-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Online Insurance in China

The Internet has completely changed the way people live. Various online ecosystems have been constructed that provide incredibly convenient access to shopping and information and that deeply penetrate every aspect of people’s daily lives.

China was hit by the Internet boom especially quickly. According to China’s National Bureau of Statistics, the total of online retail transactions in China amounts to more than USD 752 billion (CNY 5.16 trillion) in 2016, making China the world’s largest e-commence market. A most outstanding record is the “Double 11” Online Shopping Festival, created by Taobao of Alibaba Group, where more than CNY 120 billion in online shopping occurred on 11 November 2016 alone. Within this performance, there was another notable record: On the same day, over 600 million policies of shipping return insurance (to reimburse the cost of shipping if a product is returned) were sold, a world record for the amount of transactions of a single product line in a single day.

Online insurance – amazing sales and fast development

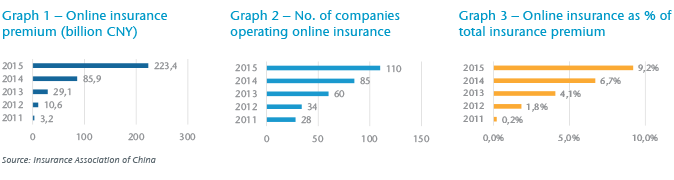

The blowout sales of shipping return insurance, as an innovative product embedded in the online shopping ecosystem, is a snapshot of the fast development of online insurance market in China. According to statistics from the Insurance Association of China, online insurance premium scales increased to CNY 223.4 billion in 2015, approximately an increase of 70 times the increase of the CNY 3.2 billion in 2011. It contributed 9.2% of total insurance premium in 2015, and plays an increasingly important role in the whole industry as compared to the 0.2% in 2011. Reports indicate that the number of Internet users of insurance service has exceeded 400 million, indicating that more than one in four Chinese has had experience with online insurance.

An increasing number of traditional insurance players have entered into this relatively new market. At the end of 2015, 110 insurance companies were operating in the online insurance area. More than 80% of market players have started online distribution channels, either setting up their own Internet distribution platforms or via cooperation with online-based brokers. It is also worth mentioning that since the launch of the first online-only insurance company Zhong An in 2013, four specialized online-only insurance companies in total have started operation as of the end of 2016. Compared to traditional new insurance entrants, online-only insurers lead the way in exploring various business models.

Analysis of the direction of China’s online insurance development – case studies

Marrying insurance and Internet technology creates the potential for different business opportunities, followed by the inherent chaos of a new market. Although the online insurance market still lacks basic infrastructure, such as regulations, the chaos is more about the very diversified business focus and the different models of operation, by which the market players are trying to transplant their own DNA, either the technologies or the insurances, into this new area.

The following analysis of three different business models features Zhong An, the first specialized online-only insurance company in China, then Ping An, the traditional insurance industry powerhouse, and thirdly Alibaba, the Internet giant. All three companies had the foresight to enter into the online insurance market as the first batch of explorers, with the aim to utilize the new insurtech of A (Artificial Intelligence), B (Block Chain), C (Cloud Computing) and D (Data). However, their choice of focus shows a diversity and is determined by their own strengths and capabilities.

Online-only insurance company Zhong An – laying the roots in the Internet mind, borrowing traditional sales power

Zhong An Online Property and Casualty Insurance, which made its initial public offering in Hong Kong in September 2017, is the first online-only insurance company in China. Upon launch, the market had high expectations for Zhong An as the first to merge the power of Internet technology with insurance, especially considering that it was founded by Alibaba, Tencent and Ping An.

Zhong An has shown much stronger Internet DNA than insurance DNA from the very beginning. As a P&C company, it did not offer motor insurance to start, despite motor insurance having the largest weight in P&C product online distribution. Instead, it led a substantial amount of experimentation in insurance product innovation, rooted in the e-commence ecosystem, by discovering new risks among consumer needs that are not currently met.

Although this model has been used by other insurers in various markets, e.g. travel insurance sold via travel websites, Zhong An is one of the first to specialize in product innovation and make such a model its core business. For example, shipping return insurance covers the cost of shipping for a small fee (on average CNY 0.4, compared to the average shipping cost of CNY 12) if a consumer wants to return unwanted goods from Taobao, which alleviates the consumer’s concern of purchasing an unwanted item. Other insurance innovations include merchant performance insurance, which protects the merchant and guarantee deposits on Taobao,1 and flight delay insurance, which can pay automatically – and has no need of a policyholder’s formal claim if a flight is delayed – by utilizing real-time flight information.

Shipping return insurance has been a major premium generator for Zhong An. In 2014 its premium income from shipping return insurance was CNY 613 million, contributing 77% of total premium. Although that percentage decreased to 35% in 2016 due to market competition and the development of other product lines, it is still the most important product in Zhong An’s portfolio.

Zhong An is also constantly exploring different product types and operation models. The shipping return insurance and other innovative products feature fragmented design, low average size, short coverage periods and low profit margins. To achieve product diversification, Zhong An entered into the health insurance area in 2016 by offering a high-deductible medical reimbursement product. Many Internet customers and mobile phone users were attracted by its high coverage amount and the simplified application process. The premium reached CNY 100 million in only four months. Over 60,000 policies were sold in eight days when the second generation of the product was launched in 2017. The product was distributed through many third-party online insurance platforms, where the mobile application IYunbao, which exclusively cooperates with Zhong An, is a major booster for the sales. In this application, anyone can register, alongside the specialized insurance agents. Registered users can buy insurance from the platform, and generate a QR code or a link containing the product information and the registered user’s information. The user can then send the link via mobile social media to others who might be interested in the product, and get a reward if anyone buys a policy via the link. In principle the sales are via “people”, a major traditional insurance channel, but it fully utilizes the convenience of Internet promotion to encourage users to share the products with their friends.

Starting with this product in 2016, the personal accident and health product line contributed 35% of Zhong An’s total premium, and changed the situation where Zhong An was highly dependent on shipping return insurance. The product is also a pilot study, showing Zhong An’s vision to integrate the advantage of using traditional channel in promoting life and health insurance business and the inherent convenience of online sales.

Zhong An’s success in creating a new health insurance market has also generated a lot of interest in other Asian markets where, although it continues to grow significantly, health insurance is still mainly sold as a door opener by the agency distribution force in the region.

Traditional insurance powerhouse Ping An – strategically focusing on FinTech innovation, utilizing the latest technology to reshape the industry and better serve customers

Ping An is well known as “the most profitable insurance company in China”. According to the 2017 interim annual reports from the five listed Chinese insurance companies, Ping An’s net profit attributable to shareholders in the first half amounts to CNY 43.4 billion, more than the sum of the net profits of the other four. Having started and still highly relying on the insurance segment, Ping An Group is now a large financial group providing various financial services, including life and health insurance, pension, property and casualty insurance, banking, asset management, and security. With the global surge in FinTech, the financial/insurance and technology boundaries are gradually blurred. As one of the earliest innovative technology embracers in China, Ping An Group has shown strong strategic focus by investing billions of CNY on FinTech and HealthTech in recent years, with the aim to form a smart customer-centric online ecosystem by applying such innovative technologies as artificial intelligence (AI) to disrupt traditional financial business models and service models.

One of their R&D achievements is Ping An’s Facial Recognition Technology. According to the latest published test results from Labeled Faces in the Wild (LFW), the internationally acclaimed facial recognition technology authority, Ping An Technology Facial Recognition Technology was given a face recognition success ratio of 98% and the lowest error range, a result superior to that of many renowned domestic and foreign rivals.2

In September 2017 Ping An held a “Simple Life” conference, announcing the launch of ten innovative AI services that will be embedded in the cycles of their financial services. The applications in insurance segments include:

- Ping An Life – “AI Customer Service” that remotely verifies a customer’s identity by matching up big data with the individual’s face and voiceprint, which can speed up the business operation and solve the problems of slow identification and slow claim process in the insurance industry

- Ping An Health – “AI Doctor” that applies smart auxiliary diagnosis and treatment systems in order to accumulate hundreds of millions of online diagnoses and health counseling data and use for online medical pre-diagnosis, triage and consultation, and for enhancing the efficiency of treatment

- Ping An Annuity – Collect Annuity Payment by “Face Recognition”

- Ping An Property & Casualty – “Cloud Claims” on Auto Insurance provides customized claim service, information on claims’ sections, progress, maintenance process and cost, with the goal of providing transparency to the entire claim process

Different from specialized online-only insurers that go to the battlefront without any burden, this traditional insurance and financial powerhouse can provide broad and solid platforms for the innovations. However, it will need more strategic vision and far-seeing plans when plunging into the wave of FinTech reform in order to fully integrate those technological capabilities with the core value of insurance and the advantages of the existing business model. Ping An’s transformation, from a capital-driven enterprise to a technology-driven one, also reflects that the core of insurance is not just the products, but more about the services to people.

For a company with more than 1.3 million agents, offering a service provided by people has played an extremely important role in the process of making Ping An an industry leader. With the help of new technologies, Ping An aims to provide smarter and optimal service experiences for the insurance customers in the Internet era. Ping An’s strategy and determination can also be observed in other major life insurance companies in Asia, although the intensity and the diversity of the investment in technologies differ from Ping An’s.

Internet giant Alibaba – creating new demand for insurance with large user database and profound understanding of Internet users’ trading behaviours

Alibaba owns Taobao, China’s largest online retail platform, with an annual transaction of more than CNY 3 trillion, and Ant Financial, which operates the ubiquitous mobile payment application Alipay with 450 million real-name users. Never behind in insurance industry innovation, Alibaba holds stakes in various direct insurance companies in different forms, including Zhong An, Trust Mutual (the first mutual life insurer in China) and Cathay P&C. Rather than stopping at the roles of undertaking insurance risk directly or serving as an insurance policy distribution channel, Alibaba is still experimenting different ways to operate in the industry by applying its deep understanding of its large online consumer database.

One example is “Free Health Insurance Coverage”. Since April 2017, Alipay has offered one year’s free coverage of critical illness insurance. There is no medical examination, health statement or waiting period, but Alipay set the criteria to decide who qualifies based on its user database. Selected users can activate the service by two clicks in the Alipay mobile application and get an additional amount of insurance coverage through daily payments made offline via Alipay. The increase of sum assured will be shown immediately in the Alipay interface, which can deepen the impression and stimulates the users’ consumption behavior toward insurance. The maximum free coverage amount is CNY 5,000 (USD 800), but users who want more can easily upgrade the policy in Alipay (subject to health declaration) at a relatively low cost.

In the 20 days after the launch of the free insurance campaign, 13 million Alipay users were reported to have activated the insurance, with the vast of majority of them being “post-90s” (born since the 1990s) who are new to health insurance. Through awareness of insurance protection via daily payment activity, insurance consumption habits are fostered in the young generation.

The insurance module in the Alipay mobile application has also undergone a substantial revision in 2017, with the construction of an online insurance community and forum. Various experts, including doctors, lawyers, actuaries and insurance agents, are invited to answer queries from Alipay users, who may be long-term Internet users but totally fresh to insurance. The insurance forum also works to collect users’ opinions on insurance demands. With the launch of a personal accidental death insurance product covering sudden death risk, more than 40% of users who followed the topic in the forum bought the product. By spending efforts in educating the market and Internet users alike, Alibaba is trying to foster the potential insurance demands of insurance from the Internet population, and construct a new Internet insurance-integrated ecosystem.

Success factors and uncertainties

The exciting environment for the development of online insurance in China may be due to a few key factors:

- An underserved but fast-growing insurance market. In 2016 China overtook Japan as the world’s second largest insurance market, but the overall insurance penetration was only 4.16%, lagging behind compared to the world average of 6.28%.3 However, the emerging middle class and strong government support for making insurance products more accessible have driven business growth to double in size over the past six years.4 In this respect, China serves as a good example of what can be expected from online insurance in other emerging Asian markets with even lower insurance penetration.

- Supportive regulatory environment. Chinese insurance regulators (CIRC) are aware of the rise of online insurance in China and show positive attitudes in fostering insurance innovation.

- The leading roles of Internet giants. The largest Internet companies in China, namely BATJ (Baidu, Alibaba, Tencent, Jingdong), are all showing ambitions to stake out their places in the online insurance market landscape. Their technology and data advantage accelerates the growth of the overall insurance industry and the online market. In particular, the speed of Chinese consumers embracing mobile payment technology provides a solid platform for online insurance, especially short-term insurance, to develop quickly. This development has caught on in other major Asian markets as well.

It is foreseeable that there will still be a rapid growth period in China’s online insurance market, but uncertainties always follow opportunities. Some scenarios include:

- Internet sales of some traditional products, such as motor insurance and long term life and health insurance, may face inherent uncertainties compared to the plethora of opportunities for simple/scenario-based insurance. China, similar to many other Asian markets, has traditionally been a market where long term health insurance products with significant guarantees dominate the sales of life and health insurance policies. The insurance industry in Asia is still waiting to see if any traditional insurance powerhouse, or an unexpected newcomer, will be the first player to penetrate the online long term insurance market.

- Some regulatory changes have been observed from time to time. It is still early days in insurance innovation, and any changes in regulatory environment might make significant difference to the recent experience.

- Competition can change quickly. In the early stages, Internet enterprises and insurance companies can be in a balanced “co-operative” relationship. However, with strong data and distribution advantages, some large Internet companies have the upper hand of initiative and discourse in the process of cooperation with small and medium-sized insurance companies. It is hard to say which will be the final winners, and whether the entire traditional insurance industry will be disrupted.

Jack Ma, founder and executive chairman of Alibaba Group, once commented, “A healthy society should not be full of stock investors, but policyholders. When everyone has insurance, there will be more certainty in the future society.”5 It is still too early to give any forecast or solutions to the uncertainties in the future online insurance development in China, but we shall believe that Internet-based insurance will finally lead to a healthier society with more certainty and security.