kong has seen an uptick of thyroid cancer as it moved up to third place in this edition of the study.

More detailed results will be delivered to our participating companies over the next few weeks. With that, we will bring to you the full results that include a market comparison of Hong Kong, Malaysia, and Singapore.

If you have any questions about the research or would like to find out more about how to participate in the future, please don’t hesitate to reach out.

Endnote

- https://www.liam.org.my/images/liam/LIAM-Protection-Gap-Report.pdf, last accessed 24.11.2022