-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Ensuring Better Inclusion for People Living With Mental Illness: Thoughts on New Product Design

October 11, 2021

Thea Weyers

English

Over the past decade, global efforts to destigmatise mental illness have made great strides, leading to an overall greater public awareness of mental health. Social media has played a major role in bursting open the conversation, with many high-profile individuals helping to give mental health issues a wider platform, encouraging people to talk more openly about their struggles and to seek treatment sooner.

Unsurprisingly, the move toward greater awareness and understanding of mental illness extends far beyond social media. In our own industry, regulators and industry bodies in many countries are now advising and guiding working groups to formalise standards that ensure broader inclusion of the disease and to provide better support for insureds affected by mental health conditions when they apply for cover.

While COVID-19 has brought the issue into sharper focus, we have believed for some time that our industry can do more to move the dial on mental health and inclusion. At the beginning of 2020, we set out to investigate the challenges relating to mental health in our industry in South Africa, and to evaluate the current product offering for people living with this illness.

An epidemic of mental illness?

As the pandemic unfolded and the first wave of lockdowns hit, many industry experts predicted that an epidemic of mental illness would soon follow. While the accuracy of these predictions is still not clear, so far the increase of mental illness in adults seems to be small.

Several factors are at play, but a core explanation is that severe psychiatric illnesses often have genetic components, meaning that they are unlikely to change much over the years. This is supported by figures from mature Disability insurance markets, such as the UK and Germany, which have seen a flattening of mental illness claims over the past 10 years.

Interestingly, prescription rates for antidepressants have increased in high income countries over the same period, as has the proportion of people seeking and receiving treatment. This is possibly due to the efforts being made to destigmatise the disease.

Unfortunately, not all the outcomes of destigmatisation are positive. Efforts to “normalise” mental health conditions can, intentionally or not, play down what it really means to have severe mental illness. Some bouts of mental ill-heath are transient, many are mild. For example, while symptoms stemming from work-related stress or bereavement are very real, they may not be prompted by a pathological condition. Some people with severe disease are not able to work or ever form personal relationships. This is a crucial clinical distinction that should also be made at underwriting and claims stages.

The importance of psychosocial factors

Although we strive for a holistic approach in our underwriting, the actual underwriting of the mental health risk is still mostly done according to the biomedical model. The questions asked at underwriting stage, which are fed into a risk calculator, are based on medical indicators of the risk, and do not consider other important psychosocial factors.

Numerous research studies, and our own internal data, suggest that there are other factors that could be integrated into our assessments to ensure better risk selection. For example, levels of self-efficacy and resilience, and work-related obstacles are some of the factors we need to consider.

Establishing a scientific way of including psychosocial factors in our risk calculators is crucial to ensuring greater inclusion going forward. The current, purely biomedical, approach means there is very little granularity in the assessment of the risk, with the underwriting outcome often resulting in a broad mental health exclusion. The currently approach also has little or no opportunity for an exclusion to be reviewed; exclusions and health loadings remain on the insured’s policy, irrespective of the disease progression and the time lapsed.

In contradiction to society’s calls for greater inclusion, in recent years the trend in the South African market has been to incorporate limitations and restrictions into our offerings in order to mitigate the risk associated with the disease. This can include restricting the percentage payment, limiting the maximum sum assured for related events, and/or defining strict criteria to only cover severe events. Some insurers have even expanded their mental health exclusions to also exclude related subjective conditions.

Tackling the issue of inclusion

While insurers worldwide are increasingly recognising the need to provide cover and support, they also realise that these current practices and trends will not assist in expanding cover and inclusion.

Some insurers are already responding to the call, offering discounts on policies where a broad mental health exclusion has been placed. Others have expanded their Critical Illness offerings to cover various psychiatric diagnoses – albeit still only covering severe disease. Success has been reported, especially in the group protection market, with early intervention programmes and support services, including fast-tracked access to psychotherapy, and apps for managing mental health.

Introducing our new framework

To provide sustainable, inclusive insurance for people affected by mental illness, a new approach, that addresses the shortcomings in many aspects of the traditional insurance offerings, is needed. Working in partnership with our colleagues from across the international Gen Re community, we have developed a framework for a new product that would:

- Ensure wider access to cover and support for people living with severe mental illness who would traditionally not be eligible for benefits other than Life cover.

- Offer alternative solutions that may provide cover for unrelated events, where possible.

- Incorporate better terms and access for individuals with less severe mental illness.

- Provide access to support services and managed programmes.

- Ensure better risk selection by including psychosocial factors in the application questions.

Dynamic underwriting

The aim at underwriting stage is to ensure a holistic assessment of the risk, identify the best management approach and guide assistance programmes accordingly. Management of the risk should include the re-underwriting and reassessment of the level of risk at certain defined intervals. Continuous underwriting would be employed to reconsider the terms and level of cover, to monitor the progression of the disease, and to identify individuals who may require early intervention and management.

The timing of the reviews and any changes to terms will depend on the severity level of the disease and would be aligned with general rules and guidelines. The goal is to enable individuals to obtain increased levels of cover, or a reduction in extra mortality or morbidity loadings, in the presence of stable and well-managed disease.

Proactive claims management

Our goal is to move the focus of claims management to a proactive approach of monitoring, prevention and early intervention rather than the current reactive model. In the event of a claim, a structured rehabilitation programme that follows a biopsychosocial approach should be put in place, rather than one which focuses on disease progression alone. After the life assured’s/member’s return to work, case management will continue through the ongoing monitoring of his or hers mental health status.

A digital platform could be used to assist the monitoring of this status, alerting the life assured, clinician, and insurance case manager to signs of deteriorating mental health or a potential relapse. Gen Re is working with a number of digital healthcare providers in order to bring AI and learning to the product solution, along with a digital interface that ensures confidentiality and ease of use.

Naturally, information obtained during ongoing monitoring and active management could assist with the reviewing of exclusions, reconsideration of forward and expanded cover, and early intervention and claims assessment.

Digital tools

One positive aspect of the pandemic has been the great leap forward made in analytic capability for assessing mental health risks and claims. Our framework, which we believe to be a prototype for the world’s first managed mental health product, is supported by two cutting-edge analytical tools developed within Gen Re during this time.

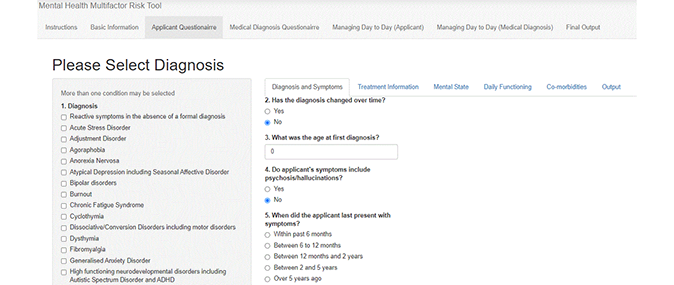

The Multi-Factor Risk Tool provides our clients with a means to a more holistic method of assessing mental health risk by incorporating not only the medical but also other psychosocial factors into the risk assessment. Various risk factors are weighted in terms of their impact on a prognosis and a final risk score guides the underwriting outcome and determines the management approach.

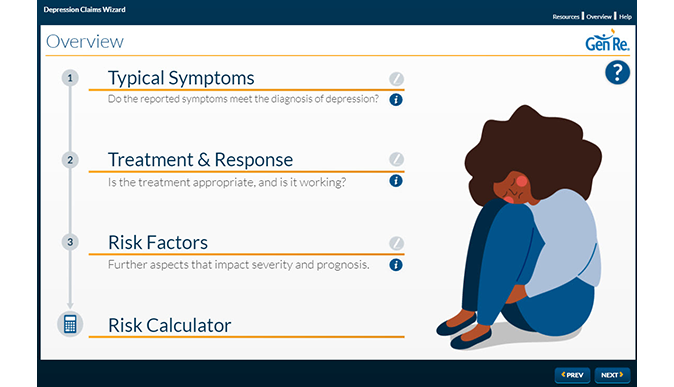

The Depression Claims Wizard (DCW) is Gen Re’s forthcoming expert system for evaluating depression claims. The DCW integrates ICD and DSM metrics with Gen Re’s claims expertise to produce a detailed evaluation of the clinical aspects of each depression claim. This includes advice on medical evidence, case management, and an estimation of the biopsychosocial risks associated with that claim.

Together, these tools lead the way in the application of this new field of analytics to the management of mental health. Ideally, the underwriting questions should be asked by a skilled tele-underwriter with a firm knowledge of mental health. A digital approach could also be followed in partnership with a digital health management solution.

Collaborating for success

We have been delighted by the response so far to the product framework and tools and are engaging with clients who share our commitment to finding innovative, inclusive, insurance solutions for those who need them most. Don’t hesitate to get in touch if you would like to find out more.

Hear Thea talking about Gen Re’s new managed mental health product framework below: