-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Six Things We Can Do to Curb Legal System Abuse

Publication

Is Human Trafficking the Next Big Liability Exposure for Insurers?

Publication

When Likes Turn to Lawsuits – Social Media Addiction and the Insurance Fallout

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Creating Strong Reinsurance Submissions That Drive Better Outcomes

Publication

Do Commercial General Liability Policies Cover Mental Anguish From Sexual Abuse? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Next Gen Underwriting Insights – 2025 Survey Results & Confusion Matrix Considerations [Webinar]

Publication

GLP-1 Receptor Agonists – From Evolution to Revolution U.S. Industry Events

U.S. Industry Events

Publication

Always On: Understanding New Age Addictions and Their Implications for Disability Insurance

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

COVID-19 – How Intelligent Reinsurance Solutions Can Help Insurers Battle the Big Squeeze

September 16, 2020

Dr. Jonas Kaiser,

Rui Wang, Enterprise Capital Strategist, NEAM (guest contributor)

English

Most industry stakeholders, including supervisory bodies, believed that it would be Life and Health carriers that would suffer the most in the event of a health pandemic. Even as the COVID-19 pandemic started to unfold, few people anticipated that non-life insurers’ balance sheets would be impacted to quite the degree they have.

Original Lloyd’s estimates projected that total losses to the global insurance industry from COVID-19 would be to the tune of USD 200 billion - split between investment and underwriting losses - making the pandemic one of the biggest industry loss events ever faced.1 While the suggested drop in investment portfolios has since been scaled down, it’s clear that this unprecedented correlation of severe underwriting and investment losses is particularly challenging for insurers, and that the solvency ratios of Property and Casualty insurers could be very badly affected by COVID-19 and its aftermath.

Huge losses from event cancellation and business interruption as well as in different liability lines continue to be incurred. Meanwhile, asset portfolios have experienced mark-to-market drawdowns with a ferocity not seen since the collapse of Lehman Brothers in 2008, before bouncing back thanks to decisive actions by central banks and fiscal authorities.

Several months after the start of the lockdown, considerable uncertainty remains over the future claims burden. On the asset side, the outlook for fixed income yields and equity market volatility is still unpredictable, despite the fiscal and monetary interventions. Meanwhile at a strategic level, insurers can’t be sure of new business pricing and volume dynamics, nor the behaviour of their competitors.

Impact of COVID-19 on Balance Sheets

Given these unknowns and the volatility that lies ahead, we believe it’s crucial for insurers to stress test their balance sheet to make sure that their solvency ratio stays within the desired range as they navigate this uncertain environment.

Of course, intelligent reinsurance structures have an important role to play in mitigating uncertainty and helping to restore the solvency ratio to target levels. This was the focus of our recent client webinar “COVID-19 - Battling the Big Squeeze,” which looked at the impact of COVID-19 on the balance sheet of a typical insurance company.

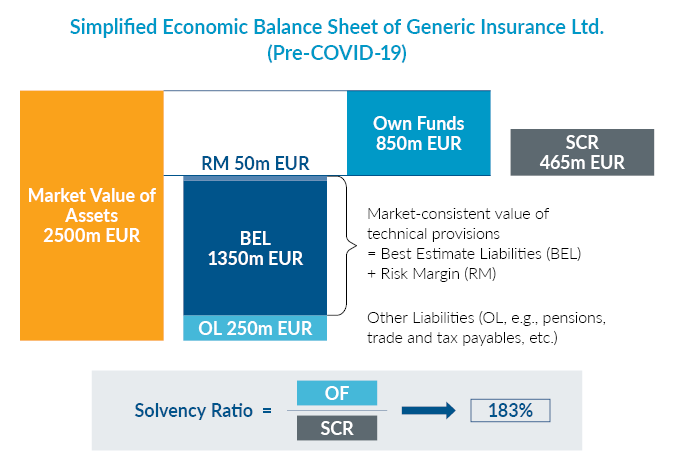

To illustrate the impact different reinsurance solutions and smart asset allocations can have on a company’s solvency position, we created a hypothetical non-life multi-line insurer, “Generic Insurance Ltd.” As a European undertaking, Generic Insurance Ltd. was portrayed as operating under the Solvency II capital regime and the image below gives a simplified overview of its financial position at the end of 2019, with EUR 1 billion in premium per annum, EUR 2.5 billion in investments, and a SCR of 183%:

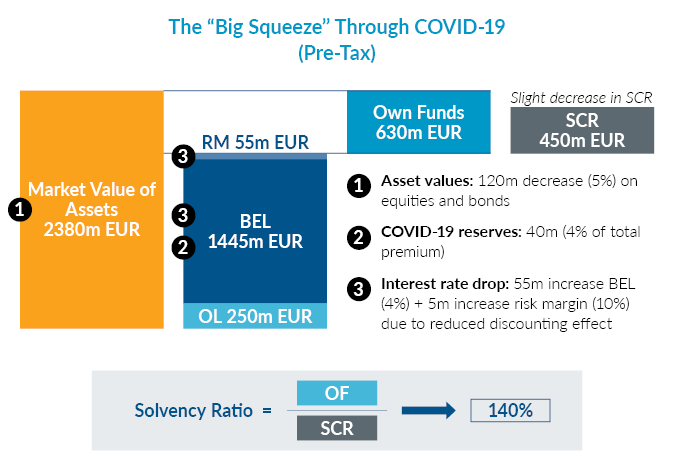

Part of the discussion was dedicated to showing the negative impact of COVID-19 on the company’s economic balance sheet, with declining asset values, the need to put up significant COVID-19 related reserves, and a stark drop in interest rates all simultaneously squeezing the company’s financial position, reducing its solvency ratio to 140%:

Given the shock this would have on a company’s solvency ratio, we then looked at additional reinsurance solutions available to Generic Insurance Ltd. to help bring their solvency ratio back to an acceptable figure

It’s important to note that, in this case, a standard quota share wouldn’t present a particularly effective solution. This is because non-life underwriting risk (in the Solvency II standard model metric) is heavily driven by net premium and reserve volume and, as a classical prospective quota share doesn’t affect the retained reserve volume, the eventual impact on the solvency ratio is limited. The same applies to typical non-proportional reinsurance structures due to their low premium volume.

Most effective would be a structure that combines prospective and retrospective reinsurance affecting both the premium and reserve volume. This would, however, be a very high-volume transaction so it might be prudent to instead focus on the segments which drive the premium and reserve volume, and therefore the risk.

To complete the picture, we also spent some time discussing how non-standard, high-volume, non-proportional structures might present viable alternatives.

Investment Allocations

Turning to the other side of the balance sheet, it’s become obvious that smart investment allocation is now critical. When we spoke to clients in the immediate aftermath of the market stress it was clear that many had found the mark to market drawdown very painful. At the other end of the spectrum, however, many insurers had taken the opportunity to buy equities and corporate bonds at attractive prices.

Given the relative calm in the market today, now is a good time to re-evaluate asset allocations - and in a way that takes the latest underwriting outlook into account. The priorities for Generic Insurance Ltd. should be to maintain a wide solvency margin, ensure an ample liquidity buffer, and support opportunities from the underwriting side.

By “de-risking” its investment portfolio to improve its solvency ratio - reducing the allocation to triple B credit and equities, increasing cash and high-grade government bonds - we demonstrated how Generic Insurance Ltd. gave itself the headroom to seize opportunities on both the underwriting and investment sides.

The pandemic is ongoing and the influence it will have on markets and insurance claims in the future remains uncertain, but we should not wait passively to find out. As mentioned, bespoke reinsurance solutions and smart asset allocation can play a vital role in helping insurers build resilience into their balance sheets. We know that the position many insurers find themselves in is not dissimilar to that of Generic Insurance Ltd. We are, of course, on hand to provide support to those who would like to explore options and solutions.

Endnote

Rui Wang CFA, FIA, CERA, Enterprise Capital Strategist, NEAM. Rui is an enterprise capital return and risk management professional at NEAM, offering investment management services to the insurance industry.rui.wang@neamgroup.com

Rui Wang CFA, FIA, CERA, Enterprise Capital Strategist, NEAM. Rui is an enterprise capital return and risk management professional at NEAM, offering investment management services to the insurance industry.rui.wang@neamgroup.com