-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Life and Health in Asia: Change Is on the Agenda With Digital As the Key Driver and Enabler

January 16, 2020

Hugh Terry, The Digital Insurer (guest contributor)

Region: Asia

English

Over the past few months The Digital Insurer (TDI) and the Gen Re team in Asia have been working closely on the first issue of Life and Health in Asia, our new quarterly joint newsletter charting the rapid pace of digital innovation and adoption across the region and providing in-depth coverage of the key protagonists operating in the insurance space.

As part of the first edition, it was a pleasure to collaborate with Dar Wei Woon, Gen Re’s Head of Strategic Initiatives for Life/Health Asia, in thinking about and articulating our combined views of the 10 key digital trends shaping Life and Health insurance across Asia’s many markets.

The full article is available to read on the TDI website (registration is free), but I thought it would be worth highlighting, granted somewhat subjectively, the three trends that interest me the most and to consider the likely impact in the medium to long term on the insurance industry.

1. The omni-customer

The macro trend of changes in consumer behaviour from the ubiquitous use of smartphones is still playing out. However, particularly for Life and Health products that are inherently complex, it is not a simple digital-only world. People have different attitudes towards engaging with technology, and insurers have struggled to upgrade their people, processes and technology to cater to a genuinely omni experience that can deal with customers on their preferred terms.

Likely impact: It’s happening here and now - but we have heard relatively little about how digital-only models need to bring back the human element in their propositions. As we move forward, we expect digital-only models to be scrutinised closely for their ability to generate upsell and cross-selling in addition to acquiring large numbers of customers from the sales of small-ticket embedded insurance.

2. Risk reduction as the new trend

Sometimes we forget the obvious: The honest consumer would rather avoid a claim than make a claim. So, insurers with a mission to reduce their role as indemnity providers and become risk elimination partners will thrive. Digital allows insurers to increase customer retention and create new revenue streams in value-added services to keep their customers healthy and informed.

Likely impact: Huge, but it’s not completely clear how it will play out as the health and wellness ecosystem is still in a relatively early stage of development.

3. Health innovation is disrupting our entire industry

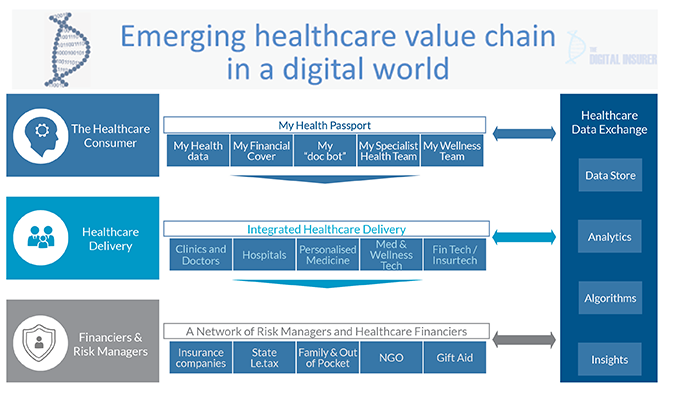

The image below shows TDI’s view of the healthcare value chain. Smart insurers are doing their best to develop, or more likely, to partner with digital health services that engage and empower consumers. The hope is that such services not only can help to reduce risk but help consumers make better choices around healthcare, as well as aggregate data that will provide insights into how businesses and services are run, such as optimizing the hospital network and enabling customer segmentation.

Likely impact: This is a significant trend, but one on a slower path of development as the ecosystem is complex and quite rightly needs enabling and protective regulation from governments around data security and privacy. Many “Life only” insurers could get caught out by this change, while group health insurers currently struggling with unprofitable portfolios could learn the most quickly how to manage the underlying risks in the data-led world that is fast-emerging.

Asia is leading the way - but these are global trends

These trends are all applicable on a global basis, but it is within Asia where growth rates remain strong - and where digital adoption comes with less “legacy” - that we are seeing significant innovation and the development of new business models.

Having migrated from Europe to Asia over 25 years ago, I suspect I am biased but I wouldn’t hesitate to recommend that insurance professionals looking to fast-track their careers, or become entrepreneurs, find a way to get experience in Asia if the opportunity arises. The next 10 years will see more change in the life insurance industry than we have seen in the last 50.

About the author

Hugh Terry is the Founder of The Digital Insurer. He has more than 20 years' experience in the insurance industry including operational, consulting and entrepreneurial roles. He is an actuary by profession and lives in Singapore. He is passionate about the application of technology to insurance business models and as well as writing articles he actively shares his experience via consulting assignments, speaking opportunities and participation in entrepreneurial initiatives in the field of digital insurance.

To read all 10 of the trends highlighted by Hugh and Dar Vei, visit Life and Health in Asia on The Digital Insurer website. Also included in the first issue of the newsletter are:

Life and Health Digital Insurance Landscape Report

An overview of the insurers and insurance startups leading the digital charge in key markets across Asia.

Why Mobile Payments Is a Game Changer for Life Insurers

This article explains why mobile payments offers so much more than distribution and reveals some of the work underway at leading mobile payment providers.

In Conversation With Haifei Chen

Haifei Chen, General Manager of Gen Re Life/Health China discusses the next phase of development within online insurance, the transition from savings-based to protection-orientated products, and the notion of the Life and Health ecosystem.