-

Property & Casualty

Property & Casualty Overview

Property & Casualty

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Trending Topics

Publication

Production of Lithium-Ion Batteries

Publication

Time to Limit the Risk of Cyber War in Property (Re)insurance

Publication

Generative Artificial Intelligence in Insurance – Three Lessons for Transformation from Past Arrivals of General-Purpose Technologies

Publication

Human Activity Generates Carbon and Warms the Atmosphere. Is Human Ingenuity Part of the Solution?

Publication

Inflation – What’s Next for the Insurance Industry and the Policyholders it Serves?

Publication

Pedestrian Fatalities Are on the Rise. How Do We Fix That? -

Life & Health

Life & Health Overview

Life & Health

We offer a full range of reinsurance products and the expertise of our talented reinsurance team.

Training & Education

Publication

Key Takeaways From Our U.S. Claims Fraud Survey

Publication

The Effects of Heatwaves – A Look at Heat-related Mortality in Europe and South Korea

Publication

The Key Elements of Critical Illness Definitions for Mental Health Disorders

Publication

An Overview of Mitral Regurgitation Heart Valve Disorder – and Underwriting Considerations

Publication

Body Mass Index as a Predictor of Cardiovascular Health Moving The Dial On Mental Health

Moving The Dial On Mental Health -

Knowledge Center

Knowledge Center Overview

Knowledge Center

Our global experts share their insights on insurance industry topics.

Trending Topics -

About Us

About Us OverviewCorporate Information

Meet Gen Re

Gen Re delivers reinsurance solutions to the Life & Health and Property & Casualty insurance industries.

- Careers Careers

Claims Management - Life on the Frontline

August 18, 2020

Mary Enslin,

Clio Lawrence

English

Français

Life insurance is no longer the quiet, predictable backwater it once was. In emerging and established markets everywhere, competition around product design, innovation, and customer service is rife. Meanwhile, claimants are discerning and ready to challenge providers when they are dissatisfied with the outcome of their claims.

Nowhere is this changing business environment felt more keenly than in Life carriers’ claims departments, as customers’ experience of claiming benefits has become one of the most important factors influencing public perception and trust.

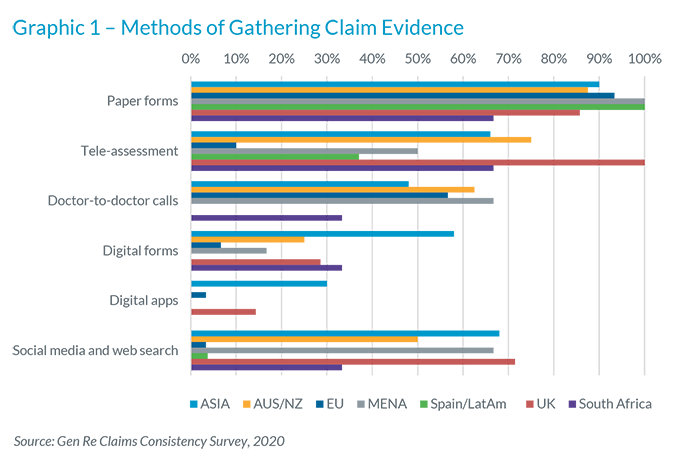

Against this background, Gen Re conducted its Claims Consistency Survey. Our aim was to gain insight into common claim causes, how claims were being assessed and managed, as well as what tools and technology were being used to assist claims teams. Over 150 participants across 33 countries participated, providing a fascinating insight into the current trends, opportunities and challenges facing claims teams around the world.

Claims assessors are finding that assessing life benefits is more challenging as technological and cultural changes start to affect our daily lives. Especially when assessing living benefits, modern claims assessment calls for the close consideration of many different issues.

In the area of claims philosophy, process and digitalisation, the areas with the most perceived change across all regions are Process and Workflow, Case Management, and Digitisation of the claims process.

It was interesting that although digitisation is identified by claims managers globally as one of the key areas of change in the last five years, very little progress has been made in this area.

Digitising the claims process is not easy, especially when it involves complex living benefits, such as disability. However, it’s clear that claims departments’ lack of digitisation is piling pressure on claims teams to meet the expectations of customers who want to engage quickly and efficiently via a digital format.

Feedback we received on claims philosophy pointed to an unlevel playing field among survey participants. On the one hand, when we asked participating companies whether they have a documented claims philosophy, it was promising to see that many do. In most companies, the claims philosophy creates a framework or foundation for how claims are assessed and serves as a reference point for all claim decisions. However, there is room for improvement and some companies still need to have a clearly documented claims philosophy that is reviewed and updated regularly to reflect changes in market conditions and practices.

Another strong theme to emerge was how claims teams prioritise and allocate resources. As with claims philosophy and systems, the careful and intentional use of skills and resources can optimise both the time taken to validate a claim and the client’s experience of the process.

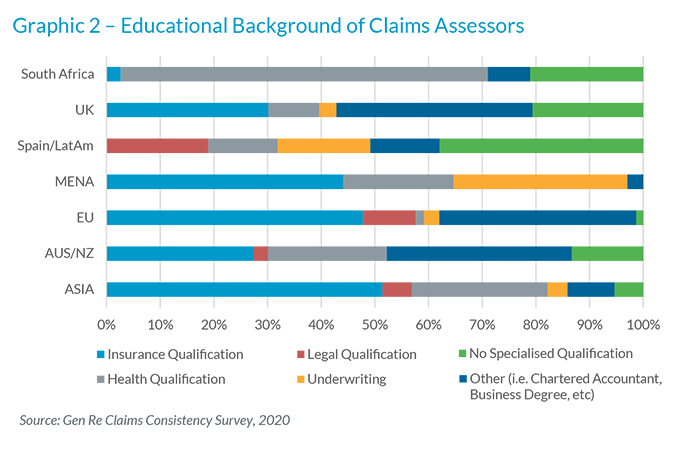

The survey questions covered such areas as team size, educational background, investment in claims training, access to a Chief Medical Officer and the input of reinsurers.

Educational background varied across regions, with some participating companies showing a preference for insurance or legal training and others preferring medical knowledge within the claims team.

It’s encouraging to see that in all markets the majority of participating companies offer some form of training for claims staff. This varied from internal and external courses, attending industry seminars and other events, and attending training offered by Gen Re.

The majority of participants highlighted the input of their reinsurer as a valuable resource in the claims process, particularly for providing advice on complex claims, conducting claims audits, and offering specialist resources, such as medical and product development.

You can certainly rely on Gen Re’s advice, services and proprietary tools to inform your claims management decisions. And if you want to learn more about the survey results, please contact us.