-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Secondary Peril Events Are Becoming “Primary.” How Should the Insurance Industry Respond?

Publication

PFAS – Rougher Waters Ahead?

Publication

Risky Left Turns – What About a Roundabout?

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

Focus Groups and Shadow Juries – Telling a Persuasive Story for Trial -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Cardiovascular Disease Deaths in Young Adults – A Tie to Substance Use?

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Ups and Downs of the U.S. Group Term Life Market U.S. Industry Events

U.S. Industry Events

Publication

New Life & Health Technologies – A Double-edged Sword? -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

If Business Interruption Is the Tip of the COVID-19 Iceberg, Are Professional Liability Claims Waiting Below?

March 16, 2021

Jeff Markowski

Region: North America

English

Early COVID‑19 lawsuits are being dominated by insurance claims for Business Interruption coverage, workplace safety and civil rights actions. Are these cases just the tip of the iceberg?

Thus far we’re not seeing the same inundation of cases for General Liability, Product or Professional policies; however, there have been some high-profile lawsuits targeting cruise ships, nursing homes, and one against a Maine hotel where a wedding became a super-spreader event.1

But what about Professional Liability? My mind immediately turns to Medical Malpractice. COVID‑19 (COVID) is a global emergency, and we are looking to medical professionals to diagnose, treat and hopefully cure or prevent further disease through vaccination. Insurance agent E&O is also a viable concern, given the potential fallout from Business Interruption insurance claims.

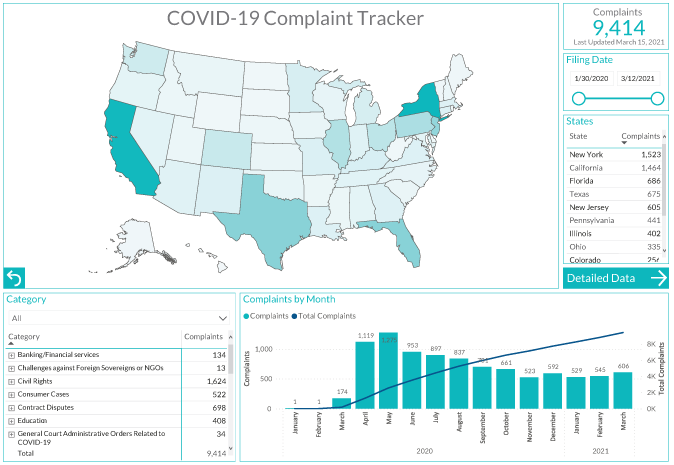

Source: Hunton Andrews Kurth, as of March 15, 2021. Reprinted with permission.

Medical Negligence in the Wings

The big question around medical malpractice involves proving violation of the standard of care or gross negligence. A well-established standard of care for benchmarking medical service is the best course of action that leads to a favorable outcome - and this is the one on which patients rely. The question of an alleged deviation from this cannot be answered with a simple yes or no; it takes the opinion of an expert, or several experts, to review what the treating professional knew and replay events as if he or she or a peer were in that situation. This is one of the reasons that medical malpractice lawsuits are so costly, typically requiring at least $100,000 in legal and expert fees to litigate.

However, we don’t have years of experience in dealing with COVID. The SARS‑CoV‑2 virus is a novel coronavirus - not previously identified - but its novelty does not shield medical providers from liability. They must still adhere to best practices or the standard of care for a patient presenting with acute respiratory distress.

To my insurance eye, intubation and assisted breathing via a respirator appeared to represent the standard of care in these instances. Reports about the number of patients in ICUs that were operating beyond capacity and with insufficient supplies of vital equipment may come into play. A jury would decide whether this rises to the level of gross negligence based on the specific circumstances. To date, the handful of lawsuits tracked by law firms involve somewhat unique scenarios, including: damage to nasal cavity in testing, sharing a hospital room with a COVID-positive patient, erroneous test results, and failure to identify and treat for COVID. Medical malpractice claims represent only 2.4% of total COVID lawsuits tracked through January.2 The anticipated wave of lawsuits against hospitals for inadequate care has not (yet) emerged.

If and when we do see lawsuits, I think the impact will be blunted or at least delayed by several factors. As of early 2021, 27 states have provided some degree of immunity to healthcare professionals through legislation specific to COVID, or more broadly to health emergencies.3 Legislation is pending in a few additional states. Also, it can be argued that the over-worked medical community would likely find a sympathetic jury. For that reason, plaintiff attorneys will likely wait to make any claims against healthcare providers until the statute of limitations is near expiry. Will that sympathy for healthcare providers fade over time?

Insurance Agent E&O - A “Lagging Indicator”

After medical malpractice, E&O on the part of insurance agents comes up as a significant COVID-related exposure for Professional Liability carriers. When insured businesses fail in their claims for Business Interruption coverage, which has happened in most cases so far, will the insureds turn against agents and brokers for a source of recovery? Do agents or brokers who placed the policies have any liability?

Although the definitions and standard of care vary across states and type of entity, in general an agent or broker (we will refer to them as agents from here onward) has the same duty of reasonable care, diligence and judgment that any other agent would have in placing the insurance requested by the client. This also means that the agent has no duty to advise the insured as to the availability of additional or extended coverage beyond what is requested. So, if the insured never asked about Business Interruption coverage due to pandemic or civil closure, does this mean that the agent is not at fault for its lack of procurement? It depends, and here are a few relevant issues to consider:

- Was there a special relationship between the insured and agent? If it is shown that the agent and insured had a special relationship, then yes, there could be liability. But what types of actions prove a special relationship existed?

- Although not an exhaustive point nor specific to any state, did the agent hold himself or herself out to the insured as an expert (in property coverages)?

- Did the insured ask about specific coverage for a pandemic, or rely on incorrect advice?

- Did the agent offer additional services, apart from the placement of the policy, for a fee?

This will also be a fact-specific exercise. Possibly the larger brokerages are more likely to have special relationships with their insureds than smaller agencies, but each situation is different.

Relatively few cases to date target insurance agents, but this could change as courts continue to rule on the Business Interruption coverage issue. E&O carriers and attorneys expect more activity, noting that agency E&O claims are a “lagging indicator.”4 To date, fewer than a half dozen lawsuits against agents have been resolved, most by dismissal for failure to state a valid claim.5 None of the dismissed cases established a special duty or relationship to advance the claim.

We all rely on professionals or experts for different things, and we have an expectation that the advice provided or service performed adheres to a standard of care for the profession. When an adverse outcome occurs that results in injury, whether bodily or monetarily, the remedy often lies in the Professional Liability or Errors & Omission coverage. It will be interesting to see if this coverage is also a part of the iceberg.

As always, please reach out to me or your Gen Re account executive with questions or to discuss this further.

Endnotes

- Many nursing home suits include medical malpractice allegations, but litigation trackers we have seen do not classify them as Health/Medical claims. In the litigation tracker we cite, they are part of the Consumer case category. See note 2.

- https://www.huntonak.com/en/covid-19-tracker.html

- https://www.ncsl.org/research/health/covid-19-state-health-actions.aspx

- https://www.insurancejournal.com/news/national/2021/01/21/598096.htm

- https://www.insurancejournal.com/magazines/mag-features/2020/09/21/583090.htm;

https://www.jdsupra.com/legalnews/court-holds-that-insurance-producer-79504/;

https://plusblog.org/2021/02/01/update-will-insurance-agents-be-the-next-target-for-covid-related-business-losses/;

https://www.natlawreview.com/print/article/exploring-directors-officers-and-broker-s-professional-liability-claims-and;

https://www.insurancejournal.com/news/national/2021/01/21/598096.htm