-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Fasting – A Tradition Across Civilizations

Publication

Alzheimer’s Disease Overview – Detection and New Treatments

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Property, Engineering, Marine

With Gen Re’s full range of products and highly trained specialists, you’ll find the reinsurance solution that’s right for you.

We offer Treaty and Facultative (Individual Risk and Program) reinsurance solutions for a broad range of Property exposures and coverages including:

Commercial Property, Personal Lines, Engineering, Agriculture, Marine, Boiler & Machinery, Machinery/Equipment Breakdown, and Natural Catastrophe perils. Our solutions can reduce volatility in your books and protect your company’s balance sheet. As a direct reinsurer, we underwrite and assess risk alongside you, sharing expertise and technical knowledge – all with the goal of helping you meet your reinsurance and business objectives.

Property

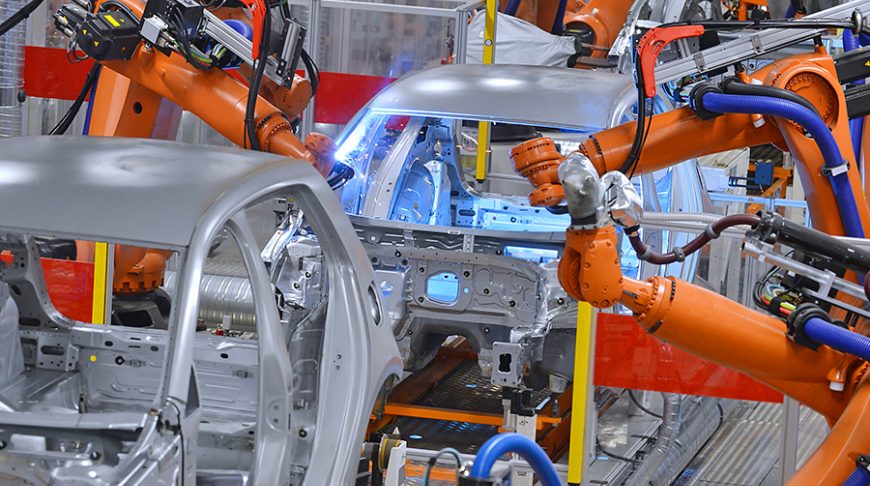

The risks in the commercial and industrial sectors are manifold and are characterized by rapid technological changes. Our Property reinsurance products fit a diverse client base across Commercial and Personal lines markets.

Our solutions address the volatility of losses as well as unique characteristics and exposures across the spectrum of Property risks, from Treaty and Facultative automatic programs to highly customized Facultative coverage on individual risks. Solutions include commercial properties, vacant/unoccupied buildings, rehabilitation/renovation, large commercial risks, homeowners with very high-valued dwellings, seasonal dwellings, farm/ranch owners, catastrophe-exposed locations, industrial, infrastructure, and many other types.

Engineering

Our specialty underwriting teams offer solutions on large, unusual, or complex occupancies, coverages, and perils. We can provide reinsurance protection for highly volatile risks such as Construction risks, Semi-conductor, Boiler and Machinery, and Equipment Breakdown.

Marine

We offer reinsurance solutions across a broad range of Ocean and Inland Marine exposures. To succeed in today's rapidly changing global environment, our teams combine global expertise with local know-how. Our product offerings include Ocean Cargo, Commercial Hull (Ocean/River), Yachts, Builders Risk, and Marine Liabilities.

Natural Catastrophe

Rising NatCat activity in recent years has created challenges for the insurance industry. In addition, supply chain and business interruption risks have exacerbated claims, making assets more exposed to losses. At Gen Re, an experienced team with a long-standing history in underwriting backed by a strong balance sheet will help you meet your reinsurance and business objectives.

Related Solutions

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Past arrivals of GPTs offer insights into potential implications of the diffusion process of Generative AI. What do these observations imply for an insurer’s technology choices in the Generative AI adoption process? How can business leaders steer the diffusion of this technology in the organization?

Frank Schmid

March 17, 2024

Structured Settlements – What They Are and Why They Matter

Structured settlement packages have been a part of claims resolution in the U.S. for more than 50 years. They can be appealing to each party, and a structured settlement consultant can be valuable during a negotiation or mediation process. Here’s an overview of how they work and the benefits.

Rebecca Selinger,

Peter Early (President of Ringler Associates – Northern New England) (guest contributor)

April 01, 2025

PFAS Regulation and Development at the European Level with Focus on Germany and France

PFAS, a group of persistent chemicals, also known as “forever chemicals” pose a risk to the environment and human health. This article highlights the multitude of existing and planned regulations and bans in Europe and describes some of the lawsuits related to PFAS contamination.

Lisa Murr,

Alix Pardo

March 12, 2025

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

We’re starting to see more of them – vehicles with cylindrical devices on top. They seamlessly merge in and out of traffic, signaling turns and making stops well within safe driving standards. Passengers enter and exit without incident. All appears normal, except: No one is behind the wheel.

Timothy Fletcher

March 10, 2025

Buildings Made of Wood – A Challenge For Insurers?

Building with wood is a global trend. Timber construction offers a high degree of prefabrication, good thermal insulation properties, high strength and load-bearing capacity with a comparatively low dead weight. However, the risk of fire is high. We explain the possible risks and point out risk reduction measures.

Leo Ronken

March 04, 2025