-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Individual Disability – Results of 2016 U.S. Market Survey

May 10, 2017

Region: North America

English

Gen Re is pleased to report results for its 2016 U.S. Individual Disability Market Survey, an industry benchmarking study covering Non-Cancelable (Non-Can), Guaranteed Renewable (GR), Buy-Sell and Guaranteed Standard Issue (GSI) product line results for 2015 and 2016. Seventeen insurance companies participated in the survey representing $5 billion of in-force premium. Of these companies, 15 offer Non-Can, 16 offer GR and eight offer Buy-Sell. Seven companies reported results for Non-Can GSI and four companies included GR GSI results. Below is a summary of the survey results.

Download the PDF version for a list of participating companies.

Market Growth

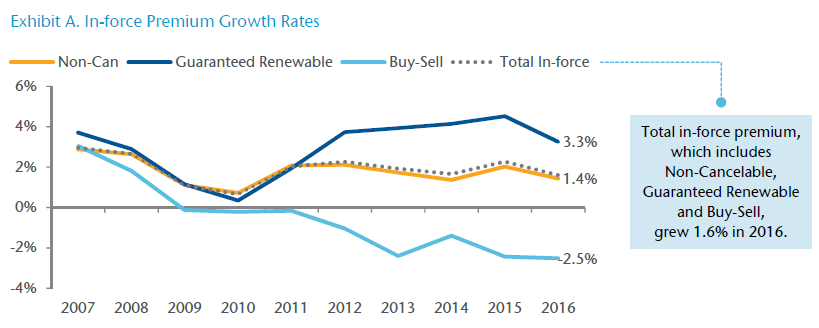

In-force premium increased 1% for Non-Cancelable and 3% for Guaranteed Renewable, while Buy-Sell decreased 3%. (Exhibit A) Non-Can represents 86% of total in-force premium, GR represents 13%, and Buy-Sell accounts for 1%.

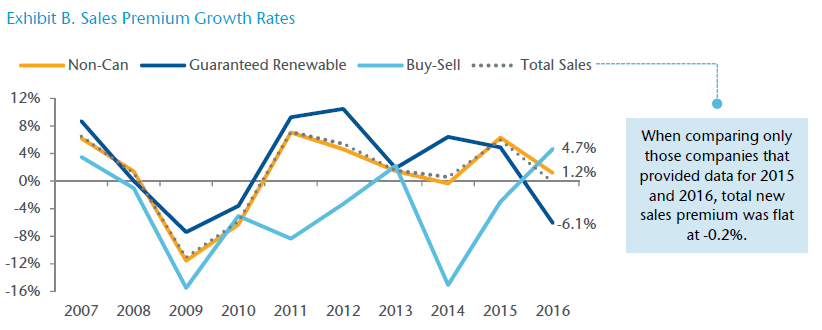

Non-Can new sales increased 1%, whereas GR fell 6%. Buy-Sell sales premium improved, growing 5%. (Exhibit B)

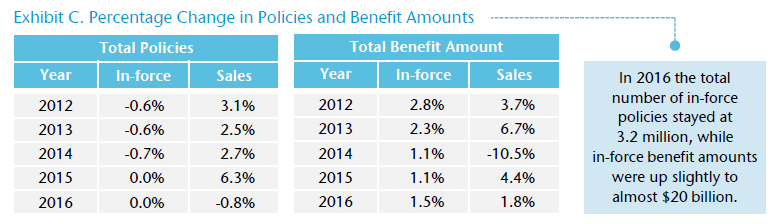

The number of new policies decreased 1% while benefit amounts increased 2% in 2016. (Exhibit C)

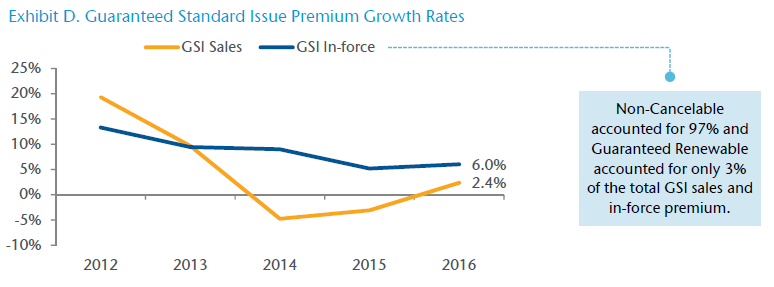

For total GSI (Non-Can and GR combined) $290.5 million of in-force premium and over 196,400 policies were reported in 2016. Based on companies that reported GSI data for both years, total in-force premium increased 6% over 2015. (Exhibit D) Of the total GSI premium in-force in 2016, employee-paid accounted for 61%; up from 59% last year.

GSI new sales premium grew 2.4%, while the number of policies dropped 5.5%. Non-Can accounted for $40.8 million of GSI sales premium, while GR accounted for $1.3 million.

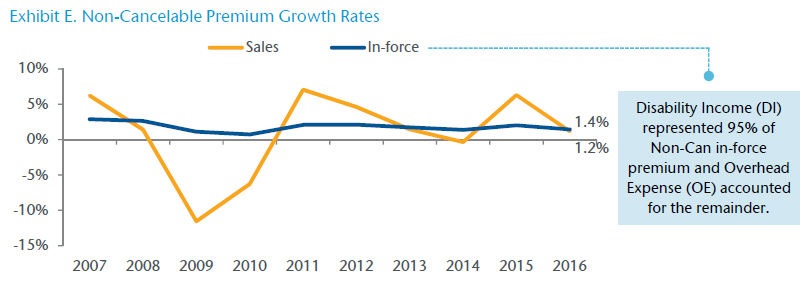

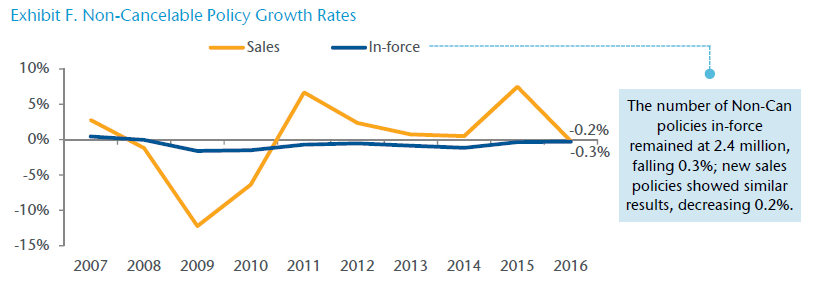

In 2016 both Non-Can in-force and sales premium grew 1%, while policies were flat, declining less than 1%. (Exhibits E and F)

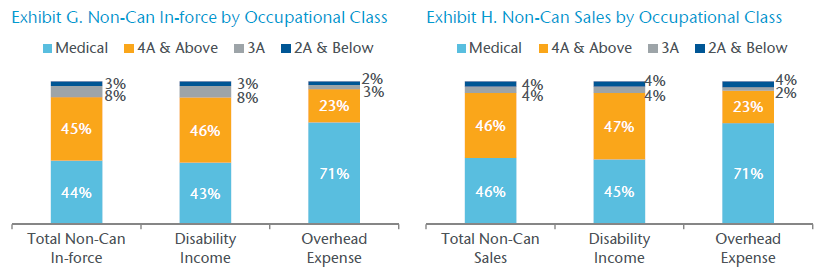

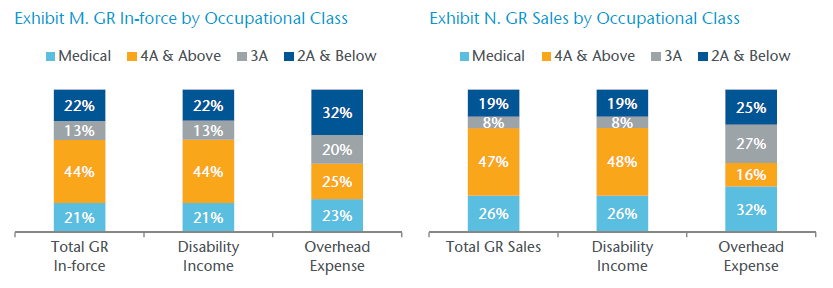

Medical and 4A occupations accounted for about 90% of Non-Can premium. (Exhibits G and H)

Non-Can Guaranteed Standard Issue

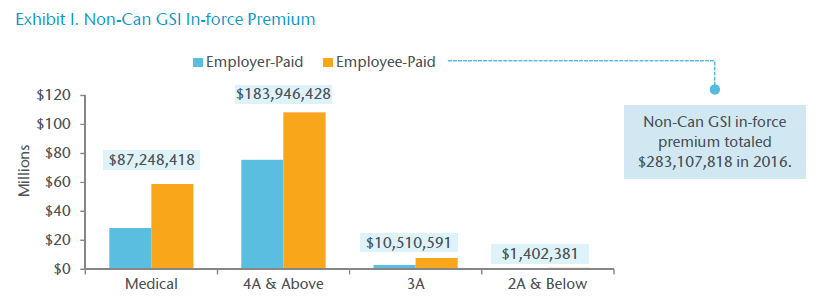

Only seven companies reported Non-Can GSI for 2016. Comparing only those companies that provided data for both years, Non-Can GSI in-force premium grew 6.3% in 2016. Employer-paid represented 38% or $107.3 million and employee-paid accounted for 62% or $175.8 million. (Exhibit I)

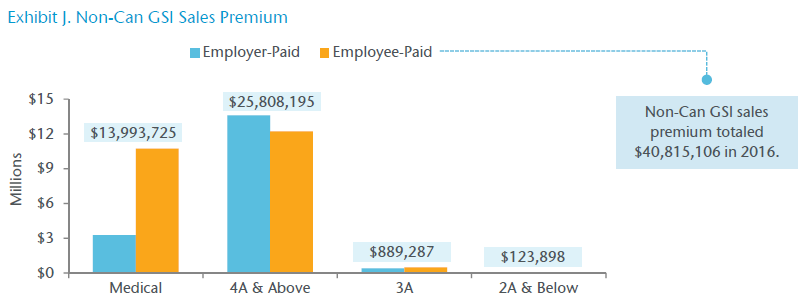

Non-Can GSI sales premium increased 3.2%. Employer-paid accounted for 42% or $17.3 million and employee-paid represented 58% or $23.5 million.

New GSI policies decreased 4.7%. Employer-paid policies fell 7.5%, and employee-paid policies fell 2.1%.

On average, the Medical occupational class accounted for 34% or $14 million of Non-Can GSI new sales premium, up from 26% in 2015. Employee-paid accounted for 77% or $10.7 million of the Medical sales premium. (Exhibit J)

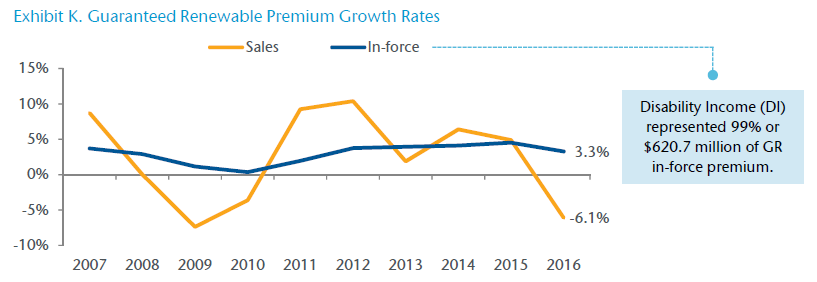

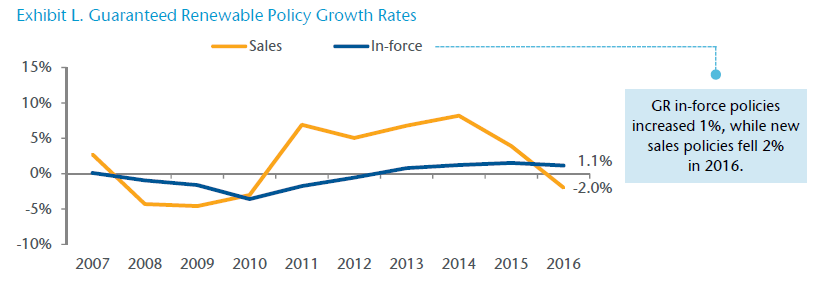

In 2016 Guaranteed Renewable in-force premium increased 3.3% to nearly $626.5 million. GR sales fell 6.1% to $64.9 million. (Exhibit K)

On average, the Medical occupational class accounted for 26% of GR new sales premium. (Exhibit N)

GR Guaranteed Standard Issue

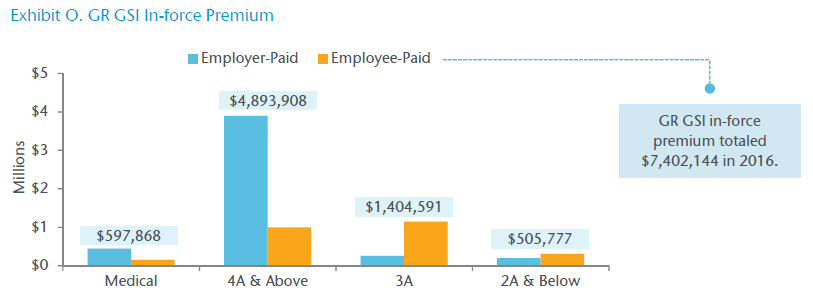

For the four companies that reported Guaranteed Standard Issue, GR GSI in-force premium fell 3.5% to $7.4 million. Employer-paid represented 65% or $4.8 million, and employee-paid accounted for 35% or $2.6 million. (Exhibit O) In-force policies fell 16.9% in 2016.

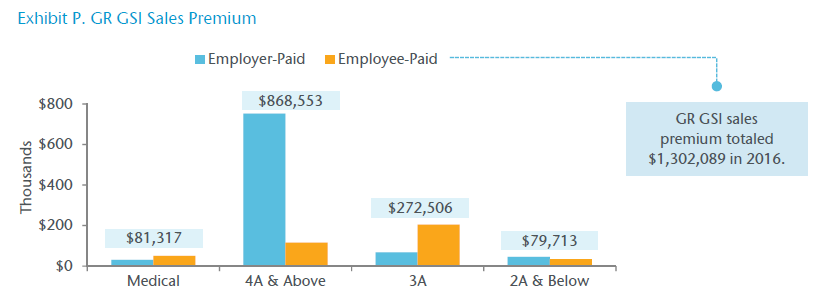

Sales for GR GSI struggled in 2016; new sales premium decreased nearly 19%, and policies decreased 16%.

On average, the Medical occupational class accounted for 6% or $81,317 of GR GSI new sales premium. Employee-paid accounted for 62% of the Medical sales premium, up from 48% in 2015. (Exhibit P)

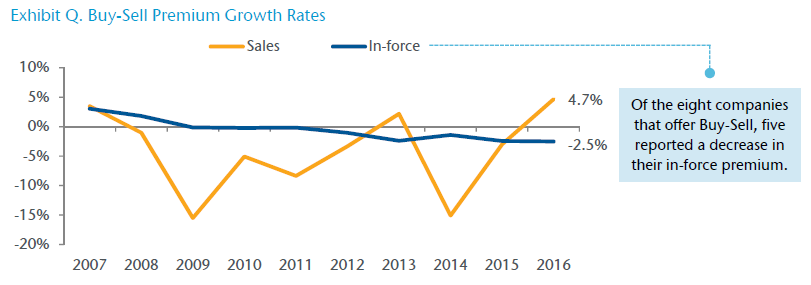

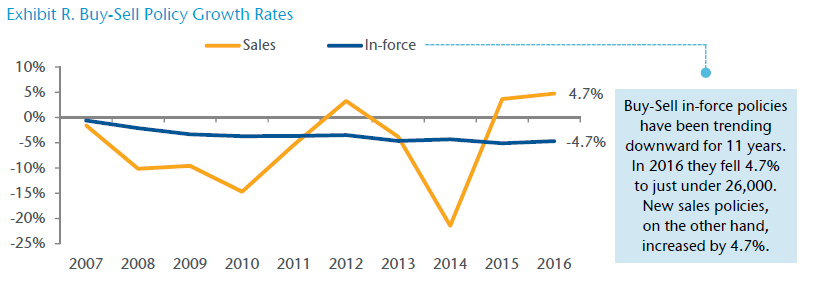

For the eighth consecutive year, Buy-Sell in-force premium declined, falling 2.5% to $66.4 million. On a positive note, sales premium grew 4.7%. (Exhibit Q)

In Our View

Some noteworthy changes occurred in the Individual Disability (ID) market over the past year. MetLife discontinued new sales of fully underwritten business effective September 1, 2016 (although they continue to sell GSI business) and Country Financial discontinued sales of ID as of January 1, 2017. On the flip side, 2016 saw new product introductions from Berkshire/Guardian and Northwestern Mutual.

Despite some of those changes, the Individual Disability market ended 2016 on a positive note, with in-force premium growing 1.6% to nearly $5 billion. And when comparing only those companies that provided sales data for both years (MetLife reported only in-force data and Country did not participate), sales premium remained flat, decreasing 0.2% to $368.5 million.

Results varied by product. Non-Cancelable new sales and in-force increased 1%, whereas Guaranteed Renewable new sales declined 6% and in-force grew 3%. For the GSI market, both new sales and in-force premium increased, 2.4% and 6%, respectively. Lastly, the Buy-Sell market continued to struggle as 2016 marked the eight consecutive year that in-force declined, and at -2.5% it is the largest decline on record. The good news is that new Buy-Sell sales increased nearly 5% (when comparing only those companies that reported new sales for both years).

As in past surveys, we asked companies to comment on their actual results versus planned. In 2016, 50% of the companies reported that new sales were below plan. However, the majority of participants (81%) reported actual claims experience performed as expected or better than plan.

We also asked responding companies what they thought the greatest opportunity would be for new sales in 2017. Traditional ID clients was the highest ranked response. In fact, seven companies ranked this segment higher than millennials.

To end, 2016 was a changing year for the Individual Disability market. With MetLife exiting the fully underwritten space, some viewed this as a negative and another challenge for an industry struggling to move to the next level. On the contrary, Gen Re regards this as an opportunity for other carriers to fill the void and grow their business. With new product introductions in 2016 and early 2017, and positive earnings for most carriers, Gen Re continues to be bullish on this product.

May is Disability Insurance Awareness Month. Each year, the Life Foundation joins forces with others in the insurance industry to raise awareness about the importance of income protection.