-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Insurtech and Claims Management - An Asian Perspective

March 28, 2019

Pei Nee Yong

Region: Asia

English

Technology is revolutionising the insurance industry in Asia, transforming functions right across the value chain - and the Life/Health sector is not missing out.

Insurtech developments, especially around blockchain, Artificial Intelligence (AI) and the Internet of Things (IoT), are providing faster on-boarding, automated workflows for claims processing as well as underwriting - all with improved customer experience.

Digital applications, such as chatbots, are simplifying and speeding up the process of buying a policy. Meanwhile, data analytics provides the potential to re-invent underwriting, pricing, product design, claims management and customer segmentation techniques.

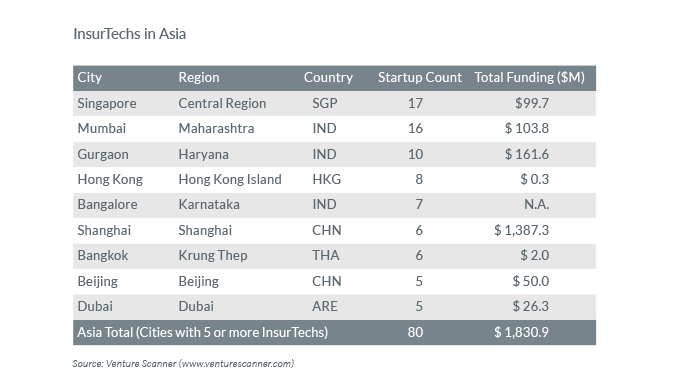

The insurtech market in Asia is still small in global terms. Willis Towers Watson note in their Asia Insurance Market Report 2018 that there are around 1,500 insurtech start-ups globally, of which 100 come from Asia.

Singapore, China and Hong Kong are the most advanced regions, but Malaysia, Indonesia, Thailand and Vietnam have also recently made regulatory provisions to allow for the development of local insurtechs.

The digitisation of claims specifically is still in its infancy in Asia, and most Life/Health insurers are a long way from fully integrating digital technology into their claims processes. Across Asia right now, claims digitisation mostly revolves around online electronic and mobile claims payments for relatively small sum assured claims, applicable to a limited range of products.

Yet many health insurers are looking closely into end-to-end digitisation of the whole claims journey, with the aim of providing simpler and faster claims services.

The pace of digital innovation in the Chinese insurance market has far surpassed that of other markets, driven by giant tech platforms - such as Alibaba and Tencent - with a total of nearly 725 million mobile Internet subscribers. Consulting firm Accenture expects online insurance sales to represent 12% of the country’s insurance market by 2018.

Zhong An Insurance, China’s first online-only insurer, launched in 2013 as a joint venture between founding partners Ping An Insurance, Tencent and Alibaba. It entered into the health insurance area in 2016 by offering a high-deductible medical reimbursement product. Premiums reached CNY100 million in just four months: Over 60,000 policies were sold in eight days when the second-generation product was launched in 2017.

Ping An Health uses mobile Internet and big data technology in its claims services. In May 2017, the company upgraded the online claims service for its e-Life insurance product, slashing claims settlement times from four days to 19 minutes.

Singapore, one of the world’s leading fintech and insurtech hubs, is moving fast. Digital life insurers started their operations in Singapore around two years ago, with Etiqa, FWD and Singapore Life at the forefront. A regulatory sandbox created by the Monetary Authority of Singapore (MAS) allows experimentation with innovative business models within pre-defined boundaries.

An example is “Vitana”, delevoped by Lumenlab, Met Life Asia’s tech development hub and launched in August 2018. The prodcut provides cover against medical expenses associated with gestational diabetes. It is downloaded as an App and uses blockchain technology to trigger claims payments automatically.

Policypal (by PayPal), Singapore’s first graduate from the insurtech sandbox, obtained a Digital Broker license in September 2017. It provides a mobile digital platform for policyholders to manage their insurance cover and buy new policies.

In January 2018 NTUC Income became the first to offer Singapore’s Integrated Shield Plan (IP) digitally via an online portal, establishing a new benchmark in terms of accessibility, convenience and speed. The IP can be purchased, claimed and managed anytime and anywhere. The online portal allows photo submission of the hospital bill; claiming a pre- and post-hospitalisation bill can be completed in seconds.

The insurance industry in Hong Kong is also undergoing an accelerated digital transformation. Launched this past September, digital life insurer Blue is a joint venture between Aviva Hong Kong, Tencent Holdings and Hillhouse Capital. The insurer offers a flexible term Life insurance and simple Critical Illness product online.

Like Singapore, Hong Kong’s regulator introduced an insurtech sandbox that has already spawned a one-stop e-claim web portal and chatbots. In 2018 we saw FWD Hong Kong launch a series of claims services, including a one-stop e-claim web portal and mobile app that supports claims submissions and other policy services. Meanwhile, Manulife launched an e-claims solution, claimsimple.hk, that allows policyholders to make a medical insurance claim online.

Gen Re can help our clients in Asia advance their digitisation agendas, and our colleagues are looking forward to collaborating with Life/Health insurers on tech initiatives. Together we can develop a digital Life/Health business ecosystem that suits the region’s tech-savvy millennials, but also caters to the growing healthcare needs of the region’s ageing population.