-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Biometric Information Privacy – Statutes, Claims and Litigation [Update]

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Illinois Changes Stance on Construction Defect Claims – The Trend Continues

Publication

Generative Artificial Intelligence in Insurance – Four Aspects of the Current Debate

Publication

Battered Umbrella – A Market in Urgent Need of Fixing -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Publication

Underwriting High Net Worth Foreign Nationals – Considerations for U.S. Life Insurance Companies

Publication

Group Term Life Rate & Risk Management – Results of 2023 U.S. Survey

Publication

Trend Spotting on the Accelerated Underwriting Journey

Publication

All in a Day’s Work – The Impact of Non-Medical Factors in Disability Claims U.S. Industry Events

U.S. Industry Events

Publication

Marginal Gains in the Medicare Supplement Market -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

New Ways of Looking at Income Protection

October 28, 2020

Carina Betz

Region: Germany

English

Deutsch

How many times have you heard that insurers must innovate in order to remain relevant and thus maintain growth? It’s hard to argue with that but developing insurance solutions that are attractive to an evolving consumer base is a real challenge.

We think about it a lot at Gen Re, especially in the context of Income Protection (IP) insurance products that will appeal to young people. One approach, which has produced some fascinating results, came out of a research initiative between Gen Re’s international underwriting department in Cologne and the Cologne University of Applied Sciences. A collaborative project conducted by four risk and insurance “masters” students, its aim was to find out how insurers could increase the acceptance of exclusions and loadings for IP products.

The research, which drew on behavioral economic (BE) theories, was based on interviews with several primary insurance carriers and agents, an insurtech and, most importantly, a target group of young people (students in the age bracket 20-30). The team examined several different theories of cognitive bias, an important focus of BE, in relation to marketing IP insurance. They then suggested ways of addressing bias in the insurance offering.

Tackling Loss Aversion

Prospect theory, for example, is a behavioral model that explains how people decide between alternatives that involve risk and uncertainty. For most of us a loss hurts more than a gain feels good (loss aversion). Also, the perceived value of a good increases when you own it (endowment effect).

In the context of IP cover, the customer sees loadings and exclusions as a loss. The student researchers suggested that one approach to counter that perception could be to create an additional benefit, especially for people with loadings/exclusions; e.g., offer supplementary health assistance services. This could be in the form of nutritional advice or suggestions for exercises and workouts. A spin-off benefit for the carrier is that this approach would create a long-term, positive contact point with the insured.

To counter loss aversion and enhance the endowment effect, the researchers proposed offering an option to review the underwriting decision. Because applicants often think it’s unlikely that their conditions will reoccur, the possibility of obtaining normal cover after a certain time is quite appealing to them.

Interviews with the target group showed that such efforts from an insurer are viewed very positively and are seen as a concession, especially if well-explained.

The student researchers took the idea further and suggested offering applicants the potential to actively change the underwriting decision by improving their health. This could be done by fulfilling certain predefined criteria, such as successful physio and rehabilitation, participation in preventive sports classes, or set hours of workout with a health app.

The target group liked the idea of working together with the insurer to achieve a common goal - improving their health, reinforcing the experience of health insurers with similar concepts that offer bonus schemes.

Out of the Exclusion Zone

Reactance theory is another aspect of cognitive bias examined by the project. The theory states that individuals want to have options; if no choice is given, the single option automatically appears less attractive. With IP, the applicants feel restricted by the requirement to accept an exclusion (in their minds unjustified) in order to get insurance cover.

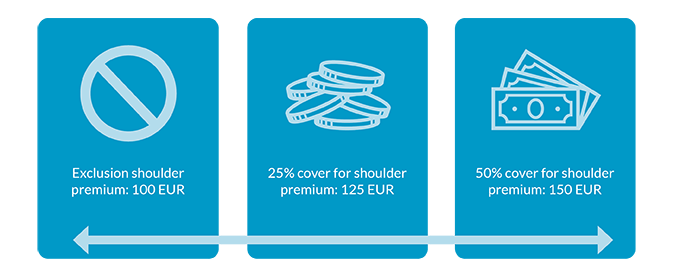

The researchers came up with the idea of identifying situations and combinations of impairments where an exclusion would normally be recommended, and offer instead partial cover of the excluded impairment via an additional premium payment.

Consider an applicant who has experienced a sport-induced injury to his shoulder. Three years after successful surgery, the client mentions that he still has problems with his shoulder from time to time. But he has no limitations and no time off work. Also, he has consulted a doctor, who has confirmed that he does not require any further treatment or follow up.

The applicant is young and healthy, regularly does sports and has a sedentary occupation. It follows that disability due to the minimal shoulder impairment is not impossible, but quite unlikely.

In this case, where a carrier might apply an exclusion, other options could be offered:

To BE or Not to BE?

These examples, though not fully realized solutions, demonstrate how innovative thinking from younger people around BE can help insurers create new concepts to drive growth and differentiate themselves.

We certainly learnt a lot from this research and it produced a number of other novel suggestions that we would be happy to share with you.

Contact me if you want to look more closely into any specific IP ideas: we could even consider starting a pilot project together.