-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

China’s Mid-Range Medical Product – Experience Monitoring and Risk Management

June 18, 2019

Chen Zhang

Region: Asia

English

While China’s private health insurance market is dominated by Critical Illness (CI) products, the fastest growing segment in recent years is for “mid-range” medical cost reimbursement products. Unlike CI that pays a lump sum on the diagnosis of certain disease conditions, these products are designed to reimburse all medical expenses incurred during hospitalization.

The “mid-range” refers to its target group that is the middle class. From 2015 to 2017, China’s mid-range medical market stood at RMB 500 million, RMB 1.2 billion and RMB 8 billion respectively, and its market value is projected to hit RMB 20 billion in 2018, according to estimates by Zhong An Online.1

Beneath the topline figures, Gen Re worked closely with insurers when the mid-range medical products were first introduced and has conducted comprehensive experience analysis on various portfolios. As the portfolios mature and grow larger, the question becomes: what factors must be considered to achieve appropriate pricing and risk management of this product? Before addressing this question, this article will first describe the design and market positioning of this product.

Product design and positioning

China’s social health insurance (SHIP) is characterized by two main attributes: universally wide coverage and significant burden of out-of-pocket payments (over 35%) placed on individuals.2 Incomplete protection from the public health sector – such as high co-payment requirements, drug and treatment exclusions and hospital or ward limitations – provides opportunities for private insurers to step in and fill the coverage gap in social insurance.

Before the launch of the mid-range product, medical reimbursement products fit mainly into two broad categories: the lower end that limits coverage to the scope of social health insurance with quite low benefits, and the high-end products that offer higher coverage with no limits on the benefits, including choices of treatment and hospital. Right in the middle is the emerging Chinese middle class, which is demanding medical upgrading above the social health insurance cover but cannot afford the high-end products.

The mid-range medical product is designed for this group of customers. It is a yearly renewable term product that covers all medical expenses incurred during hospitalization, including imported or more expensive drugs and treatments that are beyond the scope of SHIP coverage. On the other hand, it excludes treatment in private hospitals or those outside of China. The product design allows for a relatively high deductible and/or certain co-payment ratio to offer premiums within an affordable range. As the product reimburses the out-of-pocket costs incurred after SHIP, and SHIP covers around 30% to 60% of the medical costs incurred depending on the type of hospital and treatment, the premiums differentiate by whether the life assured is covered by SHIP or not.

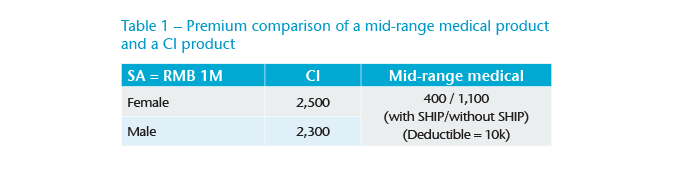

A comparison of mid-range medical premiums with CI premiums reveals that a male aged 35 can buy a one-year medical cover worth RMB 1 million (approx. USD 150,000) with a minimum premium of RMB 400 (USD 60), which is much lower than how much he needs to pay per year for a CI product. One disadvantage is that a policyholder cannot renew their policy after one year if it has been discontinued and is no longer available to buy, though it can be renewable above age 80. (Table 1)

It is not surprising that insurers are enthusiastically entering this market. In response to the intense competition, providers are continuously upgrading their products. A common product design in the market also covers doubled sum assured for CI-related treatment, as well as outpatient expenses but limited to outpatient pre- and post-hospitalization, outpatient surgery and specific therapy including dialysis and cancer treatment.

The product has been sold successfully across all distribution channels, including traditional agency, mobile app (digital) and online. In the agency channel it is commonly packaged with a Life/CI product and subject to full underwriting. In the online channel simplified underwriting with a health declaration questionnaire has been used for a seamless sales process.

Pricing considerations

The key pricing assumptions of mid-range medical products are inpatient rate (IP), average length of stay (ALOS) and average claim cost. These were derived from industry experience, public statistics and consultation with doctors when we first priced this product.

Pricing challenge

In comparison with products like CI and Term Life, which offer lump sum benefits, it is more challenging to estimate the claim costs for reimbursement-type medical products because they cover various cost categories and the amount of expenses net of payment by social health insurance and a certain level of deductibles and or copayments (if any).

With many years of experience in the mid-range medical market, Gen Re has the capability to price accurately and deliver design support for new benefits. We go into details on the bill costs behind claims and have detailed analysis on the breakdown of payments made to different categories of benefits before and after SHIP payment. We are also aware that pricing assumptions are not a static set of values; they should be adjusted case by case to reflect the fact that experience varies largely from company to company.

Hospital behaviour

Hospital behaviour determines the level of IP and ALOS of a portfolio. In general terms it represents how a customer behaves when he or she receives medical treatment in a hospital. Hospital behaviour is affected by such factors as the target customer group, specific product features, underwriting and claim requirements, the distribution channel, sales mode (e.g. whether the cover is bundled with other products) and region of issue.

For similar product features, experience differs by company for many reasons. Gen Re’s experience has shown that companies adopting more stringent or effective underwriting procedures have better experience. We also see that policies bundled with long-term products with full underwriting show better results due to the same reason. Extra loadings shall be applied to IP or ALOS to reflect these differences.

As this product has sold well in every channel, this factor may also contribute to the variations in experience from company to company. Initially, we were more concerned about online channels because they adopt simplified underwriting, which might not be able to mitigate substandard risk as effectively as full underwriting used by agency channels. However, our experience shows no clear worse experience for online channels as compared to agency channels. This is probably due to online channels targeting to customers with better hospital behaviour or implementing some risk selection model to select better risks.

In addition to the above factors, medical claims experience depends largely on geographical regions where the policies are issued due to the varying control of medical practice and the degree of economic development. More developed cities tend to have better experience due to more effective control of medical cost and higher flux of patients. In general, customers with higher disposable income tend to show better hospital behaviour. As insurers are not allowed to charge different premiums according to geographical regions, we need to be aware of the potential risk if policies sold are concentrated in a few regions.

Another trend is that medical claims experience deteriorated by calendar year in terms of the overall level of IP and ALOS, which can be explained by the unfavorable change in hospital behaviour as well. In consideration of this, the product is offered on a yearly renewable term (YRT) basis in the market. It is important to let policyholders understand premium is not guaranteed.

Possible range of costs

While IP and ALOS determine the frequency of claims, medical cost is another vital variable in our pricing. It is subject to high uncertainty in that different types of hospitals and undefined lists of diseases can lead to a wide possible range of costs that do not consider the high rate of medical inflation. Hence, product design is a powerful risk control tool to keep claim cost within a certain level.

Range of hospitals is strictly limited to Tier 2 and Tier 3 public hospitals in China because these SHIP-recognized hospitals are more relevant to the inpatient benefit. By contrast, Tier 1 hospitals are ranked lower due to lower capability for inpatient treatment and normally have worse control over medical cost and length of hospital stay. Most products in the market cover normal hospital ward stays only (mass market version) while some products extend to VIP wards of public hospitals (VIP version). The latter would incur higher cost, but our experience shows low utility of VIP wards for the VIP plan; hence, the actual cost difference between mass market and VIP plans is lower than expected.

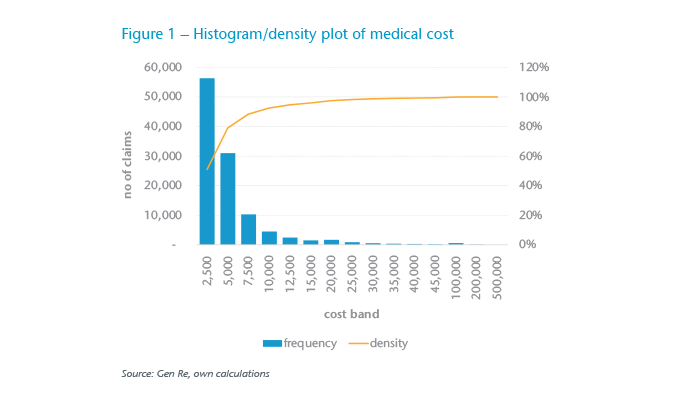

A relatively high deductible (typically RMB 10,000 per annum) can reduce the number of claims to a large extent, according to the claim analysis of our medical portfolio, as shown in Figure 1. The size of claims before deductible/copayment is skewed to the left.

Other product features, such as the co-payment ratio and restriction in renewability if life assured is diagnosed with CI, are commonly used by insurers for risk management purposes.

Importance and challenges in medical business experience monitoring

Without timely monitoring of experience, we run the risk of not being able to catch deterioration in time. The chance of deterioration is very real due to the possible wearing off of selection effect, unfavorable change of business mix (e.g. more sales in regions with poor hospital behaviour), medical inflation and increasing familiarity with products.

As experience accumulates, a richer experience study will be conducted, whether it’s a high-level loss ratio analysis or detailed multivariate analysis would depend on the time span and data quality of various portfolios.

One of the prominent challenges in medical experience monitoring is to estimate the amount of incurred but not reported claims (IBNR). The chain ladder (or Bornhuetter-Ferguson) method is often used to estimate IBNR of short-term medical business. However, we normally have observed longer delays in claim reports because policyholders generally do not feel the urgency of reporting small-sized claims. Based on our study, a maximum of two years is required for us to see the full amount of ultimate claims from a policy. The good experience shown during the first half-year can be quite misleading to our clients if they overlook the uneven claim development pattern that develops later.

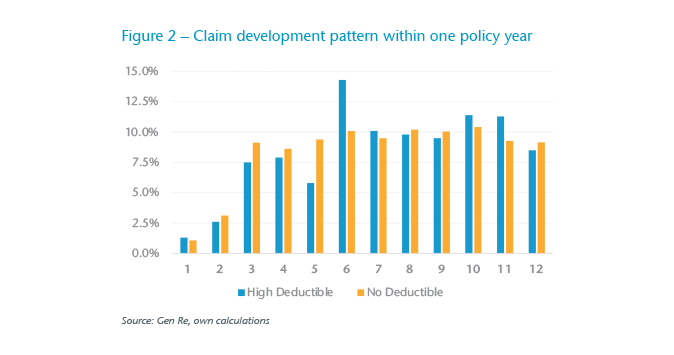

This is more of a problem for high deductible plans because policyholders tend to wait longer to report their claim, which extends the waiting period effect. We should always keep close attention to claim development to make sure we run a healthy portfolio.

Figure 2 shows the claim development pattern by month within the first policy year for high deductible policies and no deductible policies. Only claims from policies issued at least two years before are analyzed to make sure all claims have developed fully to the ultimate number. For the no-deductible policies, the proportions of claims incurred in each month to the total ultimate claims are roughly at the same level. This implies that after the waiting period, claims of the no-deductible policies develop evenly with time. Meanwhile, for high-deductible policies, claims incurred are not as evenly distributed as for no-deductible policies.

Exposure analysis is as important as claims analysis to maintain the sustainability of medical business. We pay close attention to the persistency of the portfolio. If the persistency is very low, there might be high risk of selective lapse. Through close monitoring, an unfavorable change of business mix can be identified promptly, which will allow insurers to adjust their strategies more quickly.

Monitoring the change of business mix further allows us to examine whether the product has effectively targeted the “expected” group of customers and whether its customer retention and engagement has been effectively implemented over time. Considering the rapid rise of online channels, our entire medical portfolio is shifting towards a more digital-savvy mix. In the portfolios from online channels, we see higher proportion of the younger generation in the age group of 20-30, who are new to health insurance, contributing to about 30% of the total sales. The post-80s and post-90s have gradually become the main force of buying this product. Insurers need to be aware that this group of customers has a very different perception of what an insurance product could be, and simply using a mobile channel does not guarantee engagement of the younger target group.

What does the future hold?

As the momentum of growth remains strong, we have seen intensive upgrades in terms of product features and services in the mid-range medical market. For instance, benefits have been extended to CI treatment (e.g. proton and heavy ion therapy for cancer) as well as substandard risk. To provide truly comprehensive health solutions, insurers are keen to cooperate with health service providers and add services to their products. Services like emergency assistance and referral to best doctors have become a standard option to have.

All products are easily replicable. What is the future competitive landscape of mid-range medical products? Advancements of digital technology have brought disruptions to the traditional insurance model with a surge of new players, products and services in the market. Market players have explored new digital distribution channels and focused on customizing products using big data analytics. Nowadays insurance is more customer-centric, which involves the use of mobile devices to create multiple touchpoints for better customer engagement and the application of predictive analytics for faster risk selection. In addition to these changes, insurers and big tech companies will no doubt continue to explore the potential of InsurTech in China as well.

Endnotes

- Hexun Insurance. (2018, 4 14). Zhong An Insurance outlines the footprint of future development of mid range medical market. Retrieved from Hexun Insurance: http://insurance.hexun.com/2018-04-14/192831941.html.

- MOHRSS. (n.d.). Retrieved from Ministry of Human Resources and Social Security of PRC: http://www.mohrss.gov.cn/.