-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Expertise

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves? -

Life & Health

Life & Health Overview

Life & Health

Gen Re’s valuable insights and risk transfer solutions help clients improve their business results. With tailor-made reinsurance programs, clients can achieve their life & health risk management objectives.

UnderwritingTraining & Education

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

What Are We to Make of Cannabis Use in The Insured Population? Business School

Business School

Publication

Knife or Needle: Will the New Weight Loss Medication Replace Bariatric Surgery?

Publication

Weight Loss Medication of the Future – Will We Soon Live in a Society Without Obesity? Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Tool for the Times – Art and Smart of Claims Triaging

May 19, 2020

Fionna Kossmann

English

The world of insurance is changing. These changes are particularly affecting the claims space, with a rise in the complexity of claims, not only in terms of assessing complex medical conditions, but also related to changes in occupation: people are now holding several jobs, giving them multiple income streams. The nature of employers and their approach to benefit provision and appetite for return-to-work post disability strategies has diminished – a negative outcome for employees and insurers alike. The consumer, too, has become far more aware of the dispute process and the impact that social media can have in influencing claims decisions.

The way we assess claims therefore has had to change. We have seen increased investment in upskilling of assessors and creating new capacity within the specialty within the past 18 months. However, some of this investment has come too late and created a slight vacuum in the number, level and capacity of assessors able to keep pace with change. This is exacerbated in a developing country – such as South Africa – where the competition for scarce talent is fierce.

In seeking a solution for our client partners, Gen Re created a tool to assist in improving the efficiencies and effectiveness of claims assessment by accelerating the closing of the gap between the market shift and the assessor skill level.

This tool, aptly named the Claims Triaging Tool, was initially developed in Australia to address some of the challenges in the Disability space. These challenges are like what we are currently seeing in the South African market. In addition to the challenges outlined above both markets experienced increased claims volumes, sustained regulatory pressure to pay claims and declining termination ratios and as a result, significant risk losses on Disability business.

The tool is particularly useful in identifying claims where the termination rate is likely to be worse than expected, i. e. claims that are at risk of becoming “stuck”. It looks at the optimal timing for the most effective intervention, such as review of a claim or rehabilitation, to get maximum efficacy.

How it works

The tool works by assigning a risk score to a claim using a claim risk calculator to evaluate the potential risk or complexity of a claim. Currently, claims are typically prioritised by the claims manager. However, the disadvantage of this approach is that all knowledge about claims triaging or allocation sits with one or two individuals. This method is manual and subjective, and claims are not allocated to the assessor who has the best skill set for that specific claim.

By using the tool, we can quantify the potential risk value a claim may present and determine on that basis which resource (assessor) is best suited to manage that risk based on his or her skills and experience. In our experience, the correct allocation of claims solves multiple issues, but fundamentally, in a consumer-dominated world, it speeds up the decision process and accuracy for the claimant. By triaging the match of experience to complex and simple, it prevents volatility in the turnaround speeds. It also removes the noise and expense of calls for unnecessary second opinions and documentation.

We live in the age of artificial intelligence (AI) and automation, so these kinds of functions should be done smartly and automatically. The advantages of a knowledge-based claims allocation system mean that claims are matched with the right skill set. This may require more upfront effort in determining where the claim should go, but it will save time down the line.

The risk-scoring

Examples of risk-scoring are:

- Policy duration – The longer a policy has been in force, the “safer” the claim is likely to be because it removes concerns over non-disclosure and anti-selection. A claim on a newer policy would have a higher risk score compared to one that has been in force for a long time.

- Sum insured – The higher the claim amount, the higher the risk score.

- Medical diagnosis or cause of claim – The more complex the medical condition or impairment, the higher the risk score.

- Age of the claimant – Younger claimants are more likely to be on claim for longer, therefore the higher the risk score.

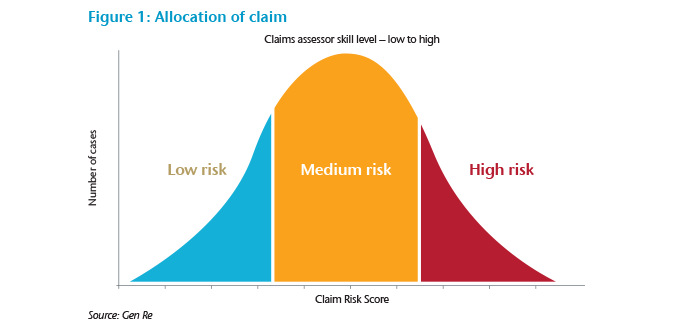

Once the overall risk score of a claim has been calculated, the claim can be allocated to the appropriate assessor. Each assessor should be allocated a risk score based on his or her level of experience. The scores can then be clustered into groups of risk scores and the claim assigned accordingly. The bell curve in Figure 1 is what you would expect the distribution of the work load to be in relation to the assessors’ experience. Junior assessors will have lower claims volumes and receive lower risk claims to assess due to less experience and the fact that they generally take longer to assess claims initially. The more senior assessors will also have lower claims volumes, but will assess higher risk and more complex claims, which take more time. The intermediate assessors will generally assess the bulk of the claims with a medium risk, therefore will have the highest claims volumes.

Benefits of using the tool

After using this tool for a while with the South African claims team, we have seen several benefits:

- Improved turnaround-times – Claims are allocated more efficiently, thereby saving time and improving internal processes.

- Data analysis – We have been able to gather very interesting data and useful insights on the profile of claims that we process. This has also enabled us to identify the growth path for assessors to progress from junior to intermediate to senior.

- Accuracy – We have found it to be very accurate in the sense that it correlates to the intuitive feeling that experienced assessors get regarding the complexity of a claim. After running our existing claims through the tool, we have found the score to be accurate in terms of high scores being allocated to those claims that have been particularly difficult to manage.

- Improved risk management – By enabling teams to match complexity of claims to assessor skill set, overall risk management is significantly improved.

- Adaptability – The tool was designed specifically for Disability claims but could easily be adjusted to use for other benefits.

- Claims management – Once a claim is assessed and admitted, the tool can be used to identify which claims to review and to decide the frequency of reviews. We often receive information at review stage that just confirms that the condition has not changed. This means that reviews become a tick box exercise. Using the tool can ensure that the reviews are more effective.

A criticism of the tool is that it limits learning for the more inexperienced assessor. In the short term this could be correct, but in the hands of a skilled manager the triaging enables the manager to monitor the development curve of the more inexperienced assessor. Knowing the score of a claim enables a manager to “test and learn” with a team what happens when a higher scored claim is allocated to a less skilled assessor; this then benchmarks the assessor’s improvement milestones and exposes gaps that need development.

Where do we go from here?

There is empirical and practical science behind this tool as it is built on data from both our Australian colleagues and our own experience in the South African context. We would like to see the tool automated and integrated into our day-to-day process so it can be used for allocation, reviews and linking to individual assessor’s authority limits and performance measures.

The end goal is to create a more effective and efficient way of assessing and processing claims. This will ensure improved overall risk management, better client service and more effective claims management.