-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Workers’ Comp – Gen Re Summary & Highlights of NCCI’s Annual Issues Symposium

June 02, 2020

Bill Lentz

Region: North America

English

Under the shadow of the ongoing 2020 pandemic, a virtual Annual Issues Symposium (AIS) presented the positive results for Workers’ Compensation in 2019, while highlighting the challenges to the industry created by COVID-19 and the resulting economic downturn. Workers’ Comp finished year-end with good results and in a strong reserve position; however, there is uncertainty ahead as every aspect of the line is likely to be impacted.

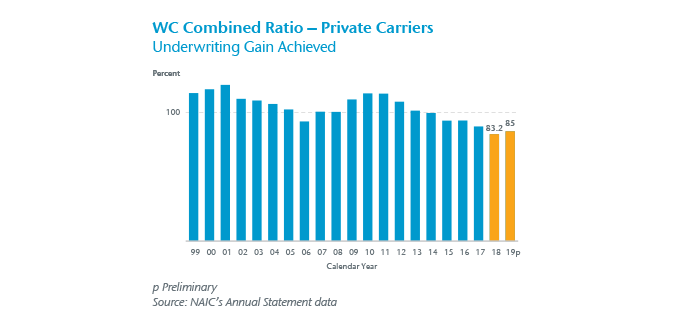

The Calendar Year 2019 combined ratio of 85% for private carriers is the sixth consecutive year that Workers’ Comp has posted an underwriting gain and the third consecutive year of results under 90%. The last two years have been the lowest combined ratios for Workers’ Comp since the 1930s.

2020 NCCI AIS Highlights

(regarding 2019 WC results)

- 85% combined ratio on a calendar year basis (AY 99%) for private carriers

- 2019 net written premium decreased by 2.6% to $42B

- Investment gain on insurance transactions increased to 11%

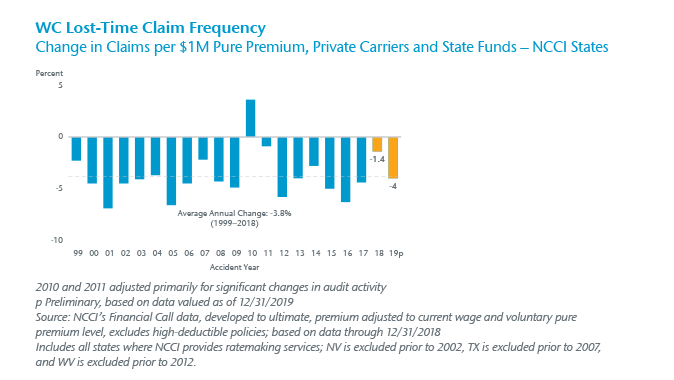

- -4% change in lost-time claim frequency, in line with long time average change

- Medical severity increase of 3% to $29,500

- Reserve position estimated to have grown to a $10B redundancy

Lost-time claim frequency continues to decline with a 2019 decrease of 4%, rebutting the theory that 2018’s decrease of only 1.4% was an indication of upward movement in this category. The long-term focus on improving working conditions and safety, along with increased use of automation and technology, continues to be credited for this trend. Business closures and higher unemployment levels may put even further downward pressure on claim frequency. However, there is also the potential for a spike resulting from the broadening of coverage due to expanding presumption laws.

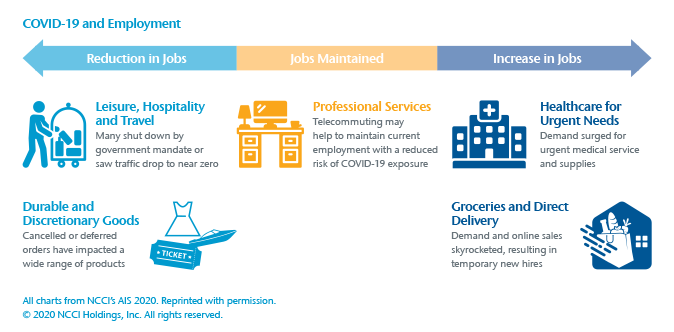

Workers’ Comp investment gain on insurance transactions increased to 11% in 2019. This level is not expected to hold considering the recent reduction in interest rates. Direct written premium decreased by 2.6%. Total Workers’ Comp premium volume is expected to further decline in 2020 due to the rise in unemployment. Industry sectors such as leisure and hospitality have seen immediate job reductions while telecommuting has helped to maintain stability in the professional service area. Although there will be significant challenges resulting from the pandemic and its effect on the economy, NCCI maintains that the Workers’ Comp system is healthy and well-positioned to respond effectively.

NCCI CEO Overview

NCCI President and CEO Bill Donnell opened the 2020 AIS by stating how the speed of recent events shows the importance of being prepared and the need for agility in responding to unexpected circumstances. He stressed that 2020 will be a pivotal year as we enter the new decade. While stating that Workers’ Comp is being tested by the COVID-19 pandemic, Mr. Donnell emphasized that the system remains strong. He is confident that the Workers’ Comp industry will rise to the challenge.

As industry stakeholders present their concerns to him about expanding presumption laws and the effects of the economic slowdown, Mr. Donnell is inspired by their continued commitment to the mission of Workers’ Comp and remaining focused on the needs of employers and injured workers.

Regarding questions as to the pandemic’s impact on the industry, Mr. Donnell pointed out that Workers’ Comp entered this crisis from a position of financial strength, particularly considering the 2019 year-end results. While acknowledging the realities of COVID-19, Mr. Donnell emphasized that Workers’ Comp has a long history of being resilient and reliable. Stakeholders working together will see it through and ensure that the system continues to work.

As Workers’ Comp addresses the current crisis, Mr. Donnell also implored the industry to look ahead to ensure the system remains healthy and relevant for the long term. While there are many topics to cover, he chose to focus on three:

- What Will Healthcare Look Like in the Future?

As any change in overall healthcare will have a significant impact on Workers’ Comp, the industry will need to take steps to be modern, efficient, and easier to do business with. One example of transformation is how COVID-19 has accelerated the use of telemedicine. Mr. Donnell cited the lower costs for the payer, higher volume for the provider, and convenience for the patient. - Will Cost Trends Change?

Loss costs have decreased by 30% over the last 10 years, and Workers’ Comp has enjoyed recent stability. However, 2020 has shown how quickly changes can occur and there are plenty of unknowns. Just the same, Mr. Donnell pointed to our improved ability to navigate from better insights through increased access and analysis of data to help direct our focus. - Is Workers’ Comp Ready for the Future?

While we must continue to ask questions for which we may not have answers to yet, Mr. Donnell asserted that the Workers’ Comp system must remain strong, healthy, and responsive. Industry stakeholders need to be watchful and stay on top of changes so that Workers’ Comp is there when needed. Accordingly, Mr. Donnell’s descriptive word for this year is “vigilance.”

Citing efforts of those on the front lines, Mr. Donnell called on all members of the Workers’ Comp community to rise to the challenge, providing the best support for injured workers and attracting talented people to the industry. In closing, Mr. Donnell stated that how we deliver at this time can change the narrative for Workers’ Comp.

NCCI State of the Line

The State of the Line report was presented by Donna Glenn, Chief Actuary for NCCI. This report provides a detailed review of results, trends, and cost drivers in the Workers’ Comp (WC) industry. The 2019 data is preliminary. Following are some selected highlights from Ms. Glenn’s presentation, with the full report available at ncci.com.

- WC Premium – Countrywide, private carrier, direct written premium decreased by 2.6%, although each state experienced various changes in premium growth. Net written premium for private carriers in 2019 is $42B, compared to $43.3B in 2018. Private carrier and state fund combined net written premium combined is $47B, which is also a slight decrease from the prior year total of $48.6B. Premium volume in 2020 will likely be lower due to higher unemployment. Mid-term adjustment and premium audits post-policy expiration may determine reduced exposure.

- WC Combined Ratio – The calendar-year combined ratio for private carriers is 85%. While a 1.8 point increase over 2018, it’s the third consecutive year of results under 90%. The 2019 accident-year combined ratio is 99%, which NCCI believes will develop favorably over time.

- Investment Results – The WC investment gain on insurance transactions increased to 11% in 2019, as compared to 9.2% in the prior year. This continues to remain below the long-term average of 12.6%.

- Pre-Tax Operating Gain – The 2019 pre-tax operating gain of 26% remains flat to 2018 but is well above the long-term average of 8.1%. Improvement in the loss ratios has resulted in above-average operating gains.

- Reserve Adequacy –NCCI estimates the 2019 reserve position for private carriers to have grown to a $10B redundancy which is double the $5B redundancy at year-end 2018.

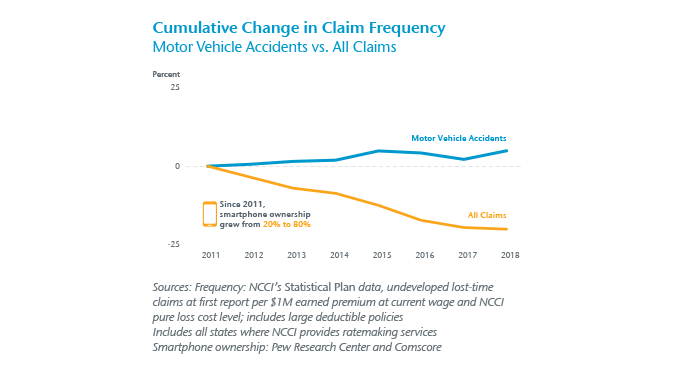

- Claim Frequency – WC lost-time claim frequency is estimated at a -4% change for 2019 which is in line with the long-term average frequency change of -3.8%. Of note is the continued deviation of Motor Vehicle Accident frequency from All Claim frequency. MVA frequency increased by 5% from 2011-2018 while All Claim frequency decreased by 20% over the same period. Claim frequency may decline even further during 2020 due to higher unemployment levels.

- Indemnity Severity – The 2019 average indemnity claim severity is $25,300 which is a 4% increase over 2018. Indemnity severity has increased by 85% since 1999 which is consistent with a 78% cumulative growth in wages over the same period.

- Medical Severity – The average medical cost per lost-time claim increased by 3% to $29,500 in 2019. WC medical severity has outpaced medical care price inflation over the past 20 years. The deferral of medical procedures and other care during the heightened pandemic period may result in extended claim duration and increased costs in 2020.

- WC Residual Market – The 2019 residual market pool premium remains at approximately $1B with small annual declines. Residual market share is down to 7% for 2019.

Summary of NCCI Observations

2019 Year-end:

- Moderate increases to indemnity and medical severity

- Further decline in claim frequency

- Very strong reserve position

- Combined ratios continue to be favorable

Challenges Due to COVID-19:

- Significant rise in unemployment

- Anticipated decline in premium

- Potential impact of presumption law expansion on costs

- Uncertainty regarding upward or downward pressure on frequency and severity

Gen Re Note

The solid results of 2019 have certainly been overshadowed by the COVID-19 crisis. As we began a new year and considered the challenges of 2020, a pandemic was not high on our list if it was on any list at all. A strong economy and record low unemployment trends suddenly reversed. The impact on the Workers’ Comp industry was immediate and continues to unfold.

While uncertainty exists as the expansion of presumption laws and workplace-safety challenges take center-stage during the gradual reopening of businesses throughout the country, Gen Re shares Mr. Donnell’s confidence that the Workers’ Comp industry is up to the challenge. Insurance carriers already have shown their resilience and flexibility by quickly shifting to a remote working model while continuing to deliver on their promise to employers and injured workers. It is times like this when the value proposition really matters.

As Mr. Donnell reminds us, the industry also needs to look beyond this crisis and into the decade ahead. Commitment and preparation for the long-term mean strengthening core functions: underwriting, claim handling, and reserving. It also means being watchful, open-minded, and adaptive to new technology and efficiencies.

Long-term planning applies to us as well: Gen Re has been delivering on its value proposition for almost 100 years. We look forward to working with you towards your continued success, regardless of what tomorrow brings. Stay safe, stay healthy, and stay vigilant!

We express our appreciation to NCCI for giving us permission to reproduce materials from its 2020 Annual Issues Symposium.

About NCCI

Founded in 1923, the mission of the National Council on Compensation Insurance (NCCI) is to foster a healthy workers compensation system. In support of this mission, NCCI gathers data, analyzes industry trends, and provides objective insurance rate and loss cost recommendations. These activities – combined with a comprehensive set of tools and services – make NCCI the source you trust for workers compensation information.