-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Engineered Stone – A Real Emergence of Silicosis

Publication

Use of Artificial Intelligence in Fire Protection and Property Insurance – Opportunities and Challenges

Publication

Generative Artificial Intelligence and Its Implications for Weather and Climate Risk Management in Insurance

Publication

Public Administrations’ Liability – Jurisprudential Evolution, Insurance Implications, and a Comparative Analysis Across Countries

Publication

Risk Management Review 2025

Publication

Who’s Really Behind That Lawsuit? – Claims Handling Challenges From Third-Party Litigation Funding -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

AI Agent Potential – How Orchestration and Contextual Foundations Can Reshape (Re)Insurance Workflows

Publication

Diabetes and Critical Illness Insurance – Bridging the Protection Gap

Publication

Group Medical EOI Underwriting – Snapshot of U.S. Benchmark Survey

Publication

Why HIV Progress Matters

Publication

Dying Gracefully – Legal, Ethical, and Insurance Perspectives on Medical Assistance in Dying Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Workers’ Comp – Emerging “Stronger Together”

June 02, 2021

Bill Lentz

Region: North America

English

2021 NCCI’s Annual Issues Symposium – Gen Re Summary & Highlights

Acknowledging that COVID-19 did not have the dire impact on Workers’ Compensation that had been expected and feared, the Annual Issues Symposium (AIS) confirmed continued profitability for the line in 2020. With strong year-end results and a reopening economy, there is confidence in the resilience of the Workers’ Comp system, however, there are still challenges to face and the pandemic has created new uncertainties for 2021 and beyond.

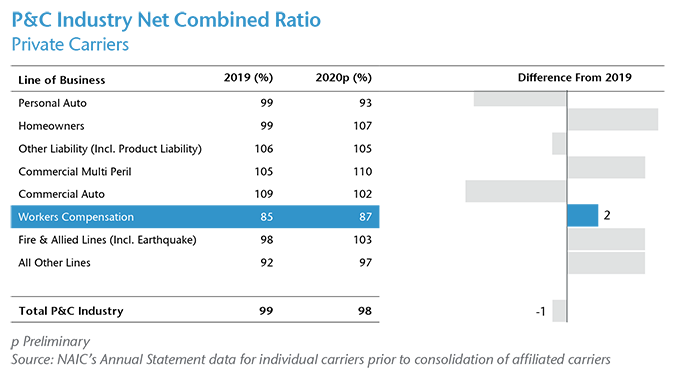

The Calendar Year 2020 combined ratio of 87% for private carriers is now the seventh consecutive year that Workers’ Comp has posted an underwriting gain and the fourth consecutive year of results under 90%. Remarkably, the last three years have been the lowest combined ratios for Workers’ Comp since the 1930s. The Workers’ Comp results compare favorably to the overall P&C combined ratio of 98% for 2020, and it continues to be the most profitable of all the P&C lines of business.

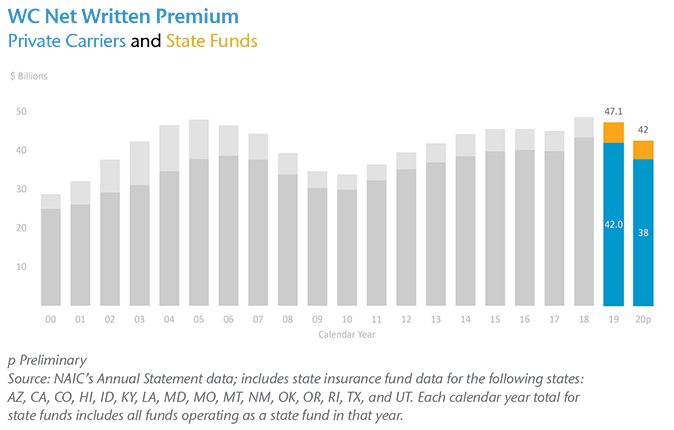

While the combined ratio for Workers’ Comp remains strong, net written premium decreased by 10% from 2019, largely due to the significant drop in payroll resulting from the pandemic. Job losses related to COVID-19 mostly impacted low-wage workers, with the Leisure and Hospitality sector being the hardest hit, while the ability to work remotely helped to maintain stability in the professional services area. Overall job growth has been improving from an employment gap of -16% in April 2020 to -5.4% in March 2021.

2021 NCCI AIS Highlights

(regarding prelim 2020 WC results)

- 87% combined ratio on a calendar year basis (AY 100%) for private carriers

- 20209 net written premium decreased by 10% to $42B

- Investment gain on insurance transactions increased to 11%

- -7% change in lost-time claim frequency, a larger than average decline likely due to shutdowns and remote work

- Medical severity estimate is between a -2% and +2% change from 2019

- Reserve position estimated to have grown to a $14B redundancy

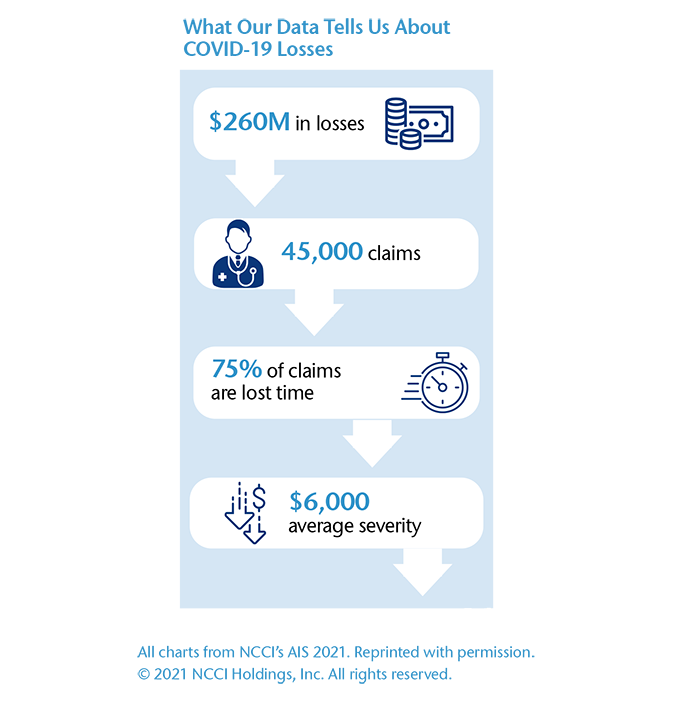

- COVID-19 WC losses of $260M from 45,000 claims with average severity of $6,000

NCCI CEO Overview

NCCI’s President and CEO Bill Donnell opened the 2021 AIS by recalling how there were questions a year ago about the resiliency and responsiveness of the Workers’ Comp system to the pandemic that had recently taken hold. Commenting on how COVID-19 was not the claims event that we feared it would be, Mr. Donnell commended the industry stakeholders for stepping up quickly to shift to remote work models and embracing technology in order to continue to deliver on the promise to injured workers and by making workplaces safer.

The pandemic is not over... However, Mr. Donnell believes that having gone through it, we, as people and as an industry, are now stronger and more resilient than ever, hence the “Stronger Together” theme of this year’s AIS. In looking ahead, Mr. Donnell stressed that Workers’ Comp stakeholders continue to focus on responsiveness, resilience, and fresh thinking. Challenging our assumptions about the future is a necessary part of planning for unknowns.

While proud of how the Workers’ Comp system rose to the challenge of the pandemic with integrity, Mr. Donnell also expressed his gratitude for how the NCCI team did their part by developing COVID-19 tools, research and insights to help the industry make informed decisions. We agree! Thank you, NCCI!

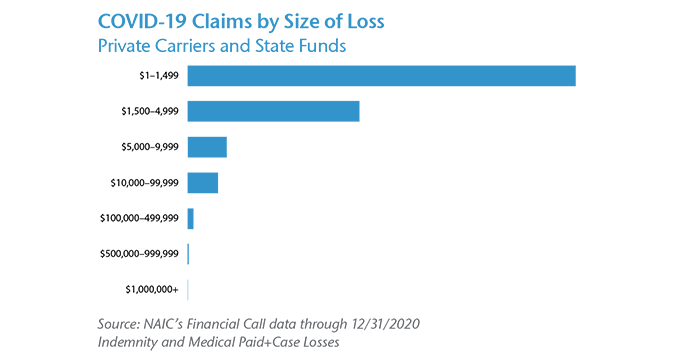

COVID-19 Losses

According to NCCI data, there were $260M in incurred Workers’ Comp losses related to COVID-19 in 2020. This consists of approximately 45,000 claims which had either a reserve or payment associated with them (does not include report only). While 75% of these matters involve lost-time, the majority were indemnity only and likely involved employees who tested positive and were required to quarantine but did not require medical treatment. With regard to the distribution of claims within Workers’ Comp, healthcare employees and first responders make up 75% of all COVID-19 losses with essential workers being an additional 15%, followed by all others. Of the total, approximately one-third of the claims arose from the nursing / convalescent home industry.

The average severity of Workers’ Comp COVID-19 claims with incurred loss is $6,000. However, 95% have incurred loss of less than $10,000 and 60% of the total incur less than $1,500. While claims that have over $100,000 in incurred loss represent approximately 1% of all Workers’ Comp COVID-19 claims, they account for 60% of the overall amount of loss dollars. Claims in this category likely required inpatient hospitalization and tended to involve employees who were older than the average age of workers impacted by COVID-19 and were likely to have one or more comorbidities.

While the long-term effects of COVID-19 are uncertain, there is concern regarding the potential for escalated medical conditions and permanent injury from certain claims which experience high severity, referred to as “long-COVID” or “longhaul.” Per early data, employees who required hospitalization showed a 12% readmission rate six months after initial discharge for issues such as pneumonia and sepsis. As treatments evolve, so will this data.

As NCCI continues its analysis, issues to keep tabs on include; the speed of the economic recovery and its impact of Workers’ Comp premiums, the impact of vaccines on future COVID-19 variants and surges, and further insight into the long-haul health effects and loss development.

NCCI State of the Line

The State of the Line report was presented by Donna Glenn, Chief Actuary for NCCI, with assistance from several of her NCCI colleagues, Len Herk, Executive Director and Senior Economist, Nadege Bernard-Ahrendts, Practice Leader and Senior Actuary, and Sean Cooper, Practice Leader and Senior Actuary. This report provides a detailed review of results, trends, and cost drivers in the Workers’ Comp industry. The 2020 data is preliminary.

The full report is available at NCCI.com, but here are some highlights from Ms. Glenn’s presentation:

- WC Premium – Countrywide private carrier direct written premium decreased by 8.7% between 2019 and 2020. Net written premium for private carriers in 2020 is $38B. Private carrier and state fund combined net written premium is $42B, a 10% decrease from 2019. Payroll reduction during the pandemic played a significant part in this decline. Based on NCCI filings, it is estimated that written premiums will decrease by 5.6%, on average, from 2020 to 2021.

- WC Residual Market – The NCCI-serviced Residual Market Pool premium declined by 8.7% in 2020 to approximately $800M.

- WC Net Combined Ratio – The calendar year combined ratio for private carriers is 87%. While a 2-point increase over 2019, it’s the fourth consecutive year of results under 90%. The 2020 accident year combined ratio is 100%. While NCCI believes it will develop favorably over time, it also estimates that the pandemic may possibly add up to three points to the overall AY combined ratio.

- Investment Results – WC investment gain on insurance transactions reflects a small increase to 11% over 10.6% for 2019. While trending higher, it remains below the long-term average of 12.2%.

- Pre-Tax Operating Gain – The 2020 pre-tax operating gain of 24% would have been higher but for the 2-point increase in the combined ratio, which offset this improvement. While slightly below the 2019 gain of 25.2%, it is the fourth straight year with results over 20%.

- Reserve Adequacy – NCCI estimates the 2020 WC reserve position for private carriers to have grown to a $14 billion redundancy, as compared to the $10 billion redundancy for 2019. This is a stark contrast to an approximate $12 billion deficiency that existed in 2012.

- Claim Frequency – Excluding COVID-19 related claims, WC lost-time frequency for AY 2020 is estimated to be 7% lower than 2019. This reduction is much larger than the -3.9% long-term average and is likely due to shutdowns related to the pandemic and increase in working remotely. NCCI estimates that adding the COVID-19 claims back in would result in a frequency change of -2%, which is more in line with the long-term average.

- Indemnity Severity – The 2020 average indemnity claim severity is estimated at $25,400, which is a 3% increase over 2019. Development in this area has been consistent and has closely tracked the change in average weekly wage for the past 20 years.

- Medical Severity – It is estimated that the average medical cost per lost-time claim for 2020 will be between a -2% and +2% change from 2019. NCCI notes there is uncertainty here due to pandemic-related impact on the percentage of medical-only claims, along with the distribution of claims by injury type and hospital inpatient facility utilization.

Summary of NCCI Observations

2020 Positives:

- Not the COVID-19 claims event we feared

- Continued profitability

- Positive operating margin

- Very strong reserve position

- Further decline in claim frequency

2021 Challenges:

- Further impact of COVID-19; variants/surges/long-haulers

- Economic recovery / Premium growth

- Closure of employment gap

- Potential impact of presumption law expansion on costs

- Possible increase in frequency due to workers in new jobs

Gen Re Note

As Bill Donnell noted, this has been a humbling year. The COVID-19 pandemic has touched all of us, both personally and professionally. We share in the gratitude that has been expressed throughout the AIS for the frontline and other workers that continued to provide essential services throughout this difficult time.

Workers’ Comp did not have the claim event that we were concerned about last year, and aside from the decline in rates and premium, it finished 2020 with solid financials. This is good news. As an industry, we should also be proud that we were able to quickly pivot to a remote working model, which allowed us to protect our own employees while continuing to serve employers and injured workers. Speaking to clients throughout the year, we were pleased to learn that despite the altered working environment, training programs continued, new employees were onboarded, and systems and processes continued to be upgraded. We adapted!

Now, as the pandemic hopefully continues to wane, we face new challenges and uncertainties in addition to those which were on our minds pre-COVID-19. In addition to the commitment to strong core functions and long-term planning, we will need, as Bill Donnell put it, “fresh thinking.”

Gen Re is in our 100th year of reinsurance relationships. We look forward to working together towards your continued success. Stay safe, stay healthy, and stay strong!

We express our appreciation to NCCI for giving us permission to reproduce materials from its 2021 Annual Issues Symposium.

About NCCI

Founded in 1923, the mission of the National Council on Compensation Insurance (NCCI) is to foster a healthy workers compensation system. In support of this mission, NCCI gathers data, analyzes industry trends, and provides objective insurance rate and loss cost recommendations. These activities – combined with a comprehensive set of tools and services – make NCCI the source you trust for workers compensation information.