The fire that ravaged Notre-Dame cathedral in April last year was a disaster that shook France to its core and prompted an outpouring of grief around the world. Shocking scenes of the blaze and its aftermath dominated the media.

Conflagrations that destroy historical buildings, cultural sites, artefacts, and documents are in the headlines all too often. Sadly, intangible values as well as significant material are frequently destroyed in the process.

Examples of such losses include the fires at Windsor Castle in the UK (1992), the Duchess Anna Amalia Library in Germany (2004), the Glasgow School of Arts in the UK (2014 and 2018), the National Museum of Brazil (2018), and Shuri Castle in Japan (2019).1

Historical buildings and properties generally represent a significant fire load, as flammable or non-fire-resistant materials were predominantly in use when they were built. They often have no fire prevention measures to speak of and subsequent preventive measures are avoided because they would allegedly impair the original condition and aesthetics of the building. Fears that cultural treasures could be damaged if extinguishing systems are triggered by a false alarm is another reason frequently given.

All too often, there is conflict between the provisions of construction law (with its core requirements relating to stability, fire safety and personal protection) and the requirements and regulations of historical building protection that focus on preserving the original structure, exterior appearance and desired or actual use of the historical building.

After taking a brief look at the construction materials that are typically used in historical buildings, this article examines existing fire safety problems and potential fire prevention measures, as well as discussing consequences from the perspective of non-life insurance.

The article also presents underwriting aspects to consider when insuring historical buildings and properties.

Construction materials and fire behaviour

Over the past few centuries, materials that could normally be obtained in the vicinity were used to construct buildings. Typically, the following materials were used:

- Natural stone (e.g., sandstone, granite and limestone).

- Wood (e.g., oak, beech, spruce/fir).

- Composite materials consisting of clay and straw/reeds.

- Natural plant products for roofing and insulation (e.g., grass, straw, flax, reeds, and seeds).

- Textiles (e.g., wool, cotton, linen, and flax).

These materials are either flammable or somewhat easy to ignite, or have low to no fire resistance at all. Additionally, the interior design of the buildings and rooms largely consists of flammable materials such as wood and textiles, e.g., wooden stairs, ceilings, wall panelling, and furnishings.

Only a few scientific studies have been carried out on the fire behaviour of natural construction materials; examples include the work of Ulrich Obojes, Michael Unterwurzbacher, Andreas Sachser, and Peter W. Mirwald.2 The fire behaviour of frequently used construction materials can be described as follows:

- Natural stone (e.g., granite, sandstone, limestone)

Many historical buildings and works of art are made of natural stone. Although they are not generally flammable, many types of natural stone become weaker when exposed to temperatures of over 500 degrees Celsius in a fire, due to changes in structure and volume. As natural stone is a poor heat conductor, in a fire, the temperature is usually significantly higher on the side facing the fire than on the side away from the fire. This causes thermal stress in the stone, leading to the formation of fine cracks, which in turn causes a decline in width and a loss of stability. There is also a risk that when cooled suddenly (e.g., when water is used to extinguish a fire), natural stone might start to flake or even fail. As such, there is always a question of stability in natural stone buildings after a fire. On specific types of natural stone:- Sandstone is a sedimentary rock consisting predominantly of quartz that tends to crack and flake in the heat and with the significant temperature fluctuations of a fire, resulting in a loss of stability in the stone.

- Granite is an equigranular, homogeneous igneous rock. In a fire, thermal stress occurs due to nonhomogeneous mineral compositions in the stone which also leads to intracrystalline and intercrystalline fracturing in the stone. Therefore, temperatures in excess of 600 degrees Celsius cause an increasing loss of structural integrity and the collapse of the mineral bonds.

- Limestone is a carbonate rock. Even at low temperatures, stress builds in the rock and can lead to cracking and deformation. Temperatures in excess of 600 degrees Celsius typically cause chemical reactions that weaken the stone permanently. For example, at around 700 degrees Celsius the compressibility of a range of carbonate rocks decreases by around 40%. Limestone also reacts with water or steam (e.g., extinguishing water) and becomes increasingly fragile.

Sandstone and limestone also have a relatively high water absorption capacity (e.g., extinguishing water), which can potentially necessitate expensive drying work after a fire. If frost becomes a factor, further damage can be expected due to cracking and flaking. If the stone inside a room becomes wet, there is a risk of mould formation which will also require expensive restoration work.

- Wood

Wood has been a popular construction material over the centuries because it was available in large quantities, was easy to work with and was resilient under both tension and pressure. In particular, it was used to build roofs, wooden ceilings and furniture. As we know, wood burns easily, and its ignition temperature is between 250 and 350 degrees Celsius. Wood that has dried over centuries is particularly easy to ignite and the fire is likely to spread rapidly. Likewise, another disadvantage is that wood must be dried after a fire has been extinguished to prevent damage from mould and rot. Insulated wooden ceilings and panelled walls have proven exceptionally problematic in this regard. - Metallic materials

Before the invention of steel, a wide range of metals and alloys such as iron, lead, zinc, copper, and tin were used to build and decorate buildings. Although largely non-flammable, their durability can degrade at high temperatures. The melting point of lead is around 330 degrees Celsius. Cast iron was often used in load-bearing supports. However, when cooled suddenly after a fire, cast iron can crack and lose its load-bearing capacity. Steel was often used in newer historical buildings, in roof and ceiling construction for example. However, steel does not behave well in a fire as its load-bearing capacity degrades by around 50% even at around 500 degrees Celsius; at around 700 degrees Celsius it will fail completely. In addition, steel is a good heat conductor and its length changes when heated (1.2 cm per 100 degrees Celsius for a 10-metre long steel support), putting buildings at risk of collapse.

Findings from cases of fire damage

It’s hard to find reliable, up-to-date national statistics regarding fires in historical buildings. Most of the statistics available online are based on evaluations of press releases or only concern sub-areas and are usually not up to date.

The way in which many historical buildings were put together creates problems in terms of fire safety. For instance, certain structural features contribute to the rapid spread of a fire (e.g., an undivided roof and cavities), whereas others can allow a fire to smoulder for hours unnoticed before the fire breaks out some distance away from its actual point of origin. In this regard, large rooms, connected cavities, long-forgotten hallways and passages, chimneys, chimney vents, ventilation shafts, and old cellar shafts present the greatest risk of fire and smoke spreading. Additionally, there is no effective fire compartmentalisation (high pillars and cross beams, open stairways, wooden ceilings and wooden walls).

It’s evident from analysing loss reports that fires in historical buildings have a higher probability of major losses, compared with modern buildings. Massive, if not total losses are common. For one, this is because these buildings have a significant fire load due to their construction materials and how the buildings and rooms have been designed with flammable materials; it’s also because fire prevention measures are seldom in place.

Roofs often consist of extensive wooden trusses that represent a significant fire load and are easy to ignite. Firefighters often have limited options in terms of setting up, rescuing people and fighting the fire because historical buildings are often difficult to access due to narrow roads, remote locations, and steep, narrow approaches. In most cases, there is insufficient documentation available about the building and its rooms, e.g., on its structural analysis, room layouts, stairways, access points, ventilation, and chimneys, which also prevents the fire brigade from operating effectively.

It should also be noted that incipient fires often go undetected for too long because automatic fire alarm systems have not been installed, which means that the fire brigade is notified too late. One reason is that fire prevention measures (e.g., fire alarm systems, sprinkler systems and fire mains) are rejected because the building is listed (i.e., registered as being of historic interest) and they are seen as interfering with the original state of a building or room and its aesthetic quality.

The considerable financial cost of such measures is another argument used against installing fire prevention systems. As these buildings have grandfather rights under construction law, the subsequent installation of fire prevention measures is not considered necessary if there is no evident danger to life and limb, despite knowledge to the contrary. Due to the delay this causes, it is unlikely that the fire brigade will be able to carry out an effective interior response to a fire.

The after-effects of a fire will usually add to the scale of a loss, because of e.g., smoke, fire water and moisture damage.

Typical causes of fires in historical buildings include outdated electrical and heating systems, candles, repair and maintenance work, and arson3. Other causes of fires can be found in workshops and warehouses, commercial and souvenir shops, and due to lightning strikes.

Recommended fire protection measures

Even though constant reference is made to the potential damage to listed buildings from fire prevention measures (such as sprinkler systems) in the case of a false alarm, or simply by their installation, they should always be a serious consideration.

In many cases, safety measures can now be fitted and integrated into an existing structure without massively impairing the original state or aesthetics of the building. Custom solutions can often be found for installing automated fire protection systems that do not ruin a building’s overall appearance and that consider the listed nature of the building.4

Here are just a few examples of what have proven to be highly advisable fire protection measures:5

- Installation of an automatic fire alarm system (e.g., a point type or aspirating smoke detector). This makes it possible to raise the alarm quickly while a fire is incipient and thereby limit the damage.

- Installation of an automatic fire extinguishing system (e.g., a sprinkler system or high-pressure water mist system). High-pressure water mist systems can fight fires successfully with minimal use of water.

- Installation of risers and wall hydrants to shorten the response time of the fire brigade and make water available for fighting fires even in inaccessible areas such as towers.

- Subsequent installation of horizontal and vertical fire compartments or retrofitting existing walls and ceilings to create fire compartments, especially between different building sections – e.g., the main building, towers, annexes, and attics – to limit the spread of a fire and subsequent smoke damage and help the fire brigade to extinguish the fire successfully.

- Use of non-flammable construction materials and replacement of pre-existing flammable materials to reduce the fire load.

- Installation of technical systems such as electrical distribution boards and heating systems in separate, fireproof rooms.

- Organisational measures, e.g., improving the local knowledge of the fire brigade through regular inspections and drills or prepare a fire emergency plan and ground maps for use by the fire brigade. Besides information on access routes, rendezvous areas, marshalling points, and the supply of extinguishing water, the plans should contain floor layouts and information on the value and urgency of saving any cultural treasures inside. Other measures include establishing and designating fire brigade rendezvous areas and marshalling points, imposing a smoking ban, introducing permits for “hot works”, and maintaining general cleanliness and tidiness.

- Improving and securing fire exit routes that can also be used as attack routes by the fire brigade.

- Regular inspection, maintenance and adaptation (if necessary) of internal systems such as electrical light and power, lightning protection, heating, and ventilation to bring them in line with what the industry considers state-of-the-art. This includes fireplaces and chimneys.

- Use of mobile fire alarms and provision of sufficient first responder fire-fighting equipment, such as fire extinguishers, when repairs and maintenance become necessary.

- Installation of shops such as souvenir shops in separate rooms or annexes.

- Installation of an automated burglar alarm system that notifies the police immediately to prevent attempted break-ins and potential arson attacks.

It’s important to remember that fire protection measures in historical buildings and properties have to be considered individually to find mutual, acceptable solutions that accommodate the concerns of historical building protection, construction law, the local situation, and fire protection. The potential risk differs from property to property, meaning that standard or “off-the-peg” solutions cannot always be implemented.

Insurance

Fires and their aftermath are always a challenge for non-life insurers but the settlement of insured claims for historical properties is even more complex. Not only is the scale of loss likely to be higher compared with newer buildings, but these buildings have specific constructions and styles (e.g., ceilings, frescoes, tapestries, cladding, decorative metal ornaments, and cultural treasures), some of which are irreplaceable.

The costs of repair work in the case of a partial loss or of restoration can increase significantly as, in the event of damage, the historic monument protection authority can force the owner to restore the damaged property to its original condition.

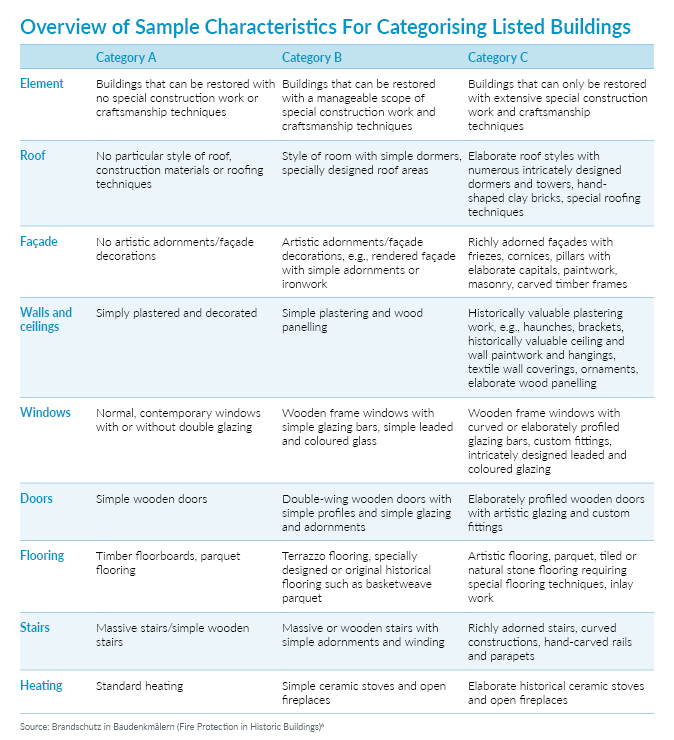

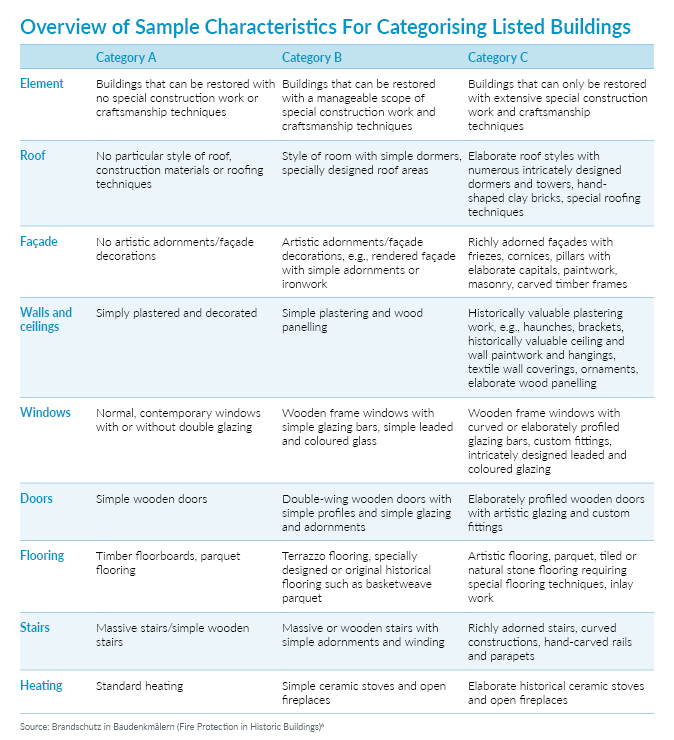

Here in Germany, historical buildings are split into various categories and there are similar practices in other countries, such as the UK:

- Category A: Buildings that can be restored with no special construction work or craftsmanship techniques.

- Category B: Buildings that can be restored with a manageable scope of special construction work and craftsmanship techniques.

- Category C: Buildings that can only be restored with extensive special construction work and craftsmanship techniques.

Category C means that only special construction materials, craftsmen with special skills and craftsmanship techniques can be used in the restoration process, which limits the availability of crafts enterprises and pushes up costs.

It often turns out after a loss that the amount of cover on which the insurance policy was based is not consistent with the actual restoration costs of the building or property, resulting in a case of considerable underinsurance. This means that the insurer only covers part of a loss and the owner must pay a significant portion of the restoration costs due to being underinsured.

Overall, the restoration costs are normally far higher for historical buildings after a fire than they are for conventional, modern buildings.

When it comes to claims settlement, it is crucial that the relevant historic monument protection authority is involved in the settlement process. Considerable additional costs can be incurred because of the requirements that apply to listed buildings or as a result of compliance with the currently applicable requirements of construction law – to say nothing of the time delays caused by the lack of availability of authorised crafts enterprises and construction materials. Further loss expenses might be incurred if a business interruption or rent insurance policy has been taken out.

Determining the amount of cover

As stated above, the insured loss can often be significantly lower than the actual value of the property. Therefore, determining the correct, actual amount of cover is of existential importance when it comes to taking out an insurance policy.7 Unfortunately, there is no generally applicable, standardised method for determining the amount of insurance cover. For churches, there are guidelines that provide a rough overview of what and how the individual elements of a building should be considered.8 These statements can also be taken as indications for other historical buildings.

Determining the amount of cover is based on:

- The category of listed building.

- The year of construction, architectural style and construction technology.

- The quality and fittings of the building.

- The location of the building.

- The size of the building.

Notre Dame – A Monumental Disaster

At around 6 p.m. on 15 April 2019, a fire was spotted at the base of the 93m spire atop Notre Dame Cathedral in Paris. The flames spread quickly to the cathedral’s roof, known as ‘the forest’ because of the hundreds of centuries-old oak beams that supported it.

Within three hours the spire had fallen onto part of the cathedral’s vaulted transept.

By the time the fire was eventually put out at 9.30 am the following morning, two-thirds of the roof had been destroyed, part of the vaulted ceiling had collapsed and up to 400 tonnes of lead from the roof and spire had been reduced to toxic dust.

Catastrophic damage to the interior was prevented by the cathedral’s stone vaulted ceiling, which largely contained the burning roof as it collapsed, and many works of art and religious relics were moved to safety. However, smoke damage was extensive and some exterior art was ruined or destroyed.

Estimates vary for the cost of the painstaking reconstruction, which involves securing the 850-year old cathedral’s structure, replacing the roof and framework, as well as conserving art and furniture. The final bill to the state is expected to be many hundreds of millions of euros.

But one year on, uncertainties remain over the stability of the building due to the difficulty of extracting 400 tons of scaffolding, in place at the time of the fire, that fused around the spire. Restoration work was also slowed by the need to remove lead contamination and, later in the Autumn, by high winds.

The Covid-19 lockdown further delayed progress and in April 2020, Jean-Louis Georgelin, the army general in charge of the rebuilding project, predicted that the cathedral would not re-open until 2024.

Looking at a range of insurance policies for historical buildings, it quickly becomes evident that approaches to determining the amount of cover vary greatly:

- Full-value insurance (like kind and quality)

The insured value represents the cost of restoring the building/property to its original condition. In the event of a total loss, this enables the owner to completely rebuild the building in the same quality and style and in compliance with the relevant legal regulations (listed building protection and construction law); in the event of a partial loss, the owner can repair and rebuild the damaged and destroyed sections.

The premiums for such full-value insurance are relatively high compared with modern buildings as it costs significantly more to repair and restore historical buildings and properties. Therefore limited coverage concepts can often involve lower insurance premiums, yet also increase the risk that the owner will have to pay the surplus amount out of his or her own pocket in the event of a loss. - Limited full-value insurance (modern material clause)

The insured value is determined based on rebuilding the building/property using equivalent modern, easily available construction materials. This means that the cover is not enough for the full cost of repairing or restoring listed buildings, especially if the building, as a protected historical monument, needs to be restored to its original condition using original craftsmanship techniques and construction materials. - First loss and agreed value insurance

In the event of a loss, the claim is only settled to the agreed value. If the cost of restoration or reconstruction is higher than the agreed value, the owner must pay the surplus amount. The agreed value is often estimated based on either the expected maximum loss or the financial resources that are available to pay the insurance premiums. - Replacement cost insurance (new building cover)

In the case of a total loss, the agreed insured value corresponds to the amount that would need to be spent to build a modern replacement building. To avoid nasty surprises, all parties should know that this needs to be coordinated with the historic monument protection authority. If only a partial loss occurs, complications can be expected to arise from this cover concept if the repair work is required by law to restore the original condition. - Fair market value (no rebuilding insurance)

The agreed insured value is based on the cost of demolishing the building/property. This type of insurance only makes sense if restoration or reconstruction is precluded in the event of a loss.

It is also not unusual for the owners of historical buildings to decide not to insure the building/property. This particularly applies to buildings and properties that are in the possession of the state. In the event of a loss, the government becomes liable to the extent that government revenue is used to restore or repair the buildings or properties.

When it comes to historical buildings, the methods commonly used by the insurance industry to calculate insured values and those used by architects to determine a property’s value often produce inaccurate results. Unlike contemporary architecture, it’s important to know which special construction materials or craftsmanship techniques that are no longer common practice were used to construct the building. Additionally, potential first risk amounts for fire-extinguishing, clearance and decontamination, plus any additional costs stemming from official restoration requirements and security must be factored in. To ensure that the insured amount represents the cost of restoring the building to its original condition, it’s advisable to engage an expert who specialises in period buildings. Depending on the nature and scale of the building, it may be necessary to involve other specialists for individual sections. This particularly applies to properties in listed building category C.

Further thoughts on underwriting

Historical buildings and properties are always special cases because they are unique. As described above, historical buildings represent higher exposure as there is an increased probability of a major or even total loss. The claims expenditure will be higher even in the case of a partial loss.

Compared with standard buildings, the risks, hazards and the effects of losses are therefore more complex and require more attention to be paid as part of underwriting.

If an application is submitted for insurance for a historical building, the following underwriting aspects should be taken into consideration:

- The insurability of the building (e.g., its state of preservation, exposure to terrorism and arson risk).

- The address, location and accessibility of the building, including details of neighbouring developments and how they are used.

- The condition of the systems in the building, e.g., electrical, heating and ventilation systems.

- Usage, including any secondary activities such as souvenir shops, warehouses and workshops.

- Listed building category.

- The scope of insurance cover (building, facility, business interruption insurance (e.g., if used commercially), loss of rent).

- The insured contents and value of these buildings, e.g., cushions, tapestries, wooden figures, furniture, paintings, instruments, collections, and other works of art. Clarification whether they are covered by the insurance policy and how their insured values have been calculated.

- Insured risks (FLEXA, named perils, all risks cover).

- Basis on which the insured amount was calculated, method used to determine the insured value and estimation of the extent to which the insured value is potentially compromised by the actual restoration costs.

- If the insured amount was determined based on an expert appraisal, it is advisable to know the name of the expert, how up to date it is (it should not be more than 3–4 years old) and the expert’s qualifications.

- Agreed basis of compensation in the event of a loss, e.g., costs of restoration to original condition, agreed insured value, demolition cost.

- Agreed first loss amounts, e.g., costs of temporary storage and costs of securing the loss site.

- Existing fire protection measures and potential deficiencies.

- Performance of regular maintenance and servicing as well as the immediate repair of deficiencies, acceptance certificates, inspection certificates.

- Readiness of the owner to fix existing fire protection problems.

- Existing underinsurance provisions.

- Agreed deductibles and maximum compensation.

- Expected maximum loss (MFL/PML), especially with consideration for consequential fire damage and insured first loss amounts.

- Foreseeable historical building protection requirements following a loss in the case of partial or total loss.

- Available documentation on the building to be insured and storage of this information for the purposes of restoration (e.g., laser scans, drawings and photographs).

- Available risk inspection reports and assessment of the inspector.

- Loss history.

Based on this information, it is possible to calculate an appropriate insurance premium for the cover that is consistent with the level of risk exposure. It must be taken into account that premium rates that are conventionally used in non-life insurance concern the insurance of buildings and contents at their reinstatement value. However, if the insurance is purchased based on a contractually agreed insured amount that only represents part of the full value, the premium rates are unsuitable and need to be adjusted.

Summary

Historical buildings and properties are an extraordinary challenge for non-life insurers, due to their uniqueness, complexity and the legal framework around them. High fire loads due to flammable construction materials, combined with missing or insufficient fire compartmentalisation, automatic fire alarms, and extinguishing systems, as well as less favourable conditions for the attending fire brigade, mean that there is a higher probability of a major loss, if not a total loss.

Before providing insurance, carriers must investigate, check and analyse the underlying exposure thoroughly to avoid surprises in the event of a loss.

When a loss occurs, the loss adjustment process will be more laborious than for standard risks as various parties such as owners, historical building protection authorities and construction authorities all pursue their different objectives; this causes the cost of repairs or restoration to increase significantly compared with modern buildings.

Additionally, when losses occur, the insured amounts often prove to have been set too low and do not cover the necessary costs of restoring the building to its original condition. It follows that greater attention to detail is needed when accepting applications and underwriting historical buildings and properties.

Our Underwriters’ Checklist for Historical Buildings provides an overview of the most important aspects to consider when assessing the risks involved in insuring period properties and structures. We hope you find it helpful.

U.S. Industry Events

U.S. Industry Events