-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Six Things We Can Do to Curb Legal System Abuse

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Creating Strong Reinsurance Submissions That Drive Better Outcomes

Publication

Do Commercial General Liability Policies Cover Mental Anguish From Sexual Abuse? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Next Gen Underwriting Insights – 2025 Survey Results & Confusion Matrix Considerations [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Is the Time Finally Right for D&O in China?

July 20, 2020

Frank Wang

Region: China

English

Chinese

Originating during the 1930s, Directors and Officers Liability Insurance (D&O) reduces the risk of liability that may be caused by the misconduct of senior managers while performing their duties. The core purposes of D&O include reducing the pressure of civil compensation liability on a company’s business activities, providing compensation protection for investors, and helping to ensure a ready supply of talent for director and senior staff positions.

Over the years, D&O has become an important part of the corporate governance of global listed companies, particularly within more developed markets. According to media reports1, nearly 100% of listed companies in the U.S., and nearly 90% of listed companies in Europe, purchase D&O. In contrast, the first D&O policy appeared in China in 2002 and, so far, less than 10% of Chinese A-share listed companies purchase it.

This lukewarm response to D&O insurance has recently become a hot topic in the domestic insurance market. This has been propelled by multiple factors, such as the newly revised Securities Law, the accelerated implementation of the securities registration system, and the recent Luckin Coffee fraud incident.2 This article summarizes the current situation concerning A-share D&O in China, analyzes new opportunities and challenges, and puts forward several development strategies for the industry.

The current D&O situation in China

D&O remains a somewhat niche liability insurance product in China, with only a few insurers engaged in the business. So far, most active players have been foreign insurers and insurance brokers mainly serving foreign-listed Chinese companies, especially Chinese Concept Stocks listed in the U.S. due to the high risk of litigation.

Since its arrival in 2002, market acceptance of D&O has remained low despite some initial foundations being laid. In August 2001, the China Securities Regulatory Commission (CSRC) pointed out in its Guiding Opinions on the Establishment of Independent Director System in Listed Companies that: “In order to ensure that independent directors can exercise their powers effectively, listed companies should provide the necessary conditions for independent directors”, including “the establishment of the necessary independent directors’ liability insurance system”.

In January 2002, CSRC and the State Economic and Trade Commission (SETC) jointly issued the Guidelines for the Governance of Listed Companies, which made extensive reference to the governance experience of foreign companies and proposed in Article 39 that: “With the approval of the shareholder meeting, a listed company may purchase liability insurance for its directors”.

Since 2005, with the enactment or revision of the Company Law, Securities Law, Bankruptcy Law, and others, China has gradually attached importance to the protection of investors’ interests. They have done so while inevitably increasing corporate management’s operational responsibility and the liability risk in their performance of duties. To balance the inequalities in the rights and risks of the operation and management of the company, D&O has attracted attention. In 2006, the State Council circulated the Several Opinions of the State Council on the Reform and Development of the Insurance Industry (abbreviated as the “National Ten Articles”), clearly proposing the development of the D&O business.

In 2014, the State Council once again mentioned the acceleration of the development of various types of professional liability insurance in the Several Opinions on Accelerating the Development of the Modern Insurance Service Industry: “The intention is to make full use of the function and role of liability insurance in pre-event risk prevention, in-event risk control, after-event claim settlement, and use economic leverage as well as diversified liability insurance products to resolve civil liability disputes”.

Chinese laws and regulations do not mandate companies to publicly disclose information on D&O. However, as its purchase must be proposed by a company’s board of directors and reviewed and approved in shareholder meetings, the number of companies that have purchased D&O can be determined by screening the content of disclosures from Shanghai and Shenzhen A-share listed companies. Reports from the Shanghai Stock Exchange show that a total of 523 listed companies purchased D&O insurance at some point during the period from 2002 to August 2019, and the insurance coverage ratio increased from 1% to 4% during this time.

In the first four months of 2020, 72 A-share listed companies announced their intention to purchase liability insurance for their directors and officers.3 Since then, a further 58 have announced plans to purchase D&O for their managers. This would imply a 25% increase on 2019. According to media reports4, as of the end of 2019, the proportion of A-share listed companies purchasing D&O was about 10%. However, this is expected to rise to 15% in 2020 as a result of judicial influence following the circulation of the new securities law.

According to reports from the Shanghai Stock Exchange5, A-share listed companies that have purchased D&O often share the following characteristics:

- Large-scale enterprises

- State-owned enterprises

- Publicly traded companies with a relatively high proportion of international shareholders and business interests

- Mostly from biomedical, chemical and financial industries. (The coverage rate in the technology and innovation sector remains particularly low)

- A high number of directors and independent directors, as well as high shareholding ratio of major shareholders

New opportunities for A-share D&O

On 28 December 2019, the fifteenth session of the Standing Committee of the Thirteenth National People’s Congress reviewed and adopted the revised Securities Law of the People’s Republic of China (the new securities law), which has been in effect since 1 March 2020. This revision has further improved the basic system, embodying the direction of marketisation, rule of law, and internationalization. It has involved implementing comprehensive reforms in the securities market, effectively preventing and controlling market risks, improving the quality of listed companies, safeguarding the rights of investors, promoting the functioning of the market to serve the real economy, and creating a standardised, transparent and resilient capital market that provides strong legal guarantees.

There are many aspects to the new securities law but the following are the most important for promoting the development of A-share D&O:

1. Fully implementing the securities issuance registration system.

The new securities law has systematically been revised and has improved the securities issuance system drawing upon learnings from the Shanghai Stock Exchange Innovation Board and its piloting of the registration system. Acknowledging that registration system reform is a gradual process, the new securities law authorizes the State Council to stipulate the specific scope and implementation steps of the system, leaving room for the step-by-step implementation of the relevant boards and securities products. On 27 April, the General Implementation Plan for the Reform and Pilot Registration System of the Growth Enterprise Market was approved and the Shenzhen Stock Exchange’s pilot for the registration system of the Growth Enterprise Market was opened. This accelerated China’s securities issuance process from the approval system to the registration system, embodying the further globalization of China’s securities market.

2. Significantly increasing the cost of securities violations.

The new securities law has greatly increased the penalties for securities violations. For fraudulent issuance, the fine has doubled from a maximum of 5% to 10%. For information disclosure violations by listed companies, the maximum fine has increased from the original RMB 600,000 to RMB 10 million. And, for the directing of others to engage in misrepresentation or concealing matters that result in misrepresentation by the issuer’s controlling shareholder (and/or the actual controller), the maximum penalty is now RMB 10 million. The new securities law has also improved the civil liability for securities violations. For example, it stipulates the civil liability to an issuer for failure to perform public commitments and clarifies the presumption of fault and/or the joint and several liability for compensation in cases of fraudulent issuance and information disclosure violations by the issuer’s controlling shareholder and/or actual controller.

3. Improving the investor protection system.

The new securities law has a special chapter dedicated to the investor protection system and has made many stipulations worth highlighting. It includes:

- Distinguishing between ordinary and professional investors

- Making targeted protection arrangements for investor rights

- Establishing a collection system for exercising the rights of shareholders of listed companies

- Stipulating a system of bondholder meetings and bond trustee managers

- Establishing a mandatory mediation system for disputes between ordinary investors and securities companies

- Improving the cash dividend system of listed companies

Particularly of note is the exploration of a civil litigation system suitable for China, stipulating that an investor protection institution may act as a litigation representative and file civil damage lawsuits for injured investors in accordance with the litigation principles of “explicit opt-out” and “implicit participation”.

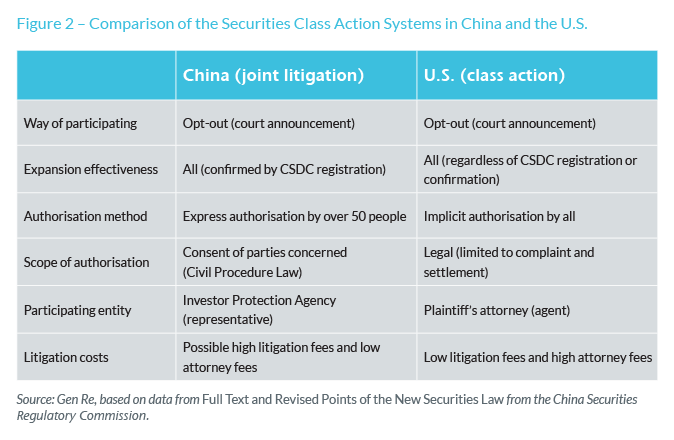

Although the new securities law has established a “Chinese-style securities class action system”, it is quite different from the American-style securities class action system (see the table below). The threshold for bringing a claim is high, excluding the direct participation of professional attorneys with low-level incentives. In addition, the law is new and still needs to be tested by judicial practice.

4. Further strengthening information disclosure requirements.

The new securities law has a special chapter dedicated to systematically improving the information disclosure system. It includes:

- Expanding the scope of information disclosure obligors

- Improving the content of information disclosure

- Emphasing the full disclosure of information required for investors to make value judgements and investment decisions

- Regulating the voluntary disclosure behaviour of information disclosure obligors

- Clarifying the requirement for acquirers of listed companies to disclose the sources of funding for the additional shares

- Establishing an information disclosure system for issuers and their controlling shareholders, actual controllers, directors, supervisors, and senior managers

To sum up, the new securities law implemented in March 2020 has not only increased the punishment for violations of information disclosure regulations by “directors, supervisors, and officers” but also explores the creation of a securities civil litigation system. The uncertainty surrounding the potential legal risks faced by senior employees going forward is significantly increasing the demand for D&O by listed companies. This is reflected in the sharp increase in the coverage rate of D&O seen so far this year.

The Luckin Coffee fraud incident in April further catalysed the market’s awareness of D&O insurance. Although Luckin Coffee is not an A-share listed company and the securities claims caused by the financial fraud may not be covered by its insurance policy, its purchase of U.S. stock D&O has caused widespread attention and much discussion in China, turning D&O from a niche product into a potential hit.

Stocks and shares in China

Depending on where the stock is listed, the stocks of Chinese listed companies are divided into A shares, B shares, and H shares.

The official name of an A-share is RMB common stock, that is, a stock issued by a Chinese registered company, listed in China, and denominated in RMB for Chinese individuals and institutions to trade and subscribe in RMB (residents of Hong Kong, Macao, and Taiwan have been able to open A-share accounts from 1 April 2013). On 5 November 2005, CSRC and the People’s Bank jointly issued the Interim Measures for the Administration of Domestic Securities Investments of QFII, which allows qualified overseas institutions approved by CSRC and the State Administration of Foreign Exchange to invest in A-shares.

A-shares are not physical stocks. Paperless, electronic accounting is used and the “T+1” delivery system is implemented. There is a 10% limit to increase and decrease for the main board with no limit for price increase and decrease during the first five trading days after listing on the Science and Technology Innovation Board and the Growth Enterprise Market. The ratio of a subsequent price increase and decrease is 20%. China’s A-shares are mainly divided into the Shanghai and Shenzhen stock exchanges. The total number of companies listed was 3,777 as of 31 December 2019.

The official name of B-shares is RMB special stock. A B-share is a foreign stock whose nominal value is denominated in RMB and is listed on a Chinese (Shanghai or Shenzhen) stock exchange to be subscribed and traded in foreign currencies. Both the place of registration and the place of listing of a B-share company is in China.

H-shares are also known as state-owned enterprise shares, referring to the shares of Chinese-funded enterprises registered in the Mainland but listed in Hong Kong They are called H-shares for the first letter in the English name of Hong Kong. H shares are physical stocks and use the “T+0” delivery system with no limit on the increase or decrease.

New challenges for A-share D&O

Until now, the development of D&O in the Chinese market has been slow because the litigation risk has been relatively low. This is mainly due to China’s securities civil compensation liability system being imperfect. China’s punishment for listed companies has always focused on administrative and criminal responsibilities as opposed to civil liability to compensate victims. Chinese stock market investors are mainly retail investors and their awareness of rights protection is limited. Small and medium-sized investors often face difficulties finding the proof necessary for prosecution. The cost of litigation is also prohibitive.

In recent years, China has been improving the securities civil compensation liability system. In particular, the preliminary procedures for administrative punishment by the CSRC have been abolished and the China Securities Investor Service Center has been established, greatly reducing the difficulty of protecting the rights of small and medium-sized investors. According to statistics from Zhong Lun Law Firm, the number of civil lawsuits for securities misrepresentation has risen sharply since 2017.6 According to their research, 9,005 new cases were reported in 2019, involving 88 listed companies – accounting for 30.22% of the publicly disclosed securities misrepresentation liability disputes found. While the numbers of shareholder claims and companies involved reached a record high, the record amount of compensation seen in securities misrepresentation civil lawsuit cases has also been updated constantly. According to public information, in a single, civil lawsuit case of securities misrepresentation tried in 2019, the maximum amount of compensation for a case with an “ordinary” investor as the plaintiff was as high as RMB 66 million.7 Given the class action mechanism established by the new securities law, it’s likely that investor civil cases – and their value – will continue to rise. Insurers engaged in the A-share D&O business must have a clear understanding and pay close attention to this rising legal risk exposure while developing new opportunities for D&O.

While monitoring the litigation risks, attention must also be devoted to the corporate governance problems of A-share listed companies. The quality of corporate governance will affect the decision of A-share listed companies to purchase D&O and the litigation risks they might face. Since many Chinese listed companies are state-owned enterprises in which the directors and senior management personnel are directly assigned and appointed by the relevant authorities or agencies, they don’t need to compete for superior management talent and therefore have less incentive to purchase directors liability insurance for these employees. Also, some listed companies and controlling shareholders do not respect the opinions and reasonable demands of small and medium-sized investors in their decision-making. It is difficult for these shareholders to participate in daily operations and management and exercise their functions of supervision and control. As mentioned, small and medium-sized shareholders can often lose their interests because they cannot collect substantive evidence of misconduct to file a lawsuit against the management of a listed company for the losses suffered.

Developing countermeasures for A-share D&O

The opportunities and challenges of the A-share D&O market coexist. If insurers want to develop this business sustainably, they need to do the following:

- Understand the risks. Being successful in the A-share D&O business means understanding its specific risk characteristics. From a macro perspective, insurers must monitor the changes in judicial practice following the implementation of the new securities law, while paying attention to economic, geopolitical, and regulatory factors affecting the trend of the A-share capital market. From a micro perspective, insurers should carefully analyse important underwriting information, such as the operating conditions, financial status, listing performance, corporate governance, and past loss records of individual insured companies.

- Price adequately. Selecting risks according to ones’ own risk appetite and collecting premiums that genuinely reflect the risks involved is vital. Risks are always evolving and must be adjusted accordingly. The low penetration of D&O over the past decade is mainly due to low litigation risk. However, this risk is increasing and will continue to do so in the future. Public data shows that the rate of A-share D&O has generally been rising since 2016, and the average market rate has risen from the original 0.3% to about 0.5% (of D&O policy limit),8 which is the correct response to the rising risk of A-share litigation in recent years.

- Use appropriate terminology. As a niche foreign product, many of the commonly used terms have been introduced from overseas by foreign-funded insurers. As a result, there is a disconnect between the terminology used for the design of policy terms in the market and the Chinese legal environment. Given the macro environment and the individual differences of Chinese listed companies, insurers need to make appropriate adjustments to the terms of their D&O offering to better meet the needs of local customers. As there are no market prevailing terms for D&O, every product needs to be customized on a case-by-case basis, which requires a higher degree of skill for insurers.

- Build a professional team. Because of the high degree of specialisation required and the relatively small scale of the market up until now, experienced D&O insurance and claims professionals are very scarce in China. A qualified D&O underwriter needs to have a combination of legal, economic, and financial knowledge as well as practical underwriting experience. Before insurers can develop an A-share D&O business, they need to establish and train their team of D&O underwriting and claims specialists, while conducting their business gradually and prudently. Strengthening cooperation with experienced insurers and reinsurers can be a valuable way to start – don’t hesitate to reach out if you would like to discuss your goals.