-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Social Inflation In the U.S. – An Issue for European Insurers?

September 30, 2020

Benedikt Sieberts

Region: Europe

English

Deutsch

For some time now, so-called “social inflation” has been in the news in connection with the U.S. Motor and General Liability insurance market. Social inflation has affected the results of some European insurers involved in those lines in the U.S. market, and some of those insurers have already discontinued all or part of their U.S. liability business. What exactly has happened there? What is behind the term “social inflation”? And, can this dynamic also affect other European insurers with business in the U.S.?

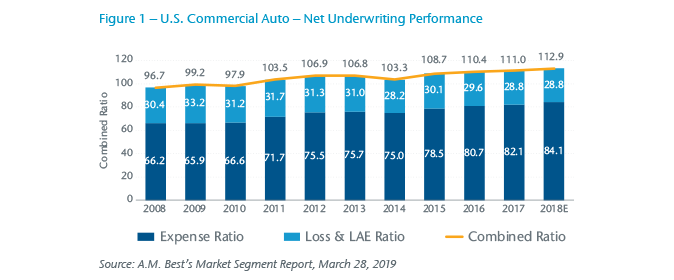

Since the 2015 underwriting year, the U.S. Motor Liability insurance market has seen major bodily injury claims trend significantly higher than consumer price inflation, sometimes reaching double-digit dimensions per annum. This trend is strongest in Commercial Auto liability and is also particularly apparent in California, Texas and Florida.

It is countered by the declining trend in claims frequency, although this is not sufficient to offset the trend in severity. In recent quarters, we have observed similar developments in the Personal Umbrella business (Personal Umbrella offers individuals or households a higher coverage for Liability, Motor and Employer’s Liability insurance) again particularly in California, Texas and Florida.

The loss ratios for the last three or four accident years of many commercial motor insurers are steadily approaching 100%, and some are already well above this level.

The drivers of social inflation

The term social inflation is often used to explain the rising liability loss ratios of U.S. primary insurers. In commercial (motor) liability business, this term refers to a bundle of social, legal and technical developments that lead to an increase in large losses.

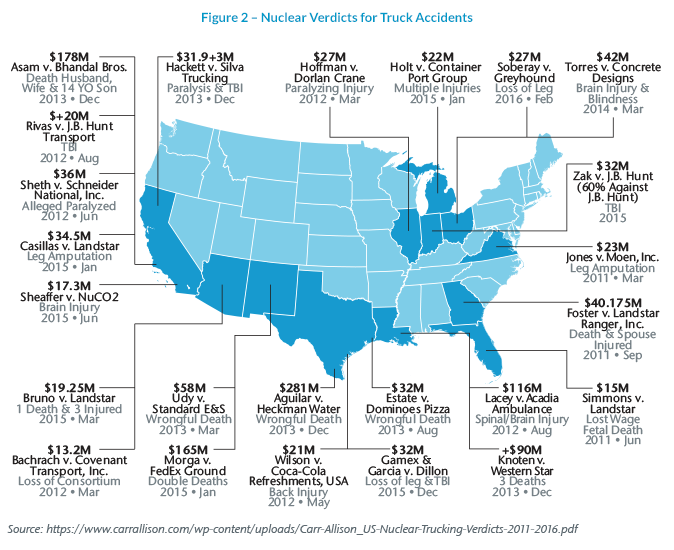

Nuclear verdicts are one contributing factor. This refers to jury verdicts in civil law suits that reach unexpectedly high amounts. The following figure illustrates such losses from truck accidents.

It is striking that almost all of the states shown in the figure are states with increasing income inequality.1 This suggests that in states with wide gaps in incomes and high poverty rates, nuclear verdicts are more likely to be awarded.

From 2010 to 2018, the average amount of damages awarded increased by 51.7% annually, while economic inflation was only 1.7% and health-care costs rose by 2.9%. In 2011, the number of verdicts over USD 1 million increased dramatically. While the number of large verdicts has fallen a little since then, the size of those large verdicts has grown.2

What is “social inflation”?

Economic inflation is generally understood to mean the increase in consumer prices for a standardized basket of goods and services. For example, in Germany this inflation is measured and reported by the Consumer Price Index, which is collected monthly by the Federal Statistical Office.

In the U.S., the term “social inflation” is used to describe the increase in insurance company payments in the liability sector due to various social factors that are not included in the basket of goods and services. These factors include: an increasing propensity to claim, increased use of social media, increasing attorney involvement in claims, social developments that influence jury members and lead to very high jury awards (so-called nuclear verdicts), widespread distrust of large corporations (“anti-corporate movement”) and the widening of income disparities.

One possible reason for this development is often cited as the changing convictions of jurors displayed in jury tribunals. These juries are now largely made up of “Millennials”, i.e. people born between 1981 and 1996, who often value consumer protection far more highly than generations before them.3 Millennials are also more critical about corporations (“anti-corporate movement”). In some cases, individual victims have been awarded compensation of well over USD 50 million.

In addition, bad faith claims pose a major challenge for many insurers in the U.S. when settling bodily injury claims. Bad faith claims are enhanced demands by accident victims due to claims practices that are harmful to the insured. Examples of bad faith claims include unreasonable delays in processing claims, inadequate claims investigation, a refusal to dismiss a claim or make a reasonable settlement offer, threats against an insured, or the inappropriate interpretation of an insurance policy. If a court finds “bad faith” on the part of the insurer, it may award compensation in excess of the sum insured (“loss in excess of policy limits”). The risk of a bad faith claim increases if the claimant’s lawyers demand compensation to the amount of the insured sum at an early stage (“time limit demand”). These claims present the insurer with the choice of either paying out the entire sum insured in an out-of-court settlement or risking a bad faith claim, which may even exceed the sum insured.

Because of the increasing risk of nuclear verdicts and bad faith claims, insurers in the U.S. are showing a growing willingness to reach out-of-court settlements faster than in the past. For the reasons mentioned above, the settlement sums negotiated are significantly higher in recent years than five or ten years ago.

In addition to these developments, another trend is also playing a role: so-called super-lawyers – i.e. particularly prominent, well-equipped and highly technical plaintiff’s attorneys or law firms – are increasingly turning from product liability lawsuits to motor vehicle bodily injury lawsuits. Many of these “super lawyers” have become well-known through their involvement in asbestos and tobacco product liability lawsuits. In recent years, similar high-profile lawsuits involved claims for glyphosate and opioids. These claims, which are usually class actions, are complicated and factually complex and, if the outcome is unclear, require a great deal of resources on both the plaintiffs’ and defendants’ sides. At the same time, the individual facts are difficult to transfer from one case to another.

Claims trend in California: + 64% annually

In the U.S., depending on the state, premium rates charged by insurers must at least be filed or approved by the state insurance commissioner. The following is an example of the claims trends in Personal Umbrella as shown in the state filing by a primary insurer in California (Personal Umbrella offers individuals or households a higher coverage for Liability, Motor and Employer’s Liability insurance):

The claims trends of this insurer over the last two years (2017 and 2018) in the Personal Umbrella segment in California were 28% for loss frequency and a further 28% for loss severity per year. As these factors are multiplied, this corresponds to an annual trend of + 64%. Over six years (2013–2018), the average annual claims trend for California is + 27%.

Source: Liberty Mutual California state filing # LBPM-131878890

Bodily injuries to motorists occur more frequently, are more similar and usually lead to clear losses and assignable liability. Therefore many plaintiff’s lawyers are shifting their focus to motor vehicle bodily injuries for economic reasons. Compared to product liability, these motor liability claims have less complex injuries and coverage questions. Besides, insurance is usually available because it often is compulsory to carry limits, and commercial insurance limits are usually even larger.

The “super lawyers” also have enough resources to use science and technology for their lawsuits. For example, in accidents involving commercial trucks, the profiles of drivers are routinely checked in social media for indications of alcohol and drug abuse. In the discovery part of the proceedings, the previous violations of road traffic regulations by drivers are also regularly checked. In this way, an attempt is made to prove organizational liability by the employers, mostly trucking companies. In addition, the lawyers have well-functioning networks through which information is exchanged about the decisive factors in successful proceedings. An example is a trend in recent years to make use of scientific findings relating to traumatic brain injuries. It is now believed that there may be connections between traumatic brain injuries (TBI), which include concussions on the mild end of the TBI scale as well as later-appearing motor and cognitive disorders. Therefore, this type of bodily injury, which is common in car accidents, is increasingly being used as the basis for new, significant claims for medical monitoring and possible later care.

The increase in litigation funding is another aspect that is leading to an increase in litigation in some areas. Since its origins in bodily injury claims in the 1990s, litigation funding has developed very rapidly in the U.S. Both investors and law firms have recognized that third-party funds can be used for a wide range of legal areas. In the past, the most important consideration for those seeking financing was: Who can offer the cheapest capital to finance my claim? Today, other variables come into play as the client base has expanded from class action litigants to less well-capitalized law firms. Proponents of litigation financing argue that it facilitates equal access to justice, as it allows plaintiffs with no personal funds to litigate and obtain legal representation that they otherwise could not afford. On the other hand, it is argued that litigation financing places the interests of investors above those of the plaintiffs and that the number of legal disputes is increasing, especially frivolous lawsuits.

Effects on European insurers

For European readers, the question may arise as to whether and to what extent these developments in the U.S. liability market could have an impact on European insurers. I would like to answer this question with a counter question: Will the trend for Motor insurance be transferred to General and Product Liability insurance in the U.S.? If so, the claims trend in the U.S. will also be relevant for European insurers, provided that they insure U.S. interests of their domestic insureds; for example, through international programs. To a certain extent, the trend observed in motor insurance has already spread to other lines of liability: The loss ratios initially rose only in Commercial Motor Liability, then they rose in Private Motor Liability, and we are now observing similar trends in Personal Umbrella.

The concern of U.S. liability insurance experts is that the trend we have been seeing for about three or four accident years could take the same path as in the last liability crisis at the end of the 1990s. There, too, a favorable claims experience for about 10 years preceded a significant claims trend that then led to substantial additional reserving in motor insurance in the mid-1990s, and in public and product liability about four to five years later, which placed a heavy burden on the underwriting results of many insurers and reinsurers. With this experience in mind, the question now arises as to whether a similar development is to be expected.

Assuming that the claims trend spreads to the insurance lines of business and product liability, the question arises, how could it affect European insurers? Only some of the European companies insured under international programs have a commercial motor fleet in the U.S. These are usually covered by a local insurance policy. Rarely is this Motor Liability insurance covered within the master policy of the international program. As a result, European insurers that do not write original business in the U.S. are little affected by the claims trends in Motor Liability insurance.

However, the situation is different if the claims trends spread to other general and product liability lines. For these lines of business, too, local basic coverage is generally in place, with the master policy of the international program attaching above the local coverage, providing for losses that occur in the U.S. and are claimed in court there. If the claims trends also affect (and are expected to affect) coverage above local policies, this would have a direct impact on the master policies granted from Europe. Normally, this would affect insureds with significant U.S. business, often with multiple locations, especially in the particularly difficult states such as California, Texas or Florida. However, some medium-sized companies with U.S. exposure could also be affected by these developments. On the insurer side, industrial insurers are likely to have a greater interest in monitoring liability trends in the U.S., but insurers of small and medium-sized businesses will also be affected.

From an insurer’s point of view, in addition to observing claims trends, it should be borne in mind that liability is not always the same as coverage. Not all claims are covered by a liability policy. “Punitive damages” are an example. These can be excluded in a policy and therefore only be insured as a part of the total damage. The insurer must also bear in mind that the scope of cover of a typical U.S. liability policy is different from that of a master policy managed from Europe. These differences in coverage can be partially compensated in both directions by means of difference in conditions clauses (DIC) and reverse DIC clauses.

We invite our clients to discuss these issues with their Gen Re contact and find out how to benefit from Gen Re’s experience in the U.S. liability market and our local liability expertise. Together we can assess the U.S. exposures and respond appropriately.

Endnotes

- Schmid, Nuclear Verdicts, Judicial Climate and Economic Conditions: The Case of Trucking, 2018.

- D Murray, et al. American Transportation Research Institute, Understanding the Impact of Nuclear Verdicts on the Trucking Industry, ATRI, June 2020, p. 15, https://truckingresearch.org/wp-content/uploads/2020/08/ATRI-Nuclear-Verdicts-One-Page-Summary-07-2020.pdf.

- Meanwhile the population of the Millennials in the U.S. is larger than that of the Baby Boomers.