-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

The Future of Work – Labor-Intensive Industries, Insurance and Law [Part 2 of series]

January 14, 2020

Frank Bria

Region: North America

English

Recent developments in robotics and artificial intelligence have changed the playing field for automated technologies. Historically, automation was beyond the reach of small- and medium-sized companies. Robotics were costly, required highly sophisticated programming expertise, took months to integrate, and could only perform single discrete tasks.

In 2012 the advent of artificial intelligence (AI) was a game changer. AI brought collaborative robots to the market - robots that see and feel like humans, learn (including integrating new data sets and information), and perform multiple tasks. These collaborative robots are also more cost effective and easier to integrate, making them available and attractive to small- and medium-sized businesses.

AI and robotics are now transforming many traditional labor-intensive industries, such as farming, construction, factories and fast food. While Amazon continues to be a global leader in leveraging AI and smart robots, there are plenty of examples of smaller businesses across the country embracing these new automated technologies. Agricultural farms are utilizing automated tractors and drones to help with growing their crops. Construction firms are purchasing automated brick laying machines (to lay 3,500 bricks per day). Restaurant owners are investing in new automated machines that can store, prep and cook fast food in a highly controlled environment without any human intervention. If the adoption of these new automated machines continues, there will be fewer jobs and payrolls in these industries. Over time, the job and payroll loss will materially impact insurance carriers who specialize in writing workers compensation insurance for these industries.

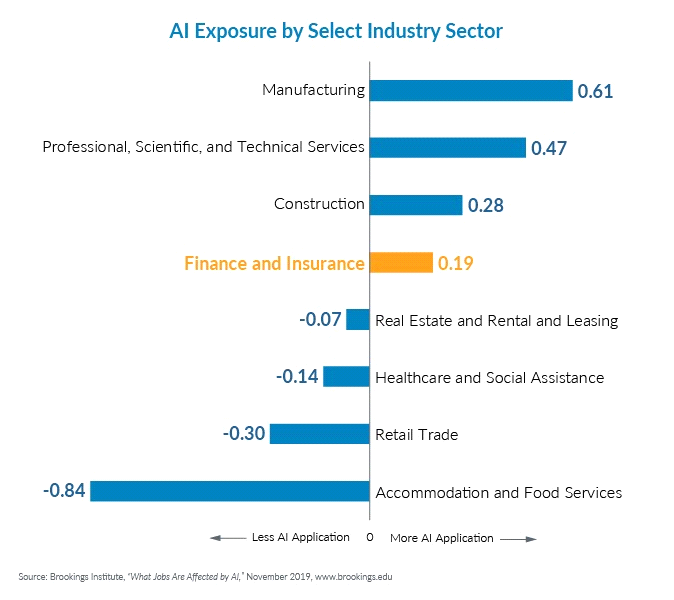

Historically, technology’s disruption was limited to blue-collar workers; however, AI technology now has its sights set on white-collar workers including insurance underwriters, claims executives and legal professionals. The insurance industry, which has not been an easy industry to disrupt, is primed for major transformations due to developments in AI and automation.

Two years ago, Cambridge University predicted that insurance underwriters were vulnerable to automation. Since that time, we have seen a greater demand among U.S. carriers to invest in new AI technologies that allow them to automate the underwriting and settlement of claims for small commercial insureds. Given the shortage of new talent available to fill expected insurance and claims executives retirements, coupled with new AI technologies, we expect this trend to accelerate.

Developments in AI and automation are already changing the U.S. legal profession, one of the most regulated and specialized professions in the U.S. - McKinsey estimates that 22% of lawyers and 35% of paralegal tasks can be automated today. A recent HBO documentary, “The Future of Work,” supports this prediction. It highlighted how LawGeex, a new AI-driven computer software, performed against skilled corporate lawyers on a common task - analyzing complex legal documents. LawGeex proved its ability to review and interpret the documents, identify potential legal issues, and provide substantive advice to a client in half the time - and with much greater accuracy - than the corporate lawyer. While LawGeex and other AI technologies will not displace lawyers in the short term, it will exert pressure on lawyers to shift their time to more highly skilled work - such as negotiating and deal structuring - and away from research, writing and reviewing documents. The result could significantly change law firm practices and economics.

Have you considered how robots, AI and automation will change the workplaces of your insureds - and your own company? Stay tuned for my next blog, “Navigating the Fourth Industrial Revolution,” for ideas on how to navigate AI and developing technologies.