-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Structured Settlements – What They Are and Why They Matter

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise?

Publication

“Weather” or Not to Use a Forensic Meteorologist in the Claims Process – It’s Not as Expensive as You Think

Publication

Phthalates – Why Now and Should We Be Worried?

Publication

The Hidden Costs of Convenience – The Impact of Food Delivery Apps on Auto Accidents

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

Favorite Findings – Behavioral Economics and Insurance

Publication

Individual Life Accelerated Underwriting – Highlights of 2024 U.S. Survey

Publication

Can a Low-Price Strategy be Successful in Today’s Competitive Medicare Supplement Market? U.S. Industry Events

U.S. Industry Events

Publication

The Latest in Obstructive Sleep Apnea -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Finding a Way Forward for Disability Income Insurance in Australia - Our Thoughts on a Future Product Offering [Part 2 of series]

December 17, 2020

Viviane Murphy

Region: Australia

English

Our Individual Disability Income Insurance (IDII) Taskforce has been conducting preliminary workshops with some clients to demonstrate our activation points for a new, sustainable approach to an IDII product design and framework. It’s part of an ongoing journey that we discussed in the first part of our Finding a Way Forward for IDII in Australia blog series.

Central to our new product framework are the key consideration areas that the Australian Prudential Regulatory Authority (APRA) has asked the industry to focus on, and to create an optimal product design. To achieve this, we have designed a modular product structure that is linked to supporting recovery and incentivising return to work.

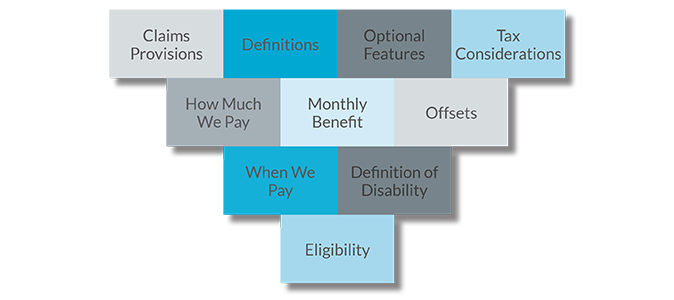

Simplified product design and structure

The overall design structure of the product clearly describes “When we pay”, “How much we pay”, “Treatment of Income”, “Claims Management” and “Optional Packages”. Overall, we have created a product structure that defines further provisions separately, rather than in the actual definition in the body of the policy. From a policy construction perspective, this approach creates better alignment, fluidity and ease of reference.

The definition of disability is the main operating clause in the policy framework. Here, we chose to have one holistic definition of disability for customer clarity and anchored assessment at claim time. This means that we recommend not splitting the definition into total disablement and partial disablement. The definition of disability is required to be met throughout the entire waiting period. All other clauses flow from this overarching provision.

Claim causation - Paying claims that are solely a result of sickness or injury

It is essential to stipulate the circumstances under which a claim will not be covered, rather than leave it to chance or interpretation. From a causation perspective, it was important to include the word “solely” due to illness/injury. We have seen claims requested to be accepted due to loss of professional license, or circumstantial occurrences in life, where the claim is not caused due to a medical illness or injury. The intention of IDII products is to compensate for a loss of income solely as a result of medical illness or injury.

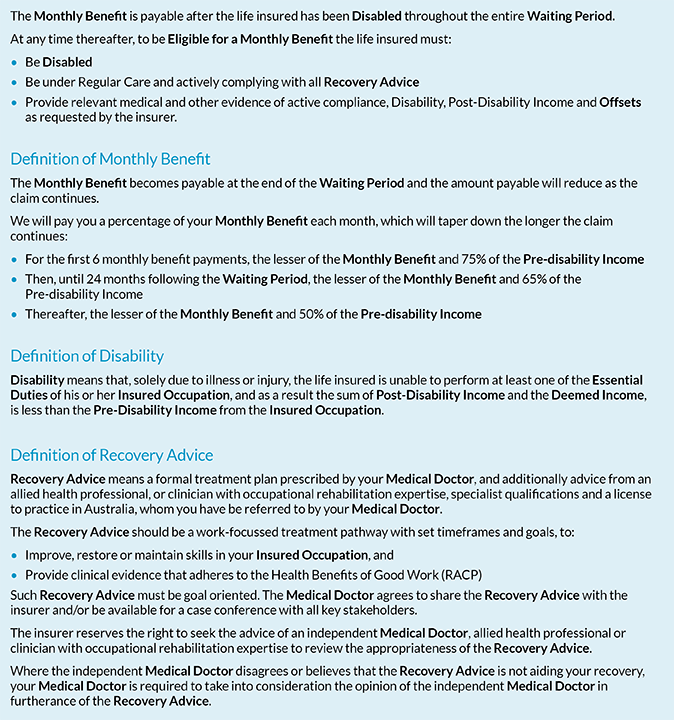

Recovery advice and regular care requirements of a claimant are better defined in our new framework. They are instrumental in the definition of disability - not only to confirm the objective evidence collated by the insurer but to ascertain that the claimant is undertaking proper treatment and advice. There is a responsibility on the part of the claimant to participate in his or her active recovery. There is also applicability for deeming capability where the treating medical doctor states the insured has work capacity, and this must be correlated to the benefit payable.

In the calculation of the monthly benefit, insurable income is clearly defined and carefully delineated for self-employed and employed insureds. We also address what is meant by post-disability income, which is based on income that is actually earned or that could be earned post-disability. This means that there is a deeming provision for income that could be earned in the total determination of calculating post-disability income.

We also include claim provisions and requirements that must be provided, rather than may be provided; these need to be clearly enunciated in the policy terms and conditions. At claim time, the rationale for these provisions ought to be explained. In other words, the requests for information, validation or verification must be at the heart of assessing the claim in order to determine the outcome of the claim. Ultimately, this transparency and consistency is in the interest of all parties.

A sample of what the definition of disability could look like

Below is the sample product specification we have developed. It can continue to be adapted and the parameters updated (for example replacement ratios) with our clients to suit their needs, customer offering and approach to the APRA IDII requirements. We preface it by noting that the bolded terms are important defined terms in our product design and structure. While we haven’t included all the definitions in the sample, we’d be happy to share these with our clients to aid the further development of new product design.

We have developed the definition of disability with the intention of giving greater clarity to the embedded and associated definitions. This makes the obligations for the key stakeholders of the insured, insurer and the medical practitioners clearer. We have structured the definition of disability to ensure that there are two-way obligations and objective measures for effective assessment at claim time.

Health benefits of “Good Work”

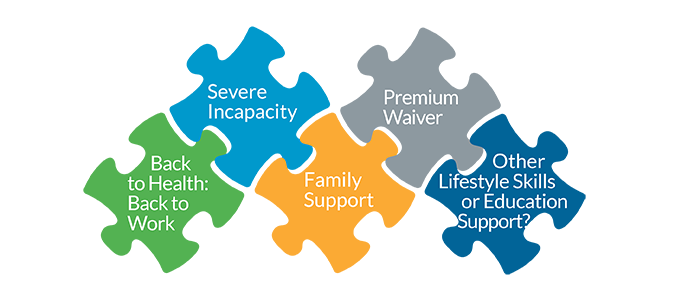

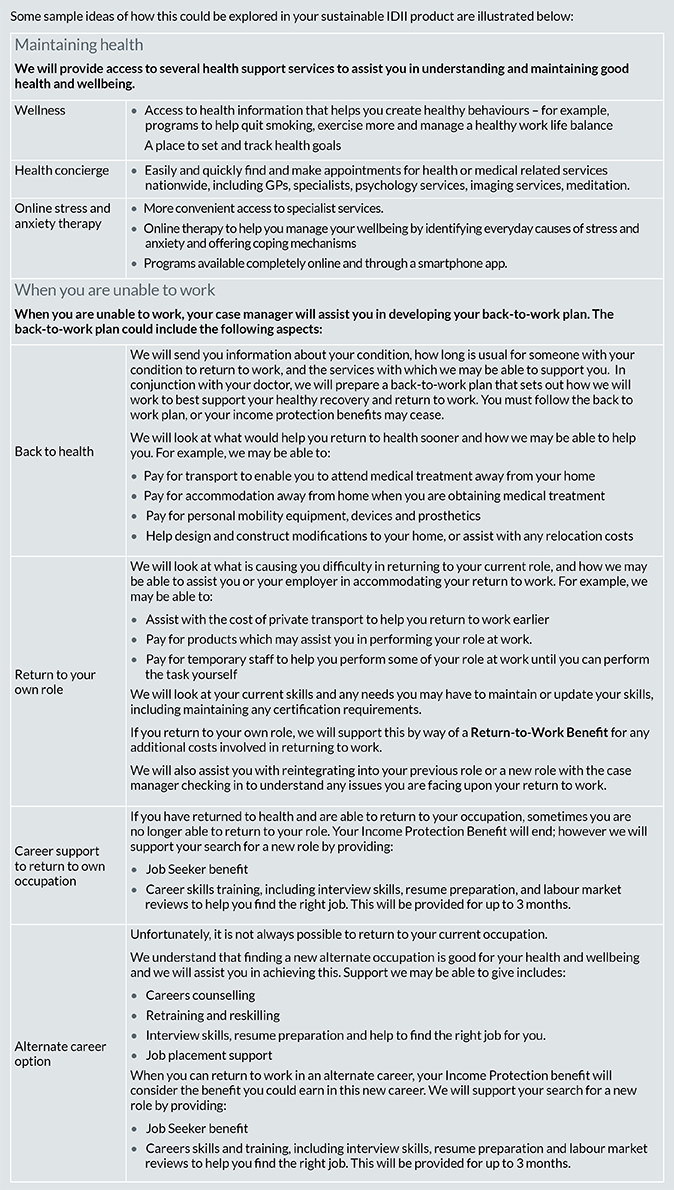

We believe that a Back to Work: Back to Health philosophy should form part of the base product and any “extra” features can be added on. We also believe there is a distinct opportunity to activate the digitalisation of services that support the mental health and wellbeing of customers.

Securing IDII coverage that is fit for purpose

Insurers can simply do what is expected of them by APRA or we can move beyond the regulatory scope and produce coverage that is fit for purpose and provides protection now and for decades to come. This element of sustainability is essential to appeal to those people who are underinsured, uninsured, and those that wish to preserve the value of their cover.

Australia is not alone in grappling with the need to future-proof its personal protection systems and create a conscionable buy-in of the risk pooling concept. To put Australia’s challenges in perspective, the next blog in our IDII Taskforce series will look at the performance of Disability Income Insurance in other markets around the world.