-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Florida Property Tort Reforms – Evolving Conditions

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Understanding Physician Contracts When Underwriting Disability Insurance

Publication

Voice Analytics – Insurance Industry Applications [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Critical Illness insurance (CII) is a type of insurance that pays a lump sum to the policyholder if they are diagnosed with a specific illness or condition that is covered by the policy. It can help cover the costs of medical treatment, recovery, and living expenses that may arise from a serious health problem.

However, only a handful of CI products cover mental health disorders, although they can have a significant impact on the quality of life, the ability to work, and the risk of premature mortality. This article will point out challenges and opportunities of covering mental health disorders in CII and provide a summary of key elements which we consider useful for CI definitions using the example of severe schizophrenia.

Schizophrenia is a mental disorder that affects how a person thinks, feels, and behaves. People with schizophrenia may experience hallucinations, delusions, disorganized speech, and impaired functioning in various areas of life. It affects about 0.32% of the global population.1

The direct costs of schizophrenia include the expenses related to the diagnosis, treatment, hospitalization, and rehabilitation of people with the condition. The indirect costs include losses in productivity, income, and quality of life due to disability, unemployment, reduced social participation, and premature mortality. People diagnosed with schizophrenia are more than twice as likely to suffer an early death than the general population.2

Schizophrenia also imposes a substantial burden on the families and caregivers of affected individuals, who may experience emotional distress, financial strain, and reduced quality of life.

Despite the severity and frequency of the disease, stigmatization and discrimination are still common, and only one third of people worldwide who suffer from schizophrenia, or other forms of psychosis, have access to specialized treatment.3 Providing a lump sum benefit for the diagnosis of severe schizophrenia can facilitate access to care and support the patient and their family with both direct and indirect costs.

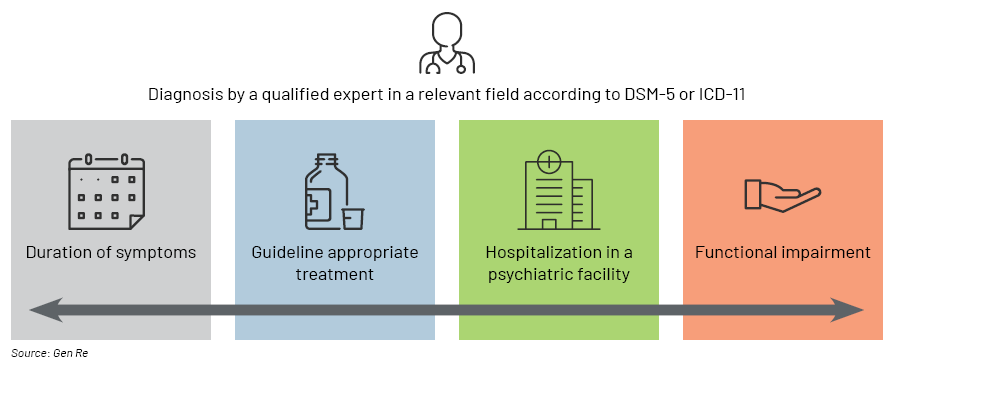

Different diagnostic manuals, such as the DSM‑5 and the ICD‑11, have slightly different criteria and thresholds for schizophrenia. But to offer a lump-sum benefit for a CI, one needs to objectively define the insured event, in this case the diagnosis and severity level at which schizophrenia is covered. This is a challenge compared to typical CI conditions such as cancer, because with mental health disorders there is no imaging test or biomarker to confirm it. Instead, the diagnosis relies on clinical interviews and observations, conducted by qualified experts in a relevant field. The diagnosis requires a careful evaluation of the symptoms, history, and functioning of the person, as well as the exclusion of other possible causes of schizophrenia-like symptoms, such as substance use, medical conditions, or mood disorders.

The basis of a CI definition for schizophrenia is that the diagnosis must be made and evidenced by a medical expert trained in the relevant field and fulfil the diagnostic criteria of the widely recognized DSM‑5 or ICD‑11, or a later version of either. Further requirements to make the diagnosis such as confirmation by two different medical experts or naming a medical expert subject to agreement by the insurance company should be taken into consideration.

In addition to the diagnosis, a severity level is a must for mental health disorders to assess the impact that the disease has on the insured’s life. The criteria should be of reasonable severity to support the insured in case of suffering from a mental health disorder that significantly reduces the quality of life and causes a high financial burden for insureds and their families.

Severe schizophrenia causes long periods of persistent disturbance, including one or more months of acute psychotic symptoms. The strain this puts on the insured’s life is particularly high if the symptoms remain despite receiving appropriate treatment consistent with generally accepted guidelines. This would further lead to a difficulty in functioning in personal, family, social, educational, or occupational areas.

It is important to require proof of an inpatient stay for several weeks in a specialized psychiatric clinic. This is due to the typical disease course of severe schizophrenia, which involves persistent delusions and hallucinations, making longer-term hospital stays necessary for appropriate treatment.

Even when we include several measures to assess disease severity and to limit the risk of anti-selection, this would be a new benefit to most markets for which we have little experience data. Due to social stigma and lack of awareness, mental illnesses are probably still underdiagnosed in many countries, and cultural acceptance may substantially affect the incidence in a given country. This results in high uncertainty of the projected claims frequency.

Hence, one should exercise caution when introducing mental health disorder benefits to CII, for example by limiting the sum assured or offering only partial benefits to CII. In addition, it is advisable to closely monitor claims experience.

Insurers can actively participate in the reduction of stigmatization and discrimination of people suffering from mental health disorders. When providing a comprehensive CII, one could consider adding severe cases of mental health disorders such as schizophrenia, clinical depression, and bipolar disorder to the benefit triggers, as many of these conditions can have a significant impact on the lives of insureds and their families.

This appears to be necessary for a robust and objective definition of severe mental health disorders. In addition to offering monetary benefits, insurance companies can enhance their products by including wellness benefits in the form of exercises, hotlines or apps that provide support at early stages of mental health disorders or arranging appointments with medical specialists.

Endnotes

- “Schizophrenia”. World Health Organization. 2024. Retrieved 10 September 2024

- Laursen TM, Nordentoft M, Mortensen PB. Excess early mortality in schizophrenia. Annual Review of Clinical Psychology, 2014;10, 425‑438

- “Schizophrenia”. World Health Organization. 2024. Retrieved 10 September 2024