-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

That’s a Robotaxi in Your Rear-View Mirror – What Does This Mean for Insurers?

Publication

Cat Bonds – A Threat to Traditional Reinsurance?

Publication

Decision-Making in the Age of Generative Artificial Intelligence

Publication

Buildings Made of Wood – A Challenge For Insurers?

Publication

The CrowdStrike Incident – A Wake-Up Call for Insurers?

Publication

PFAS Awareness and Concern Continues to Grow. Will the Litigation it Generates Do Likewise? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

When Actuaries Meet Claims Managers – Data-Driven Disability Claims Review

Publication

Chronic Pain and the Role of Insurers – A Multifactorial Perspective on Causes, Therapies and Prognosis

Publication

Fasting – A Tradition Across Civilizations

Publication

Alzheimer’s Disease Overview – Detection and New Treatments

Publication

Simplicity, Interpretability, and Effective Variable Selection with LASSO Regression Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Secondary Peril Events Are Becoming “Primary.” How Should the Insurance Industry Respond?

August 20, 2024

Timothy Fletcher

Region: North America

English

Update to our December 6, 2023 blog:

As Secondary Peril Events Continue, The Destructive Song Remains the Same in 2024

As we move through 2024, secondary peril events and Severe Convective Storms (SCS) continue to wreak havoc on personal residences, commercial enterprises, and their insurers. The year began with predictions that a rapid shift from an El Niño to a La Niña climate cycle, coupled with other factors such as the sun entering its solar maximum, would result in an even more extreme SCS season in 2024, with the number of tornadoes likely to be once again well above average and the most since 2020 and 2021. Additionally, those projections stated that we’d see more tornadoes than hail events, due to warmer and wetter weather rather than the cool and dry atmosphere previously seen that foments hail formation.

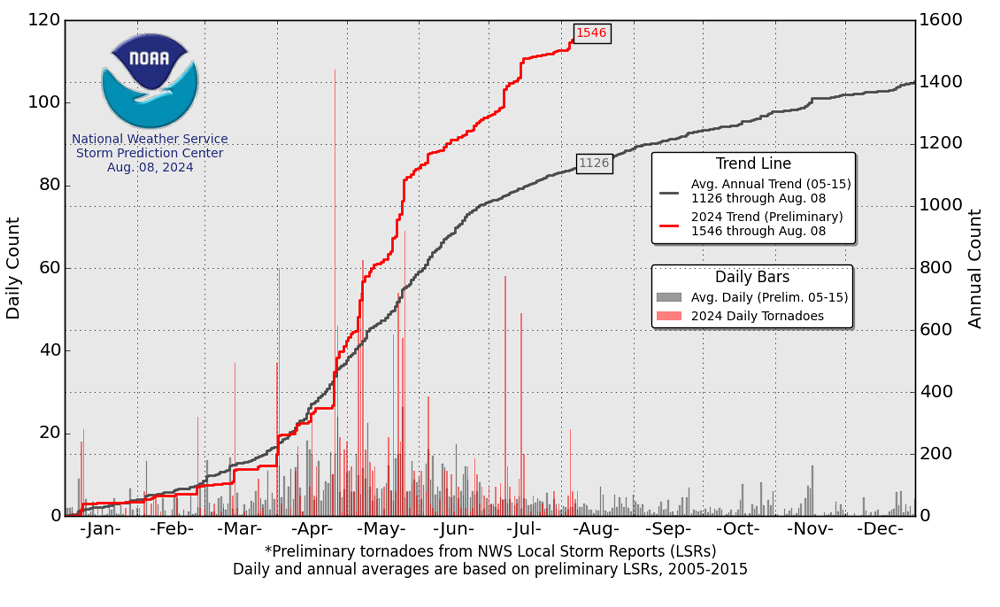

Data points through the end of July would seem to validate those forecasts. Tornadoes are near historic highs in both numbers and annual trend:

U.S. Tornadoes – Daily Count and Running Annual Trend*

Source: NOAA’s National Weather Service Storm Prediction Center, https://www.spc.noaa.gov/wcm/

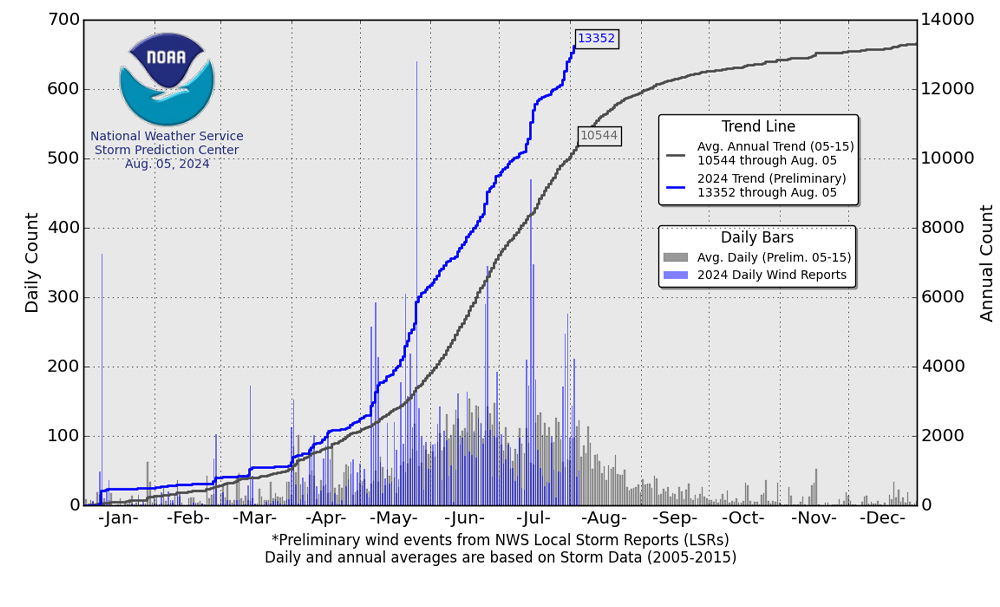

Relatedly, the number of wind events – which can include windstorms, high winds, and damaging winds – are well above historical trends:

U.S. Wind Reports – Daily Count and Running Annual Trend*

Source: NOAA’s National Weather Service Storm Prediction Center, https://www.spc.noaa.gov/wcm/pwindgraph-big.png

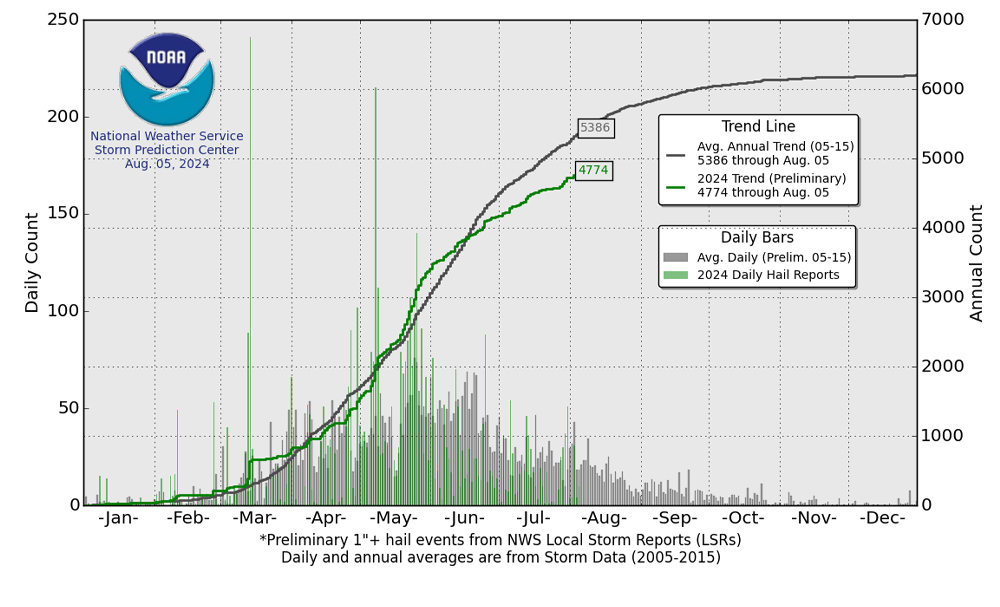

As to hail, the number of events with stones at least 1” is running behind what would historically be expected, in line with projections:

U.S. Hail Reports – Daily Count and Running Annual Trend*

Source: NOAA’s National Weather Service Storm Prediction Center, https://www.spc.noaa.gov/wcm/phailgraph-big.png

Whether these trends continue remains to be seen. Regardless, severe weather continues to fuel increased loss frequency and severity. In this environment, proactive risk and accumulation management remain vital, as does pricing that responds to increased uncertainty.

Secondary Peril Events Are Becoming “Primary.” How Should the Insurance Industry Respond?

December 6, 2023

The images they generate startle the mind, even as they become increasingly commonplace. Campers mired in mud, unable to depart from the Burning Man festival in the remote desert of Nevada. Residents using canoes rather than cars to traverse deluged city streets. Swaths of communities wiped out by fast-moving tornadoes and large hailstorms, increasingly outside of traditional seasonality and geography.

Public attention has historically been directed toward large-scale catastrophes such as tropical storms and hurricanes due to their size and scope. However, recent events have steered public attention and industry focus to what are known as “secondary perils,” generally defined as smaller to mid-sized events, such as a severe convective storm (SCS) or the floods and storm surge that follow “primary” hurricanes and tropical storms.1

Severe Convective Storms

SCS events are common, destructive, and largely unique to the United States due to its geography. In contrast to Europe where the Alps serve as a barrier to separate cold air from the North and warmer air from the South, air masses in the continental U.S. have free rein to collide over the Midwest and Great Plains, potentially generating destructive tornadoes and thunderstorms.2 Additionally, continued population growth in areas susceptible to hail and thunderstorms poses a growing challenge for the insurance industry.3

As would be expected, loss costs are escalating. As discussed in a Triple‑I Issues Brief, “[a]s of late September, U.S. insured SCS-related losses exceeded $50 billion for the first time on record for a single year,” highlighted by significant hail losses around the Dallas-Fort Worth metroplex and Hot Springs, Arkansas.4 The map below shows the approximate location of severe convective storms that resulted in $1 billion or more in damages as of August 2023.

Severe Weather Storms

Extreme Rain Events

Adding to the concern represented by SCS activity is the recent increase in the number of extreme rain events, defined as “days with precipitation in the top 1 percent of all days with precipitation.”5 Put another way, extreme precipitation can be described as intense, localized heavy rain and snowfall events that occur within a relatively short timeframe.6 Further, some research suggests that “[h]eavy precipitation is becoming more intense and more frequent across most of the U.S., particularly in the Northeast and Midwest.”7

Total Annual Precipitation Falling in the Heaviest 1% of Events (Observed change 1901‑2016)

Multiple extreme rain events during 2023 seemingly support this assertion. For example, the table below shows selected significant rain events that occurred between July and September 2023.

Selected Significant Recent Rain Events (2023)8

|

Date |

Location |

Description |

|---|---|---|

|

July 8, 2023 |

Chicago, Illinois |

Record-breaking rainfall of 8.12 inches in Garfield Park area |

|

July 10, 2023 |

Montpelier, Vermont |

Record-breaking 5.28 inches of rain |

|

July 18‑19, 2023 |

Mayfield, Kentucky |

State record-breaking rainfall of 11.28 inches of rain |

|

September 1‑3, 2023 |

Las Vegas, Nevada |

Portions of the city received more than three inches of rain, flooding streets and sidewalks |

|

September 11, 2023 |

Duluth, Minnesota |

6.62 inches of rain fell in portions of city, generating flash floods and closing I‑35 |

Intuition may tell you that “1‑in‑100 year” events like those listed above are occurring more frequently than that – and a recent study by the non-profit First Street Foundation (FSF) confirms it. Using early 21st century research data, FSF found that the U.S. will experience more occurrences of extreme precipitation (heavy rainfall) in the future and that the recent experiences of catastrophic events seen over the last few decades should be treated as the “new normal” for many areas.9 FSF also noted that flood risk will continue to worsen in the near and long term due to climate change; in some areas, a flood risk previously associated with a 1‑in‑100 year event may now occur as often as every ten years in the most severe case, and in the next 30 years, such events may be better characterized as even more frequent (a 1‑in‑5 year event for instance).10

Is a Warming Atmosphere the Cause?

As air temperatures increase, the atmosphere can carry greater amounts of water vapor and then discharge that moisture through heavy rainfall. To illustrate, for every 1°C increase (1.8°F) in temperature, the same air volume carries 7% more water vapor.11 As a result, increased temperatures have changed expectations for the Intensity, Duration, and Frequency (IDF) of rainfall events, with occurrences previously thought to occur only once every 100 years now taking place with greater frequency.12

Some scientists believe that warming air may be increasing hailstone size but advise that more research is needed.13 Other research suggests that a warming atmosphere may be more conducive to forming thunderstorms “with strong updrafts that can support the development of larger hailstones” that would hit the earth while also forming smaller hailstones that would likely melt before reaching the ground.14

At this juncture, it should be noted that much more needs to be learned as to what’s driving the increase in extreme weather events, whether society is in fact on the precipice of an ominous “new normal,” and the extent to which the frequency and severity of extreme weather events can be reliably predicted. Regardless, progress is being made through a new wave of modeling that attempts to meld the “general circulation models,” which base large-trend forecasts on physics with “catastrophe risk” models that use historical data to infer future probabilities of hurricanes, earthquakes and the like.15 Over time, the hope is that greater modeling precision that considers both human-caused climate change and seasonal weather patterns such as El Niño and La Niña will result.16

Underwriting Takeaways

- Severe-event frequency is increasing.

While science and data analysis continue to establish patterns and forecast trends, carriers need to plan for a future filled with more severe weather events. - Insurers should fund for these events over time.

Loss activity can decimate any given accident year. However, the period to recover those losses takes longer. Pricing needs to account for that reality, and the reality that more frequent severe events will occur going forward. In many regions, increasing the portion of rates allocated to weather will help manage volatility. - Risk concentration needs to be managed.

Multiple data points tell us that risk-prone areas continue to experience significant and rapid population growth. As a result, carriers will need to closely monitor demographic changes and guard against concentration of risk. - Risk quality matters.

Now more than ever, resiliency matters. This ranges from buildings constructed to withstand extreme weather events to robust business continuity plans to minimize disruptions when extreme weather events take place. As an example, risk inspections focused on roof quality and maintenance will help with risk selection. Coverage adjustments to deductibles, and types of roof coverage will help keep loss amounts manageable.

Many regions of the U.S. have experienced increased frequency of severe weather events, driving increased loss activity. While long-term trends on weather are difficult to predict, carriers will benefit from proactive risk and accumulation management. Insurance pricing and coverage also need to be adjusted to respond to increased risk and uncertainty. Please reach out to me or your Gen Re representative with questions or to learn more about this topic.

- https://resilience.iii.org/resilience-blog/general/whats-in-a-name-secondary-perils-may-be-outliving-theirs

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/insurers-hit-hard-as-us-hailstorms-grow-more-severe-costly-in-warming-climate-76991910#:~:text=14%20Aug%2C%202023-,Insurers%20hit%20hard%20as%20US%20hailstorms,severe%2C%20costly%20in%20warming%20climate&text=Severe%20hailstorms%20that%20scientists%20believe,the%20first%20half%20of%202023

- Ibid.

- https://resilience.iii.org/resilience-blog/convective-storms/severe-convective-storm-loss-trends-highlight-need-for-timely-granular-data

- https://www.globalchange.gov/indicators/heavy-precipitation

- https://firststreet.org/research-lab/published-research/article-highlights-from-the-precipitation-problem

- Id. at note 5.

- https://www.noaa.gov/stories/july-2023-brought-record-high-temperatures-devastating-floods-across-us; https://abcnews.go.com/US/wireStory/las-vegas-drying-after-2-days-heavy-rainfall-102895595; https://www.wdio.com/front-page/top-stories/flooding-and-high-rainfall-totals-overnight-in-and-around-duluth

- Id. at note 6.

- Ibid.

- https://www.pik-potsdam.de/~stefan/Publications/Nature/Coumou_Rahmstorf_NCC2012.pdf

- Id at note 6.

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/insurers-hit-hard-as-us-hailstorms-grow-more-severe-costly-in-warming-climate-76991910

- Ibid.

- https://www.wsj.com/business/entrepreneurship/climate-risk-is-becoming-uninsurable-better-forecasting-can-help-b9c94ca6?st

- Ibid.