-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Florida Property Tort Reforms – Evolving Conditions

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

A Decade of Direct Economic Losses From NatCat Perils in China: What Does the Future Hold?

September 27, 2017

Tom Qiu

Region: China

English

Chinese

Every year China is hit by natural catastrophes (NatCat) that create significant direct economic losses. Yet NatCat insurance coverage remains quite low in China.

From data analysis of natural catastrophes in China over the last decade, it appears that direct economic losses come from two major categories – mainly meteorological events but also seismic events, notably earthquakes.

This study has collected direct economic loss data over the past 10 years – from 2007 to 2016 – for all natural catastrophes in both categories.1 But significantly, we note the lack of publicly available insurance loss data relating to weather events or earthquakes, and Property & Casualty insurers usually require a long period of observation and data to form a pattern or come up with a trend.

Although a 10-year period is a short time span to observe natural catastrophes, these data do provide some new perspectives on the direct economic loss trends related to NatCat hazards in China.

They also provide some meaningful insurance implications for government policymakers and insurance companies to consider when tackling NatCat hazards in China.

China NatCat hazards

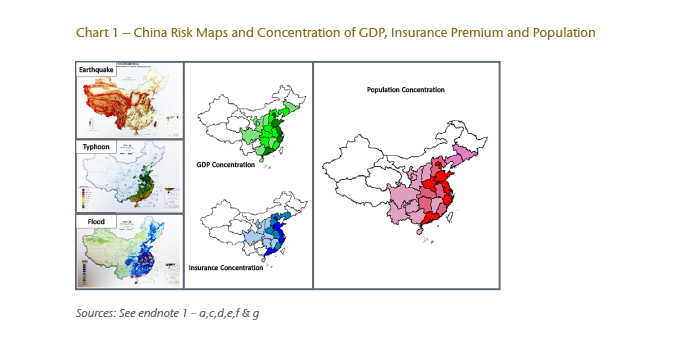

China’s natural catastrophe perils are scattered all over the country but are geographically distributed to a pattern.

Broadly, typhoons affect the eastern coastal provinces, are seasonal and usually bring heavy rainfall. Flooding happens mostly along and between the catchment regions of the big rivers and the major and vast flood-prone area is between Yellow River and Long River (or Yangtze river).

Earthquake activity has been in the southwestern and the western region of China over the last century. Earthquake-induced tsunami risk in the coastal areas of China is considered rather low because the Chinese coastal area has barricades of reefs and small islands, as well as the shallow continental shelf under the China coastal sea area, all of which have a damping effect on tidal waves and surges.2

Tornados and hailstorms are quite frequent but of much less intensity and of smaller geographical scale, restricted to small geographic strips and spots. Snowstorm and low temperatures are also common in the northern and southwestern part of China, with low intensity but huge aggregating potential.

Looking at economic development over thousands of years, human colonization has been concentrated in areas less affected by NatCat hazards – with the exception of typhoons and flooding. Historically, typhoons and flooding are the two largest causes of economic losses and China is no exception, as seen in Chart 1.

To give a broad overview of China NatCat and its potential impact, we produced some gradient charts to show concentrations of GDP, population and insurance. They were computed as follows: Gross Domestic Product (GDP) by province, divided by the square footage of each province, gives us “GDP concentration”; we used the population numbers divided by the province square footage to produce “population concentration”, and we did the same for insurance premium divided by the square footage for “insurance concentration”.

There is quite high co-relativity among the population density, GDP and insurance.3 Clearly, insurance development goes hand-in-hand with economic growth and population.

A statistical review of direct economic losses in China

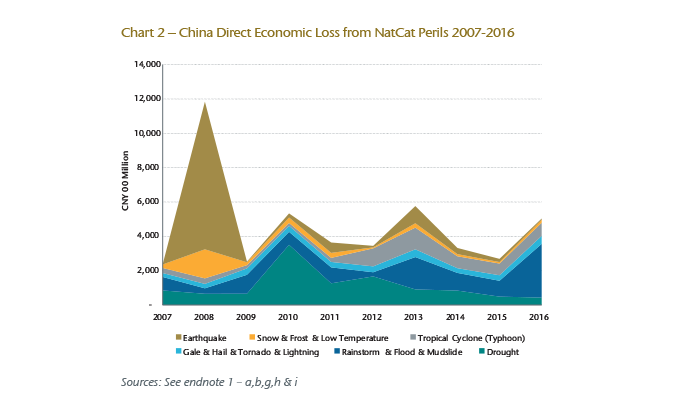

As mentioned, direct economic losses in China are mostly a result of earthquakes, typhoons, droughts, rainstorms (and rainstorm-induced floods) and snow. Rainstorms, rainstorm-induced floods and typhoons have a yearly effect and produce reasonably predictable losses, relatively speaking.

Statistics on earthquake damage show high severity but much less frequency.

Drought damage is mostly agriculture-related and has little relevance to Property & Casualty insurance business, but it is a major risk factor for crop insurance and therefore for the overall economic loss.

Chart 2 shows a few spikes marking major natural catastrophe events in the past 10-year period:

- In 2008 the spikes were due to both the Sichuan 512 Wenchuan earthquake (M7.9; death toll 7,982) and snowstorms in the South and West, which disrupted power and telecom transmission as well as distribution lines, and caused rooftops to collapse across China’s Southwestern territory.

- The 2010 droughts were particularly serious and caused huge agriculture loss, but that year the other NatCat perils were benign in relative terms that year.

- In 2012 many typhoons developed and a few major typhoons made landfall – Vicente, Saola, and Haikui – in July alone.

- In 2013 one smaller scale but devastating earthquake (Sichuan Ya’an M7.2) took place. This earthquake occurred along the same active fault line that caused the 2008 Sichuan 512 Wenchuan earthquake (M7.8). The major losses in the 2013 earthquake were accompanied by a major Cat 4 typhoon “Fitow”, which swept through the eastern part of China, drenching the coastline with an extraordinary amount of rainfall.

- The years 2014 and 2015 depict relatively mild NatCat events in China.

- The 2016 spikes were caused by the Yangtze River flooding in the middle stream area, particularly in Hunan and Hubei provinces where several weather systems poured millions of tons of rainfall into the river basin area, causing river-overflow as well as prolonged waterlogging in both the urban and the rural areas.

Note that rainstorm and rainstorm-induced flooding caused higher economic losses in the last five-year period, compared with the first five years, partly due to severe typhoons lashing the coasts. This is believed to be a result of the alternating El Niño and La Niña effect in the southeastern part of the Pacific Ocean. Those rainstorm losses were from property damages incurred mostly in urban areas as opposed to agricultural damage in rural areas. The damage incurred in the city areas was mostly due to poor drainage systems and inadequate urban planning. (Local urban planning has not kept pace with fast economic development and urbanization. This is particularly relevant in the third-tier cities.)

The rapid growth of the economy and the expansion of urban areas meant that heavy rainfall caused extensive flash flooding as well as prolonged waterlogging in cities due to deteriorated ground water infiltration and insufficient drainage. Property and motor vehicle damage was severe and there were mortalities. In the 2013 Beijing 712 rainstorm, torrential rain caused severe inundation of the highway ring-road bridges, trapping people in their cars.

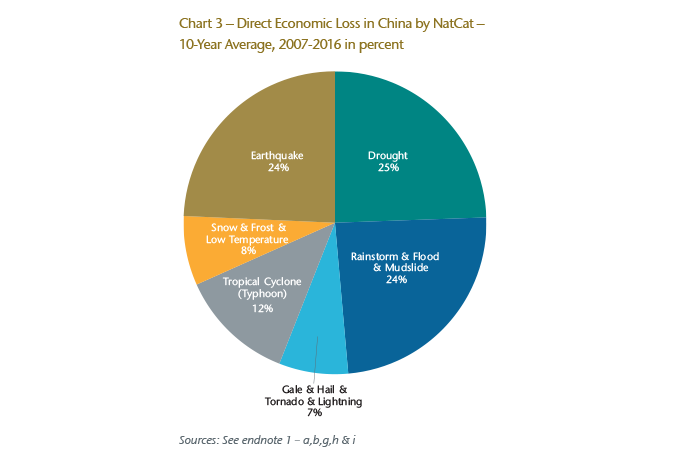

Looking at a 10-year average of all losses for the period 2007 to 2016, it’s apparent that earthquake, drought and rainstorm (including rainstorm-induced flood) will each account for about 25% of the direct economic losses (See Chart 3). The other major elements for direct economic losses are typhoons in the coastal areas, although such losses are more related to places where both the insurance penetration and density are higher than in other parts of the country.

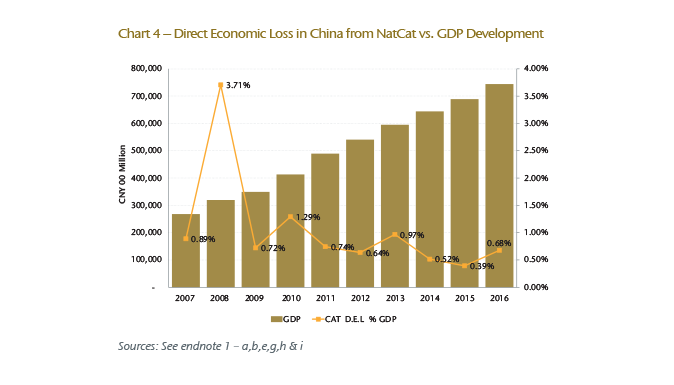

Taking direct economic losses and dividing by China GDP numbers provides a ratio of NatCat losses versus economic growth, as shown in Chart 4. It is interesting to see that over the past 10 years, despite rapid GDP growth and the tremendous increase of social assets, direct economic losses did not grow at the same pace as GDP. Actually, the percentage of direct economic losses out of GDP has trended downwards over the past 10 years, which implies that the general risk management and risk prevention infrastructure has improved over the period – a very encouraging development.

Insurance take-up challenges

Some people might be surprised to find that no centralized NatCat insurance loss data is available for the China market, or at least not in a centralized and public form. However, this is also true for many countries in the world, as noted by AIR Worldwide in a recent global Cat report: “There is considerable uncertainty in the estimated percentage of economic losses that [are] insured, which partly stems from uncertainty in reported economic losses for actual catastrophes.”4

Meanwhile, modeling companies estimate insurance loss data by various proxy methods to population distribution; some modeling firms use one or two major insurers’ loss data to recalibrate their models and back-test the estimated results.

Nonetheless, it is safe to say that a limited number of NatCat losses are actually covered by insurance, particularly in the so-called hinterlands. For example, in the major Wenchuan 512 earthquake in 2008, the insurance industry’s charitable donation to the disaster relief effort was much higher than the actual insurance claim payout.

Insurance cover for NatCat perils currently accounts for a small share of China insurance premiums to date. First, insurers are reluctant to provide such insurance cover for high risk areas at the current inadequate price; secondly, the take-up rate for NatCat covers is also very low because the prospective insureds tend to rely heavily on the government for compensation, as well as simply their own luck.

It is only recently that the government has started to encourage the development of NatCat commercial insurance and encourage businesses to transfer risk through affordable commercial insurance.

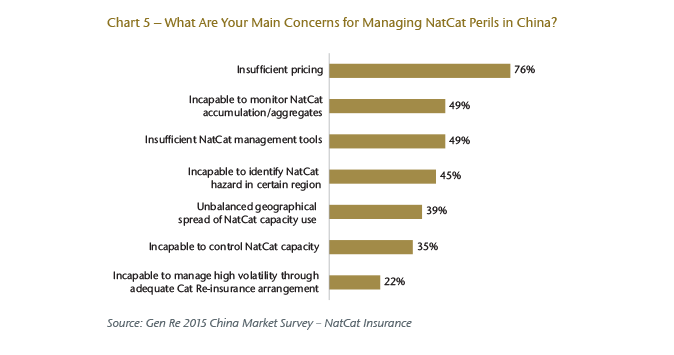

In a China insurance market survey conducted by Gen Re China in 2015, we interviewed over 50 Property & Casualty insurance companies and asked their professionals, “What are your main concerns for managing NatCat perils in China? (multiple choice)”.5 We obtained the following responses, as illustrated in Chart 5.

It’s quite clear that “Insufficient pricing” is the top challenge for insurance companies in managing NatCat perils (76%). It’s also interesting to find that 49% of companies answered “Incapable to monitor NatCat accumulation/aggregates” and “Insufficient NatCat management tools”.

NatCat – a societal issue beyond insurance

For a country exposed to serious natural disasters, catastrophe insurance in China is seriously underdeveloped. The level of compensation for NatCat is low, yet people continue to rely on government subsidies and charity when major disasters happen.

Natural catastrophes are the cause of great economic losses and destruction of people’s livelihoods, yet catastrophic insurance penetration is low. According to AIR Worldwide, in the developed regions, catastrophe insurance indemnity can account for 20% – 40% of the direct economic loss (Europe 21%; North America 38%; Australia and New Zealand 33%). In Asia, however, the number is just 9%.6

In China a projection of this number would be even lower if based on the past 10 years’ major NatCat events. For example, insurance payout against total direct economic loss for the Wenchuan 512 earthquake in 2008 was 0.2%, and less than 1% for the Ya’an earthquake in 2013.7

The situation will improve, however, as the national strategy deems development of catastrophe insurance to be an important aspect of the development of China’s insurance industry.

Rapid economic development requires the Chinese government’s policymakers and city planners to have a long-term vision for infrastructure planning. The urbanization process will change the landscape of cities and rural areas, which will require measures to prepare for NatCat events.

For example, the change of river catchment areas, re-directing river courses, insufficient drainage and flood prevention will make both new and old city areas vulnerable to more severe NatCat losses.

This is not a unique problem; other fast developing Asian nations, such as Thailand and India, have experienced problems as well. With inadequate city planning and insufficient anti-hazard infrastructure, urban flooding events have been common, some in very new economic development zones.

Insurance companies can play a social role in reducing the impact of NatCat hazards – by offering affordable insurance coverage to a wider population. Insurance products need to cover populations in the areas likely to be affected, including less affluent communities. Government should also play an active role, especially before events, by providing subsidies or sponsorship that assists insurance companies looking to expand the scope of insurance coverages.

In conclusion

The seriously low level of NatCat compensation in China requires greater cooperation between government agencies, legislative departments, commercial insurance companies and financial institutions.

In addition to establishing an effective multiparty NatCat coping mechanism and compensation system, it is also important to enhance the role of commercial insurance. In order for commercial insurers to fully participate and contribute, the following aspects are critical:

- The insurance industry must start collecting and centralizing insurance NatCat loss data on various levels, starting at least from country level then down to county level. NatCat data collection helps to recalibrate Cat models.

- Risk mapping and hazard information should be made publicly accessible.

- Commercial insurance should be a platform to build out a multi-level risk sharing mechanisms.

- Regulatory support is needed to coordinate government disaster relief funds and put all parties together to pool all available resources.

- Promote NatCat insurance to achieve total coverage of the country, and to provide NatCat products at affordable rates.

- Insurance companies should be strongly encouraged to provide NatCat covers in high risk areas as well as low risk areas. Market forces should be given a role to play in both providing the cover and setting the price.