-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Risk Management Review 2025

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Why HIV Progress Matters

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Unemployment Coverage in Life Loan Products in Latin America – An Underestimated Risk?

March 21, 2018

Dr. Antonio Monroy,

Saskya Córdova

Region: Latin America

English

Español

The sale of insurance through banks in Latin America has proven to be a successful alliance, with benefits for both parties. On the one hand, the insurance company has the chance to distribute its products on a mass scale through bank branch networks, thus reducing its distribution costs. On the other, the banks are able to offer their customers comprehensive financial solutions and also benefit from an additional income stream.

An important area of banking business is the granting of personal loans for various purposes. Life insurance has proven useful to protect the balance of a loan (mortgage, car, consumer, etc.) in the event of the death or disability of the borrower, as well as the co-signer, if there is one. If these risks were to materialise, they could result in the borrower being unable to meet credit obligations, causing the bank significant financial losses. This is especially sensitive in the case of loans where family members may end up losing property, often their homes, which have been deposited as a security with the financial institution.

Similarly, loss of employment is a significant risk that can lead a borrower to partially or totally default on credit obligations. Particularly in countries lacking state systems of protection against unemployment, it has become attractive to offer additional coverage for life insurance, aimed at covering a specific and limited number of loan instalments in the event the borrower becomes unemployed.

This article analyses different characteristics of unemployment risk that differentiate it significantly from coverage for biometric risks, such as death and/or disability. In practice it can be seen that the design and marketing of additional unemployment coverage, in some markets, underestimates one or several characteristics of this risk specifically, even jeopardising the profitability of the entire product.

Characteristics of products distributed through banks

The bank sales channel has certain specific characteristics that largely determine the design of insurance products. Some main characteristics of insurance sold through banks include the following:

- Straightforward coverage: It is essential to convey the idea and purpose of the product clearly and efficiently to both the customer and the seller at the bank, who is not usually an insurance sales specialist.

- Single rates or rates with minimal differentiation: Not only should the coverage be straightforward and transparent, the coverage costs must also be straightforward and easy to manage for the bank. In the case of unemployment coverage, it is common to offer single rates for all customers regardless of age, gender or any other factor.

- Simplified process for taking out the policy: Depending on the product, the process for taking out the policy is usually reduced considerably. This may vary from answering a very small number of questions (between one and three) to signing a personal declaration of good health.

Common characteristics of unemployment coverage

Loss of employment can be due to many reasons. Because some reasons may be attributed to employee behaviour, offering insurance where the benefit is only activated by the loss of employment carries a high degree of moral hazard. To mitigate this hazard, the definition used in unemployment coverage usually limits the definition to any involuntary loss of employment for reasons not attributable to the borrower. Examples of these types of reasons include staff cuts within a company or employer bankruptcy.

Moreover, in cases where the loan instalments represent a significant portion of an employee’s monthly liabilities, remaining unemployed and collecting that coverage may be more attractive than the prospect of a job that is less lucrative than the previous one. To reduce this kind of moral hazard, unemployment coverage – especially in Latin America – therefore usually only covers a small number of monthly instalments (traditionally between three and six).

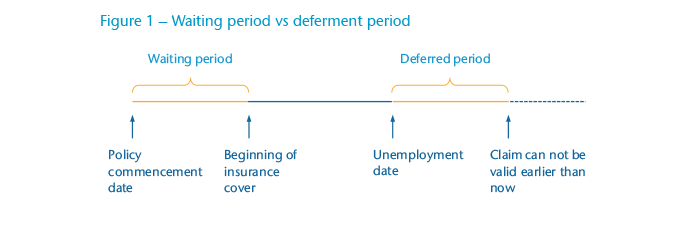

If unemployment coverage is not designed carefully, it can also be highly selective as it may be attractive to purchase this coverage at a time when the person’s employment is at risk (e.g. in the event of an economic crisis or crisis with the employer). For this reason, minimum waiting periods, deferment periods (see Figure 1) in the coverage and limited maximum insured amounts are all required to be able to effectively control possible adverse selection.

Given the specific characteristics of the labour market in Latin America and the high level of informality observed, unemployment coverage is usually only offered to people with the following characteristics:

- Subordinate, remunerated employment

- An open-ended, written contract

- Meet a minimum previous employment period before completing purchase of the coverage

These characteristics in themselves already show that the nature of this risk is very different to biometric risks, such as the risk of death or total and permanent disability. Not only does it consist of coverage that is temporary and has a higher frequency in the claims incurred, but the trigger of the coverage is also unrelated to the physical condition of the insured person, as its specific origin is in the insured person’s workplace and more generally in the conditions affecting the labour market itself.

High volatility over time

In Latin America, it is common to see Unemployment coverage being sold with a single premium, i.e. the entire insurance premium is covered at the start of the loan and usually considered an initial part of the debt to be covered by the borrower. Given the nature of the sales channel, simplicity is essential in the product sales and management process, and therefore the products tend to be offered with single rates for all ages and both genders.

In general, offering a Life insurance based on a single premium is equivalent to granting a guarantee with respect to the premium level over the duration of the loan; by receiving the premium in advance, it is not possible to change it over the course of the duration of the insurance. This guarantee is important not only in the case of mortgage loans, but also in long consumer loans, as it can be extended for 10 years or more.

When designing products that cover the death of the insured person, it is usually assumed that the mortality curves tend to remain stable over time. This is true in the majority of cases, if one excludes extraordinary worsening of mortality due to the increase in violence or catastrophic events, such as a pandemic affecting a certain region.

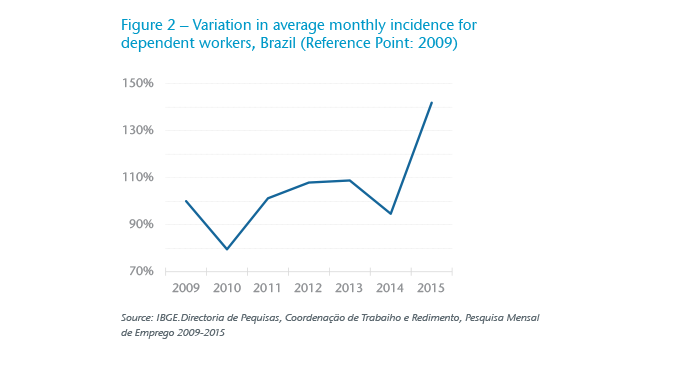

Unlike the risk of mortality, or even the risk of total and permanent disability to a lesser extent, the risk of unemployment can vary suddenly and significantly over time. This variability comes from different factors external to the insured person, such as economic cycles, so it is difficult to accurately predict their behaviour over long periods of time.1 Figure 2 shows the annual variations in the average monthly incidences of unemployment, which are estimated using data from Brazil’s National Employment Survey (Pesquisa Mensal de Emprego – PME) with information for the years 2010 up to February 2016. The exposure for the calculation of short-term unemployment incidences was estimated, taking into account only individuals in a dependent employment relationship, with an open-ended, written contract and with at least one year of service in the job. Moreover, only those individuals who lost their employment less than four weeks before the time of the PME interview were considered as newly unemployed.

This time sequence clearly shows how incidences can suddenly worsen from one year to the next in a significant way. The average monthly incidence for 2015 was 42% higher than the incidence observed in 2014. Even during the period 2009-2014, which can be considered stable, the incidence in 2011 was 15% lower than that observed in 2013.

This example, although somewhat extreme, shows the difficulty encountered in pricing and designing an employment product when long-term guarantees (direct or indirect) are offered regarding the premium level, such as the offer of a single premium.

Incidence is not prevalence

One of the elements needed in pricing insurance is the incidence, i.e. the proportion of new claims out of the population at risk (exposure). Calculating unemployment incidence is an arduous task, especially for new products where there is no claim experience from a real portfolio, since different countries’ statistical institutes usually only publish unemployment prevalence. This means the percentage of unemployed population within the total population is known, although the new cases of unemployment during the measuring period is not known. Although there are models that can transform prevalence into incidence and vice versa, in practice the lack of additional information available about other variables, such as the recovery of unemployment, makes these models difficult to use when pricing the product.2

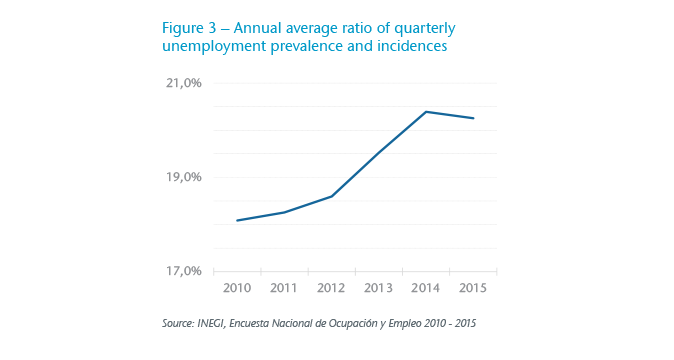

The relationship between prevalence and incidence of unemployment is not constant over time either, and therefore it is difficult to use pure prevalence without any adjustment as an approximation of incidence. As can be seen in Figure 3, the average ratio between quarterly unemployment incidences calculated using the National Occupation and Employment Survey (Encuesta Nacional de Ocupación y Empleo – ENOE) in Mexico for the years 2010 to 2015 and the quarterly prevalence of the unemployed population published by the National Statistics and Geography Institute (Instituto Nacional de Estadística y Geografía – INEGI) vary considerably over time. The ratio in the year 2014 is approximately 13% higher than in the year 2011.

Socio-demographic factors affecting unemployment

Life insurance designed to protect the balance of a loan is usually marketed in Latin American countries via a single rate without any kind of differentiation in biometric risk factors, such as age and gender. This way of selling has also been extended to other types of coverage related to different conditions of human life (biometric conditions) – such as disability and morbidity, where, even though there can be other factors influencing the risk, age and gender are the factors with the biggest impact. Although under certain circumstances it is justifiable from the risk point of view to express the total mortality or disability rate through a single rate when dealing with a stable insurance portfolio open to new business, it is dangerous to do the same with unemployment risk.

Unemployment risk is different; there are not only economic factors but also significant socio-demographic factors – such as remuneration and occupational field – that determine the level of risk. In practice, however, the distribution of the majority of these varied factors within a group of insured persons is not usually known. Therefore, offering unemployment coverage through a single rate without considering additional factors carries a high risk of error, which may jeopardise the product’s profitability, because there are guarantees in the premium level and significant and unexpected changes may take place in the composition of the portfolio over time.

To illustrate the above, the following case study shows the real impact of different socio-demographic factors on unemployment risk measured through quarterly incidences calculated with information obtained from the ENOE survey in Mexico between 2010 and 2015. To measure the real effect of different factors, the incidences of unemployment were modelled using a generalised linear model (GLM) and assuming a Poisson distribution for the incidences.

Generalised linear model (GLM)

A generalised linear model makes it possible to analyse the effect of different variables on an dependent variable, such as the frequency or incidence of unemployment. Unlike ordinary regression, GLMs allows to study non-linear relationships by assuming that the dependent variable behaves according to a specific distribution. Morover, the model can adjust for exposure correlations that may exist in the underlying data.

In our case, because the information relates to frequency, we assumed that the incidence of unemployment behaves according to a Poisson distribution. The following socio-demographic variables compiled in the ENOE survey were used as explanatory variables in our model:

- Salary

- Age

- Gender

- Occupational field

- Access to social security

- Human Development Index

- Marital status

Results

We present the results of the model used below. However, it is important to mention the following first:

- The variables used were statistically relevant to explain unemployment risk. Nevertheless, the model used is not unique and additional variables, including interactions between them, may explain the risk of unemployment.

- The results are only valid for Mexico. Due to the high dependence on economic factors, the real impact of the different variables may be different in other Latin American countries.

- Although the quarterly incidences were estimated in such a way that the exposure used is as close as possible to the target market for unemployment coverage, it is population information. The observed effects may vary with respect to a real insured population. The aim of our case study is to show the effect different socio-demographic factors may have on unemployment coverage, factors that are not usually used in biometric risk coverages.3

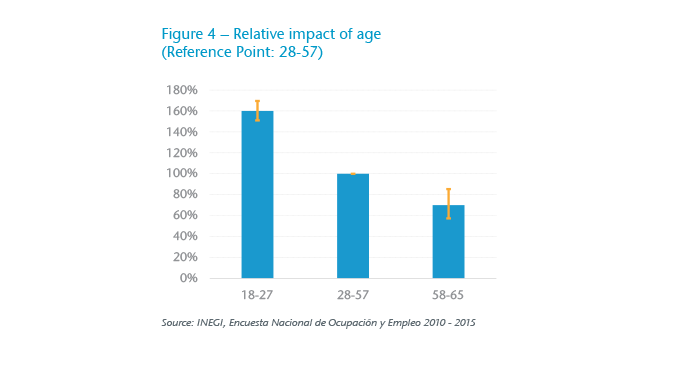

Relative impact of age

Three age ranges were considered: 18 to 27, 28 to 57 and 58 to 67. As can be seen in Figure 4, the risk of unemployment, unlike biometric risks, decreases with age. The incidence for young people aged 18 to 27 is approximately 60% higher than in the range of persons aged 28 to 57. The younger an insurance portfolio, the higher the risk of unemployment. This phenomenon can be observed throughout Latin America and has different causes. One of these causes is labour vulnerability due to the lack of experience that makes young people more susceptible to losing their jobs when employers have to make staff cuts.

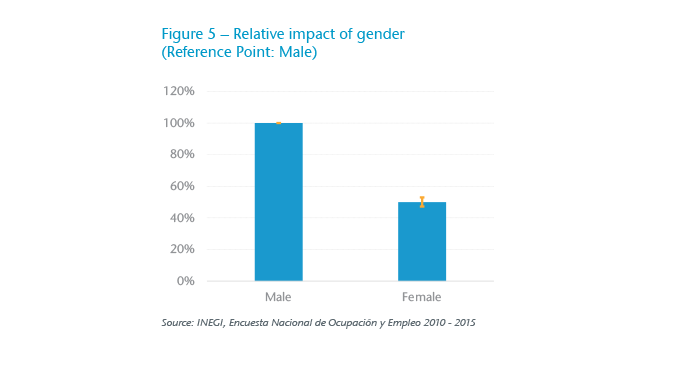

Relative impact of gender

Similar to biometric risks, unemployment also depends on the insured person’s gender. According to our model, the incidence of unemployment is 50% lower for women than for men in Mexico (Figure 5). This is of great importance when the unemployment coverage rates are unisex; an increase of 100 basis points in the proportion of men leads to a 1% increase in the unemployment rate (if one assumes that the other factors in the portfolio remain the same). Therefore, when pricing unemployment coverage with guaranteed rates, it is essential to know in detail the actual expiry of the product due to validity in both men and women, so as to be able to estimate the evolution of the portfolio and, by extension, the incidence over time, and to thus avoid underestimating the risk.

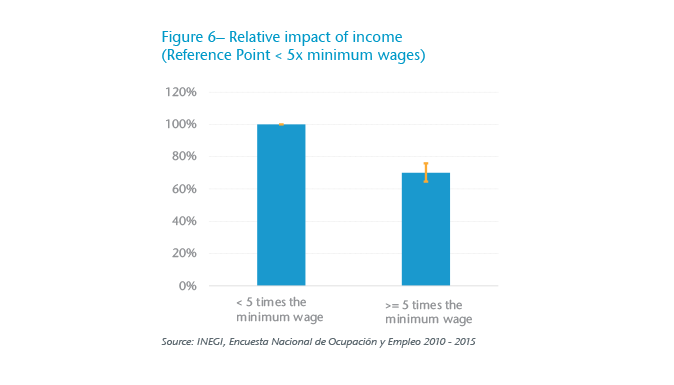

Relative impact of income

Wages have a significant impact on unemployment incidence. Two wage groups were used for our model: people who earn up to five times the minimum wage and people who earn more than five times the minimum wage. The minimum wage in Mexico is the lowest amount the worker must receive in cash for the services provided during a work day. The amount of this wage is regulated by the Mexican Federal Labour Act. Although this salary varies between different geographical areas, it can be used to compare a head of household’s ability to meet normal needs in the place of residence.

In our example, the risk of remaining unemployed is around 30% lower for people who earn more than five times the minimum wage per day than it is for their counterparts (Figure 6). It is therefore important to take into account the target market of the unemployment product in question. Unemployment coverage for mortgage loans where, in general, the socio-economic and therefore wage level of the insured persons is high does not represent the same risk as a consumer loan with low insured sums.

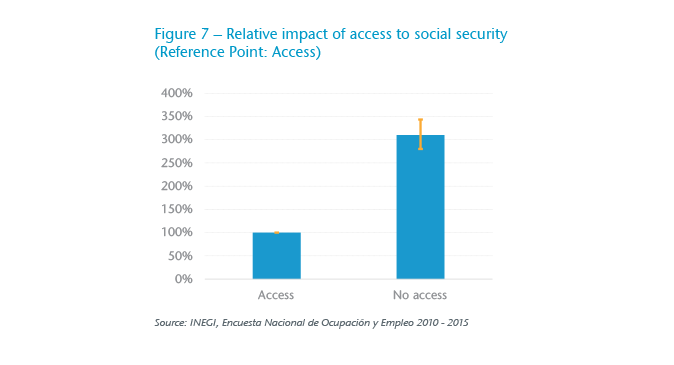

Relative impact of access to social security

The data were divided into two groups: those with and those without access to social security. The model indicates that the unemployment incidence is around three times higher for workers without access to social security (Figure 7).

Although the fact of having a job with a written contract forms a requirement for insurability for the majority of the unemployment coverage offered on the market, this is not a guarantee that the person is registered with social security. Failing to ask for registration with social security as a minimum requirement can lead to underestimating unemployment rates, especially in products intended for a low and middle socio-economic class where access to social security services is lower than in other segments of society.

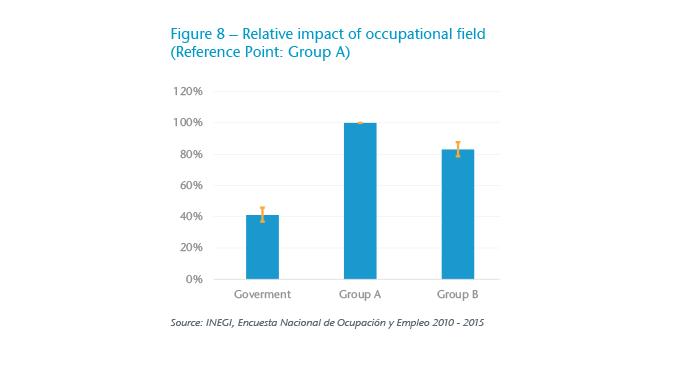

Relative impact of occupational field

The model shows that occupation is an important factor in pricing unemployment coverage. Given the survey data, in our model we approximated occupation through the survey response about the field in which the interviewee works. The data were classified into three different groups:

- “Government” – State employees

- “Group A” – Employees belonging to fields of various services, restaurants, hotels, commerce, transport, communications, mail, etc.

- “Group B” – Employees in the fields of agriculture, stockbreeding, extractive and electricity industry, manufacturing industry and construction industry

As shown in Figure 8, state employees have an unemployment incidence between 40% and 60% lower than on the open economy. Moreover, in the specific case of Mexico, employees in industrial fields (Group B) have more job security than service employees (Group A).

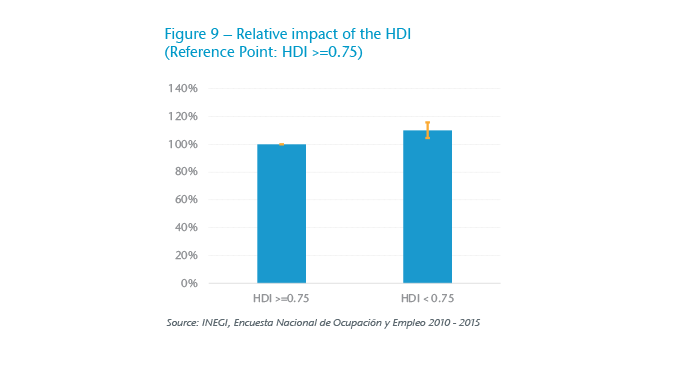

Relative impact of the Human Development Index (HDI)

The Human Development Index (HDI) has been calculated by the United Nations Development Programme since 1990 and includes three components aimed at defining a society’s human development:4

- A long and healthy life measured as life expectancy at birth

- Knowledge measured through the education index

- Decent standard of living measured through GNI per capita (PPP)

For the purposes of our model, the different federal entities in Mexico were classed into two groups according to their average HDI of the years 2010 and 2015. While the first group consists of entities that showed a high index (greater than or equal to 0.75), the second group (<0.75) consists of less developed entities.

The impact of this index on unemployment is not as marked as other variables used; however, it can be considered relevant through its p-value in the model. On average, the unemployment incidence in less developed regions is 10% higher than in other regions (Figure 9). This suggests that the geographical distribution of the target market in question must not be ignored when pricing unemployment coverage.

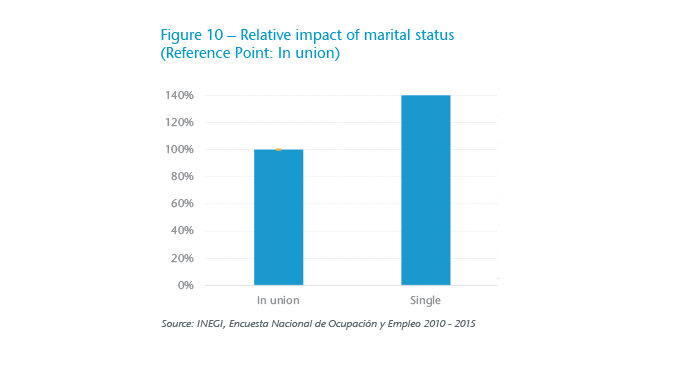

Relative impact of marital status

Evidence shows that marital status has an impact on the unemployment incidence. We used two groups in our model:

- “In union” – This group is formed by individuals who responded they were in a domestic partnership or marriage.

- “Single” – This group includes anyone who responded he or she was separated/divorced, widowed or single.

The people in a marriage or partnership have a 55% lower risk of becoming unemployed than their counterparts (Figure 10).

Marital status does not usually play an important role in the pricing of biometric risk products. However, through our example it is possible to see that marital status has an important impact and not taking it into account during pricing can result in a high risk of error.

GLM conclusion

Modelling the population unemployment incidences using a GLM allowed us to analyse the effect of different socio-demographic factors on unemployment in the presence of complex relationships. Moreover, the GLM allows for adjusting correlations that may exist in the exposure. An example of such a correlation is the age and the salary: the older a person is, the higher is the salary. Our model enabled us to see that unemployment risk is different to biometric risk coverages. Therefore, responsible practice in managing unemployment risk should consider not only the characteristics of the labour market in the country, but also the product’s target market, the structure of the portfolio in question, and the types of loans being insured. Furthermore, the product must have a balanced risk profile with regard to the options and guarantees offered, especially guarantees at premium level.

Finally, factors that have an effect on unemployment risk such as access to social security show that other design elements must not be underestimated either – elements such as an exact definition adapted to the market in question, eligibility characteristics, necessary exclusions, etc. – all of which make it possible to limit the risk in a responsible manner.

General conclusion

The bancassurance sales channel is important for the insurance market in Latin America. Banks can use this channel to offer their customers comprehensive solutions and thus strengthen their position in the market.

Growth has recently been seen in the popularity of Unemployment coverage sold as additional coverage within Life Loan products. Although unemployment presents a real risk for the insured person with regard to their financial obligations, this risk has very different characteristics compared to classic biometric risk products, such as Death and Disability coverage. Not only it is more volatile over time, which makes calculating incidences or the fraction of newly unemployed persons a significant challenge during pricing. Moreover, unemployment is also highly dependent on very varied socio-demographic factors that in practice are not usually considered in the pricing or sale of traditional Life products. These factors can be fundamental, however, and can have a huge influence on the profitability of the portfolio itself. Therefore, as part of responsible practice in risk management, it is important to keep in mind their high degree of complexity and specific characteristics in order to develop and market products where all the parties win: the insured person, the bank and the insurer.

Endnotes

- Crises, Labor Market Policy, and Unemployment. L. E. Bernal-Verdugo, D. Furecery and D. Guillaume, IMF Working Paper, March 2012.

- Barendregt et al. A generic model for the assessment of disease epidemiology: the computational basis of DisMod II. Population Health Metrics 2003; 1:4.

- Given the rotating design of the survey, it is possible to follow up a fraction of the interviewees for up to five quarters. The only people considered in each quarter were those who were also interviewed in the following quarter. The exposure of active persons consists of any economically active persons aged 18 to 65, who are employed with a written, remunerated and open-ended contract. The persons considered to be newly unemployed in quarter T were any persons aged 18 to 65 who were also interviewed in T-1 and who, according to the interview, lost their job in the three months between two surveys for any of the following reasons: a) the company ceased operations or went bankrupt; b) there was a reduction in staff; c) the person was fired; d) unknown reasons.

- The Rise of the South: Human Progress in a Diverse World. Human Development Report 2013. United Nations Development Programme.