-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Secondary Peril Events Are Becoming “Primary.” How Should the Insurance Industry Respond?

Publication

PFAS – Rougher Waters Ahead?

Publication

Risky Left Turns – What About a Roundabout?

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

Focus Groups and Shadow Juries – Telling a Persuasive Story for Trial -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Cardiovascular Disease Deaths in Young Adults – A Tie to Substance Use?

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Ups and Downs of the U.S. Group Term Life Market U.S. Industry Events

U.S. Industry Events

Publication

New Life & Health Technologies – A Double-edged Sword? -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Maintaining Accurate Property Valuations Requires Renewed Focus in a COVID World

March 10, 2021

James Kenworthy,

Shannon Dowd

Region: North America

English

Currently a lot of attention is focused on movement in rates. However, that is only half the story: determining the correct insured value is vital.

As any Property underwriter will tell you, the basic building blocks for determining an appropriate premium to collect boils down to establishing the correct rate and the correct insured value. The rate reflects the characteristics of the property, or “risk”, based on the following: What is it constructed of? What occupation is it used for? What are the protective features and exposures from its surroundings or natural perils? The insured value, however, is the base against which the rate is applied to determine the premium to be collected.

It might seem surprising that more than 60% of homes1 and more than 70% of commercial buildings2 are undervalued in the U.S. That’s, in part, because the buildings and the costs of replacing them can change significantly over time.

Furthermore, the current COVID‑19 pandemic is making the challenge of maintaining appropriate valuation even harder. Underwriters must counter that challenge by being alert to some of the pitfalls of underinsurance, which are also identified by Leo Ronken in a Gen Re article last February.

Pitfalls of Underinsurance

- Carriers collect insufficient premium to adequately cover losses - normally, this can be countered with a coinsurance clause to reduce claims payments in line with the proportion underinsured.

- Underwriters discount the exposure and probable maximum loss (PML) scenarios and offer more capacity than they would otherwise have offered.

- Problems are exacerbated on shared/layered programs when exposure to excess layers is not fully realized and loss distribution curves assign inadequate premium to upper layers.

- Individual risks which might otherwise have required facultative reinsurance may not be ceded to the reinsurer, possibly resulting in additional net retention by the cedant out of the top of their treaty reinsurance.

- Miscalculations can occur in cumulative assessments, especially regarding natural perils being run through third-party vendor models. For carriers, this could mean their catastrophe reinsurance treaty might be insufficient potentially leading to additional net retentions and erosion of policyholder surplus. It would also add scrutiny from regulators and rating agencies for operational and data quality shortcomings.

Commercial Lines Issues

For Commercial lines, the insured value is typically the Total Insured Value (TIV) and reflects the value of the building, its contents - including stock or inventory - as well as a provision for business interruption (BI) to help replace lost income and pay for extra expenses when a business is affected by a covered peril. Undervaluation may occur in any or all of these coverages for a number of reasons, including:

- Building

- Reliance on agent or broker building valuations

- Using insurance-to-value (ITV) tools and benchmarks that are outdated or provide replacement cost estimates instead of reconstruction costs

- Failure to consider increased costs for historical or ornate buildings

- Not including material coverage extensions, such as ordinance and law limits in the rating base

- Contents

- Machinery and equipment reconstruction costs that may be significantly more expensive as replacement parts might no longer be available.

- Contents that are customized for the operation

- Discounts and concessions that are no longer available from suppliers/OEMs

- The lack of standard industry-wide tools available to evaluate most contents exposure means that attention needs to paid to the occupancy and the degree to which replacement equipment can be readily sourced

- Stock

- Incorrectly identifying whether or not indemnification is at production price or selling price

- Failure to account for seasonality and changes in inventory levels and changes in economic conditions affecting stock values (i.e., commodity type products)

- Business Interruption/Extra Expense

- Growth and changes in profit not factored in

- Changes in the economic conditions not recognized

- Unrealistic estimate of period of restoration

- Growing complexity and economic links between businesses

Business Interruption and Extra Expense portions of a claim often become loss drivers and, in many circumstances, exceed the physical loss; understanding how income is derived and business continuity plans are key to setting appropriate time and/or dollar limits to the coverage.

Personal Lines Issues

Personal Lines business often struggles with similar problems. The cost per square foot estimator used to establish the Dwelling value of a home (Coverage A) may overlook custom fittings and finishes or remodeling work. In the rush to streamline application forms or utilize prefilled data from third-party vendors, this is often-neglected information that can have a material impact. The limit for Additional Living Expenses (Coverage D) can also be insufficient, depending on the availability of accommodation or if there are delays in rebuilding the home, such as after natural disasters.

COVID Effects

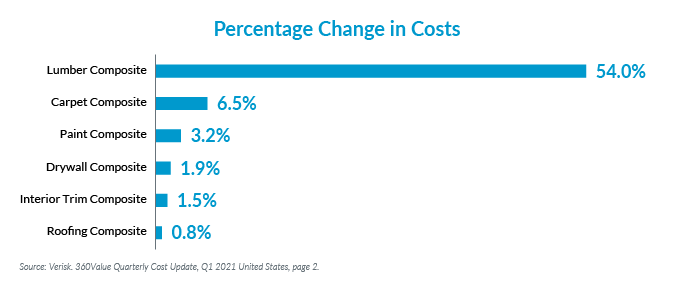

The problem of accurate valuation of property risks has been exacerbated during the COVID pandemic as reconstruction costs in the United States have surged. Investment in the existing housing stock has increased as Americans spend significantly more time at home and focus on home improvements while, at the same time, suppliers have been slow to meet that demand. As a result, Verisk’s latest “360Value Quarterly Cost Update”3 shows that reconstruction costs rose an average of 9.1% from January 2020 to January 2021 and in some states was into the teens. Driving the increase is a 54% surge in lumber costs as higher-than-expected demand during the pandemic contends with already low inventories and supply chain disruptions.

The spike in demand also means that labor costs have increased in the construction sector - up 7.9% year-over-year - and for some specialists, such as drywall installers and finishers, costs are up 13.0%.

Both Commercial and Personal Lines policyholders have felt financial pressure as an outcome of the pandemic, and they may be tempted to look toward trimming insurance premiums. For Commercial insureds, the desire to use blanket limits as opposed to scheduled limits can mask individual locations that are undervalued. Likewise, reduced sales (or for selected businesses, dramatically increased sales) and generally uncertain revenue projections for 2021 introduce increased uncertainty on setting Business Interruption limits.

Overall, in the current COVID world and with interest rates at near all-time lows, the emphasis for all insurers is on the need to make an underwriting profit. For Property lines, addressing undervaluation is a vital battle in that war. As such, we want to conclude with some underwriting considerations on this topic that insurers might like to ask themselves:

Underwriting Considerations to Avoid Undervaluation |

Do you have a means of verifying insurance to value in the current climate? |

Who develops the calculations - Agent, broker, underwriter, loss control? |

If property values are not refreshed annually, are they indexed to factor in inflation and changes in economic values? Are these still appropriate in the COVID business environment? |

Do you have coinsurance clauses, and do you offer Agreed Amount policies? |

If you are offering blanket limits, have you considered using margin clauses to tie location limits more closely to the schedule of values? |

Do you offer BI worksheets to help insureds determine accurate Business Interruption values? If this class of business has been affected by COVID, are these BI values still appropriate? |

Does the insured have a Business Continuity Plan, and does the BCP make sense in terms of how it will impact the period of restoration and BI/EE limits? |

Do you have shared/layered business or reinsurance cessions where a closer inspection of risk values might be necessary to determine if they exceed the given attachment point? |

What limits are provided to Cat modeling, and does any adjustment need to be made? |

Do you have a formal process for reviewing valuations after a loss, and comparing them with the original rated values and providing feedback to underwriting? |

For questions on, or assistance with, anything presented here, please reach out to us or your local Gen Re representative.

Endnotes

- Bronson, C, The Problem Affecting 60% of Homeowners Policies. Insurance Business America, 29 September 2015.

- Wilson, B, On the Hook for Property Undervaluation. IA Insight + Analysis for the Independent Agent, 3 March 2011.

- Verisk, 360Value Quarterly Cost Update, 1Q 2021 United States, https://www.verisk.com/insurance/campaigns/360value-quarterly-cost-updates/