-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Fasting – A Tradition Across Civilizations

Publication

Alzheimer’s Disease Overview – Detection and New Treatments

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Commercial Umbrella Lesson From Losses – Segmentation Insights

May 25, 2016

Matt Burns

Region: North America

English

These are uncertain times for U.S. Commercial Umbrella writers. Rising auto severity is threatening the profitability of otherwise stable books of business. Several commercial writers have announced large rate increases or tightened underwriting authorities. A few have gone so far as to exit troublesome segments altogether. With low interest rates and less reserve redundancy available, there is little room for underwriting errors.

From conversations with many insurers, we find that market disruption and uncertainty around loss trend are also undermining confidence in companies’ renewal books and their ability to evaluate new business rates adequately. Insurers may well wonder: Do we have a problem, and if so, how do we fix it without throwing out good business with the bad?

To help our clients, and us, stay in front of severity exposures and loss trend, Gen Re conducts loss studies by mining our experience from nearly $9 billion in Umbrella claims. Part of this effort includes a detailed review of the 3,686 claims reported to Gen Re between 1990 and 2014 - allowing us not only to aggregate data but also to gain insights on longer developing losses and look for emerging trends.

Some of our findings may help you identify trends that may exist in your own company portfolio. Given the volatility with inconsistent frequency of the Umbrella line of business, that is often difficult for any one carrier to do on its own.

Segmentation and This Study

Why do we segment loss experience? It is one way we mine loss data to understand the various drivers of loss by risk characteristic. No insurance or reinsurance book is static for a large window of time, including ours. We recognize that both business mix and limits profiles shift over time. Yet there are valuable lessons to be learned from understanding sources of umbrella loss over a long period.

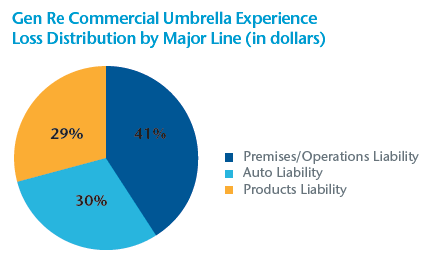

To start we segmented claims into three main categories: Auto, Premises/Operations and Products Liability. This breakout reflects our total Commercial Umbrella book of business, from small business and specialty/niche to large national accounts, over the 24-year period from 1990 to 2014. From this segment, we found that 70% of losses come from General Liability and 30% come from Auto Liability. When we drilled further into General Liability claims, we found many emanate from larger risks with heavier products/completed operations or greater third-party premises liability exposure.

Segmentation by Risk Size

Next we pulled out small- and mid-size commercial risks from the rest of the study sample, as these segments are more representative of the business that our customer base targets. There is no bright-line for these group segments, and we understand that each company’s definition of this business varies.

For this study, small business segment characteristics included small commercial package, standard business owner classes and risks typically with little to no auto. Those that fell into more mid-size risks included businesses with several locations, medium-size contractors (larger than artisans but no heavy contracting), some products exposure and risks with slightly heavier vehicle types. What did we not include? We omitted risks that were in the large/national account segment, specialty books written by program administrators or specialty divisions, and predominantly transportation risks or more auto-driven exposed risks. This allowed our review to uncover loss characteristics from our small to mid-size Commercial Umbrella book, rather than treating all "business" as if it were similar. Gen Re does this continually as part of our line-of-business discipline so that when we engage with a client on its portfolio, we offer experience against similar books of business.

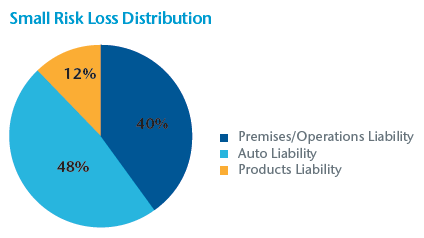

What lessons did we take away from this analysis? For small risks, we found that Business Auto premium made up less than 20% premium for this segment but generated almost 50% of total losses. Auto even surpassed Premises Liability losses, the more common exposure underwriters evaluate for these classes. It also showed that even for smaller, Main Street businesses with hired and non-owned or very little exposure, Auto still has the potential to drive severity loss.

A number of hired and non-owned claims involved employees using their own vehicles. As we think about future trends in the small commercial business sector, will more employers be asking employees to use their own vehicles? Will they require minimum liability limits? If employers allow this, how often or for what purpose will they drive? Should insurers monitor this - by class, by segment, by state?

Small Business Sector by Type of Operation

When we drilled down into Auto by insured operation in the small risk book, we found that four industry classifications made up 63% of total Auto losses. They are, in order of magnitude:

- Construction

- Agriculture

- Retail

- Restaurant

As these were small commercial businesses, artisan contractors represent the majority of the Auto construction losses. The significant contribution of agricultural losses might surprise some carriers, but many serious claims came from high-speed accidents arising from pulling into and turning out of rural roads. Retail trade Auto claims often involve delivery vehicles. Restaurants, not surprisingly, include a number of hired and non-owned losses as well as delivery vehicles.

What does this mean? Auto exposure underwriting is critical, regardless of risk size. Rural risks may provide greater severity exposure than is accounted for by some excess pricing methodologies. Small businesses with few vehicles still have the potential to experience loss severity, and such risks signal the need to purchase Commercial Umbrella to protect the business if it is not already in place.

Mid-size Business by Type of Operation

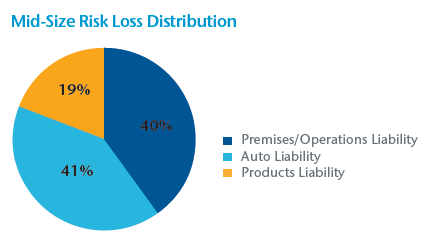

Auto was also the largest loss contributor in the mid-size commercial segment, at 41% of total losses. Yet there was more correlation between premium and losses, as exposures were more fairly split between General Liability and Auto.

What about the 59% of losses from Non-Auto type claims? Contractor risks played a much greater role in the middle market loss data - over 30% of General Liability losses came from artisan and specialty trade contractors and developers. We also saw significant loss dollars coming from retail trade, habitational and liquor losses.

Closing Thoughts

Your Commercial Umbrella book as a whole might be performing above or below your expectations; segmentation can help you identify where it is performing well and where it is not. While you might not need to tighten underwriting guidelines or raise rates across the board, a more segmented approach might laser out a problem without disrupting renewals on your more profitable accounts. If we can help you by sharing more findings from our study or help analyze your book, just ask your Gen Re representative.